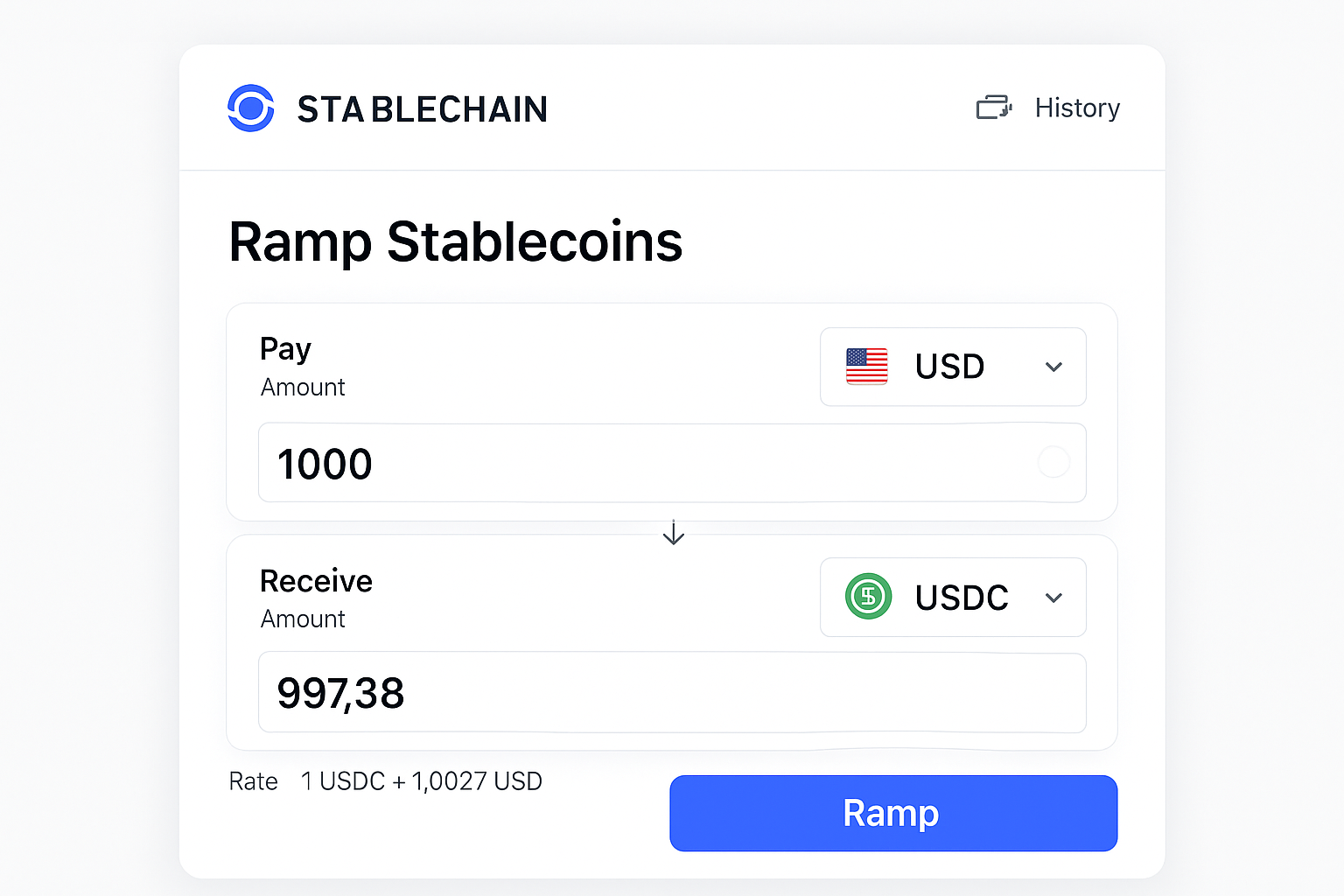

Stablecoins have become the backbone of digital payments, but even as adoption soars, on/off-ramping between crypto and fiat still feels clunky for many users. The introduction of Stablechain in July 2025 is a game-changer for anyone navigating the stablecoin ecosystem, especially those who value speed, predictability, and privacy. By making Tether’s USDT both the native gas and settlement token, Stablechain is quietly rewriting the playbook for how we move money in and out of crypto.

