Stablecoins have become the backbone of digital asset transfers, with USDT leading the charge as a stable, liquid, and universal value bridge. Yet, for all their promise, stablecoin users have long faced friction at the crucial points of entry and exit: on-ramps and off-ramps. These are the gateways where crypto meets fiat, and where seamless user experience often collides with technical complexity, high fees, and privacy concerns.

Enter Stable, the first USDT-native blockchain, which is rewriting the rulebook for stablecoin infrastructure. By making USDT itself the native gas token, Stable eliminates an entire layer of complexity from transactions, users no longer need to acquire or manage volatile tokens just to pay network fees. This innovation could be a game-changer for anyone seeking frictionless conversion between fiat and crypto using stablecoins.

The Problem With Traditional Stablecoin On/Off-Ramps

Despite their reputation for stability, most stablecoins operate on networks like Ethereum or Polygon that require users to hold additional tokens (ETH or MATIC) to cover gas fees. This creates an awkward paradox: to move your USDT, you need something other than USDT. For retail users and institutions alike, this extra step introduces risk, inefficiency, and cost, not to mention headaches when network congestion sends gas prices soaring.

According to recent research from McKinsey and Company and BCG, the true cost advantage of stablecoins is often eroded by these operational hurdles at the ramp level. The result? Users face delays in converting between crypto and fiat, inconsistent transaction costs, and sometimes even failed transfers when they run out of native gas tokens.

How Stable’s USDT-Native Layer 1 Is Redefining Ramps

Stable‘s architecture flips this script by letting users pay all transaction fees in USDT itself, no side tokens required. With sub-second finality and minimal fees (often approaching zero for peer-to-peer transfers), Stable delivers a smooth experience that feels more like sending cash than navigating blockchain intricacies.

This design directly addresses pain points highlighted in reports by CoinDesk and Lightspark: namely that on/off-ramp efficiency determines whether stablecoins can truly serve as a bridge between traditional finance (TradFi) and digital assets. By removing volatility from fee calculations and guaranteeing predictable costs in a familiar currency ($1.00 per USDT at time of writing), Stable paves the way for mass adoption across both retail payments and institutional settlement.

