Swipe, tap, or click – stablecoin cards are making crypto payments in 2024 as easy as using your everyday debit card. For anyone who’s ever wished they could spend USDC or USDT at their favorite coffee shop or online store, the wait is over. Stablecoin cards are rapidly bridging the gap between digital assets and real-world purchases, all while keeping things fast, private, and flexible.

Stablecoin Cards: The Missing Link for Everyday Crypto Spending

Stablecoins have long promised to deliver the best of both worlds – the stability of fiat with the borderless convenience of crypto. But until recently, actually spending those stablecoins in daily life meant jumping through hoops: on-ramping to exchanges, converting to fiat, waiting for bank transfers. Now that’s changing.

In 2025, partnerships like Mastercard and MoonPay, plus Visa and Baanx, have unleashed a new era of stablecoin cards. These aren’t just gimmicks – they’re full-fledged payment solutions backed by the world’s largest networks. With a single swipe or tap, your USDC or USDT balance is instantly converted to local currency at any merchant that accepts Visa or Mastercard – that’s over 150 million shops worldwide.

Why Stablecoin Cards Are Gaining Ground in 2024

The adoption curve has been staggering. In 2024 alone, stablecoin transfer volumes hit $27.6 trillion, outpacing even Visa and Mastercard by 7.7%. This isn’t just about speculation anymore – it’s about real people using digital dollars for groceries, travel, subscriptions, and more. Here’s why:

Top Benefits of Using Stablecoin Cards in 2024

-

Instant, Real-World Spending: Stablecoin cards like KAST Card and Bitget Wallet Card enable users to spend USDC, USDT, and other stablecoins at millions of merchants worldwide, with real-time crypto-to-fiat conversion at the point of sale.

-

Lower Transaction Fees: Platforms such as PayPal’s ‘Pay with Crypto’ and Visa-backed stablecoin cards offer reduced fees compared to traditional credit cards, helping users and merchants save on every transaction.

-

Fast, Borderless Payments: Stablecoin cards leverage blockchain technology for near-instant settlement, allowing users to make cross-border purchases without delays or currency conversion hassles.

-

Enhanced Financial Access: By connecting directly to self-custodial wallets (as with the Visa and Baanx card), stablecoin cards empower users worldwide—including the unbanked—to participate in digital payments without relying on traditional banks.

