Stablecoins have become the backbone of crypto payments, offering users the speed and reliability of blockchain with the price stability of fiat. Yet as the market has matured, the infrastructure underpinning stablecoin on/off-ramps has struggled to keep pace with user demand for seamless, secure, and low-cost transactions. The rise of USDT-native Layer 1 blockchains marks a pivotal shift in how stablecoin flows are managed, finally addressing the pain points of fragmented liquidity and dependency on risky third-party bridges.

Why Stablecoin Infrastructure Matters for Modern Finance

According to McKinsey and Company, for stablecoins to function as true digital cash, users must have access to robust infrastructure: on/off-ramps, digital wallets, and reliable settlement rails. Until recently, even the most popular stablecoins like Tether’s USDT and Circle’s USDC were scattered across multiple blockchains, leading to fractured liquidity, unpredictable fees, and security vulnerabilities. In October 2025, Tether and Circle still control over 80% of global stablecoin value by market cap, but their dominance is being tested by new entrants focused on infrastructure innovation.

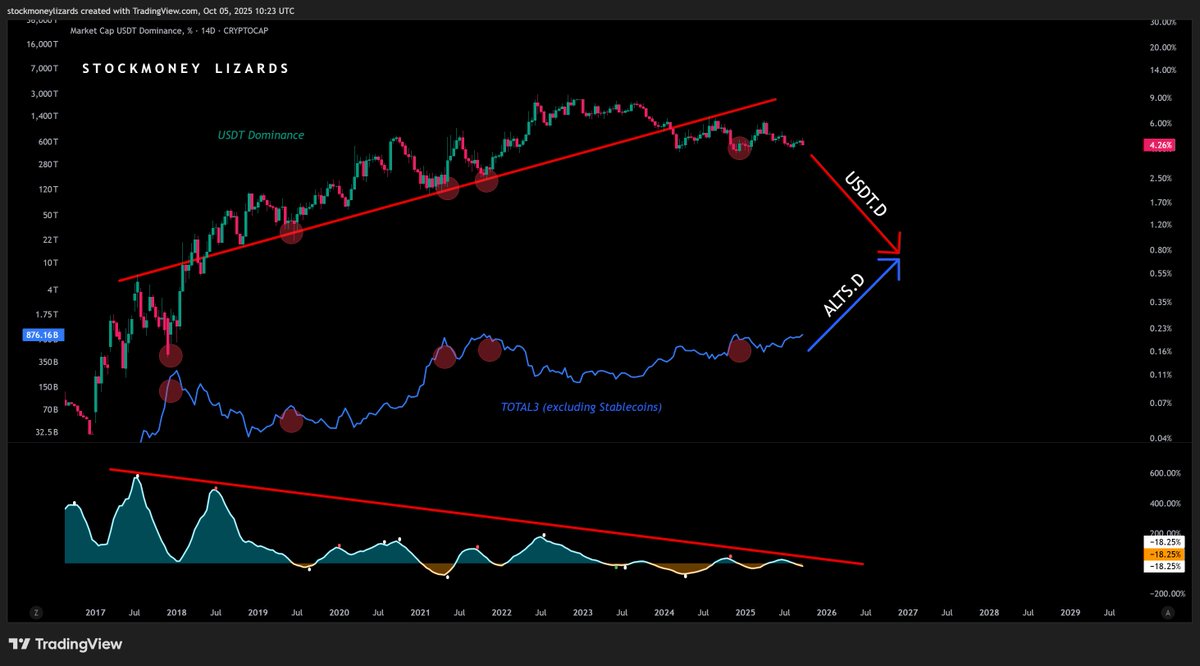

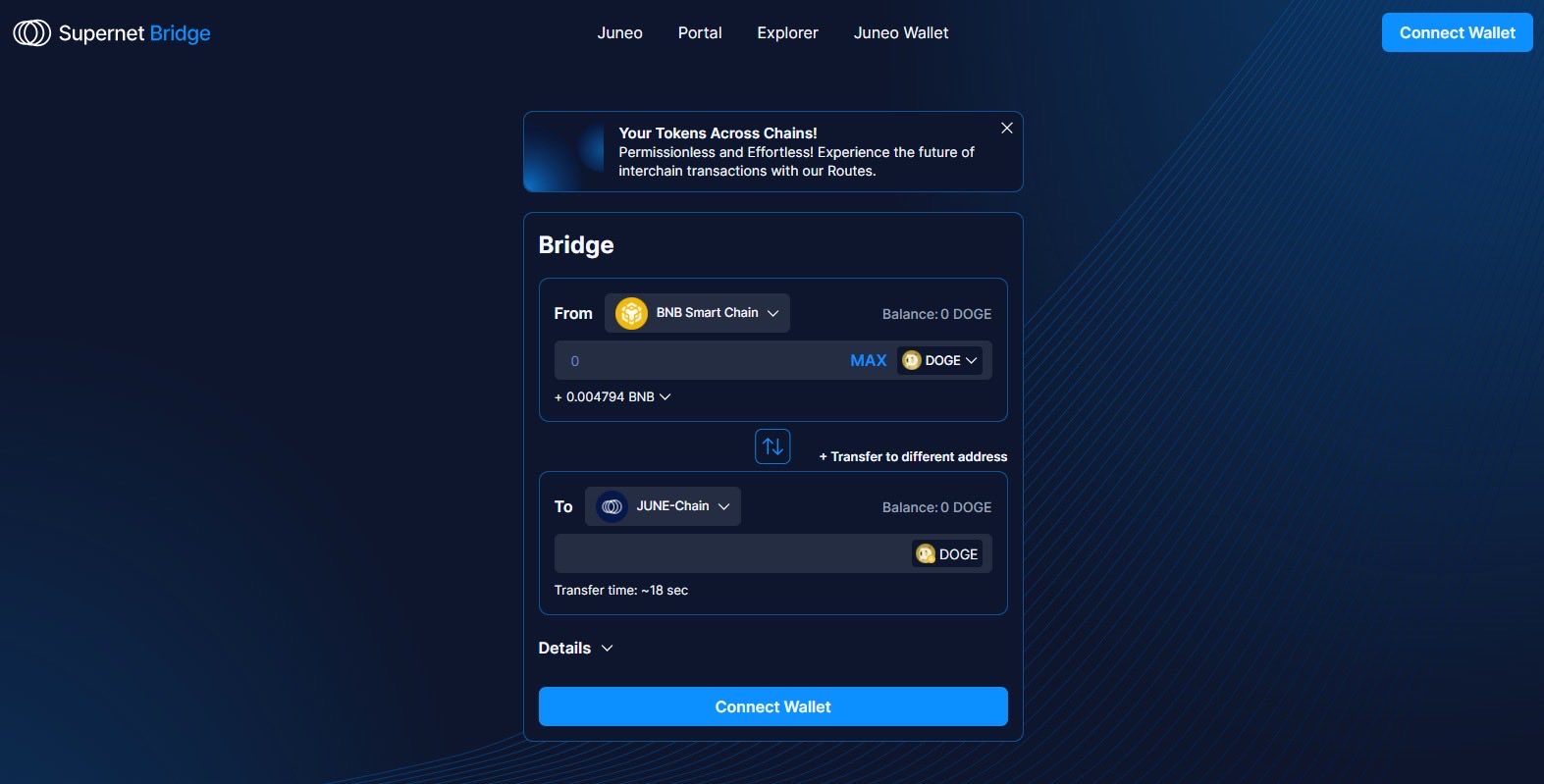

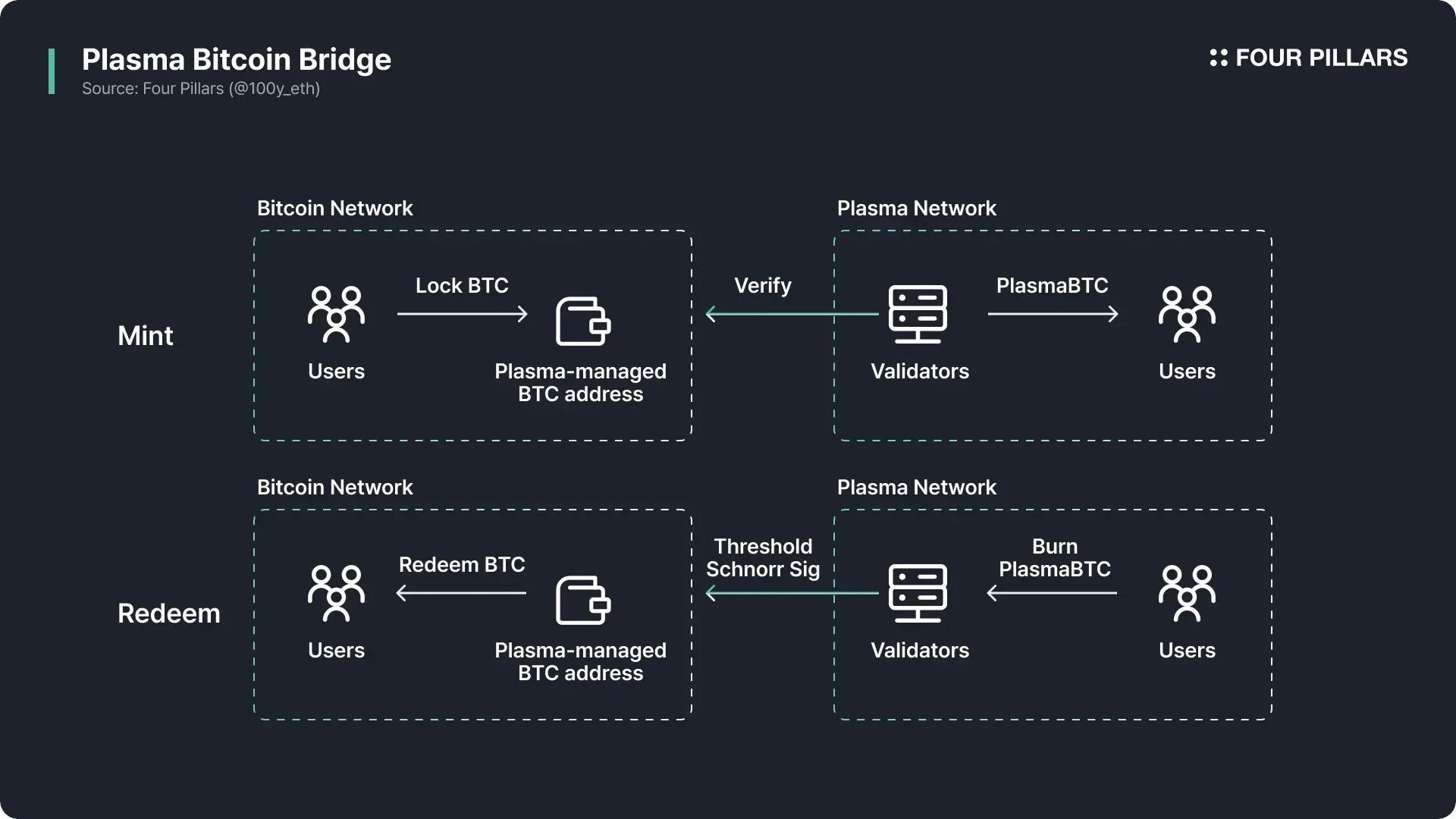

The core challenge: most blockchains do not natively support stablecoins like USDT. Instead, third-party bridges lock up native tokens on one chain and issue a synthetic version (“bridged USDT”) on another. This process is inherently risky. If the bridge operator is compromised or fails, users can lose their funds, and Tether itself will not make them whole. Only natively issued USDT is fully backed and redeemable by Tether.

