Stablecoin debit cards have rapidly evolved from niche products to essential tools for crypto users seeking practical, private, and flexible off-ramps in 2025. As the regulatory landscape matures and payment giants like Visa and Mastercard embrace stablecoins, these cards are no longer just for early adopters. They’re now a bridge connecting your digital assets to everyday life, whether you’re spending USDC at a coffee shop in Buenos Aires or withdrawing cash from an ATM in Berlin.

What sets this new generation of stablecoin-backed debit cards apart is their focus on seamless conversion, privacy, and global accessibility. The passage of the GENIUS Act has brought much-needed clarity, requiring stablecoins to be fully backed by secure reserves. This has paved the way for innovative card products that offer speed, security, and peace of mind, even as they challenge traditional banking rails.

The Top 10 Stablecoin Debit Cards Shaping Crypto Off-Ramps in 2025

Let’s break down the most influential cards driving the stablecoin revolution this year. Each one on this list stands out for unique features that solve real pain points, like instant crypto-to-fiat conversion, zero FX fees, robust privacy options, or integration with DeFi wallets.

Top 10 Stablecoin-Backed Debit Cards for 2025

-

KAST Solana Multi-Chain Card: Offers seamless spending of stablecoins and crypto across multiple blockchains, with enhanced SOL staking rewards and zero conversion fees. Accepted at over 100 million merchants worldwide.

-

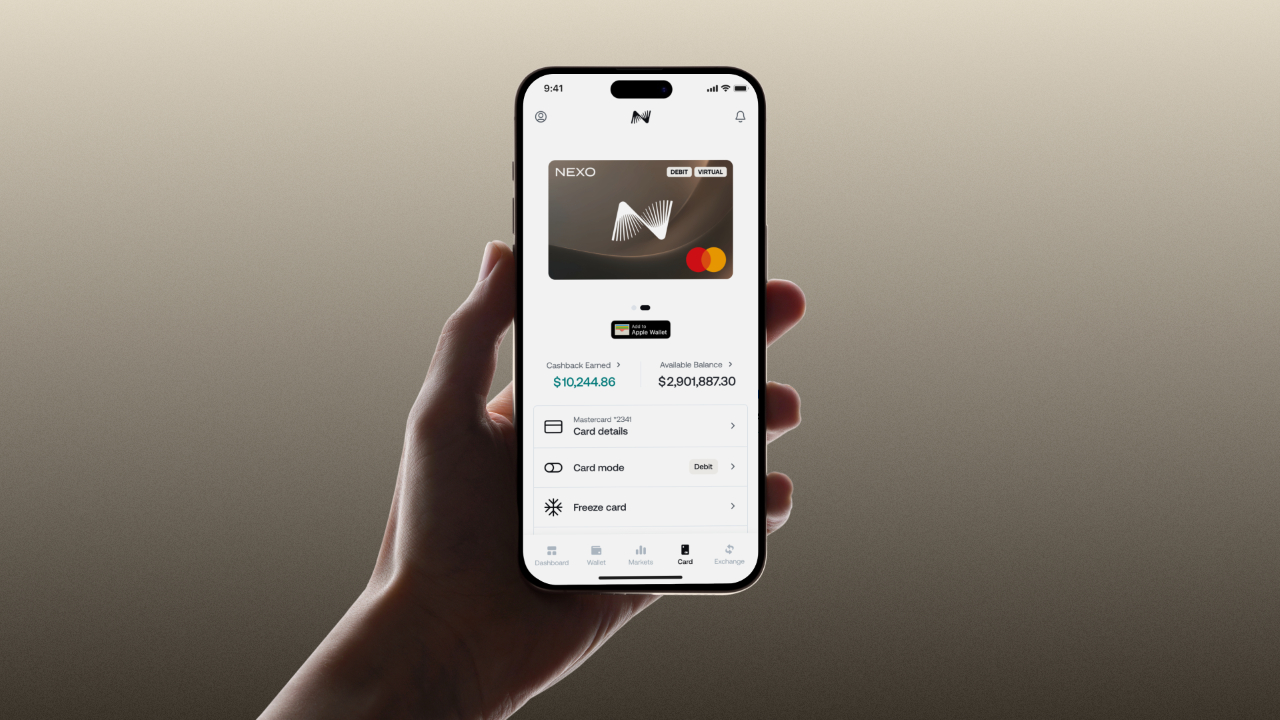

Nexo Card: A Mastercard-backed card that lets users spend or borrow against crypto holdings without selling, supports Apple Pay, and operates in both credit and debit modes for flexible off-ramping.

-

CoinJar Card: Enables users to spend stablecoins and crypto instantly via Google Pay and Apple Pay, with real-time conversion to fiat and no monthly fees.

-

Mural Pay Debit Card: Focused on fast, global crypto-to-fiat off-ramps, this card supports multiple stablecoins and is integrated with major payment networks for worldwide acceptance.

-

Circle Mint Card: Directly linked to USDC balances, it enables instant fiat conversion at point of sale, with robust regulatory compliance and broad merchant coverage.

-

Bitso Card: Popular in Latin America, the Bitso Card allows users to spend stablecoins and crypto globally, with low fees and support for cross-border transactions.

-

Crypto.com Visa Card: A widely-used card offering cashback rewards on stablecoin and crypto spending, no annual fees, and support for multiple digital assets.

-

Wirex Card: Supports multi-currency spending including stablecoins, offers real-time conversion, and provides cashback rewards for every purchase.

-

Binance Card: Lets users spend stablecoins and crypto from their Binance account at millions of merchants, with instant conversion and low transaction fees.

-

Monolith Visa Card: A non-custodial, Ethereum-based card that enables direct spending of stablecoins from a user-controlled wallet, prioritizing privacy and security.