-

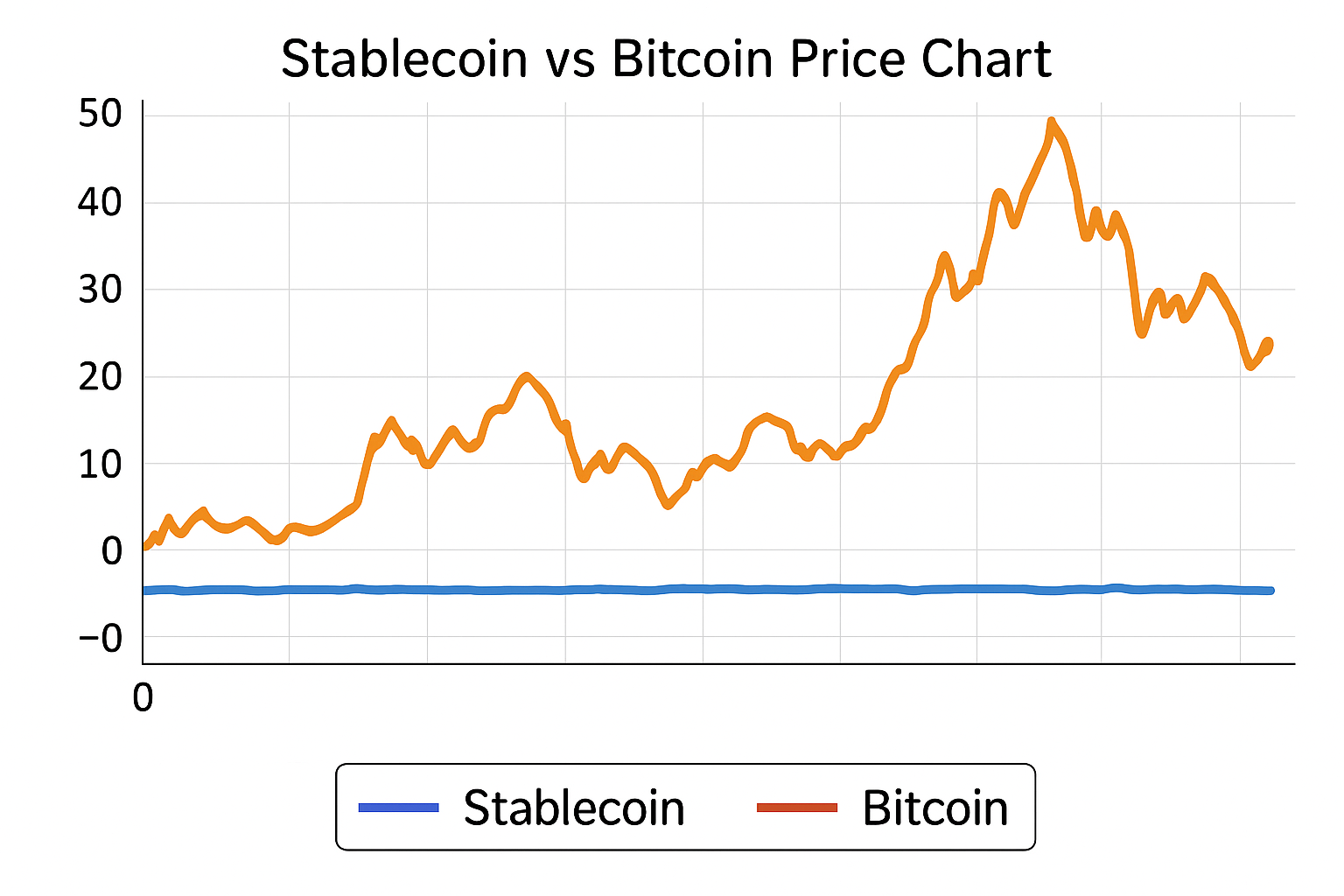

Stability and Predictability: Since stablecoins are pegged to fiat currencies like the US dollar, users avoid the volatility of other cryptocurrencies, making budgeting and everyday spending simpler and more reliable.

-

Rewards and Earning Potential: Some stablecoin cards, such as the Bitget Wallet Card, offer perks like up to 8% APY on staked stablecoins and cashback bonuses, adding extra value for users.

-

Seamless Integration with Digital Wallets: Stablecoin cards integrate with popular wallets (e.g., Coinbase, MetaMask, Google Pay, Apple Pay), making it easy to manage funds and pay directly from your preferred crypto wallet.

Instant settlement: No more waiting days for bank transfers. Stablecoin cards settle transactions in seconds.

Lower fees: Forget the hefty charges from traditional banks and remittance services.

Global reach: Spend your crypto wherever Visa or Mastercard is accepted.

Anonymity options: Privacy-focused users can choose cards (like those from anonofframp. com) that keep personal data off centralized servers.

No volatility risk: Stablecoins are pegged to the dollar (or other fiat), so you’re not gambling every time you buy lunch.

The Latest Innovations: What Sets 2025’s Cards Apart?

This year has seen a leap forward in both technology and user experience. Let’s break down some standout offerings:

- KAST Card (Visa): Supports USDC, USDT, and USDe across multiple blockchains with tiered rewards and global acceptance.

- Bitget Wallet Card: Available as a Mastercard in the EU and Visa in Asia; integrates with Apple Pay/Google Pay; offers up to 8% APY on staked stablecoins.

