Stablecoin cards are rapidly redefining the crypto to fiat off-ramp landscape, giving users a frictionless way to spend digital assets in the real world. The appeal is clear: bypass lengthy bank transfers, dodge volatile conversion rates, and enjoy near-instant liquidity with minimal KYC headaches. As stablecoins like USDT, USDC, and DAI continue to dominate on/off-ramp flows in 2025, these cards are at the center of a new wave of private crypto spending.

How Stablecoin Cards Bridge Crypto and Fiat Instantly

The mechanics behind an instant stablecoin card are refreshingly simple yet powerful. Users load their preferred stablecoins onto a card issued by fintech partners connected with major payment networks such as Visa or Mastercard. When making purchases at any compatible merchant, the stablecoins are automatically converted into local fiat currency at point-of-sale, no manual swaps or delays required.

This seamless experience mirrors traditional debit cards but with the added benefits of blockchain speed and global accessibility. As highlighted by Bleap’s 2025 on-ramp review, stablecoins’ 1: 1 peg to fiat currencies ensures predictable value for both users and merchants, eliminating the guesswork often associated with crypto payments.

No KYC? Navigating Privacy and Limits

The privacy advantage is a key driver for adoption among tech-savvy users. Many are searching for stablecoin off-ramp without KYC options, especially for smaller transactions where full identity verification feels excessive. Platforms like SwapRocket and GhostSwap (see 99Bitcoins’ best non-KYC exchanges list) have set precedents in this space by offering instant swaps without burdensome checks.

However, regulatory compliance is never far behind. Most card issuers implement tiered KYC policies: minimal checks for low-value usage (often just an email), but stricter requirements as transaction volumes scale up. Hong Kong’s recent stablecoin ordinance illustrates this shift, mandating full ID verification for all holders from August 2025 onward to combat financial crime risks.

