Stablecoins have quickly evolved from a niche solution for crypto traders to the backbone of modern digital payments, offering a bridge between the volatility of cryptocurrencies and the predictability of fiat currencies. Yet, despite their promise, stablecoin on/off-ramps have long faced friction: complex user interfaces, unpredictable fee structures, and slow settlement times. In 2025, a new player is redefining this landscape, Stablechain. By leveraging USDT as its native gas token and introducing technical innovations like gas-free transfers, Stablechain is transforming how users move between crypto and fiat with stablecoins.

Why Stablecoin On/Off-Ramps Matter

On/off-ramps are the gateways that let users convert between fiat money and cryptocurrencies. For years, these ramps have been bottlenecked by high fees, opaque processes, and regulatory hurdles. According to Boston Consulting Group, the end-to-end cost advantage offered by stablecoins depends heavily on the ramp’s efficiency and network design. Traditional payment rails still dominate because they offer familiarity and regulatory clarity; however, they lag in speed and global accessibility.

The unique value proposition of stablecoins, especially USD-backed options like USDT, lies in their ability to enable fast, borderless payments without exposing users to the volatility that plagues assets like Bitcoin or Ethereum. Yet for all their advantages, even leading stablecoin networks require users to hold volatile tokens (such as ETH or SOL) just to pay transaction fees, a persistent pain point for mainstream adoption.

Stablechain: A Layer 1 Blockchain Purpose-Built for USDT

Enter Stablechain, a dedicated Layer 1 blockchain engineered specifically for Tether’s USDT. Unlike generic blockchains that treat stablecoins as secondary tokens, Stablechain integrates USDT at its very core: all transaction fees are paid directly in USDT itself. This eliminates the need for users to acquire or manage additional volatile tokens just to move their funds, a significant simplification that lowers barriers for both individuals and businesses.

This architecture not only streamlines user interactions but also addresses one of the most persistent challenges in crypto payments: predictable costs. By anchoring all fees in a single stable asset (USDT), Stablechain ensures that users always know exactly what they will pay, no more surprises due to fluctuating gas prices or token values.

USDT as Gas: Technical Innovation with Real-World Impact

The decision to use USDT as gas is more than a technical curiosity, it’s a catalyst for mass adoption. On platforms like Ethereum or Solana, newcomers often struggle with onboarding because they must first purchase small amounts of native tokens solely for transaction fees. This dual-token requirement creates complexity at exactly the point where simplicity is needed most.

Stablechain’s approach removes this hurdle entirely. Every interaction, from peer-to-peer transfers to merchant payments, can be completed using only USDT. This not only enhances usability but also unlocks new business models around stablecoin card solutions, privacy-focused ramps, and seamless off-ramp services tailored for both retail users and enterprises seeking efficient digital payment rails.

Key Benefits of Using USDT as Gas on Stablechain

-

Simplified User Experience: Paying network fees directly in USDT removes the need to manage volatile native tokens, streamlining onboarding and everyday transactions.

-

Gas-Free Peer-to-Peer Transfers: Leveraging EIP-7702 and Account Abstraction, Stablechain enables USDT transfers without network fees, making microtransactions and daily payments more practical.

-

Predictable and Low Transaction Costs: Using a stablecoin like USDT for gas eliminates concerns about fluctuating fee structures, ensuring cost predictability for both users and businesses.

-

High Performance and Scalability: Stablechain delivers sub-second finality and high throughput, supporting thousands of transactions per second to accommodate retail and institutional demands.

-

Enterprise-Grade Features: The platform offers guaranteed blockspace, batch settlement, and privacy-enhancing transfers, supporting regulatory compliance and large-scale operations.

-

Enhanced On/Off-Ramp Efficiency: By removing the need for dual-token management and reducing transaction complexity, Stablechain makes stablecoin entry and exit points more accessible and user-friendly.

Pioneering Gas-Free Peer-to-Peer Transfers

A standout feature of Stablechain is its support for gas-free peer-to-peer USDT transfers. Leveraging advanced mechanisms like EIP-7702 and Account Abstraction (AA), users can send or receive funds without incurring traditional network fees. This innovation makes microtransactions practical, enabling new use cases such as tipping content creators globally or facilitating everyday remittances without cost overheads.

