Stablecoins have become the lifeblood of digital finance, powering everything from cross-border payments to crypto-fiat conversions. Yet, as the ecosystem matured, pain points emerged: unpredictable gas fees, slow settlement, and fragmented liquidity across chains. In 2025, the rise of Layer 1 stablechains like Stable is rewriting the playbook for stablecoin on/off-ramps, offering dedicated blockchains engineered exclusively for stablecoin transactions. This shift is not just technical – it’s fundamentally changing how users, businesses, and entire economies interact with digital dollars.

Layer 1 Stablechains: Purpose-Built for Stablecoin Efficiency

Traditional blockchains like Ethereum were designed for general-purpose smart contracts, not specifically for stablecoin payments. This led to a reliance on volatile native tokens for gas and inconsistent transaction costs. Enter Stable, a Layer 1 blockchain launched in 2025 by Bitfinex and Tether. Stable’s architecture is a breakthrough: it uses USDT as the native gas token, eliminating the need for ETH or other volatile assets. For users, this means every transaction – whether sending, receiving, or swapping – is denominated and settled in USDT, providing true predictability for both individuals and enterprises.

But Stable doesn’t stop there. The introduction of USDT0, a LayerZero-enabled version of USDT, powers gasless stablecoin transfers. Peer-to-peer payments can now occur without users incurring network fees, making microtransactions and remittances not only possible, but practical at scale. This is a direct response to the needs of emerging markets and high-frequency traders who require both cost efficiency and transaction speed.

Why Vertical Integration Matters for On/Off-Ramps

Stable is not alone in this movement. Major issuers are spinning up their own Layer 1 networks, marking a strategic shift toward vertical integration. Circle’s Arc and Stripe’s Tempo are following suit, each with their own stablecoin-native blockchains. By controlling the infrastructure, these companies can optimize transaction costs, deliver consistent user experiences, and foster entire ecosystems of stablecoin-native financial products. For on/off-ramps, this means faster, cheaper, and more reliable crypto-to-fiat flows, with the ability to offer instant settlements and predictable pricing.

Stable is positioning itself at the intersection of digital finance and global commerce, enabling businesses to build cost-effective solutions directly on-chain.

– cointrust.com

Cross-Chain Liquidity and Interoperability: The Next Frontier

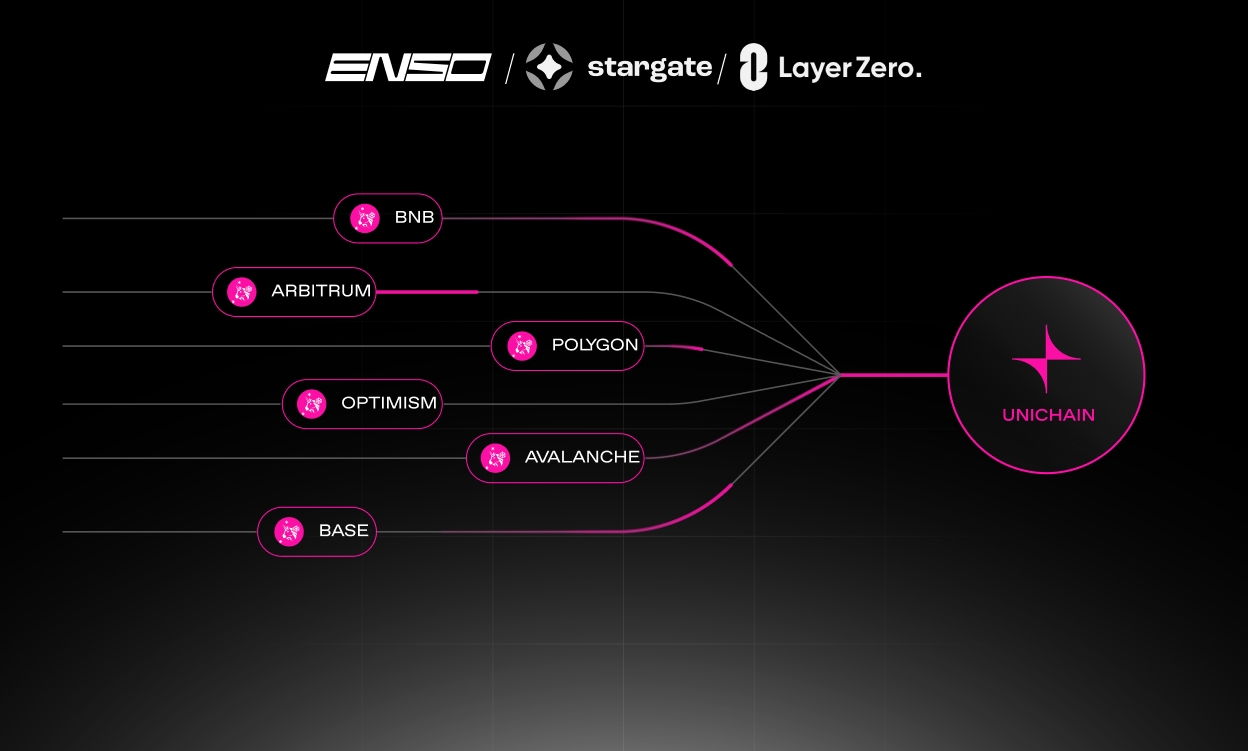

One of the most exciting aspects of Layer 1 stablechains is their focus on cross-chain liquidity and interoperability. Technologies like LayerZero are being integrated to allow seamless movement of assets across multiple blockchain ecosystems. This is crucial for users who need to move funds between platforms, exchanges, or wallets without friction. For example, with Stable’s USDT0 and LayerZero, users can transfer stablecoins from Stablechain to other major networks without losing value to fees or slippage.

