Imagine swiping your card in Paris, topping up in Tokyo, or paying for coffee in Buenos Aires – all with crypto, no KYC headaches, zero hidden fees, and complete privacy. That’s the new reality powered by stablecoin debit cards. Forget the old barriers: these cards are slashing friction and letting you spend USDT, USDC, DAI, and more like cash anywhere on earth. The secret sauce? Stablecoins keep value steady while non-custodial architecture keeps your funds in your hands, not a bank’s.

Why Stablecoin Debit Cards Are Exploding in 2025

The market is on fire for one reason: privacy and cost. Users are fed up with legacy banking fees and invasive ID checks. Today’s best stablecoin cards – like Gnosis Pay, KAST Solana Card, and Bleap Mastercard – are rewriting the rules:

Top 5 Features of Leading Stablecoin Debit Cards

-

Zero Fees on Spending: Leading cards like Gnosis Pay and Stables offer no annual, issuance, or transaction fees for spending stablecoins such as USDC, USDT, and DAI, making everyday crypto payments cost-effective.

-

Non-Custodial Wallet Integration: Cards from Gnosis Pay, Cypher, and Ether.Fi connect directly to your self-custodial crypto wallet, ensuring you retain control of your funds at all times—no third-party custody required.

-

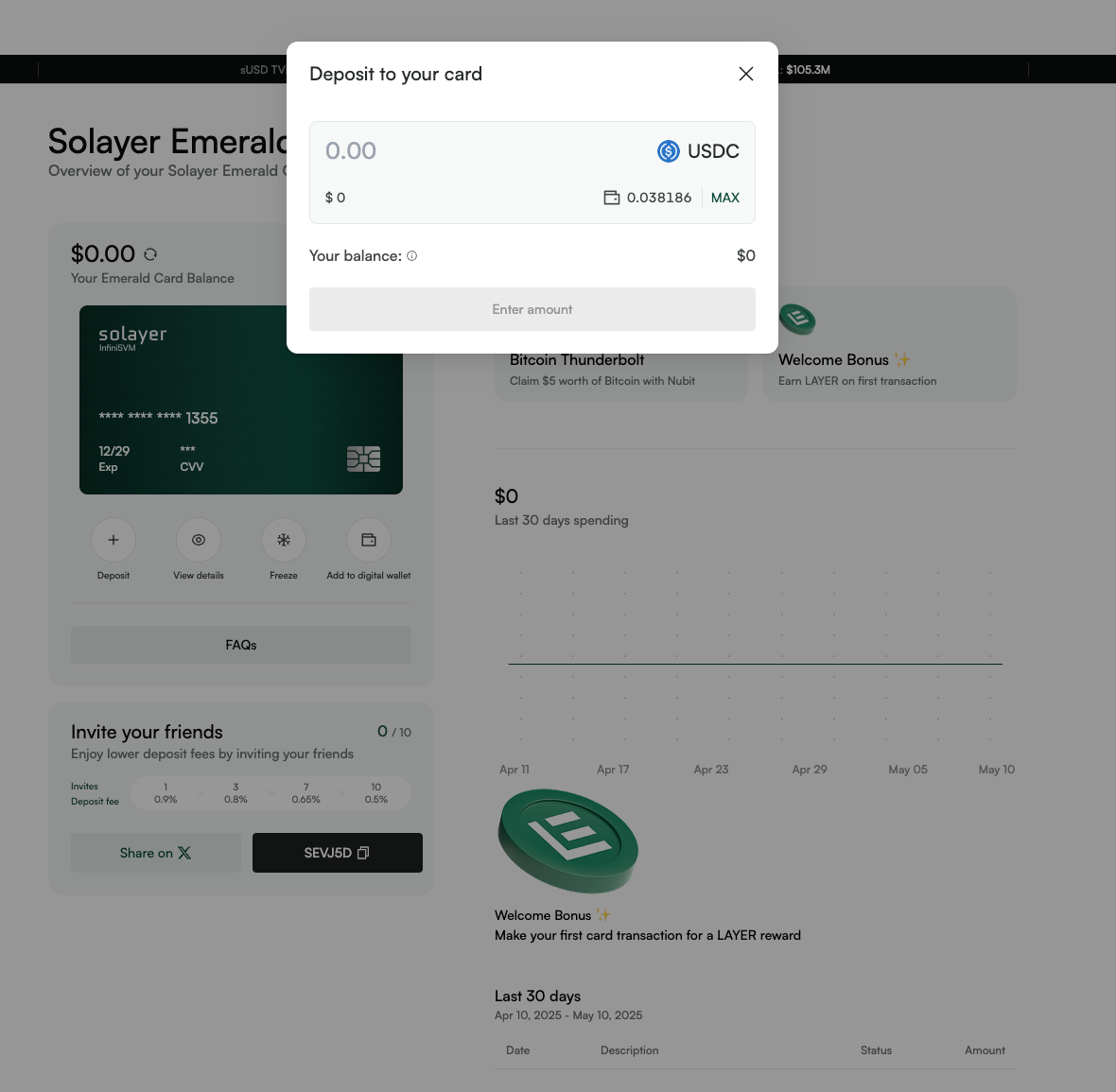

Instant Card Activation: Solutions like the KAST Solana Card and Bleap Mastercard deliver instant digital card issuance—get your card in minutes, fund it with stablecoins, and start spending immediately, no lengthy waiting period.

