The crypto payments landscape is being fundamentally reshaped as stablecoin cards finally bridge the gap between digital assets and daily spending. Gnosis Pay, a decentralized payment network built on Gnosis Chain, is at the forefront of this shift, recently processing over $87 million in transactions as of September 11,2025. This surge in volume brings Gnosis Pay within striking distance of its $100 million milestone – a figure that not only cements its relevance but also signals the mainstream arrival of stablecoin-linked payment cards.

Gnosis Pay and the Era of Spendable Stablecoins

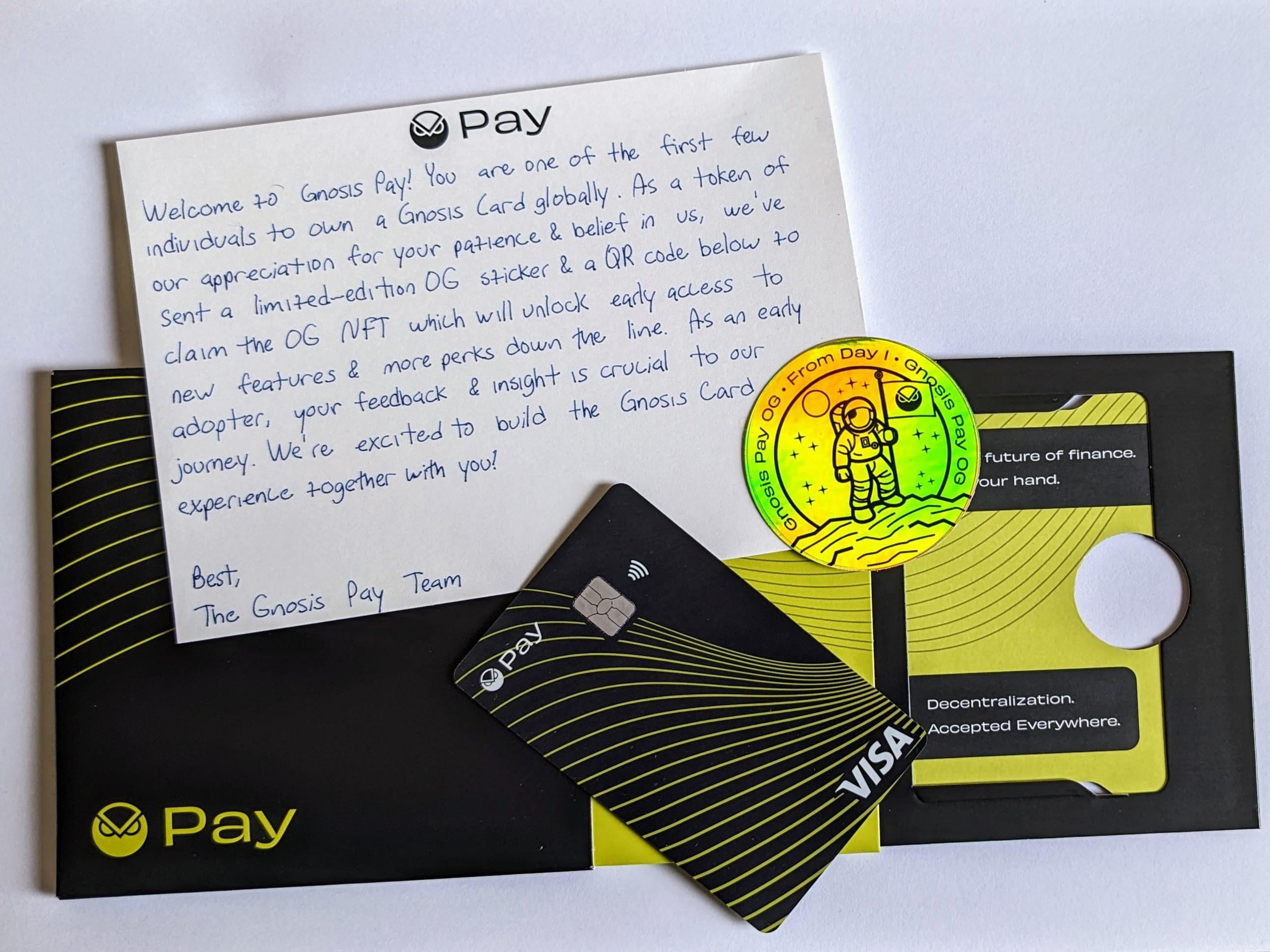

Traditionally, crypto has been siloed from real-world commerce, with users forced to rely on clunky exchanges or opaque intermediaries to access their funds. Enter Gnosis Pay: by integrating with Visa’s global network, it allows users to spend stablecoins directly from self-custody wallets wherever Visa is accepted. No more waiting for off-ramps or worrying about third-party custody risks. The current $87 million processed milestone isn’t just a number – it’s a testament to growing adoption and real-world utility.

This isn’t happening in isolation. The total supply of stablecoins has now surpassed $300 billion as of October 2025 (Axios), rivaling some of the largest U. S. retail money market funds and regional banks in scale. Platforms like Rain are enabling partners to issue stablecoin-linked Visa cards at scale (Wikipedia: Rain (fintech)). The industry is rapidly converging around one thesis: if you can hold digital dollars, you should be able to spend them anywhere, instantly.

