Stablecoin adoption is rapidly evolving, but the on/off-ramp experience has long been a pain point for both retail users and enterprises. The emergence of Stable’s USDT-Gas Layer 1 blockchain is fundamentally reshaping this landscape by eliminating legacy frictions and unlocking a new level of usability for stablecoin rails. With USDT as its native gas and settlement token, Stable is erasing the volatility risk and complexity that have hampered mass adoption of crypto-to-fiat payments.

Why Stable’s USDT Gas Token Model Is a Game Changer

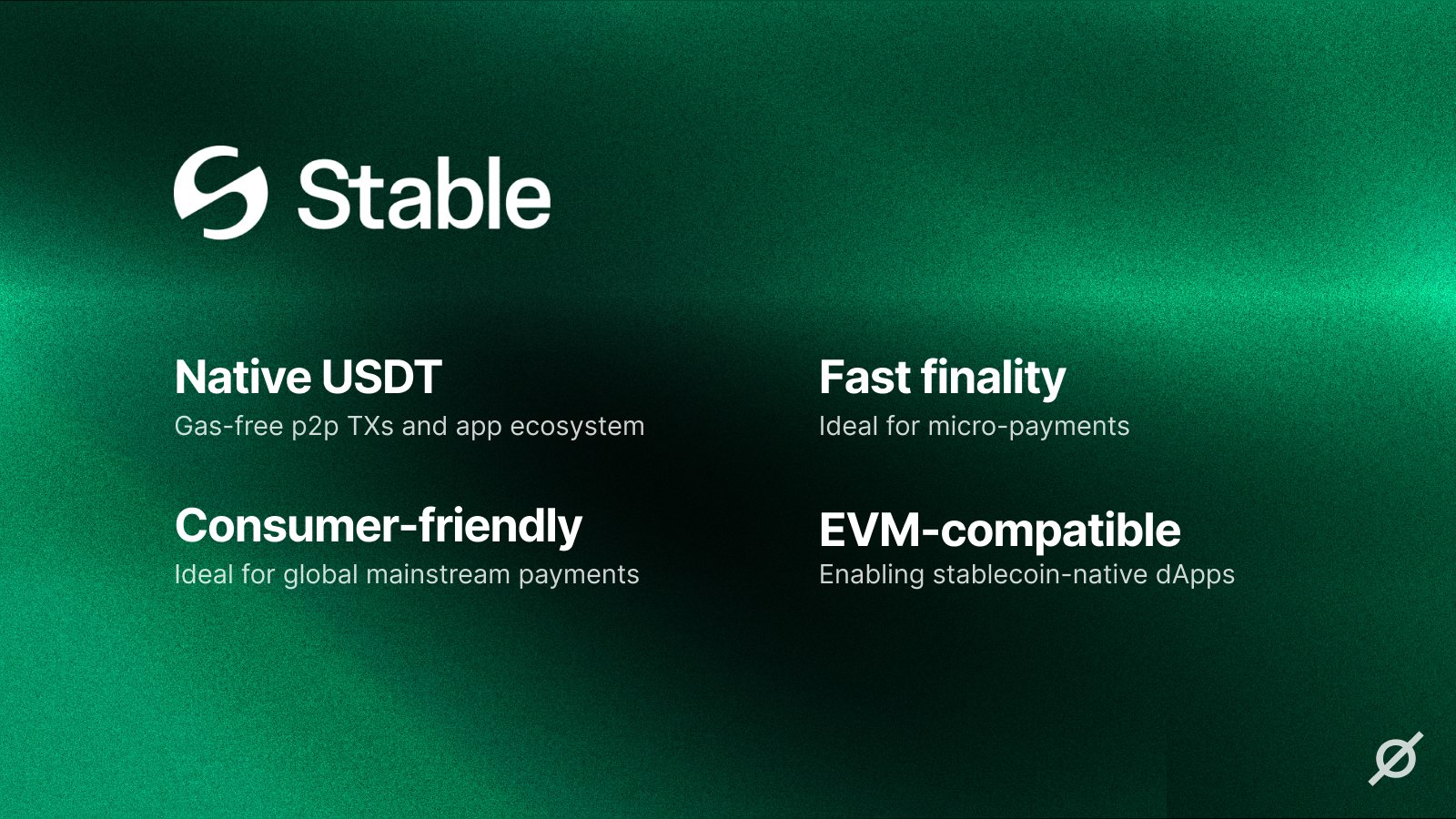

The traditional on-chain user journey is riddled with friction: want to transfer stablecoins? You still need to hold a volatile asset like ETH or SOL just to pay network fees. This creates operational headaches, extra conversions, and unnecessary exposure to price swings. Stable flips this script. By using Tether’s USDT as both the gas fee token and settlement currency, Stable removes the need for any secondary asset. Users can send or receive USDT without ever touching another coin – dramatically simplifying onboarding for both individuals and businesses.

This design isn’t just theoretical. According to Stable’s documentation, their architecture enables true gas-free USDT transfers. Through the innovative “USDT0” mechanism, users can execute peer-to-peer transactions with zero network fees, bypassing the need for traditional bridges or wrapped assets.

High Performance Meets EVM Compatibility

The Layer 1 race has always been about throughput and latency – but most blockchains force a tradeoff between performance and developer accessibility. Stable sidesteps this by delivering sub-second block finality alongside full EVM compatibility. That means developers can port existing Ethereum dApps directly onto Stablechain with minimal friction, leveraging familiar tooling while benefiting from instant settlement.

This technical edge is crucial for on/off-ramps because it ensures that fiat-to-crypto flows aren’t bottlenecked by slow confirmation times or unpredictable network congestion. For enterprises requiring guaranteed transaction performance – think payroll providers or payment processors – Stable offers dedicated blockspace allocations regardless of network activity levels.

$28 Million in Backing: Why Institutional Players Are Betting on Stablechain