Top Stablecoin Card Providers Leading the Charge

Top Stablecoin Card Providers for Privacy & Speed

-

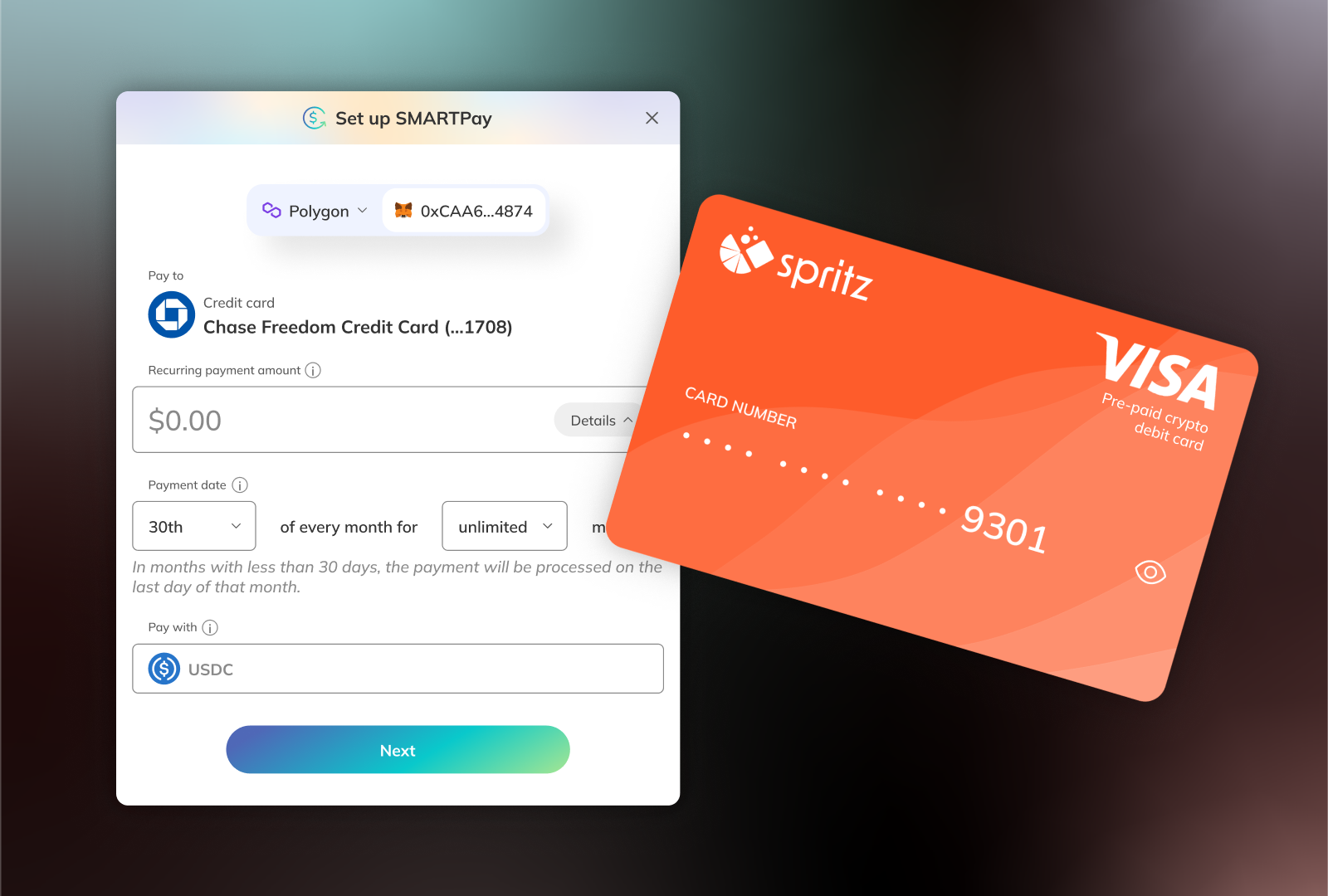

Spritz Finance: Enables direct off-ramping from stablecoins (USDC, USDT, DAI) to prepaid Visa cards with minimal KYC for low limits. Known for fast processing and a privacy-friendly approach.

-

Crypto.com Visa Card: Offers instant conversion of stablecoins like USDC and USDT to fiat for spending worldwide. Provides tiered KYC—basic features available with minimal verification, supporting privacy-conscious users.

-

Trust Wallet (with MoonPay & Ramp): Integrates off-ramp features that let users convert stablecoins to fiat and load them onto a card, with streamlined KYC for small transactions and rapid processing.

-

Wirex Card: Supports multiple stablecoins and enables instant crypto-to-fiat conversion for spending. Offers a quick sign-up process with soft KYC for lower transaction tiers.

-

BitPay Card: Allows USDT and USDC holders to spend globally via Mastercard. Offers rapid off-ramping and basic KYC for lower limits, balancing privacy and usability.

The competitive field is heating up as fintechs race to deliver fast, private off-ramp solutions:

- Rain: Backed by significant VC funding, Rain issues Visa-linked stablecoin cards through API-driven infrastructure targeting global partners.