Why On/Off-Ramping Still Frustrates Crypto Users

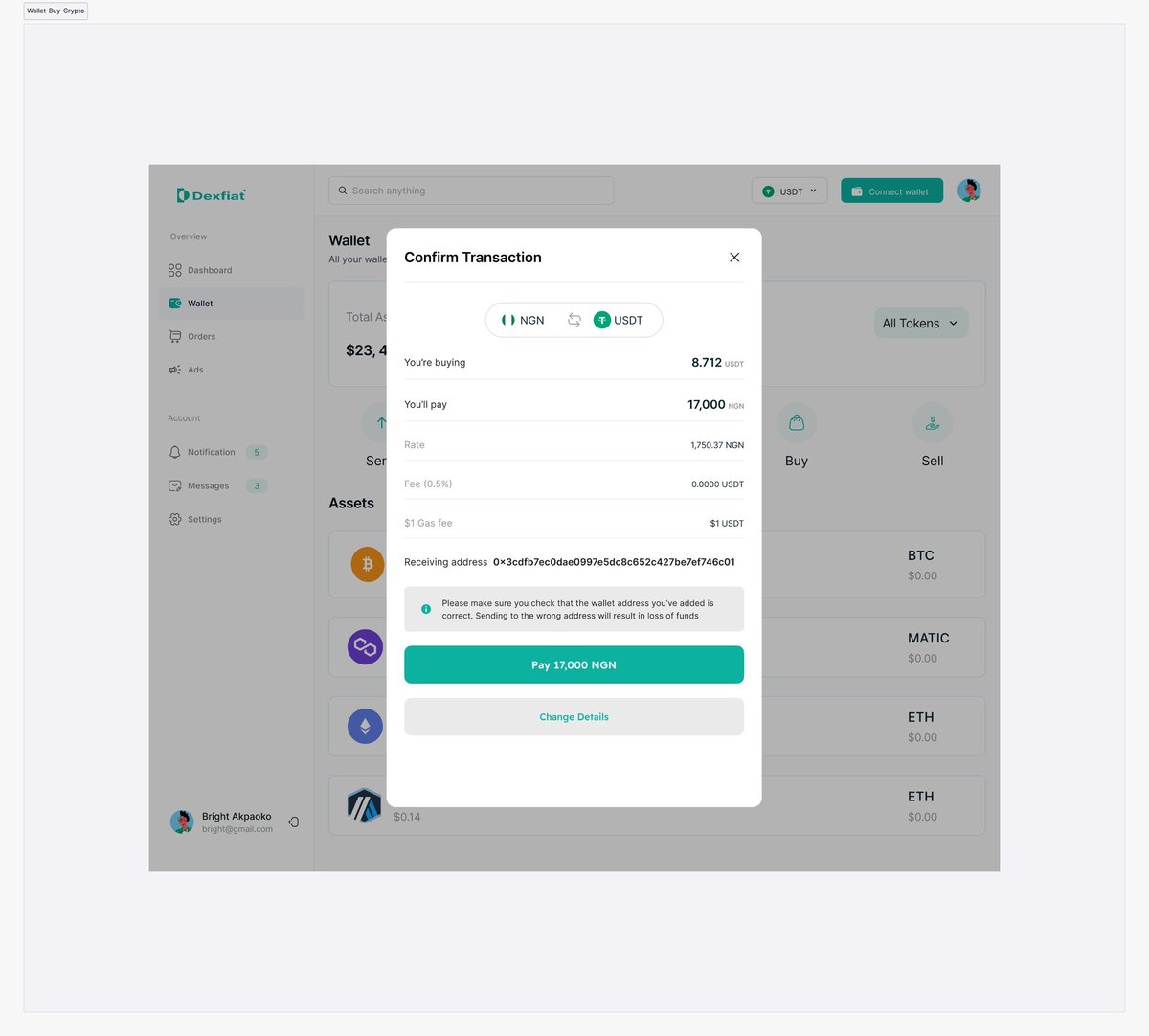

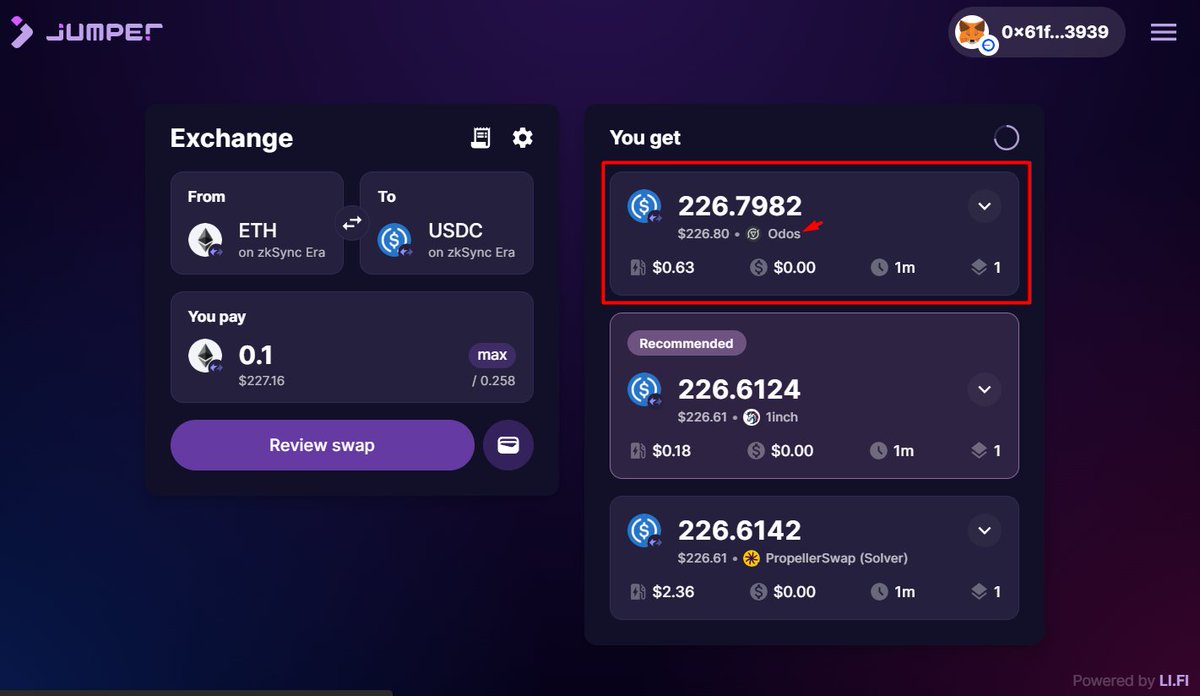

If you’ve ever tried to cash out your crypto or top up with stablecoins, you know the drill: juggling multiple tokens just to pay network fees, waiting for slow confirmations, and sometimes getting hit with unpredictable costs. Even on major blockchains like Ethereum or Tron, you need to keep a stash of their native tokens (ETH or TRX) just to move your USDT. It’s an awkward extra step – one that adds friction for both newcomers and seasoned users alike.

