Stablecoin-powered cards are rapidly redefining how crypto users move between digital and traditional finance. No longer just a speculative asset class, stablecoins like USDC and USDT now fuel real-world spending, private payroll, and on/off-ramp crypto solutions with a level of speed and privacy that legacy banks struggle to match. The ecosystem is evolving fast, with major players like Mastercard, Visa, Rain, and Baanx rolling out robust infrastructure that lets users spend stablecoins at millions of locations worldwide. The result? A frictionless bridge between crypto wallets and everyday commerce, without sacrificing control or anonymity.

Stablecoin Cards: The Engine Behind Private On/Off-Ramp Payments

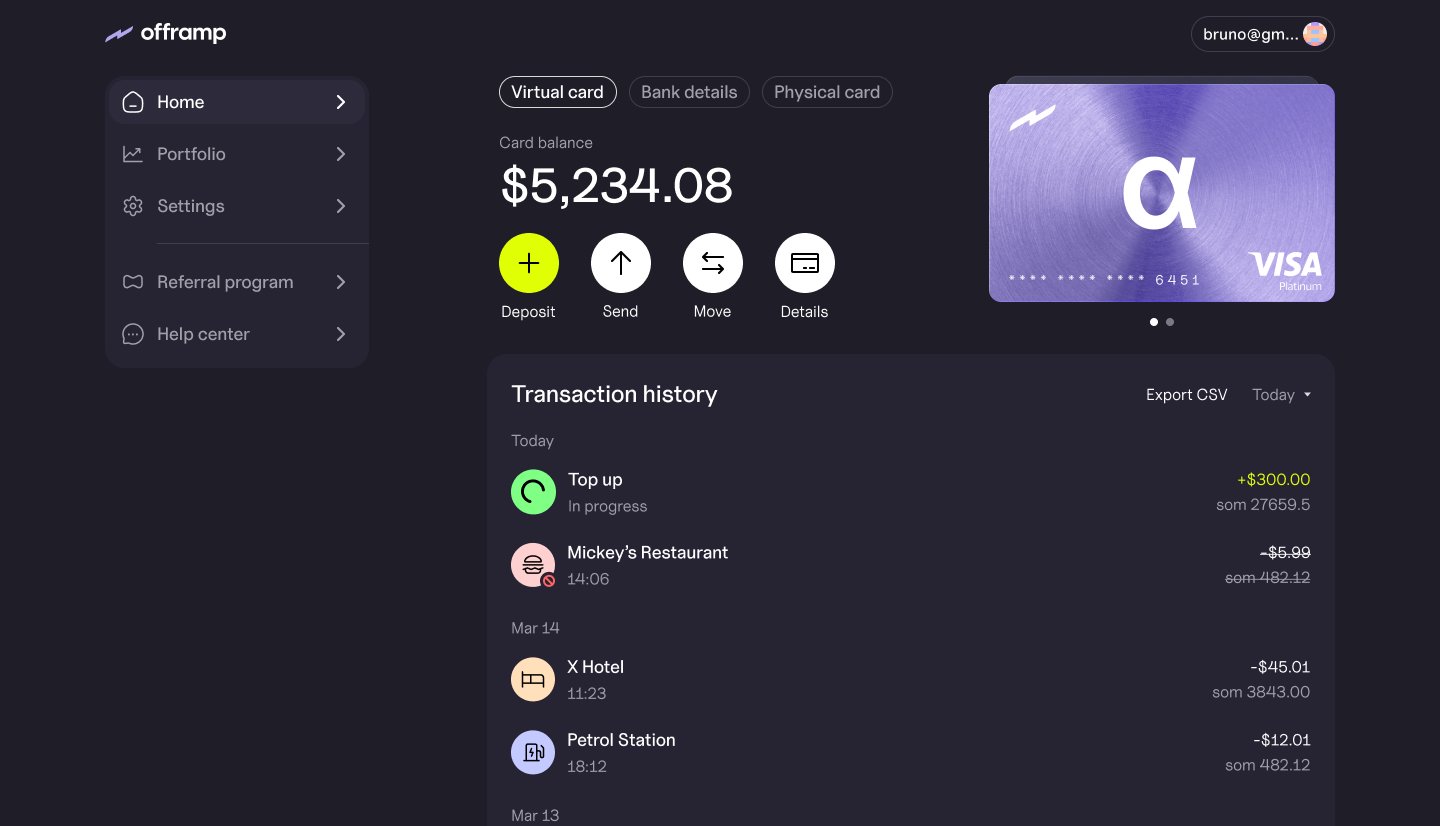

At the heart of this transformation are stablecoin cards. These cards let users pay for coffee, groceries, or even business expenses by converting stablecoins to fiat currency in real time at the point of sale. Unlike traditional debit cards, many stablecoin cards are directly linked to self-custodial wallets. This means users retain full control over their funds while enjoying seamless payments wherever Visa or Mastercard is accepted.

![]()

Recent partnerships have supercharged this trend. In May 2025, Mastercard and MoonPay teamed up to let consumers and businesses pay and get paid in stablecoins globally, an integration that brings stablecoin spending to over 150 million merchant locations (mastercard.com). Meanwhile, Visa’s collaboration with Baanx enables users to spend USDC directly from self-custodial wallets, with smart contracts ensuring instant conversion to fiat during purchases (cointelegraph.com).

Privacy and Control: The New Standard for Crypto Payments

The allure of private crypto payments goes beyond convenience. Privacy advocates have long sought alternatives to the data-hungry practices of traditional banks. Stablecoin cards answer that call by minimizing data trails. When linked to self-custodial wallets, these cards empower users to control their financial footprint, sidestepping unnecessary KYC hurdles and intrusive monitoring.