How Stablecoin Cards Work: Self-Custody Meets Everyday Spending

The technical leap here isn’t just about payments – it’s about sovereignty and speed. With Gnosis Card, users retain full control over their assets until the moment they tap or swipe. Funds are drawn directly from on-chain balances – typically USDT, USDC, DAI or region-specific stablecoins like EURe – with settlement handled via blockchain rails instead of legacy banking infrastructure.

This model delivers several hard-hitting advantages:

- Anonymity and Privacy: Non-custodial design means no centralized KYC honeypots.

- Instant Settlement: Transactions clear in seconds via smart contracts and sidechains.

- No Forced Off-Ramping: Users spend crypto natively without fiat conversion friction.

- Global Acceptance: Thanks to Visa rails, merchants worldwide can accept these payments without even realizing they’re crypto-powered.

$87 Million Processed: Why This Milestone Matters for Crypto Adoption

The numbers don’t lie: Gnosis Pay is now routinely processing volumes that put it on par with established fintech upstarts. At a current price of $152.78 per GNO token, the value proposition for both users and investors has never been clearer. This growth isn’t just hype-driven; it’s powered by real transaction demand from web3 natives who want frictionless access to their digital wealth.

Gnosis (GNO) & Leading Stablecoins Price Prediction 2026-2031

Professional outlook based on adoption trends, stablecoin card growth, and evolving crypto payments landscape.

| Year | Minimum Price (GNO) | Average Price (GNO) | Maximum Price (GNO) | Stablecoin Peg Scenario | Annual Change (%) |

|---|---|---|---|---|---|

| 2026 | $120.00 | $165.00 | $215.00 | Stablecoins remain pegged near $1.00 (USDT/USDC/EURe) | -4% to +41% |

| 2027 | $140.00 | $190.00 | $265.00 | Stablecoins remain pegged near $1.00 | +17% to +23% |

| 2028 | $170.00 | $235.00 | $335.00 | Stablecoins remain pegged near $1.00 | +24% to +26% |

| 2029 | $210.00 | $280.00 | $400.00 | Stablecoins remain pegged near $1.00 | +19% to +20% |

| 2030 | $250.00 | $330.00 | $470.00 | Stablecoins remain pegged near $1.00 | +18% to +19% |

| 2031 | $290.00 | $380.00 | $540.00 | Stablecoins remain pegged near $1.00 | +15% to +16% |

Price Prediction Summary

Gnosis (GNO) is poised for substantial long-term growth, supported by rapid adoption of stablecoin payment cards and expanding real-world use cases. While volatility will persist, GNO’s integration with mainstream payment rails and strong ecosystem development position it for steady appreciation. Leading stablecoins (USDT, USDC, EURe) are expected to maintain their $1.00 peg, barring systemic disruptions, and will benefit from increased transaction volumes as crypto payments proliferate.

