Stablecoin on/off-ramp platforms have become the backbone of modern digital asset management, providing a vital bridge between crypto and fiat worlds. As stablecoins increasingly power payments and settlements, seamless access to on-ramps and off-ramps is essential. Yet, beneath the surface of this convenience lies a complex web of regulatory compliance, with Know Your Customer (KYC) requirements standing front and center.

The Foundation: Why KYC Matters for Stablecoin Ramps

KYC is more than a regulatory buzzword – it is the cornerstone of trust in stablecoin infrastructure. Platforms that facilitate fiat-to-crypto conversions must comply with global Anti-Money Laundering (AML) standards, which require verifying user identities before allowing access to services. This process helps prevent illicit activities such as money laundering, terrorism financing, and fraud.

Recent regulatory shifts have made these requirements even more stringent. For example, Hong Kong’s stablecoin ordinance effective August 1,2025 mandates that issuers verify the identity of every token holder (source). While such measures strengthen security and foster institutional adoption, they also spark debate about privacy and accessibility within the crypto community.

KYC in Practice: How Leading Platforms Implement Compliance

Modern stablecoin ramps like TransFi and Endl have set new benchmarks for KYC standards. TransFi integrates robust KYC, AML, and Know Your Transaction (KYT) protocols to create a secure environment for digital asset transactions. Their approach includes instant KYC on multiple ID types and shareable credentials via API integrations – streamlining onboarding while maintaining compliance (source).

Endl takes this further with a three-tier system: users must submit government-issued identification; advanced tiers require video verification or source-of-funds documentation (source). These layered checks are designed to match risk profiles and transaction sizes, balancing efficiency with regulatory rigor.

Common KYC Documents for Stablecoin On/Off-Ramp Platforms

-

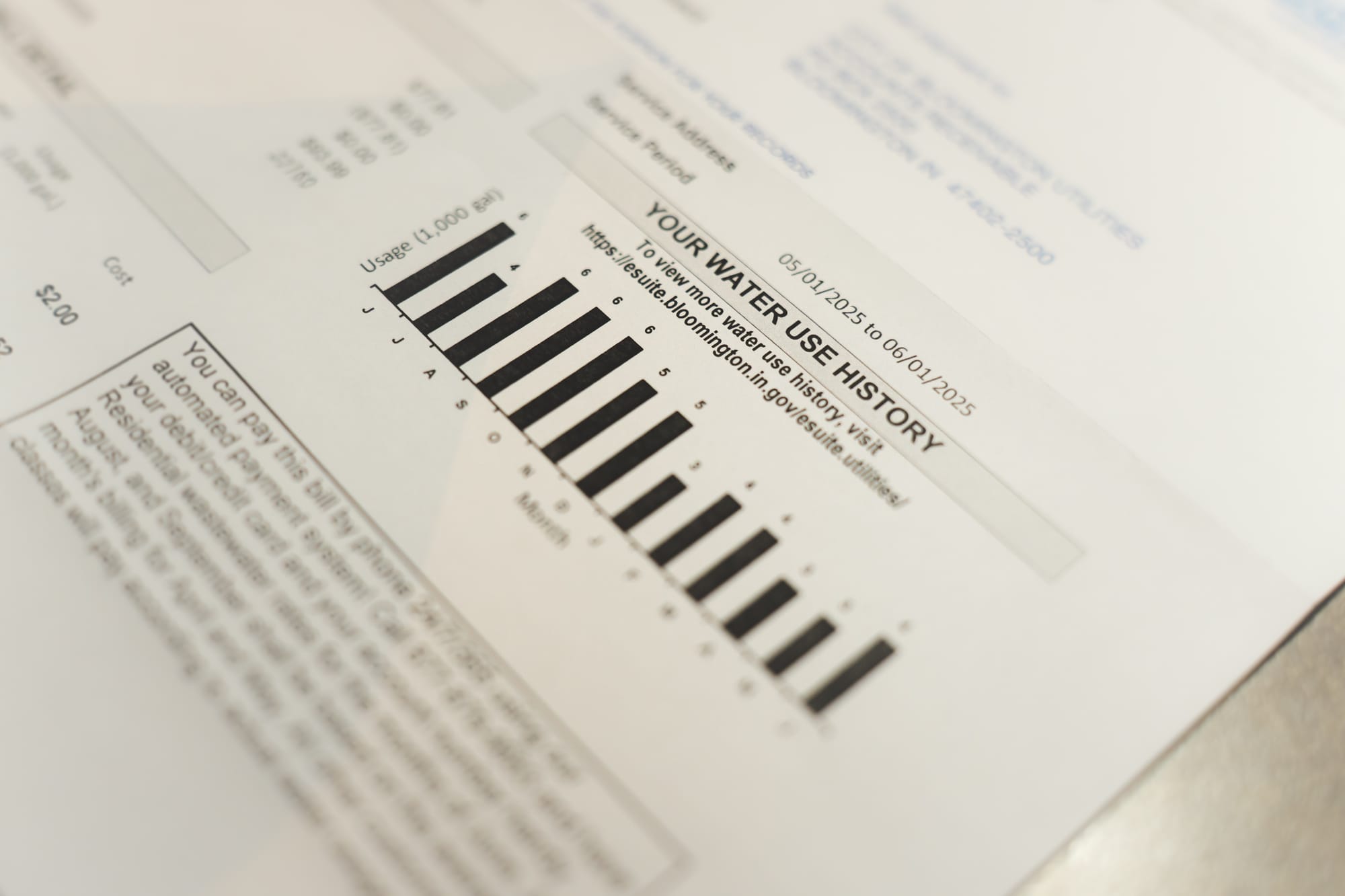

Proof of Address such as a recent utility bill, bank statement, or government correspondence, is commonly requested to confirm the user’s residential address and jurisdiction.

