Global payments are undergoing a seismic shift. Stablecoin cards have emerged as the stealth disruptor, fusing the best of decentralized finance with the reach of legacy payment networks. In 2025, these cards are not just a crypto novelty, they’re rapidly becoming the preferred rails for fast, private, and borderless transactions. The likes of Mastercard, Visa, and fintech innovators are doubling down on stablecoin infrastructure, signaling a new era for anyone moving value across borders or seeking privacy without sacrificing convenience.

Stablecoin Cards: The New Standard for Fast and Private Payments

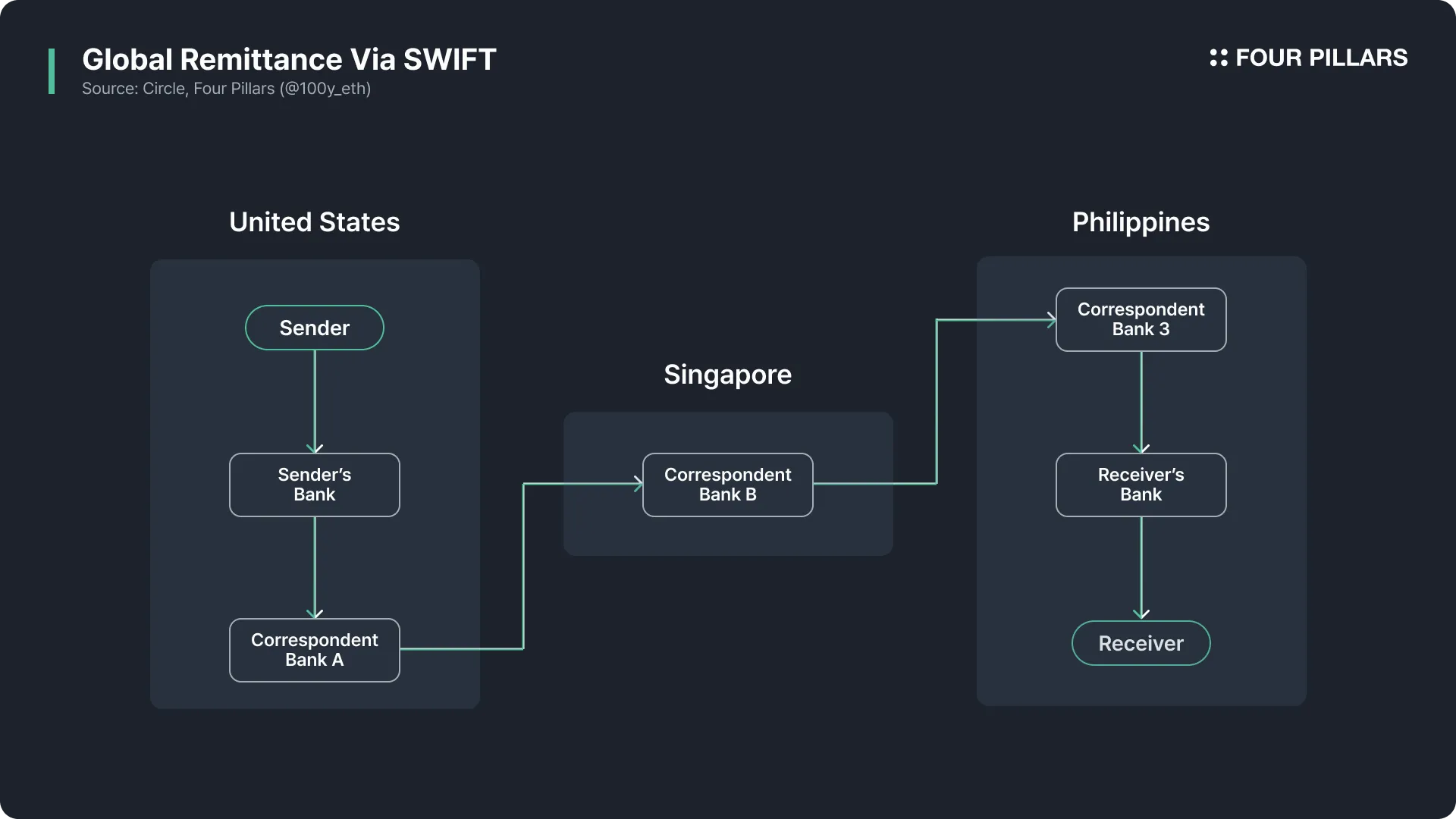

Traditional cross-border payments remain plagued by friction, slow settlement times, high fees, and intrusive data collection. Stablecoins solve these problems at their root. By pegging digital tokens to fiat assets like the US dollar, stablecoins deliver price stability while leveraging blockchain’s speed and transparency. Now, with stablecoin cards linked directly to your crypto balance, you can spend globally in seconds.