Developer-First Tools Powering Next-Gen Ramps

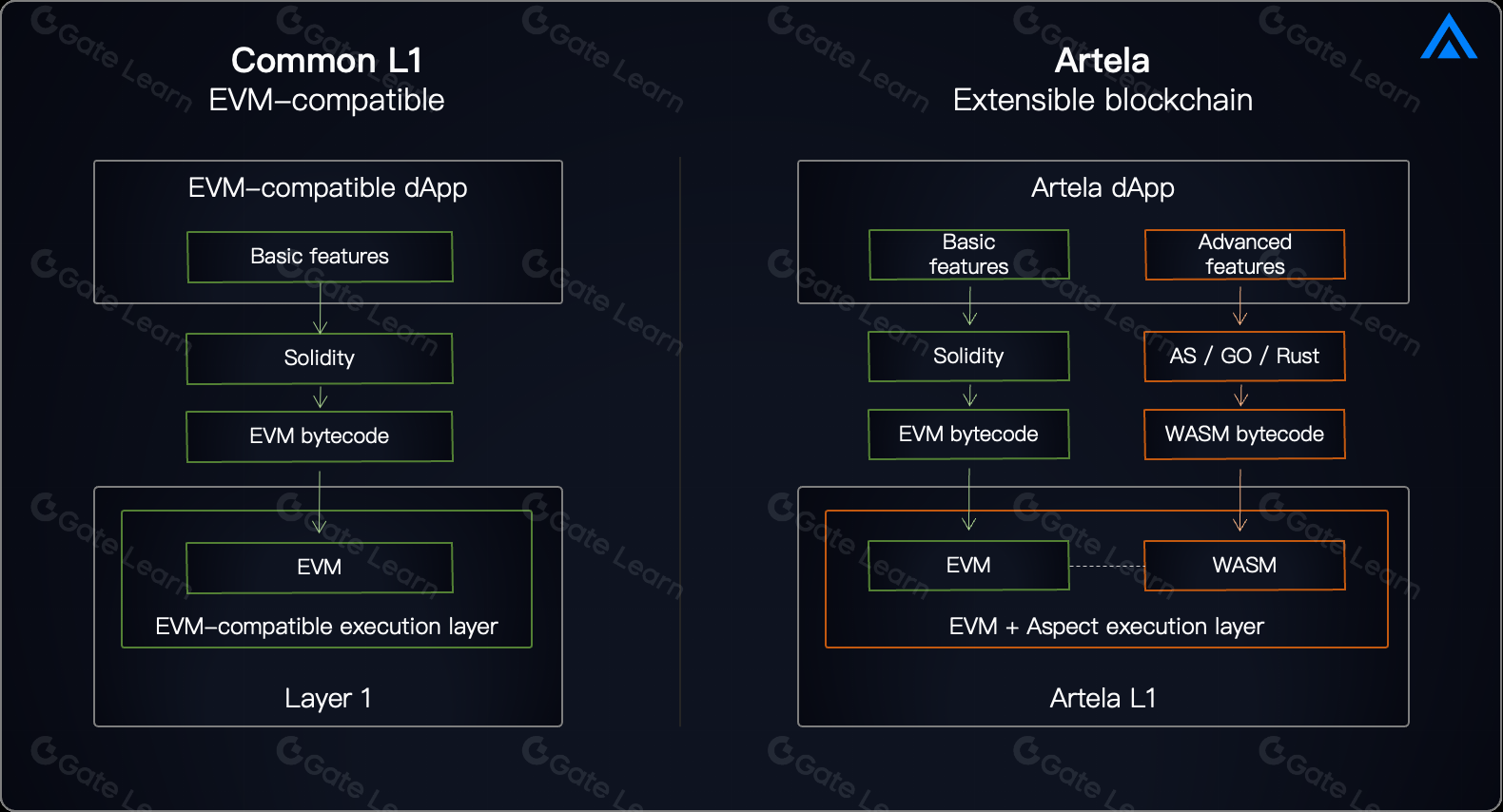

The impact of Stable goes beyond just end-users; it’s also transforming what developers can build. With EVM compatibility built in, developers can deploy smart contracts directly in USDT, no need to juggle multiple assets or worry about fluctuating fee markets. The platform’s robust SDKs and APIs further lower barriers for fintechs aiming to launch private stablecoin ramps or integrate fiat-to-crypto conversion flows into wallets.

This developer-centric approach encourages rapid innovation around use cases like stablecoin cards, instant remittances, payroll solutions, or even automated trading bots, all powered by a single asset with transparent fee economics.

Tether (USDT) Price Prediction 2026-2031

Professional Outlook on USDT Price Stability in a Rapidly Evolving Stablecoin Landscape

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg. YoY) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | 0.0% | Continued global adoption, regulatory clarity, and robust on/off-ramps maintain tight peg. |

| 2027 | $0.98 | $1.00 | $1.02 | 0.0% | USDT maintains dollar parity; minor volatility possible during high market stress or regulatory shifts. |

| 2028 | $0.97 | $1.00 | $1.03 | 0.0% | Increased competition from CBDCs and algorithmic stablecoins; peg remains firm due to liquidity and network effects. |

| 2029 | $0.97 | $1.00 | $1.03 | 0.0% | Stable L1 and Layer 2 integrations further reduce transaction friction; peg stability persists. |

| 2030 | $0.96 | $1.00 | $1.04 | 0.0% | Potential for brief depegging events in extreme scenarios (e.g., major regulatory intervention), but rapid recovery expected. |

| 2031 | $0.96 | $1.00 | $1.04 | 0.0% | USDT remains the dominant stablecoin, but faces increasing scrutiny and competition; peg reliability endures. |

Price Prediction Summary

USDT is engineered to maintain a 1:1 peg with the US dollar, and this stability is expected to persist through 2031, supported by advancements such as the Stable USDT-native blockchain, robust market infrastructure, and strong global liquidity. While minor deviations are possible during periods of extreme market volatility or regulatory upheaval, USDT is likely to remain highly stable, with average prices consistently at $1.00. The min/max ranges reflect rare, short-lived outlier events rather than fundamental shifts in value.

Key Factors Affecting Tether Price

- Advancements in stablecoin infrastructure (e.g., Stable USDT-native chain) enhancing efficiency and cost-effectiveness.

- Global regulatory developments impacting stablecoin issuance, reserves, and usage.

- Competition from emerging stablecoins and central bank digital currencies (CBDCs).

- Institutional adoption and integration with traditional finance (TradFi) and payment systems.

- Market sentiment and liquidity, especially during periods of high volatility or systemic stress.

- Technological improvements in blockchain scalability, security, and interoperability.