-

Selfie or Live Photo Verification is often required to match the user’s face with their submitted ID, adding an extra layer of security against identity theft.

-

Source of Funds Documentation (e.g., payslips, tax returns, or bank statements) may be requested, especially for higher transaction limits or in jurisdictions with stricter AML requirements, as seen in Endl’s three-tier KYC process.

-

Video Verification is increasingly used by platforms to further validate a user’s identity, particularly for higher-risk transactions or advanced KYC tiers.

User Impact: Navigating Friction Versus Security

While comprehensive KYC enhances platform integrity, it does not come without trade-offs:

- User Experience: Lengthy onboarding processes can deter users who value speed or privacy. Sensitive data submission may also raise anxiety about data breaches or misuse.

- Operational Costs: Deploying advanced KYC frameworks requires significant investment in technology, personnel training, and ongoing compliance monitoring.

- Privacy Concerns: Some users seek anonymous stablecoin off-ramp solutions but find their options limited as regulatory scrutiny increases.

This tension between compliance and usability has sparked innovation across the sector. Research into reusable KYC credentials or user-controlled data sharing points toward future solutions that could reconcile privacy with regulatory demands (source).

As regulatory frameworks evolve, platforms are forced to adapt or risk exclusion from the mainstream financial system. The GENIUS Act and similar legislation worldwide have redefined what is expected from a compliant stablecoin ramp. Now, providers must operate with the same rigor as traditional banks, which includes comprehensive KYC stablecoin ramp protocols and continuous monitoring of user activity. For users, this means that the days of truly anonymous stablecoin off-ramp options are rapidly fading in regulated markets.

Innovation at the Edge: Emerging Approaches to Crypto On Ramp KYC

To address user friction without sacrificing security, some platforms are experimenting with tiered onboarding. For example, low-value transactions may require minimal KYC, while higher thresholds unlock additional services after more stringent checks. This risk-based approach is gaining traction as a way to preserve accessibility for smaller users while satisfying regulators for larger flows.

Meanwhile, technologies such as zero-knowledge proofs (ZKPs) are being piloted to prove eligibility within a KYC perimeter without revealing underlying personal data. If widely adopted, these cryptographic techniques could enable private yet compliant on/off-ramp activity, an ideal scenario for privacy advocates and mainstream institutions alike.

Innovative KYC Solutions in Crypto On/Off-Ramps

-

TransFi’s Instant, Multi-Platform KYC: TransFi enables users to complete KYC instantly using multiple ID types, with verified credentials shareable via API across partner platforms, streamlining onboarding for stablecoin transactions.

-

Endl’s Three-Tier KYC Verification: Endl employs a comprehensive, tiered KYC system, requiring government-issued IDs, video verification, and source-of-funds documentation for higher transaction limits, enhancing both compliance and user trust.

-

KYChain: User-Controlled KYC Data Sharing: KYChain is a research-backed approach allowing users to control and share certified KYC data securely across multiple platforms, improving privacy and reducing redundant verifications.

-

Sumsub’s Modular KYC & AML Suite: Widely adopted by crypto exchanges, Sumsub offers customizable KYC workflows, biometric verification, and ongoing AML monitoring, supporting regulatory compliance for global stablecoin ramps.

-

Onfido’s AI-Powered Identity Verification: Onfido leverages AI and biometrics to verify user identities quickly and accurately, facilitating seamless onboarding for users of stablecoin on/off-ramp platforms.

The Road Ahead: Balancing Compliance with User-Centric Design

The challenge for both platforms and regulators is clear: how to maintain robust AML/KYC standards while minimizing operational drag and respecting user autonomy. Solutions like reusable digital identity credentials, where users complete verification once and port their status across multiple services, are promising but still nascent (see TransFi’s approach). As these models mature, we may see a new equilibrium where friction is reduced but trust remains uncompromised.

For users seeking anonymous stablecoin off-ramp or KYC free crypto services, options will likely remain limited in fully regulated environments. However, decentralized protocols that leverage advanced cryptography may offer partial alternatives outside traditional fiat rails, though these come with their own risks and limitations.

Key Takeaways for Stablecoin Users

- KYC is non-negotiable for most reputable on/off-ramp platforms due to global regulatory pressure.

- User privacy concerns are real, but innovative solutions like ZKPs and reusable credentials are emerging.

- Operational costs and onboarding times will remain factors, especially as compliance requirements increase.

- The future lies in balancing compliance with seamless user experience, leveraging technology to satisfy both sides of the equation.

The evolution of stablecoin ramps will be shaped by how well they can integrate rigorous compliance with fast, private, and intuitive user journeys. Platforms that strike this balance will not only survive regulatory waves but thrive as gateways for a new era of digital finance.