The recent Mastercard-MoonPay partnership is a watershed moment: enterprises and fintechs can now issue Mastercard-branded cards that convert stablecoins to fiat at over 150 million merchants worldwide. Meanwhile, Visa has expanded support for USD-backed stablecoins like USDC on Ethereum and Solana networks (source). The result? Real-time settlement with global acceptance, and no need to pre-fund local bank accounts or worry about volatile exchange rates.

Key takeaway: Stablecoin cards combine instant blockchain settlement with the fraud protection and merchant reach of established card networks, making them ideal for both everyday purchases and high-value business transactions.

Why Privacy Advocates Are Turning to Borderless Stablecoin Cards

Privacy is more than a buzzword, it’s a necessity in today’s data-hungry financial ecosystem. Traditional banking leaves an extensive paper trail; every transaction is logged, analyzed, and often sold or surveilled. Stablecoin cards flip this model by allowing users to maintain greater control over their financial identity.

Why Privacy Advocates Prefer Stablecoin Cards

-

Enhanced Transaction Privacy: Stablecoin cards often leverage blockchain technology, allowing users to control the visibility of their payment data. Unlike traditional cards, transactions can be pseudonymous, minimizing the exposure of personal financial information.

-

Reduced Data Sharing with Third Parties: Major stablecoin card providers like Mastercard (via MoonPay partnership) and Visa now enable spending stablecoins with minimal data shared beyond what is required for compliance, reducing the risk of data aggregation by banks and payment processors.

-

Borderless and Censorship-Resistant Payments: Stablecoin cards, such as those issued by Infini, empower users to transact globally without reliance on local banking systems, making it harder for governments or intermediaries to monitor or restrict cross-border payments.

-

Real-Time Conversion Minimizes Traceability: With instant conversion of stablecoins to fiat at the point of sale (as seen with Mastercard and Visa integrations), transaction trails are less likely to be linked back to crypto holdings, offering an extra layer of privacy compared to moving funds through exchanges.

-

Optional Integration with Non-Custodial Wallets: Many stablecoin cards support funding from non-custodial wallets, giving privacy-focused users full control over their keys and reducing exposure to centralized custodians that might be subject to surveillance or data requests.

Unlike conventional credit cards that require extensive personal information for issuance and use, many modern stablecoin onramp/off-ramp platforms (like anonofframp. com) enable users to transact with minimal KYC, sometimes only requiring an email or wallet address for activation. This is game-changing for freelancers paid internationally or individuals living under restrictive regimes.

The Global Reach: How Borderless Stablecoin Cards Enable True Financial Inclusion

The impact of borderless stablecoin cards extends far beyond tech-savvy urbanites. For millions in emerging markets who lack access to reliable banking but own smartphones, these cards offer a lifeline into global commerce. With no need for local bank infrastructure or currency conversion headaches, users can hold their wealth in USD-pegged coins and spend anywhere from Buenos Aires cafés to Berlin boutiques.

Infini’s global card launch, which integrates daily yield on stablecoins with Apple Pay and Google Pay compatibility (source), exemplifies this trend, users not only spend but also earn yield on idle balances. For digital nomads and gig workers paid in crypto, this means frictionless access to both online services and brick-and-mortar retailers worldwide.