Key Benefits of Layer 1 Stablechains for On/Off-Ramps in 2025

-

Native Stablecoin Gas Fees: Platforms like Stable use USDT as both the transaction currency and gas token, eliminating the need for volatile cryptocurrencies for network fees. This streamlines user experience and reduces complexity for on/off-ramp operations.

-

Gas-Free Peer-to-Peer Transfers: Stable introduces USDT0, a LayerZero-enabled token allowing free peer-to-peer USDT transfers. This feature removes transaction costs for users, making stablecoin on/off-ramps more accessible and efficient.

-

Optimized Payment Efficiency: Layer 1 stablechains are purpose-built for high-speed, low-latency stablecoin transactions, enabling near-instant settlement and improved reliability for both retail and institutional on/off-ramp flows.

-

Enterprise-Grade Scalability: Dedicated stablecoin blockchains like Stable and Circle’s Arc are designed to support large transaction volumes, meeting the needs of global payment processors and fintechs integrating stablecoin on/off-ramps.

-

Interoperability via LayerZero: Integration with LayerZero technology allows seamless movement of stablecoins across multiple blockchains, supporting efficient on/off-ramp operations between diverse crypto and fiat ecosystems.

-

Vertical Integration & Cost Control: Stablecoin issuers like Tether and Circle are launching proprietary Layer 1 networks (e.g., Stable, Arc) to control transaction costs, enhance user experience, and foster ecosystems of stablecoin-native products.

-

Enhanced Ecosystem Development: By providing a stablecoin-native infrastructure, Layer 1 stablechains empower developers and businesses to build innovative on/off-ramp solutions, wallets, and financial products directly on-chain.

This interoperability is not just a technical upgrade – it’s a catalyst for unlocking new payment models, cross-border commerce, and decentralized finance (DeFi) applications that were previously hampered by network silos. The seamless integration of stablecoin rails across chains is setting the stage for a truly global, borderless financial system.

For more details on the emergence of Layer 1 stablechains and their impact on global payments, see this analysis from Stabledash.

What’s unique about the 2025 landscape is how these stablecoin-optimized networks are now directly powering the next generation of crypto on/off-ramps. The days of waiting for slow, multi-hop swaps or worrying about unpredictable gas spikes are fading. With Stablechain and its peers, users can now move value between crypto and fiat with the kind of speed and certainty that traditional payment networks have long promised but rarely delivered for cross-border or digital-native money.

Enterprise-Grade Payments and New Use Cases

Layer 1 stablechains are not just a win for retail users. Enterprises are rapidly building on these networks, leveraging features like gasless transfers and USDT-native settlements to create payroll systems, B2B payment rails, and real-time invoicing tools. For global businesses, the ability to denominate all transactions in a stable unit like USDT, without conversion or volatility risk, is a game-changer. This enables predictable cash flow management and seamless integration with both crypto-native and traditional finance systems.

Moreover, platforms like Stable Pay are introducing user-friendly wallets that abstract away blockchain complexity, making instant, secure, and cost-free stablecoin payments accessible to anyone with a smartphone. The result is a new wave of financial inclusion, especially in regions where traditional banking infrastructure is limited or unreliable.

The impact is visible across the spectrum: from Latin American freelancers receiving instant USDT payments, to European importers settling invoices without FX fees, to DeFi protocols able to offer real-time, low-cost stablecoin swaps. The emergence of stablecoin cross-chain liquidity means value can flow wherever it’s needed, unlocking a truly global marketplace.

Security, Transparency, and Compliance in a Stablecoin World

Security remains paramount. Purpose-built stablechains like Stable incorporate robust consensus mechanisms, real-time auditing, and compliance features tailored for high-value transactions. By focusing on transparency and regulatory alignment, they’re helping to bridge the gap between decentralized finance and mainstream adoption. This is especially important as volumes surge, Artemis’ 2025 study notes $26T in economic stablecoin settlement for 2024, a figure rivaling traditional payment networks (see Stabledash).

The launch of these specialized blockchains is a direct challenge to the dominance of general-purpose blockchains like Ethereum for payment-related activities.

For privacy advocates and power users, the new generation of on/off-ramps built atop Layer 1 stablechains offers not just speed and low cost, but also enhanced control over personal data and transaction history. This aligns with the core ethos of crypto: financial sovereignty and privacy, without sacrificing usability or compliance.

What’s Next for Stablecoin On/Off-Ramps?

The next phase will see even greater integration of stablecoin-native products: embedded stablecoin cards, programmable payments, and automated compliance checks. As more issuers and payment processors embrace this model, expect to see further reductions in settlement times, expanded fiat currency support, and new DeFi-powered financial services tailored for both individuals and enterprises.

Ultimately, Layer 1 stablechains like Stable are not just a technical upgrade, they’re the foundation for a new era of global payments. By focusing on efficiency, interoperability, and user-centric design, they’re making seamless crypto to fiat ramps a reality for millions worldwide.