The implications go beyond convenience; they touch on financial inclusion by making digital dollars accessible even in regions underserved by traditional banking infrastructure. For privacy advocates and those seeking regulatory compliance alike, this model offers both transparency (through auditable transactions) and confidentiality (via privacy-enhancing mechanisms).

Stablechain’s architecture is not just about technical novelty; it’s about delivering a user-centric experience that finally realizes the promise of stablecoins as true money-in-motion. The ability to pay fees in USDT, coupled with gas-free transfers, means that anyone, from a first-time crypto user in Southeast Asia to an institutional treasury manager in Europe, can move value instantly and predictably, without the friction that has long plagued the industry.

The Institutional Angle: Enterprise-Grade Features and Compliance

Where Stablechain truly distinguishes itself is in its suite of enterprise-grade features. Guaranteed blockspace allocation ensures that high-volume businesses can process transactions without congestion or delay. Batch settlement processing allows for the aggregation of thousands of payments into a single on-chain action, dramatically reducing operational costs for payment processors and remittance firms.

Privacy-enhancing transfer mechanisms are built with compliance in mind, striking a balance between regulatory requirements and user confidentiality. This is critical as governments and financial institutions increasingly scrutinize digital asset flows. By offering auditable yet private transactions, Stablechain positions itself as a compliant-yet-user-friendly backbone for modern payment solutions.

Transforming On/Off-Ramps: From Friction to Fluidity

The integration of USDT as gas directly impacts the efficiency of stablecoin on/off-ramps. Users no longer need to juggle multiple assets or worry about volatile fee structures when moving between fiat and crypto. For platforms like anonofframp.com, this means it’s now possible to offer near-instant conversion services with clear, predictable costs, an essential step toward mainstream adoption.

How Stablechain Enhances Stablecoin On/Off-Ramps

-

USDT as Native Gas Token: Stablechain allows users to pay all transaction fees directly in USDT, eliminating the need to hold volatile cryptocurrencies for gas. This streamlines the on/off-ramp process and reduces friction for both new and experienced users.

-

Gas-Free Peer-to-Peer Transfers: Leveraging EIP-7702 and Account Abstraction, Stablechain enables gas-free USDT transfers between users. This innovation removes network fee barriers, making stablecoin transactions more practical for everyday payments and remittances.

-

Sub-Second Transaction Finality: With transaction finality achieved in under a second, Stablechain ensures that on/off-ramp operations are fast and reliable, reducing waiting times and uncertainty for users moving between fiat and stablecoins.

-

High Throughput for Scalability: Stablechain processes thousands of transactions per second, supporting high-volume on/off-ramp activity without congestion. This scalability is crucial for both retail and institutional adoption of stablecoins.

-

Enterprise-Grade Features: The platform offers guaranteed blockspace allocation, batch settlement processing, and privacy-enhancing transfers. These features cater to the needs of businesses and financial institutions seeking secure, compliant, and efficient stablecoin on/off-ramp solutions.

-

Simplified User Experience: By addressing fluctuating fees, slow confirmations, and complex wallet management, Stablechain makes the process of converting between fiat and stablecoins more intuitive and accessible for users worldwide.

Consider the current market landscape: most exchanges require users to convert stablecoins into native tokens before withdrawal or payment, adding time, cost, and confusion. With Stablechain’s single-token model, these steps are eliminated. The result is a smoother pipeline for both retail users seeking privacy and fintechs aiming to deploy scalable digital dollar solutions.