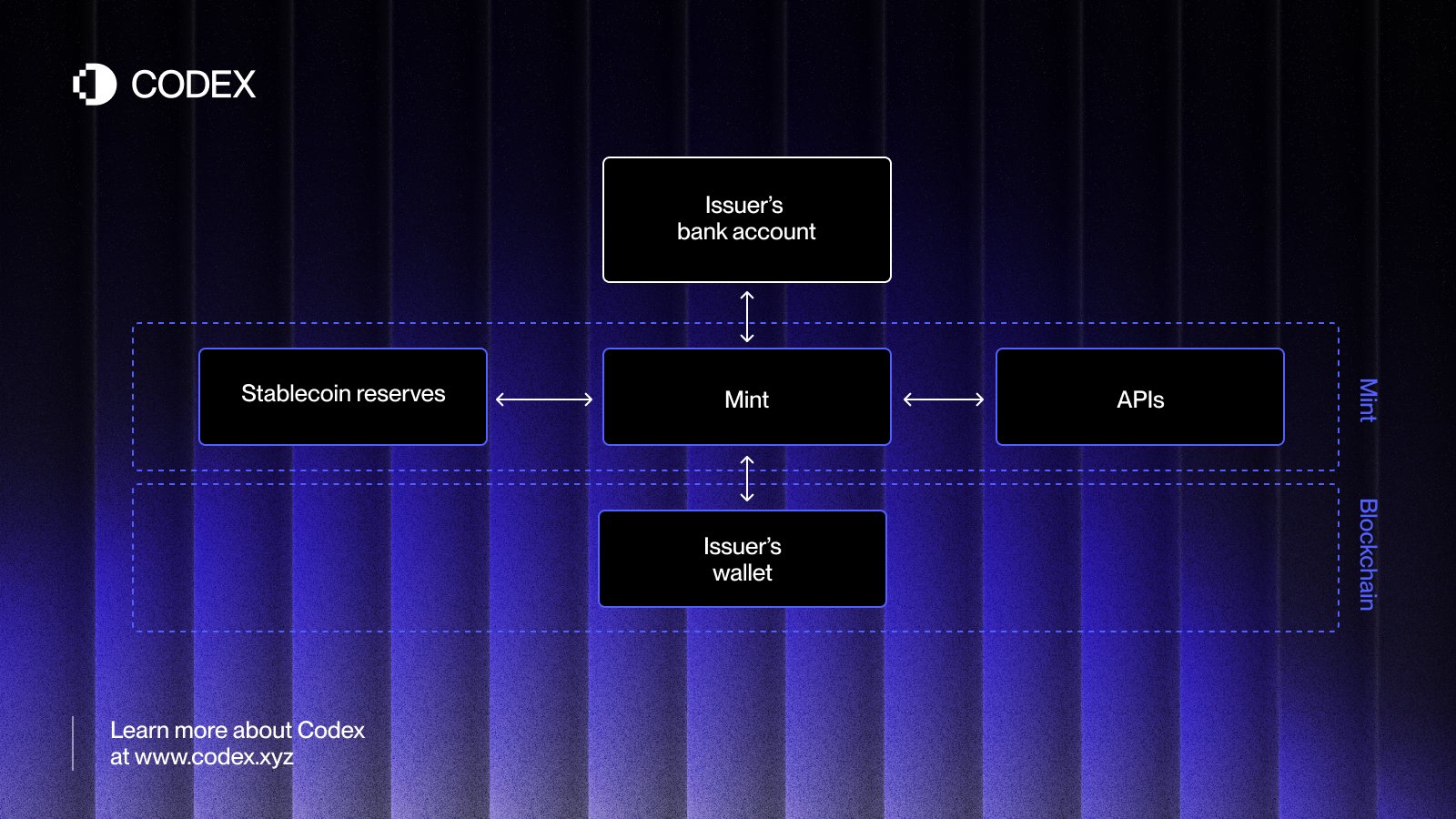

The Tech Under the Hood: How Crypto-to-Fiat Conversion Works Seamlessly

Beneath the hood of every borderless stablecoin card is an instantaneous conversion engine that bridges Web3 assets with legacy point-of-sale systems. When you swipe your card at checkout:

How a Stablecoin Off-Ramp Works During Payment

-

1. Cardholder initiates a purchase using a stablecoin card: The user selects their stablecoin-linked card (such as those offered by Mastercard-MoonPay, Visa, or Infini) at a merchant terminal or within a digital wallet (e.g., Apple Pay, Google Pay).

-

2. Transaction request is sent to the payment processor: The merchant’s point-of-sale system sends the payment request through established card networks (Visa, Mastercard) for authorization, just like a traditional card transaction.

-

3. Stablecoin balance is verified and locked: The card issuer’s platform (e.g., MoonPay, Infini) checks the user’s stablecoin wallet to ensure sufficient funds and temporarily locks the transaction amount in stablecoins (such as USDC or USDT).

