Stablecoins have evolved from a niche tool for crypto traders to the backbone of digital payments in 2025. With the global stablecoin market cap projected to surge from $208 billion in early 2025 to nearly $2.8 trillion by year’s end, the infrastructure for on/off-ramp payments has undergone a radical transformation. This shift is being driven by the emergence of stablecoin-powered Layer 1 (L1) blockchains, which are fundamentally reshaping how users move between crypto and fiat with unprecedented speed, privacy, and efficiency.

Why Stablecoin L1 Chains Are Disrupting On/Off-Ramp Payments

Traditional crypto onramps and offramps have long suffered from high fees, slow settlements, and regulatory bottlenecks. In response, a new breed of Layer 1 blockchains purpose-built for stablecoins has emerged, designed to address these pain points head-on. Take Stablechain, engineered specifically for Tether’s USDT. It enables users to transact entirely in USDT, eliminating the need for volatile native tokens for gas fees. Even more groundbreaking is its support for gas-free transactions via USDT0, a LayerZero-enabled token that allows peer-to-peer transfers without network fees. This marks a significant leap in making stablecoin onramp 2025 solutions more accessible and user-friendly.

Major payment gateways are also embracing this trend. For example, Alchemy Pay’s partnership with World Liberty Financial Inc. now allows users worldwide to purchase USD1 (a US dollar stablecoin) using Visa, Mastercard, Apple Pay, Google Pay, mobile wallets, and regional bank transfers. This direct integration bridges the gap between traditional finance and the crypto ecosystem, dramatically simplifying the stablecoin off-ramp solutions landscape. (Source)

Cross-Chain Innovation: Liquidity Without Borders

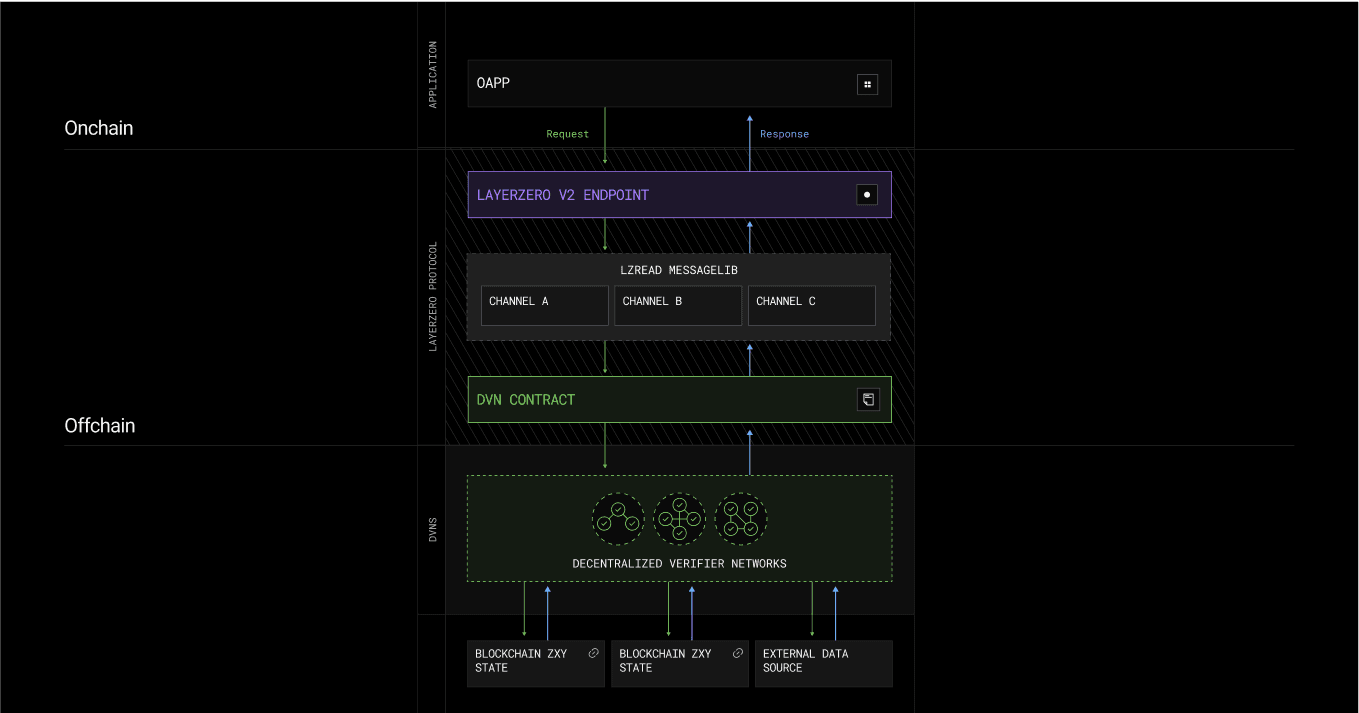

One of the most significant advancements in 2025 is the seamless movement of stablecoins across blockchains, thanks to protocols like LayerZero. Previously, transferring assets between chains required complex bridges or wrapped tokens, introducing both friction and risk. Now, cross-chain stablecoin transfers are direct, eliminating intermediaries and ensuring consistent behavior across multiple networks. This not only enhances liquidity but also empowers developers to build applications with true stablecoin interoperability. For users, it means instant crypto to fiat conversion and easier access to stablecoin cards 2025 products, all without worrying about network compatibility or hidden fees.

Top 5 Stablecoin-Powered Layer 1 Chains in 2025

-

Stablechain – Purpose-built for Tether’s USDT, Stablechain enables transactions entirely in USDT, including gas fees. Its innovative USDT0 token, powered by LayerZero, allows for gas-free peer-to-peer transfers, minimizing transaction costs and volatility risks.