The Leap Forward: USDT0 and Omnichain Expansion

Tether’s response to these risks was the introduction of USDT0, an omnichain version built using LayerZero’s OFT (Omnichain Fungible Token) standard. Unlike bridged tokens, each USDT0 transfer is backed 1: 1 by original USDT reserves, no intermediaries or synthetic layers required. This architecture eliminates the fragmentation that plagued DeFi on-ramps in previous cycles.

The result? Users can move stablecoins across blockchains without worrying about which version of USDT they hold or whether their funds are safe from a bridge hack. For anyone seeking fast, private crypto-to-fiat conversions, omnichain assets like USDT0 are rapidly becoming the gold standard.

Key Differences: Bridged USDT vs. Native/Omnichain USDT

-

Backing and Redemption: Bridged USDT is issued by third-party bridges and is not directly redeemable with Tether. Its value depends on the bridge’s solvency and operational security. Native/Omnichain USDT (including USDT0) is directly issued and backed by Tether, ensuring 1:1 redemption and full support across supported chains.

-

Security Risks: Bridged USDT exposes users to additional risks from bridge hacks or failures, as seen in multiple high-profile exploits. Native/Omnichain USDT eliminates these risks by removing the need for external bridges, relying solely on Tether’s infrastructure.

-

Liquidity Fragmentation: Bridged USDT often leads to fragmented liquidity, with wrapped tokens not always interchangeable across chains. Native/Omnichain USDT (e.g., USDT0 via LayerZero) enables unified, omnichain liquidity, streamlining transfers and DeFi participation.

-

Transaction Efficiency: Bridged USDT can suffer from higher fees and slower settlement due to bridge bottlenecks. USDT-Native Layer 1s like Stablechain and Plasma offer sub-second finality, minimal or zero fees, and allow USDT as the native gas token for seamless payments.

-

On/Off-Ramp Experience: Bridged USDT may face limited exchange and wallet support, complicating fiat conversions. Native/Omnichain USDT benefits from broader integration, with exchanges and payment networks increasingly supporting direct on/off-ramps for natively issued USDT.

USDT-Native Layer 1 Chains: Stablechain and Plasma Redefine On/Off-Ramps

The real breakthrough in stablecoin on/off-ramp infrastructure comes with the launch of purpose-built Layer 1 chains where USDT functions as both settlement asset and gas token. Two projects stand out:

- Stablechain: Debuted in mid-2025 as a Layer 1 blockchain optimized for high-volume retail payments and cross-border transfers. With sub-second finality and minimal fees, paid entirely in USDT, it removes friction for businesses moving millions in stablecoins daily.

- Plasma: Launched September 2025 with zero-fee transfers, full EVM compatibility, and instant settlement. Plasma processes over 1,000 transactions per second using only native USDT as gas, making it ideal for DeFi protocols seeking predictable costs at scale.

This new breed of L1s eliminates the need for volatile gas tokens like ETH or BNB when moving stablecoins. By allowing users to pay all network fees in the same asset they are transferring provides USDT as gas: the experience becomes as intuitive as sending dollars via a traditional fintech app but with blockchain’s global reach and privacy guarantees.

The Impact: Security, Efficiency and Adoption at Scale

Tether’s strategy isn’t just technical, it’s fundamentally about trust. By removing third-party bridges from the equation, these L1s dramatically reduce attack surfaces for hackers while ensuring every transaction remains fully collateralized by Tether reserves. This has already led to faster settlement times, lower fees for users ramping between crypto and fiat via stablecoins, and increased confidence among institutions exploring blockchain payments.

For users and businesses alike, the implications are profound. Stablecoin on/off-ramp providers can now offer near-instant conversions with minimal slippage, since liquidity is concentrated natively on these Layer 1 chains. The days of waiting for slow, expensive bridge transactions or worrying about the solvency of a third-party custodian are fading. Instead, USDT-native blockchains like Stablechain and Plasma signal a new era of secure, predictable, and user-friendly stablecoin flows.