The market has taken notice in a big way. In July 2025, Stable closed a $28 million seed round led by Bitfinex and Hack VC, joined by Franklin Templeton and Castle Island Ventures (source). This influx of capital is earmarked for infrastructure buildout and global expansion of USDT distribution – signaling deep institutional confidence in the chain’s potential as the next-generation stablecoin payment rail.

The vision goes beyond just speed or cost savings; it’s about transforming stablecoin onramp/offramp workflows into seamless user experiences that rival traditional fintech platforms but with greater privacy, programmability, and composability.

Key Advantages of Stable Layer 1 for Stablecoin Onramps

-

USDT as Native Gas Token: Stable eliminates the need for volatile cryptocurrencies by allowing users to pay transaction fees directly in USDT, streamlining onboarding and reducing friction for new users.

-

Gas-Free Peer-to-Peer Transfers: Through the USDT0 mechanism, Stable enables zero-fee USDT transfers between users, making on/off-ramp transactions more cost-effective and accessible.

-

High Throughput & Low Latency: Stable’s architecture delivers sub-second block finality and high transaction throughput, ensuring rapid settlement and a seamless user experience for stablecoin onramps.

-

Full EVM Compatibility: Developers can easily port existing Ethereum applications and utilize familiar tooling within the Stable ecosystem, accelerating integration for on/off-ramp providers.

-

Guaranteed Blockspace for Enterprises: Stable offers guaranteed blockspace allocations to enterprise partners, ensuring consistent transaction performance even during periods of high network activity.

-

Confidential Transfers with ZK Cryptography: Planned zero-knowledge (ZK) features will enable private USDT transactions while maintaining regulatory compliance, addressing privacy needs for institutional and retail users.

-

Robust Backing and Ecosystem Support: With $28 million in seed funding led by Bitfinex and Hack VC, and participation from Franklin Templeton and Castle Island Ventures, Stable is positioned for global expansion and infrastructure growth.

With innovations like confidential transfers via zero-knowledge cryptography on the roadmap, privacy advocates are watching closely as well. In short: if you’re building or using stablecoin infrastructure today, ignoring what’s happening on Stable would be a mistake.