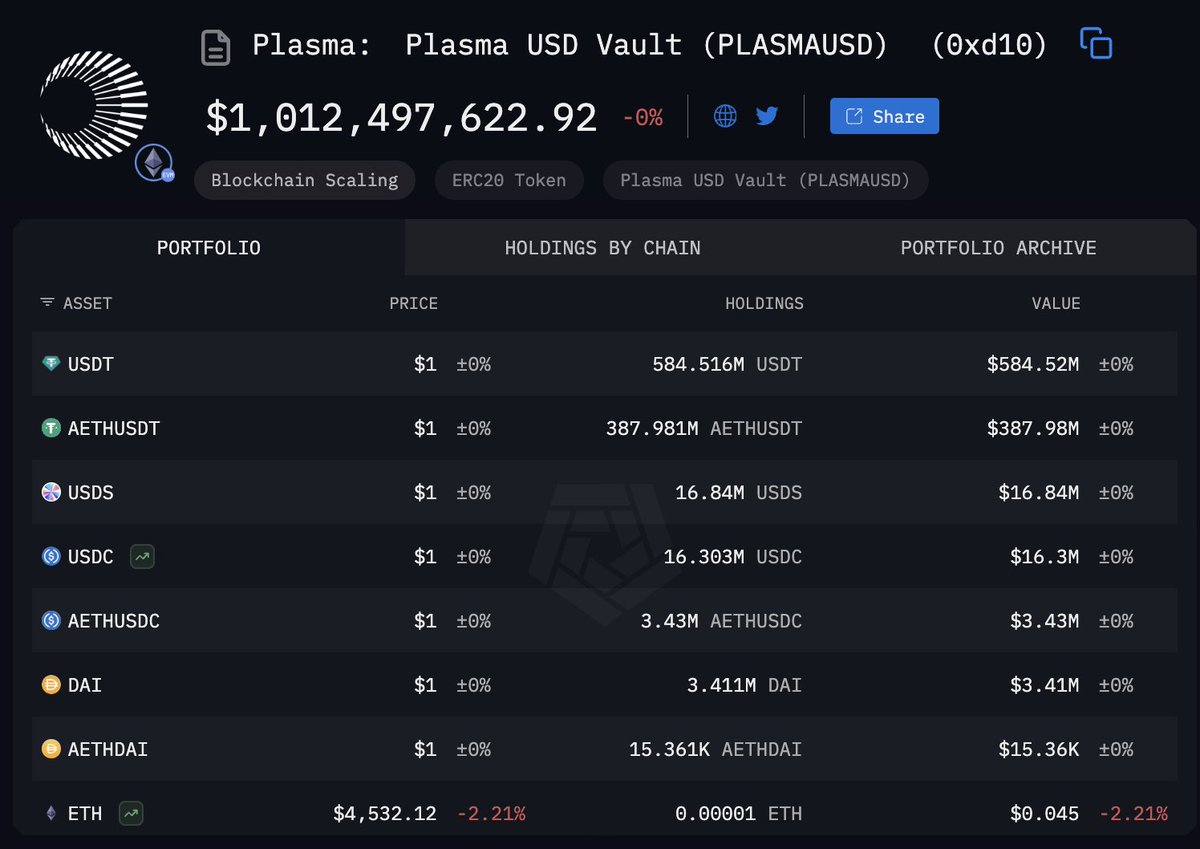

The latest research from McKinsey and Company highlights that stablecoins are rapidly emerging as a global alternative to conventional payments. Yet even as USDC and USDT dominate the market (source), cross-border transfers and fiat conversions still suffer from fees that can range from 0.1% on exchanges to over 1% via specialized providers. These inefficiencies are exactly what Stablechain aims to eliminate.

Stablechain’s Core Innovation: USDT as Native Gas

The real breakthrough? On Stablechain, you don’t need anything but USDT in your wallet – no more swapping into another coin just to cover gas fees. Every transaction fee is paid directly in USDT, which means costs are always predictable and there’s no exposure to volatile native tokens. This simplicity has huge implications for stablecoin on/off-ramps:

- No more stranded balances: You won’t be left with unusable dust amounts of random coins after cashing out.

- Straightforward accounting: All fees are denominated in the same stable asset you’re sending or receiving.

- Easier onboarding: New users can skip confusing steps around acquiring gas tokens just to get started.

This is particularly valuable for privacy-focused users who want minimal exposure points when converting between fiat and crypto – fewer steps mean fewer data trails.

Top Benefits of Using Stablechain for Private Stablecoin Fiat Conversion

-

Seamless USDT On/Off-Ramping: Stablechain lets users convert between fiat and USDT without juggling multiple tokens for fees. All transaction costs are paid in USDT, eliminating the need to manage separate cryptocurrencies and ensuring a smoother experience.

-

Sub-Second Transaction Finality: With block times under one second, Stablechain enables near-instant settlement for deposits and withdrawals. This speed makes stablecoin conversions practical for both retail and institutional users.

-

Gas-Free Peer-to-Peer Transfers with USDT0: Leveraging USDT0, users can send USDT on Stablechain without paying gas fees. This reduces friction and cost when moving funds between private wallets or accounts.

-

Enterprise-Ready Scalability: Stablechain is built to handle high transaction volumes without congestion, making it suitable for both individual users and large businesses needing reliable on/off-ramp infrastructure.

-

Predictable and Transparent Fees: By using USDT as the native gas token, Stablechain ensures stable and transparent transaction costs, which is crucial for financial planning and compliance in fiat conversion workflows.