Privacy advocates also benefit from this shift. With USDT as both the settlement and gas token, users no longer need to expose themselves to multiple blockchain ecosystems or centralized exchanges just to move money in and out of crypto. For those seeking discreet, compliant off-ramps, especially in regions where financial privacy is paramount, these innovations offer a compelling alternative to legacy rails.

What Sets USDT-Native Chains Apart?

The core differentiators of USDT-native Layer 1 blockchains extend beyond just technical efficiency:

Key Advantages of USDT-Native Layer 1 Stablecoin Payments

-

Elimination of Third-Party Bridge Risks: USDT-native Layer 1 blockchains, such as Stablechain and Plasma, allow users to transact directly with natively issued USDT. This removes dependence on third-party bridges, significantly reducing exposure to security vulnerabilities and compatibility issues associated with wrapped or bridged tokens.

-

Ultra-Low and Predictable Transaction Fees: By enabling USDT to serve as both the settlement and gas token, platforms like Stablechain and Plasma eliminate the need to hold volatile cryptocurrencies for transaction fees. This results in minimal, stable fees—often near zero—making payments more transparent and affordable for both individuals and businesses.

-

Instant, High-Throughput Settlement: USDT-native Layer 1s offer sub-second transaction finality and high throughput (e.g., Plasma supports over 1,000 TPS). This ensures rapid settlement, making these blockchains ideal for cross-border payments and high-volume retail transactions.

-

Seamless On/Off-Ramp Integration: The native design of these blockchains streamlines integration with digital wallets and fiat on/off-ramps, enabling users to move funds in and out of the crypto ecosystem efficiently and securely.

-

Enhanced Liquidity and Omnichain Interoperability: With the introduction of omnichain USDT0, users can transfer fully-backed USDT across multiple blockchains without intermediaries, eliminating liquidity fragmentation and supporting more efficient DeFi and payment flows.

- Unified Liquidity: By concentrating all USDT activity on a dedicated chain, depth improves and price discovery becomes more reliable.

- Fee Predictability: No more juggling volatile gas tokens, network fees are always paid in USDT at transparent rates.

- Universal Access: EVM compatibility ensures that existing DeFi protocols can onboard seamlessly, while simple APIs lower barriers for fintechs building next-gen payment apps.

- Resilience: With bridges out of the equation, systemic risk is reduced and network downtime is minimized.

This all translates into real-world improvements for both retail users and institutions. Whether you’re cashing out stablecoins for local currency or deploying capital across DeFi protocols, the experience is now faster, safer, and more cost-effective.

The Road Ahead: Interoperability and Mainstream Adoption

The next challenge for USDT-native blockchains will be interoperability, ensuring seamless movement between Layer 1s without reintroducing old risks. Solutions like omnichain standards (USDT0) are paving the way for unified liquidity across networks while maintaining native backing. As these standards mature and gain traction among wallets and payment providers, expect even greater efficiency in how users ramp between crypto and fiat.

Moreover, as regulatory clarity around stablecoins improves globally, we’re likely to see further institutional adoption. Banks and payment processors are already piloting integrations with Layer 1 stablecoin infrastructure to facilitate cross-border settlements at scale. For users who value speed, privacy, and security in their digital asset management, this marks a turning point, one where Layer 1 stablecoin payments become not just an alternative but the preferred standard.

Key Takeaways

- USDT-native Layer 1s like Stablechain and Plasma deliver lower fees, faster settlements, and greater security for stablecoin users.

- The move away from third-party bridges eliminates systemic risks and unlocks true interoperability via omnichain assets like USDT0.

- This infrastructure shift is rapidly scaling mainstream adoption of stablecoins for payments, remittances, and DeFi.

As the landscape evolves, platforms specializing in stablecoin on/off-ramp services will play a crucial role in onboarding the next wave of users, delivering financial sovereignty with the speed and privacy that modern crypto finance demands.