For users and businesses seeking seamless crypto to fiat stablecoin solutions, Stable’s architecture delivers a frictionless experience that stands apart from legacy blockchains. The ability to pay network fees natively in USDT means fewer failed transactions, no surprise fee conversions, and a dramatically simplified onboarding process for new users. This is particularly relevant for global payroll, remittance, and e-commerce use cases where operational efficiency and predictability are paramount.

Gas-Free Transfers: Real-World Impact

The gas-free USDT transfers enabled by Stable’s USDT0 mechanism are more than just a technical novelty, they have real economic consequences. By eliminating transaction fees for peer-to-peer payments, Stable reduces the total cost of ownership for both retail and institutional actors. This makes microtransactions viable again and unlocks new business models that were previously cost-prohibitive on other chains.

Imagine an onramp where users can purchase USDT with fiat and immediately send it globally without worrying about gas balances or hidden costs. Or an offramp where merchants can accept USDT payments directly into their wallets and cash out to fiat with zero slippage or conversion headaches. That’s the paradigm shift Stable is engineering.

It’s not just about speed or cost, it’s about creating a user journey that feels as intuitive as Web2 fintech but with all the advantages of programmable money. The result is a powerful value proposition for anyone building stablecoin onramp/offramp infrastructure at scale.

Enterprise-Grade Features: Guaranteed Blockspace and Confidentiality

Stable isn’t stopping at performance improvements. Its roadmap includes enterprise-grade features like guaranteed blockspace allocations, ensuring consistent transaction throughput even during periods of high network congestion. This is critical for regulated industries, financial institutions, payroll platforms, cross-border payment providers, that cannot afford unpredictable settlement times.

The upcoming integration of confidential transfers using zero-knowledge cryptography will bring privacy guarantees to stablecoin payments without sacrificing compliance. This dual focus on privacy and regulatory alignment positions Stable as a serious contender in the next wave of digital asset infrastructure.

What Does This Mean for On/Off-Ramp Providers?

The implications are significant: by abstracting away volatility risk and offering instant settlement with predictable costs, Stable Layer 1 blockchain allows on/off-ramp providers to deliver experiences that rival (and often surpass) traditional payment rails.

- No need for users to manage multiple tokens or wallets, everything runs through USDT.

- No surprise gas spikes, fees are stable, transparent, and denominated in the same asset being transferred.

- No waiting hours for confirmations, even during peak traffic periods.

Key Ways Stablechain Streamlines Crypto-to-Fiat Ramping

-

USDT as Native Gas Token: Stablechain eliminates the need for volatile cryptocurrencies by using USDT for all transaction and settlement fees, simplifying on/off-ramp workflows and reducing user friction.

-

Gas-Free USDT Transfers: Through its USDT0 mechanism, Stablechain enables peer-to-peer USDT transactions without network fees, making crypto-to-fiat conversions more cost-effective and accessible.

-

Seamless Cross-Chain USDT Movement: The platform supports cross-chain USDT transfers without traditional bridges, allowing users to move funds between networks efficiently when ramping in or out of fiat.

-

High Throughput & Low Latency: With sub-second block finality and EVM compatibility, Stablechain ensures fast, reliable transaction processing for on/off-ramp providers and users.

-

Guaranteed Blockspace for Enterprises: Stablechain offers guaranteed blockspace allocations, ensuring consistent transaction speeds for institutional on/off-ramp operations even during periods of high network activity.

-

Confidential Transfers with Compliance: Planned zero-knowledge cryptography features will allow private USDT transactions while maintaining regulatory compliance, enhancing privacy for fiat ramping workflows.

This is why institutional players, from Bitfinex to Franklin Templeton, are betting big on this ecosystem. They see the writing on the wall: stablecoins are not just another asset class but the backbone of programmable money flows worldwide.

The Bottom Line: A New Standard for Stablecoin Infrastructure

Stablechain review: If you’re building in crypto payments, DeFi, or embedded finance, and you care about speed, security, privacy, or simply delivering a better user experience, the innovations coming out of Stable’s USDT-Gas Layer 1 should be at the top of your radar. With $28 million in fresh funding and major industry support behind it, Stable isn’t just another chain; it’s an entirely new standard for how stablecoin rails should work in practice.