- PayPal’s ‘Pay with Crypto’: Lets U. S. merchants accept over 100 cryptocurrencies – including major stablecoins – with instant access to funds and lower transaction costs.

The result? Crypto users can now pay at millions of locations without friction or forced conversions through banks. For privacy advocates and power users alike, these developments mean more control over their financial lives than ever before.

But it’s not just about convenience. The latest generation of stablecoin debit cards is rewriting the rules for privacy, accessibility, and control. Platforms like anonofframp. com are leading the charge by offering private crypto card solutions that let you manage your digital assets without sacrificing your identity or data security. For those who value financial autonomy, this is a game-changer.

How Stablecoin Cards Simplify On/Off-Ramping

One of the biggest headaches in crypto has always been moving funds between digital assets and fiat. Traditional on/off-ramp processes often mean lengthy verification steps, high fees, and frustrating delays. Stablecoin cards are streamlining this process by acting as a direct bridge: top up with USDC or USDT, spend anywhere, cash out to fiat at ATMs worldwide, all without jumping through hoops.

How Stablecoin Cards Simplify On/Off-Ramps

-

Instant Crypto-to-Fiat Conversion at Checkout: Stablecoin cards like KAST Card and Bitget Wallet Card automatically convert your stablecoins (e.g., USDC, USDT) to local currency in real time, letting you pay at millions of merchants without manual swaps.

-

Direct Spending from Self-Custodial Wallets: With solutions such as the Visa x Baanx Card, users can spend stablecoins directly from their own wallets, maintaining full control of their assets while enjoying seamless payments.

-

Global Acceptance via Major Payment Networks: Partnerships like Mastercard x MoonPay and Visa-backed cards enable stablecoin cards to be used at over 150 million merchants worldwide, bridging crypto and traditional finance.

-

Lower Fees and Faster Settlement: Stablecoin cards, such as those integrated with PayPal’s ‘Pay with Crypto’ platform, offer merchants and users reduced transaction costs and near-instant access to funds compared to traditional banking.

-

Easy Top-Ups and Multi-Blockchain Support: Leading cards like KAST Card allow users to top up balances from multiple blockchains, making it simple to move funds between crypto and fiat ecosystems.

For traders, freelancers, and global nomads, this means you can receive payments in stablecoins and use them instantly for real-world purchases or withdrawals. No more waiting days for wire transfers or worrying about local currency restrictions. The borderless nature of these cards lets you live, and spend, on your own terms.

Choosing the Right Stablecoin Card: What Should You Look For?

The market is booming with options, but not all stablecoin cards are equal. Here’s what to consider before making your pick:

- Supported currencies: Does the card support your preferred stablecoins (USDC, USDT, DAI, etc. )?

- Privacy features: Look for cards that minimize KYC requirements and protect user data, especially if anonymity matters to you.

- Fees: Compare transaction costs, ATM withdrawal charges, and any annual fees.

- Global usability: Make sure the card works wherever you travel or shop, check network coverage (Visa/Mastercard) and regional availability.

- Integration: Some cards sync with wallets like MetaMask or Coinbase for seamless top-ups; others offer staking rewards or cashback perks.

A bit of research goes a long way, read reviews (like our upcoming anonofframp review), check community feedback on privacy crypto card options, and test out virtual versions before committing to a physical card.

What’s Next? The Road Ahead for Crypto Payments

The momentum behind stablecoin cards is undeniable. With giants like Mastercard and Visa now fully embracing crypto-to-fiat conversion at scale, and transaction volumes hitting $27.6 trillion in 2024, the stage is set for even broader adoption in the coming years (source). Expect more innovation around instant settlement times, cross-chain compatibility, enhanced privacy controls, and new reward models tailored to digital asset holders.

If you’re ready to take control of your finances with speed, security, and true ownership, without sacrificing everyday usability, it’s time to explore what a stablecoin debit card can do for you. Crypto payments are no longer just a promise; they’re here now, reshaping how we spend worldwide.