Platforms like Rain are leading the charge, having recently secured $58 million in Series B funding to expand their stablecoin card infrastructure (Ledger Insights). Rain’s multi-chain support, including Solana, Tron, and Stellar, lets partners launch custom card programs tailored for privacy-focused users. This approach is not just for retail; businesses can also leverage Rain’s corporate card platform for direct crypto payroll and expense management (sacra.com).

Key Features: What Sets Stablecoin Cards Apart?

Top 5 Features That Make Stablecoin Cards Superior

-

Global Acceptance via Major Payment Networks: Thanks to collaborations with Visa and Mastercard, stablecoin cards are accepted at millions of merchants worldwide, including online and physical stores, as well as ATMs for cash withdrawals.

-

Enhanced Privacy and Self-Custody: Many stablecoin card solutions, such as those from Offramp.xyz and Baanx, allow users to link self-custodial wallets, giving them greater control over their funds and financial data, and reducing reliance on banks.

-

Multi-Chain and Multi-Asset Support: Platforms like Rain offer multi-chain compatibility (supporting Solana, Tron, Stellar, and more), enabling users to spend a variety of stablecoins across different blockchain networks from a single card.

-

Low Fees and Transparent FX Rates: Stablecoin cards typically eliminate hidden foreign exchange markups and offer lower transaction fees compared to traditional banks, making them ideal for international spending and travel.

Let’s break down what makes these cards game-changers:

- Real-time conversion: Spend stablecoins instantly as fiat at any supported merchant.

- Global acceptance: Use your card anywhere Visa or Mastercard is accepted, no more worrying about FX markups or hidden bank fees.

- Self-custody integration: Retain control over your assets without relying on centralized exchanges for off-ramping.

- Enhanced privacy: Minimize exposure of personal data thanks to reduced KYC and direct wallet linkage.

- Multi-chain support: Tap into card programs running on Polygon, Solana, Tron, Stellar, and more for maximum flexibility.

This new wave of stablecoin card issuers, like Rain and Offramp. xyz, is making it easier than ever for both individuals and businesses to manage digital assets securely, and privately. Whether you’re seeking a crypto payroll solution, merchant settlement in crypto, or just want to ditch your bank’s hidden fees, these cards are setting the new standard for on/off-ramp crypto payments.