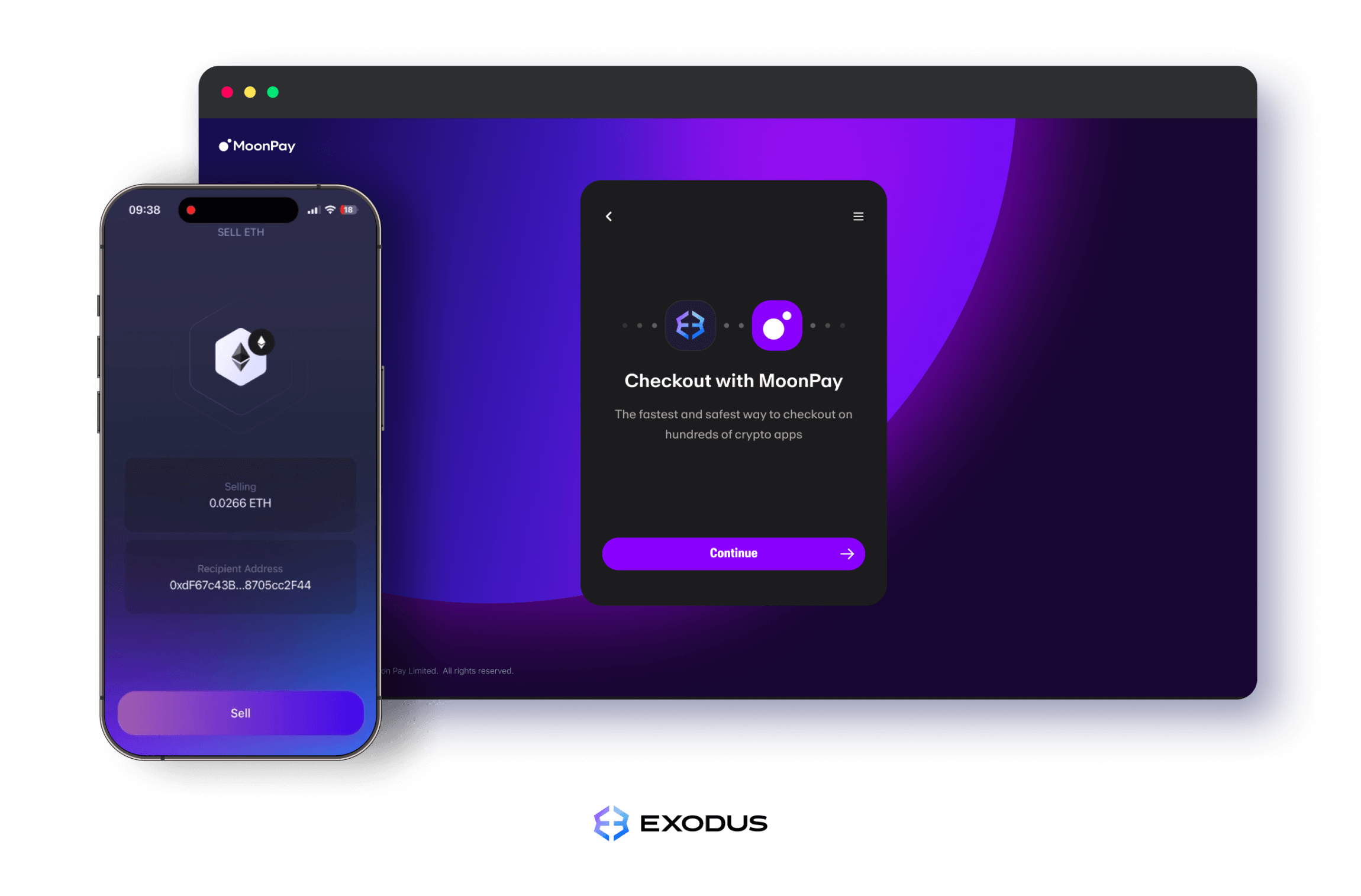

- Trust Wallet: Their integration with MoonPay and Ramp enables direct crypto-to-fiat conversion inside the wallet app, no external steps needed.

- Mural Pay: Recently spotlighted by Mural Pay’s 2024 roundup for ultra-fast off-ramping at minimal fees.

This innovation isn’t just about convenience, it’s about control. With more platforms embracing reduced-KYC models (within legal limits), users can choose how much personal data they share while enjoying near-instant access to their funds.

For privacy advocates and frequent traders, this new breed of stablecoin card offers a rare blend of speed, discretion, and global reach. The ability to off-ramp USDT or USDC directly onto a card, then spend anywhere Visa or Mastercard is accepted, has turned these cards into a lifeline for those seeking autonomy from traditional banks.

Yet, the market is fragmented. While some platforms still allow limited no-KYC usage for small amounts, others are tightening access in response to evolving regulations. It’s essential to compare providers not just on fees and speed but also on their compliance stance and regional availability. For example, Mural Pay’s 2024 roundup highlights that most leading off-ramps now offer transparent fee structures and clear KYC thresholds, letting users plan their transactions with confidence.

User Experience: Fast, Frictionless, Flexible

The real-world impact? Users can now move funds from their crypto wallet to spendable fiat in minutes rather than days. No more waiting for slow ACH transfers or jumping through hoops at legacy exchanges. This fluidity is especially valuable for freelancers paid in crypto, digital nomads living across borders, and anyone who prizes financial sovereignty.

Consider the workflow: load your stablecoins onto a private card via an app interface, pass a minimal KYC check (often just an email), then swipe at checkout, funds are converted instantly at the current stablecoin value. No manual conversion steps, no third-party delays.

As one Redditor noted in a recent r/ethereum thread, “Stablecoin cards finally make it possible to live off crypto without constantly worrying about bank freezes or intrusive questions. ” This sentiment is echoed across forums as users share tips on maximizing privacy while staying compliant with local laws.

Risks and Considerations

Of course, no system is bulletproof. Even with reduced KYC friction, users should be aware of potential risks:

- Regulatory shifts: Laws can change quickly, Hong Kong’s August 2025 ordinance is proof that what works today may be restricted tomorrow.

- Card acceptance: Not all merchants support crypto-linked cards equally; always check coverage before relying solely on your stablecoin card abroad.

- Fee transparency: Some providers advertise low fees but hide FX markups or withdrawal charges, read the fine print before committing large sums.

The bottom line? Stablecoin cards are reshaping how we think about spending digital assets in everyday life. By balancing privacy with compliance, and leveraging the predictability of stablecoins, they empower users to stay agile as regulations evolve. As competition intensifies among providers, expect even more options for fast, private crypto to fiat off-ramp solutions in the months ahead.