-

4. Real-time conversion to fiat currency: The locked stablecoins are instantly converted to the merchant’s local fiat currency using the issuer’s off-ramp infrastructure. This conversion leverages real-time rates and blockchain settlement, ensuring minimal slippage and fast processing.

-

5. Settlement with the merchant: The payment processor settles the transaction in fiat currency to the merchant’s account, while the equivalent amount of stablecoins is debited from the cardholder’s wallet. Card networks (Visa, Mastercard) guarantee global acceptance and fraud protection.

-

6. Transaction confirmation and receipt: Both the cardholder and merchant receive instant confirmation. The cardholder’s stablecoin balance is updated, and the merchant receives funds in their preferred currency, completing a fast, private, and borderless payment.

This seamless flow eliminates manual exchanges or waiting periods typical of traditional off-ramps, and it’s all powered by smart contracts plus robust APIs from network partners like Mastercard and Visa.

Security and speed are only half the equation. What sets stablecoin cards apart is their ability to abstract away the complexity of blockchain, delivering a user experience that rivals, or even exceeds, that of legacy cards. With instant settlement, there’s no more waiting for international wire transfers or sweating over unpredictable SWIFT delays. The funds move as quickly as the blockchain allows, often in under a minute, and the conversion to local fiat is handled invisibly in the background.

For businesses operating globally, this means dramatically lower overhead and a level playing field for small merchants. No more exorbitant cross-border fees, chargeback headaches, or opaque FX spreads. Stablecoin cards empower merchants to accept payments from anywhere, settle instantly, and keep more of what they earn.

Regulatory Landscape: Navigating Compliance Without Compromising Privacy

As adoption accelerates, regulators are catching up. Institutions like the Bank of Italy have recently called for clearer rules around multi-issuance stablecoins (source). The challenge? Balancing anti-money laundering (AML) concerns with user privacy and financial inclusion. Forward-thinking platforms are addressing this by implementing non-invasive compliance checks that respect user autonomy while satisfying legal requirements.

The result is a pragmatic middle ground: users retain control over their data, but bad actors find it increasingly difficult to exploit the system. As frameworks mature in 2025 and beyond, expect even greater interoperability between compliant stablecoin networks and traditional finance.

Choosing Your Card: What to Look For in a Stablecoin On/Off-Ramp Solution

Not all stablecoin cards are created equal. When evaluating your options, whether it’s for everyday spending or large-scale remittance flows, consider:

Essential Features to Compare in Stablecoin Cards

-

Supported Stablecoins and Blockchains: Assess which stablecoins (e.g., USDC, USDT) and blockchains (such as Ethereum, Solana) are compatible, as broader support increases flexibility and access.

-

Global Merchant Acceptance: Verify if the card is backed by major networks like Visa or Mastercard, ensuring you can spend at millions of locations worldwide, both online and in-store.

-

Conversion and Settlement Speed: Look for cards that offer real-time conversion of stablecoins to fiat, minimizing delays and optimizing transaction efficiency.

-

Privacy and Data Protection: Evaluate privacy features, such as minimized data sharing and on-chain privacy options, to maintain control over your financial information.

-

Fees and Yield Opportunities: Compare transaction, withdrawal, and FX fees, and check if cards like Infini offer daily yield or rewards on stablecoin balances.

-

Integration with Digital Wallets: Confirm compatibility with platforms like Apple Pay and Google Pay for seamless mobile payments and enhanced convenience.

-

Regulatory Compliance and Security: Ensure the service complies with evolving regulations and offers robust security measures, including fraud protection and transparent audit trails.

Platforms like anonofframp. com have set themselves apart by prioritizing user privacy, lightning-fast settlements, and minimal onboarding friction. Their approach is tailor-made for tech-savvy users who demand both security and discretion from their payment tools.

The Bottom Line: Stablecoins Are Quietly Becoming Ubiquitous

The convergence of crypto-native assets with traditional card networks is no longer theoretical, it’s happening now at scale. With Visa and Mastercard both supporting stablecoin rails across Ethereum and Solana, we’re witnessing the birth of truly borderless money movement (source). Merchants win with faster access to funds; users gain privacy and global reach; regulators get improved transparency without stifling innovation.

Whether you’re a freelancer in Lagos or an e-commerce merchant in London, stablecoin cards offer a frictionless bridge between digital assets and real-world spending power. The future of global payments isn’t just fast, it’s programmable, private, and accessible to all.