-

Circle Payments Network (CPN) – Developed by Circle, CPN provides direct, programmable access to mint, transfer, and settle USDC across licensed financial institutions. It supports B2B payments, treasury disbursements, and regulatory compliance, making it a cornerstone for institutional adoption.

-

Alchemy Pay – By integrating with World Liberty Financial Inc., Alchemy Pay supports seamless on-ramp access to USD1 stablecoin. Users can purchase USD1 via Visa, Mastercard, Apple Pay, Google Pay, and bank transfers, driving global stablecoin accessibility.

-

TransFi – TransFi’s stablecoin-native global payment infrastructure enables businesses to send, receive, convert, and settle payments in stablecoins across multiple countries and digital assets, all through a single integration. This streamlines stablecoin adoption for enterprises worldwide.

-

LayerZero – While not a standalone L1, LayerZero is pivotal in enabling cross-chain stablecoin transfers without wrapped assets or third-party bridges. Its technology enhances liquidity and risk management, supporting consistent stablecoin behavior across leading Layer 1 chains.

Stablecoin-Native Infrastructure: The New Global Payment Standard

Dedicated stablecoin-native infrastructures are propelling global adoption among businesses and institutions. Companies like TransFi now offer a single integration point where businesses can send, receive, convert, and settle payments in digital assets across dozens of countries. This infrastructure bypasses the need for deep blockchain expertise, making it easier for enterprises to leverage stablecoin technology in day-to-day operations. Meanwhile, institutional-grade networks like the Circle Payments Network (CPN) offer programmable access to mint, transfer, and settle USDC across licensed financial institutions, supporting B2B payments, treasury disbursements, and regulatory compliance with built-in auditability (Source).

These innovations are not just theoretical, they are actively redefining how users interact with both crypto and fiat worlds. The result is a more open, efficient, and privacy-preserving digital payment landscape, positioning stablecoin-powered Layer 1 chains as the backbone of modern finance in 2025.

As stablecoin-powered Layer 1 chains mature, users are experiencing tangible benefits in both everyday payments and institutional finance. The frictionless nature of these networks, combined with their global reach, has led to a surge in new use cases, from streaming micropayments to instant payroll and borderless B2B settlements. Stablecoins are no longer just a bridge between crypto and fiat; they are becoming the default settlement rail for the digital economy.

Privacy, Security, and Accessibility: The Anonofframp. com Edge

For privacy advocates and tech-savvy users, platforms like anonofframp. com are at the forefront of this evolution. By leveraging stablecoin L1 chains, users can access on/off-ramp services that prioritize anonymity and speed without compromising regulatory standards. With stablecoin cards 2025 products, instant crypto to fiat conversion is now possible in seconds, making it easier than ever to spend digital assets in the real world.

- Speed: Stablecoin L1 chains settle transactions in seconds, reducing wait times for on/off-ramp conversions.

- Low Fees: Gas-free or minimal-fee models, such as USDT0 on Stablechain, drastically lower costs compared to legacy systems.

- Privacy: Enhanced privacy controls and non-custodial options empower users to retain control over their assets.

- Global Access: Integration with major payment gateways ensures universal reach, regardless of geography or local banking infrastructure.

- Compliance: Institutional-grade networks like CPN provide auditability and regulatory alignment for business users.

What’s Next for Stablecoin On/Off-Ramp Solutions?

The rapid expansion of stablecoin-powered Layer 1 chains is setting the stage for even more ambitious innovation. The next wave will likely focus on programmable money, automated settlements, conditional payments, and smart contract-driven compliance. As on/off-ramp solutions become more user-centric and interoperable, expect to see further democratization of access to global finance. Platforms like anonofframp. com will play a crucial role in this ecosystem by offering seamless bridges between traditional banking and the decentralized world.

Key Benefits of Using anonofframp.com for Stablecoin On/Off-Ramp Payments

-

Frictionless On/Off-Ramp Experience: anonofframp.com leverages dedicated stablecoin Layer 1 blockchains, such as Stablechain, to enable seamless and efficient transactions with minimal network fees, including gas-free transfers via USDT0.

-

Broad Payment Method Support: By integrating with leading payment gateways like Alchemy Pay, anonofframp.com allows users to purchase stablecoins using Visa, Mastercard, Apple Pay, Google Pay, and local bank transfers, enhancing accessibility worldwide.

-

Seamless Cross-Chain Transfers: anonofframp.com utilizes advanced protocols such as LayerZero to support direct, secure stablecoin transfers across multiple blockchains, eliminating reliance on wrapped assets or risky third-party bridges.

-

Stablecoin-Native Global Payment Infrastructure: Through integration with platforms like TransFi, anonofframp.com enables businesses and individuals to send, receive, convert, and settle stablecoin payments across borders with a single, user-friendly interface.

-

Institutional-Grade Compliance and Auditability: anonofframp.com benefits from partnerships with networks like Circle Payments Network (CPN), ensuring regulatory compliance, transparent audit trails, and secure settlement for B2B and treasury transactions.

It’s clear that stablecoin L1 chains are not just an incremental upgrade, they represent a foundational shift in how money moves. By marrying the stability of fiat with the programmability and reach of blockchain, these networks are delivering on the promise of fast, secure, and inclusive digital payments. Whether you’re an individual seeking privacy or an enterprise looking for efficient global settlements, the new era of stablecoin onramp 2025 solutions is here, and it’s rewriting the rules of modern finance.