Scalability and Performance at Scale

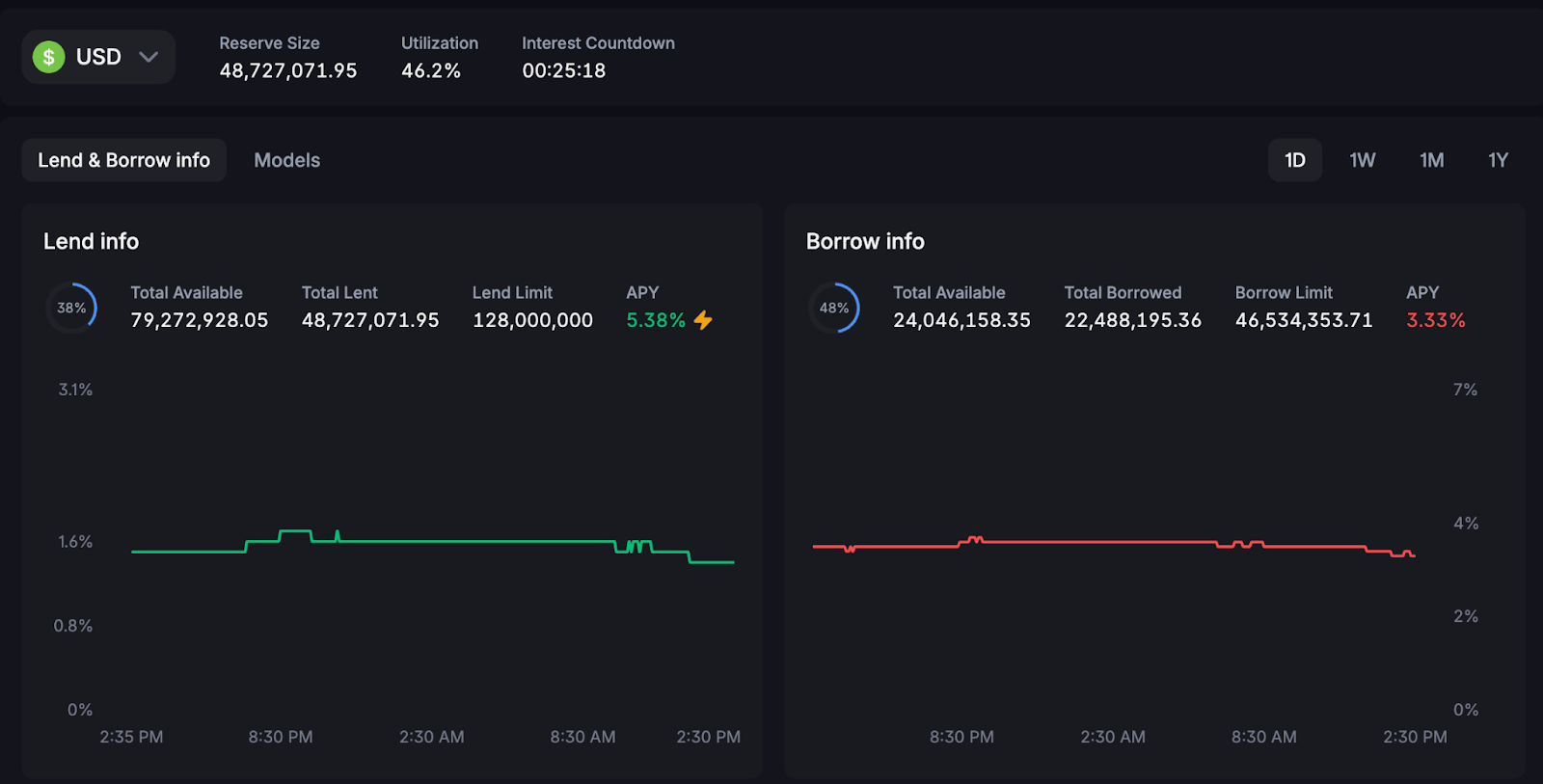

Beneath these user-facing improvements lies a robust technical foundation. With sub-second finality and throughput measured in thousands of transactions per second, Stablechain is engineered for both everyday retail payments and institutional-scale settlements. Predictable performance isn’t just an aspiration, it’s table stakes for any blockchain hoping to serve as a global payments backbone.

This scalability translates into real-world benefits: merchants can accept USDT with confidence that payments will clear instantly; remittance providers can settle cross-border transfers without waiting hours or days; enterprises can automate payroll or supplier payments without worrying about network congestion or fee spikes.

The Road Ahead: Unlocking New Use Cases

The innovations pioneered by Stablechain open doors to use cases once considered out of reach for blockchain-based money. Imagine streaming micro-payments for content consumption, automated royalty distributions for artists worldwide, or privacy-preserving payroll systems, all powered by gas-free USDT transfers on a purpose-built Layer 1 blockchain.

As more fintechs integrate with platforms like anonofframp. com, and as regulatory frameworks mature, the combination of Stablechain USDT gas, enterprise-grade compliance tools, and seamless ramp services will accelerate adoption across both developed markets and emerging economies.

The bottom line: By making stablecoin transactions fast, affordable, private, and predictable at scale, Stablechain is not merely iterating on existing models, it’s redefining what’s possible for digital dollars worldwide.