The Power of Sub-Second Finality and Gas-Free Transfers

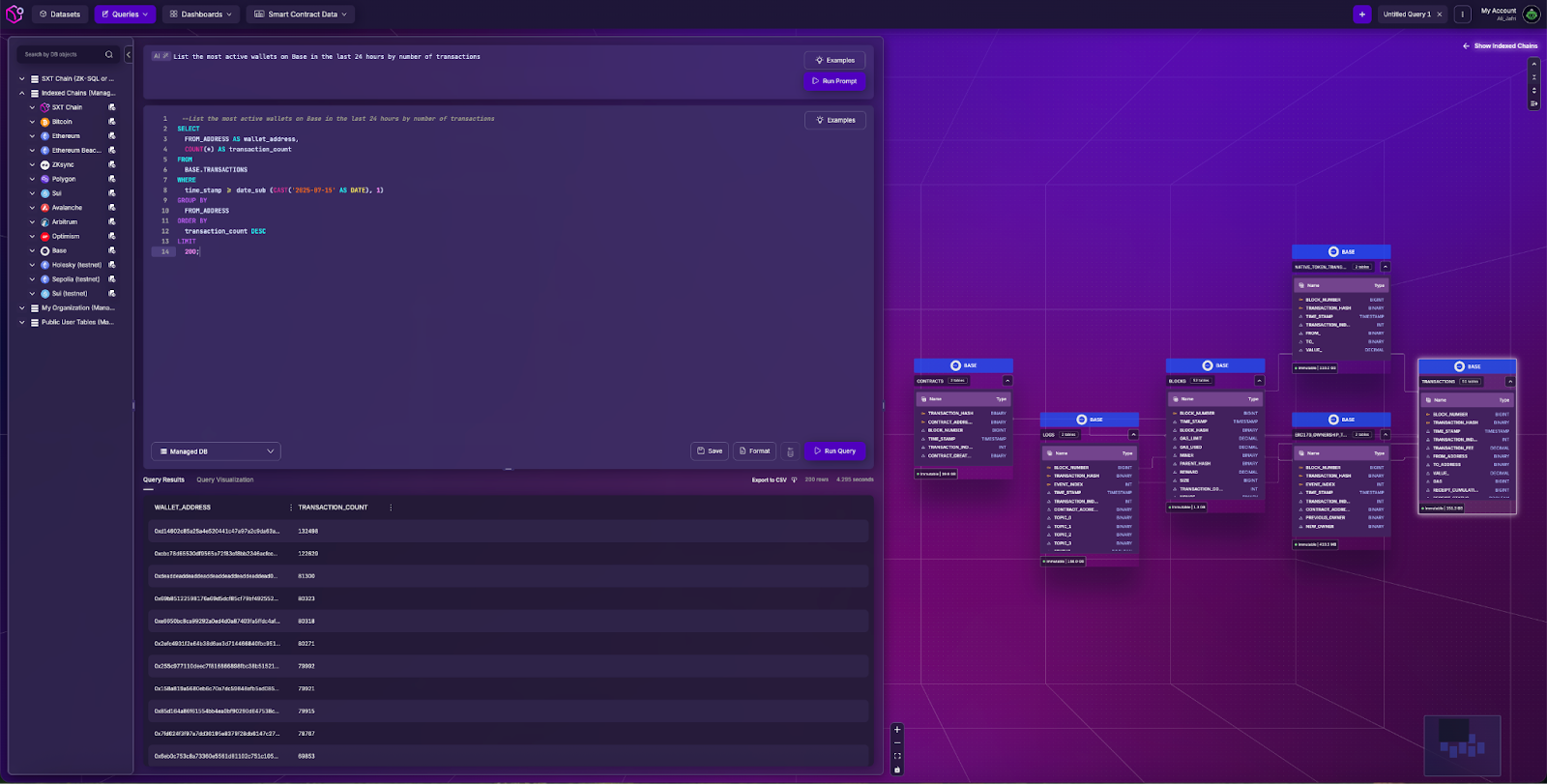

Speed matters when you’re moving money across borders or trying to catch a market opportunity. Stablechain delivers sub-second transaction finality (source), which is a leap forward from traditional blockchains where transactions can take minutes (or longer during network congestion). This near-instant processing makes both on-ramping (fiat-to-USDT) and off-ramping (USDT-to-fiat) far more practical for everyday use cases – think payroll, remittances, or merchant settlements.