-

Global Merchant Acceptance: Major stablecoin debit cards are Visa or Mastercard-backed, enabling you to spend at over 100 million merchants worldwide. For example, the KAST Card and Stables Card both support seamless global payments in local currencies.

-

Anonymous or Minimal KYC Onboarding: Some cards, like Cypher and select offerings from Bitcoin.com Cards, provide anonymous or low-KYC sign-up options, letting you spend crypto privately without intrusive verification processes.

Cards like Gnosis Pay connect directly to your self-custodial wallet. There’s no middleman – just pure crypto spending power. Gnosis Pay even rewards you with up to 5% cashback in GNO tokens while supporting EURe and GBPe for euro and pound-pegged stability.

Private Crypto Spending: Beyond Borders and Bureaucracy

This isn’t just about convenience – it’s about financial freedom. Stablecoin debit cards let you bypass restrictive capital controls and overreaching compliance demands. Want to spend USDT or USDC at over 100 million merchants? The KAST Card makes it happen instantly with Visa backing. No monthly fees. No conversion headaches.

The privacy angle is massive. Some of the best cards require minimal or zero personal info to get started – a game-changer for users who value anonymity or live under oppressive regimes. As highlighted by Stablecoin Insider, these cards are now available worldwide with multi-chain top-ups so you can move fast wherever you are.

The Real Fee-Free Revolution

Let’s talk numbers. Traditional banks gouge you on FX rates and maintenance charges; many crypto services sneak in conversion fees that eat into your stack. But the new wave of zero fee stablecoin cards, like Gnosis Pay (no issuance or annual charges) and Bleap Mastercard (2% USDC cashback), flips this script entirely.

- No annual fee: $0 to issue or maintain your card

- No transaction fee: Spend USD or USDC without extra cost

- No conversion fee: Many leading cards skip the usual 2-3% cut most banks take when converting between currencies

Your crypto stays whole until the moment you swipe – then it converts at market rate right as you pay.

The Non-Custodial Edge: You Own Your Funds

A non-custodial stablecoin card means total control. Your assets live in your wallet until transaction time; there’s no centralized custodian freezing funds or tracking purchases. This is true DeFi utility brought to real-world spending.

With non-custodial stablecoin cards, you’re not just sidestepping banks, you’re opting out of surveillance finance. Every tap or swipe is powered by your private keys, not a third party. This is why power users and privacy advocates are ditching legacy cards for these new tools. Forget waiting days for withdrawals or sweating over sudden account freezes, your crypto, your rules, every single time.

How to Choose the Right Stablecoin Debit Card

Ready to go all-in? Here’s what actually matters when you’re picking a card in 2025:

Essential Factors When Choosing a Stablecoin Debit Card

-

Supported Stablecoins & Networks: Ensure the card supports major stablecoins like USDT, USDC, DAI, PYUSD, EURe, and GBPe, and is compatible with key blockchains such as Ethereum, Solana, and Polygon. For example, Gnosis Pay and KAST Card offer broad multi-chain and multi-coin support.

-

Level of Privacy & Custody: Look for non-custodial or self-custodial cards that don’t require you to hand over your private keys or personal data. Gnosis Pay and Bleap Mastercard are leading options for privacy-focused, self-custodial spending.

-

Global Acceptance: Choose cards that are Visa or Mastercard-backed for maximum worldwide reach—like KAST Card and Floki Debit Card, which are accepted at millions of merchants globally.

-

Cashback & Rewards: Compare cards that offer cashback or rewards for stablecoin spending. For instance, Gnosis Pay offers up to 5% cashback in GNO tokens, while Bleap Mastercard pays 2% cashback in USDC.

-

Fees & Spending Limits: Opt for cards with zero or low fees and transparent spending limits. Gnosis Pay and Bitget Wallet Card are known for no monthly fees and low conversion rates, while Floki Debit Card offers fee-free payments across Europe.

For maximum flexibility, look for cards that support multiple blockchains and stablecoins (USDT, USDC, DAI, PYUSD) and offer instant activation. Some cards like KAST and Cypher even let you top up via Solana or Ethereum with no extra steps. If privacy is your top concern, prioritize non-custodial options with anonymous onboarding, these let you spend globally without leaving a data trail.

Real-World Use Cases: From Nomads to Small Businesses

Who benefits most? Digital nomads can pay rent worldwide without currency headaches. Freelancers get instant access to crypto earnings, no more waiting days for bank wires. Even small businesses are adopting stablecoin Mastercards for seamless vendor payments and payroll. This isn’t niche speculation, it’s mainstream money movement.

The Road Ahead: Stablecoins Take Over Everyday Payments

The momentum isn’t slowing down. With Visa rolling out stablecoin-linked cards in Latin America (Reuters), and new zero fee offerings hitting Europe and Asia every quarter, it’s clear: stablecoin debit cards will soon be as common as traditional credit cards, and far more powerful.

The next frontier? Expect deeper DeFi integrations (think auto-staking rewards as you spend), broader merchant adoption, and even more robust privacy features as demand skyrockets. For anyone serious about private crypto spending, the time to make the switch is now.