- Ongoing transparency and auditability of Tether reserves.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The State of USDT On/Off-Ramp Pricing Today

As of now, Polygon Bridged USDT (Polygon) holds steady at $1.00, with no notable 24-hour fluctuations ( and 0.000000%). This kind of price consistency is exactly what both individuals and institutions crave when moving funds across borders or between asset classes, a core promise that platforms like Stable are finally making practical at scale.

For anyone who has ever had to scramble for a few dollars’ worth of ETH or MATIC just to move their stablecoins, Stable’s approach is more than a technical upgrade, it’s a user experience revolution. The predictability of always paying fees in USDT, coupled with sub-second finality, means that settlement risk and operational delays are dramatically reduced. This is especially relevant for high-frequency traders, remittance operators, and payroll providers who rely on instant, low-cost settlements.

What’s more, the privacy features emerging around USDT-native infrastructure are attracting a new wave of users who value discretion without sacrificing compliance. For privacy advocates and those seeking to avoid intrusive KYC at every turn, the ability to move funds through private stablecoin ramps is a major draw, one that platforms like anonofframp. com are already leveraging through innovative card solutions and off-ramp services.

Why Stablechain Features Matter for Modern Finance

Stable’s Layer 1 isn’t just about speed or cost; it’s about enabling financial inclusivity. By stripping away the technical hurdles of legacy blockchains and focusing on the core utility of stablecoins, reliable value transfer, Stable opens doors for underbanked populations and businesses in volatile economies. The ability to send, receive, and settle funds globally using only USDT (at exactly $1.00 per token) brings digital cash closer to reality than ever before.

Key Benefits of Stable’s USDT-Native Blockchain

-

Zero-Fee USDT Transfers: Stable enables fee-free peer-to-peer USDT transactions for simple transfers, eliminating the need for volatile gas tokens and reducing overall transaction costs.

-

USDT as the Native Gas Token: All network fees are paid in USDT, simplifying the user experience by removing the need to hold or convert other cryptocurrencies for transaction fees.

-

Sub-Second Transaction Finality: The platform delivers near-instant settlement, allowing users to complete on/off-ramp operations and payments with minimal waiting times.

-

High Throughput for Peak Usage: Stable’s infrastructure is designed for consistent performance even during high network demand, making it suitable for both retail and institutional users.

-

EVM Compatibility and Developer Tools: Developers can build and deploy smart contracts directly in USDT using familiar Ethereum tools, thanks to Stable’s EVM compatibility and robust SDKs/APIs.

-

Streamlined On/Off-Ramp Experience: By focusing on stablecoin-centric infrastructure, Stable simplifies the process of converting between fiat and USDT, enhancing accessibility for users worldwide.

This shift also empowers fintech innovators. With open-source SDKs and EVM compatibility, developers can build custom payment rails or integrate with existing TradFi systems, without worrying about gas volatility or custodial risk. The result is an ecosystem where on/off-ramps become invisible: users simply move money where it needs to go, securely and instantly.

“The best infrastructure is the kind you don’t notice, Stable’s gasless transfers make stablecoin payments feel as easy as sending an email. “

Practical Use Cases: From Payroll to Private Ramps

The real-world impact of Stable’s design is already visible in use cases ranging from business payroll to cross-border remittances and private off-ramps:

- Payroll Automation: Companies can pay global teams instantly in USDT without conversion hassles or surprise fees.

- Remittances: Families send money across borders at predictable costs with no banking intermediaries.

- Private Off-Ramps: Users leverage platforms like anonofframp. com for secure fiat withdrawals via stablecoin cards, no need for centralized exchanges or invasive verification processes.

This flexibility extends even further as more institutions explore direct integration with stablecoin Layer 1s for settlement and treasury operations, a trend likely to accelerate as regulatory clarity improves worldwide.

What Sets anonofframp. com Apart?

If you’re seeking a practical way to harness these advances today, anonofframp.com stands out by offering seamless on/off-ramp solutions tailored for privacy-conscious users. Their stablecoin card products integrate directly with platforms like Stable L1, allowing you to convert crypto-to-fiat (and vice versa) efficiently while maintaining control over your data. Minimal friction, transparent pricing pegged at the current $1.00, and robust security protocols make them an ideal partner in this new era of digital finance.

The future of stablecoin payments infrastructure looks bright, and refreshingly simple, for those ready to embrace dedicated networks like Stable L1. As adoption grows among both developers and end-users, expect frictionless ramps and private conversion flows to become not just possible but standard across modern finance.