For users who demand a frictionless experience, stablecoin cards are resetting expectations for speed and transparency in financial transactions. The days of waiting hours or even days for fiat off-ramps are fading. With stablecoin rails, settlement is measured in seconds, not business days. This is particularly critical for cross-border commerce and remote workforces, where instant crypto payroll cards and global merchant settlement in crypto are now not just possible but practical.

Real-World Impact: From Payroll to Point-of-Sale

The utility of stablecoin cards extends well beyond retail spending. Businesses are deploying them for direct payroll disbursement, eliminating the fees and delays of traditional banking infrastructure. Platforms like Rain have rolled out multi-chain support, allowing companies to issue payroll on Polygon, Solana, or Tron, whichever chain offers the best cost and speed profile (sacra.com). For contractors and freelancers, this means instant access to funds that can be spent globally, without the need to convert through centralized exchanges or wait on bank wires.

On the merchant side, acceptance of stablecoin payments is gaining traction thanks to robust APIs and direct card integrations. Merchants can settle in crypto or instantly convert to local currency, optimizing for both privacy and volatility management. The ability to withdraw from ATMs worldwide or pay at any Visa/Mastercard location reduces the last-mile problem that once plagued crypto adoption.

Top Stablecoin Card Issuers Leading the Market

-

Rain — Global Stablecoin Card Pioneer• Key Features: Visa-backed cards, instant stablecoin-to-fiat conversion, supports USDC, USDT, and more.• Supported Regions: North America, Europe, Asia, and expanding globally.• Unique Benefits: Multi-chain support (Solana, Tron, Stellar), corporate expense management, and seamless integration for businesses and individuals.

-

Offramp.xyz — Spend Stablecoins Anywhere Visa Is Accepted• Key Features: Self-custodial wallet integration, real-time conversion, ATM withdrawals worldwide.• Supported Regions: Global (where Visa is accepted).• Unique Benefits: No hidden FX fees, privacy-focused, and instant access to cash from stablecoin balances.

-

Mastercard x MoonPay — Global Stablecoin Payment Enablement• Key Features: Mastercard-branded cards linked to stablecoin balances, spend at 150M+ locations.• Supported Regions: Worldwide.• Unique Benefits: Enterprise-grade issuance, seamless on/off-ramp, and direct stablecoin payments for consumers and businesses.

-

Visa x Baanx — Self-Custodial Stablecoin Cards• Key Features: Visa cards tied to self-custodial wallets, USDC spending, smart contract-powered conversions.• Supported Regions: Europe and expanding.• Unique Benefits: Real-time, on-chain conversion to fiat at point of sale, enhanced privacy and control.

-

Visa x Bridge — Stablecoin Cards for Latin America• Key Features: Visa cards linked to stablecoin wallets, everyday crypto purchases.• Supported Regions: Latin America.• Unique Benefits: Solves the “last mile” problem for crypto spending, enabling routine transactions with digital assets.

Challenges Ahead: Regulation and User Education

No innovation comes without obstacles. Regulatory clarity remains a moving target in many jurisdictions. While privacy-focused solutions minimize data trails, some regions may tighten rules around KYC and AML compliance for crypto-linked cards. The onus is on both issuers and users to stay informed about evolving requirements.

User education is another frontier. Despite their advantages, stablecoin cards still require a baseline understanding of self-custody, blockchain fees, and potential volatility, even with stablecoins. As these products move mainstream, clear onboarding flows and transparent communication will separate the leaders from the pack.

What’s Next: The Roadmap for Stablecoin Card Adoption

Looking forward, expect further expansion into emerging markets where traditional banking infrastructure is weak or exclusionary. Partnerships like Visa’s collaboration with Bridge in Latin America signal a push to solve the last-mile problem at scale (reuters.com). Integration with DeFi protocols could soon allow users to earn yield or borrow against card balances without ever leaving the crypto ecosystem.

For privacy advocates and power users alike, the combination of real-time conversion, global reach, and self-custody sets a new benchmark in digital payments. As stablecoin card APIs mature and more merchants come online, expect this sector to become the backbone of private on/off-ramp crypto payments, delivering not just anonymity but genuine utility at every swipe.