Key Factors Affecting Gnosis Price

- Adoption of Gnosis Pay and stablecoin-linked cards in daily commerce

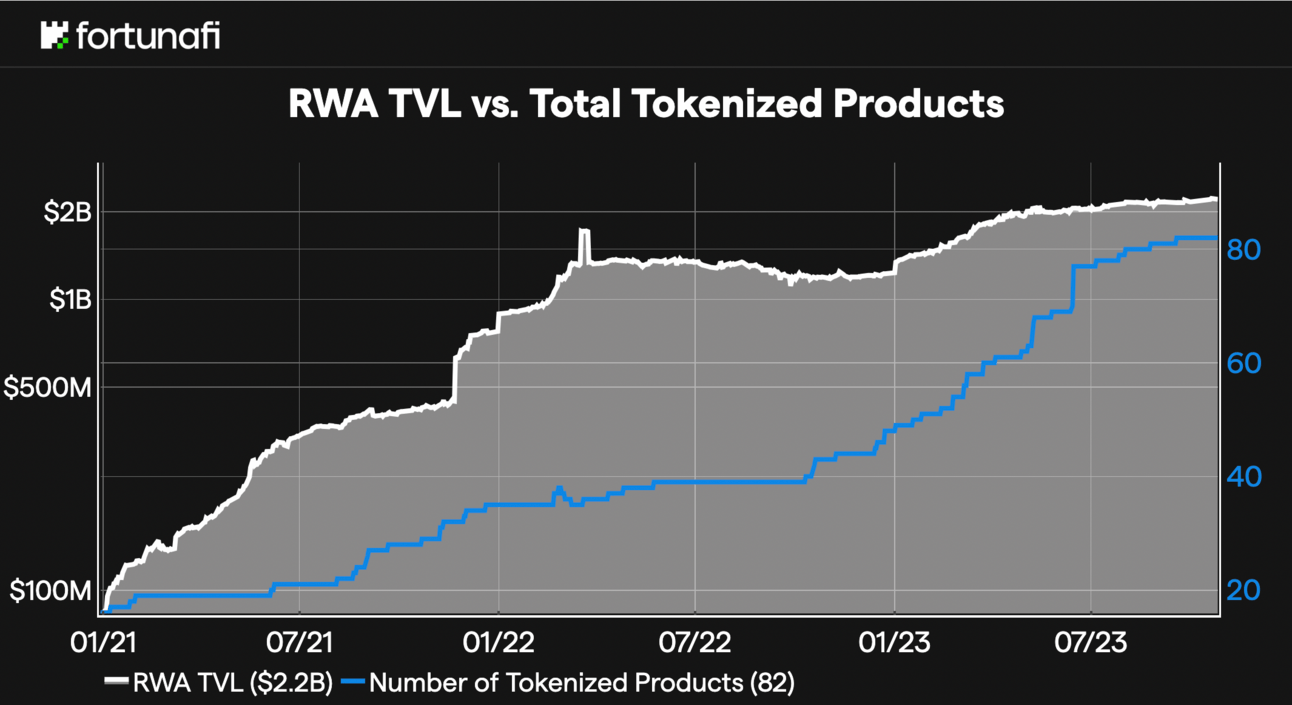

- Growth in total stablecoin supply and DeFi integration

- Regulatory clarity and global policy on crypto payments

- Technological advancements in cross-chain and payment infrastructure

- Potential competition from other payment-focused blockchains and fintechs

- Macro market cycles and investor sentiment

- Network upgrades and ecosystem partnerships driving utility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The implications are massive for both sides of the on/off-ramp equation:

- For crypto holders: Instant liquidity without sacrificing custody or privacy.

- For merchants: Seamless integration with existing payment terminals – no retraining required.

- For regulators and TradFi institutions: A glimpse into how programmable money can coexist with legacy rails while boosting transparency and efficiency.

Gnosis Pay’s rise is also a signal flare for the broader stablecoin card ecosystem. We’re seeing a new breed of Web3 payment platforms, like Wirex and Suberra, jump into the self-custody card arena, each racing to capture a slice of this rapidly expanding market. What sets Gnosis apart is its open infrastructure: developers can build on top of the protocol, enabling new use cases from DeFi-powered rewards to on-chain credit scoring. This composability is what will ultimately unlock the next phase of crypto payments.

But it’s not just about tech for tech’s sake. The real-world impact is already being felt across emerging markets and privacy-focused communities. In regions plagued by capital controls or unstable currencies, stablecoin cards offer an escape hatch, a way to preserve value and transact globally without dependence on local banks. For privacy advocates, non-custodial cards are the antidote to surveillance-heavy fintech solutions.

The Stablecoin Card Playbook: Why Adoption Is Accelerating

Top 5 Reasons Users Are Switching to Stablecoin Cards

-

Seamless Everyday Spending: Stablecoin cards like Gnosis Pay let users pay for groceries, coffee, and online shopping directly with stablecoins—bridging crypto and real-world commerce.

-

Self-Custody and Security: Platforms such as Gnosis Pay and Wirex offer non-custodial cards, allowing users to maintain control of their funds without relying on third-party banks.

-

Global Acceptance via Visa: With Visa-supported stablecoin cards, users can spend their digital assets anywhere Visa is accepted, making crypto as usable as cash worldwide.

-

Low-Cost, Fast Cross-Border Payments: Stablecoin cards leverage blockchain technology to enable efficient, affordable international transactions, bypassing traditional banking fees and delays.

-

Growing Ecosystem and Adoption: With the total stablecoin supply surpassing $300 billion and Gnosis Pay processing over $87 million in transactions, users are joining a rapidly expanding, mainstream financial movement.

Let’s be clear: the $87 million milestone isn’t just a vanity metric. It’s proof that people want, and will use, crypto-native payment tools when they’re fast, private, and easy to integrate into daily life. The frictionless spending experience is winning over everyone from hardcore DeFi users to casual spenders who simply want more control over their money.

Of course, challenges remain. Regulatory scrutiny is intensifying as stablecoins reach systemic scale (now over $300 billion in supply). Compliance frameworks for non-custodial solutions are still evolving, and traditional financial institutions are watching closely as their role in settlement shrinks with every blockchain-powered transaction (Visa expands USD cross-border settlement via blockchain). But if there’s one thing Gnosis Pay has shown, it’s that user demand for seamless on/off-ramp stablecoins isn’t going away, it’s accelerating.

Volatility is opportunity: As more users migrate funds from centralized exchanges into self-custody wallets linked to stablecoin cards, we’re witnessing a true paradigm shift in how digital assets move through the economy.

What Comes Next for Gnosis Pay and Stablecoin Cards?

With Gnosis (GNO) currently trading at $152.78, all eyes are on when, not if, the platform will smash through its $100 million processed milestone. Expect even greater competition among card issuers and more integration with DeFi protocols as volume ramps up. If you’re holding stablecoins today, odds are you’ll be able to spend them at your favorite retailer tomorrow, no off-ramp headaches required.

The bottom line? Stablecoin cards like Gnosis Pay aren’t just another crypto novelty, they’re rapidly becoming essential infrastructure for modern finance. Watch this space as programmable payments move out of the shadows and onto Main Street.