The chain also introduces USDT0, a LayerZero-enabled version of Tether that supports gas-free peer-to-peer transfers. Imagine sending $1,000 worth of USDT0 without worrying about topping up your wallet with any other token – it’s frictionless by design. For anyone running large-scale operations or simply wanting hassle-free personal transfers, this feature alone could be transformative.

Enterprise-Ready Infrastructure Meets Everyday Utility

Beneath these user-friendly features lies an enterprise-grade backbone built for scale. According to Stable.xyz, Stablechain was engineered with high throughput in mind so it can handle everything from individual peer-to-peer payments up to institutional flows without bottlenecks or delays. That means whether you’re a freelancer cashing out earnings or a fintech platform managing millions in daily volume, the infrastructure won’t slow you down.

This robustness also helps ensure that on/off-ramp services built atop Stablechain remain reliable even during periods of high demand – something legacy chains have struggled with historically. It’s no wonder that industry analysts see this as a pivotal development in making stablecoins truly viable as everyday money rather than just speculative assets.

For privacy advocates and power users, Stablechain’s design is especially compelling. By keeping all transactions and fees within the USDT ecosystem, it minimizes the number of touchpoints where personal information or transaction data might leak. This approach helps users maintain a higher level of anonymity, something that’s increasingly valued as regulatory scrutiny ramps up worldwide.

But it isn’t just about privacy or speed. The predictability of fees and instant settlement are reshaping how businesses think about stablecoin infrastructure. Merchants can accept payments with confidence that funds will arrive in seconds and that costs won’t fluctuate due to network congestion or token volatility. Payroll providers can process mass payouts without worrying about stranded balances or complex reconciliation between different assets.

How Stablechain Stacks Up for On/Off-Ramp Users

Let’s break down why Stablechain is already gaining traction among those who regularly convert between fiat and stablecoins:

Top Reasons Users Are Switching to Stablechain

-

USDT as the Native Gas Token: Stablechain lets users pay transaction fees directly in USDT, removing the need to manage multiple cryptocurrencies and ensuring predictable, stable costs for on/off-ramp transactions.

-

Sub-Second Transaction Finality: With block times under one second, Stablechain offers near-instant settlement, making on-ramping (fiat to USDT) and off-ramping (USDT to fiat) much faster and more practical for everyday use.

-

Gas-Free Peer-to-Peer Transfers with USDT0: By leveraging USDT0 (a LayerZero-enabled version of USDT), users can send funds without paying gas fees, reducing friction and cost for moving money in and out of the stablecoin ecosystem.

-

Enterprise-Ready Scalability: Stablechain is built to handle high transaction volumes without congestion, supporting both individual users and institutions for seamless on/off-ramping even during peak demand.

-

Simplified User Experience: By combining stable transaction fees, rapid settlement, and gas-free transfers, Stablechain streamlines the entire on/off-ramp process, making stablecoin adoption easier for everyone.

- Simplified onboarding: No need to acquire extra tokens for network fees, making the first step into crypto less intimidating.

- Lower total cost: With gas paid in USDT and support for gasless transfers via USDT0, users keep more of their money when moving funds in or out.

- Consistent experience across borders: Sub-second finality means your transaction speed doesn’t depend on geography or time zone.

- Enterprise-grade reliability: Designed to handle surges in demand, so you’re not stuck waiting during peak periods.

This is a big leap forward compared to legacy chains where off-ramping often meant juggling multiple wallets, worrying about network congestion, or getting stung by surprise fees. Now, with a single asset as both value and gas, the process becomes almost as seamless as using traditional fintech apps – but with the added benefits of self-custody and global reach.

The Road Ahead: What Stablechain Means for Crypto Finance

The launch of Stablechain sets a new benchmark for what users should expect from stablecoin infrastructure. As more platforms integrate with this USDT-native chain, we’re likely to see an explosion in real-world use cases – from international payrolls to instant merchant settlements and frictionless remittances. The ability to move value at the speed of software without sacrificing control or privacy could finally make stablecoins live up to their promise as digital cash for everyone.

If you’re looking for a smoother path between crypto and fiat – whether you’re an individual seeking privacy or an enterprise demanding scale – keeping an eye on Stablechain makes sense. Its blend of speed, simplicity, and security is already attracting attention across the industry.

If stablecoins are money for the digital age, then chains like Stablechain are building the highways that make them truly usable everywhere.

– Sophie Renner