KAST Solana Multi-Chain Card: Instant Spend and SOL Staking Rewards

The KAST Solana Multi-Chain Card is setting new standards with multi-chain support and enhanced staking rewards. Users can spend stablecoins (like USDC) or native crypto directly at over 100 million merchants worldwide. What really makes KAST stand out is its instant activation process and zero crypto conversion fees, a boon for those who value both speed and cost efficiency.

KAST’s exclusive SOL staking bonus means you earn while you spend, a compelling proposition for anyone looking to maximize passive yield without sacrificing liquidity. This blend of utility and reward puts KAST at the forefront of private crypto card innovation.

Nexo Card and CoinJar Card: Borrow or Spend Without Selling Your Crypto

Nexo’s approach is all about flexibility. The Nexo Card supports Apple Pay integration and allows users to either spend their crypto or borrow against it, without triggering taxable events by selling assets outright. This dual functionality has made it a favorite among DeFi users who want both convenience and capital efficiency.

CoinJar Card, meanwhile, offers straightforward support for multiple cryptocurrencies including popular stablecoins. With its user-friendly mobile app and transparent fee structure, CoinJar appeals to those who want simplicity without compromising on access or security.

Mural Pay Debit Card and Circle Mint Card: Fastest Global Off-Ramps

Mural Pay Debit Card leads with ultra-fast crypto-to-fiat settlements across borders, ideal for freelancers or businesses operating internationally. Its standout feature? Near-instant payouts in local currency while maintaining custody of your assets until the moment of transaction.

The Circle Mint Card, powered by USDC infrastructure leader Circle, delivers seamless interoperability with both Web3 wallets and major payment networks. It’s designed for those who demand reliability when moving funds between DeFi protocols and real-world spending.

Why Stablecoin Cards Are Winning in 2025

This year’s top cards don’t just offer convenience, they address the core needs of privacy advocates and global users frustrated by legacy banking friction. From Wirex’s cashback rewards to Binance’s deep integration with its exchange ecosystem to Monolith’s non-custodial design (letting you retain full control over your keys), each product brings something unique to the table.

If you’re looking to dive deeper into how these innovations work behind the scenes, and what makes them different from previous generations, check out our detailed guide on private fee-free crypto spending with stablecoin debit cards.

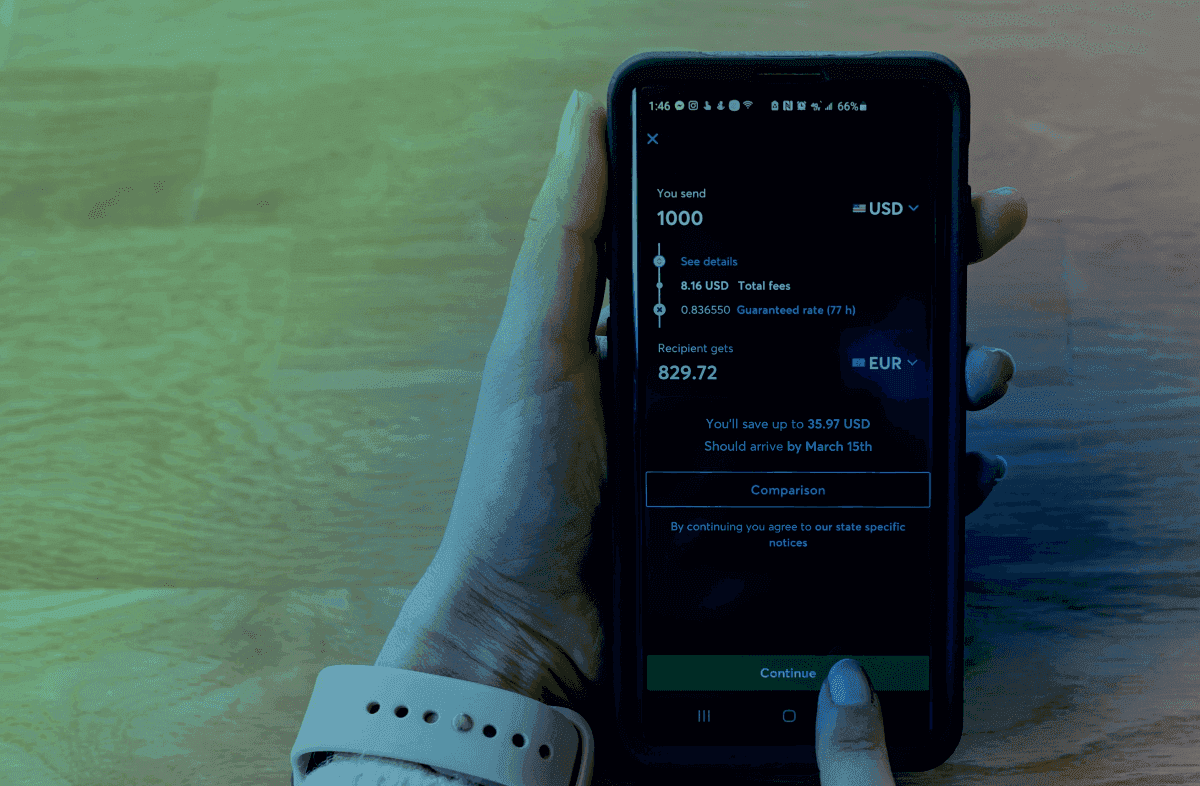

What’s striking about the 2025 landscape is how these stablecoin debit cards are not just closing the gap between crypto and fiat, but actively reshaping how people think about money movement. The days of waiting days for a wire transfer or being grilled by your bank about an international payment are fading. Now, with just a few taps on your phone, you can off-ramp USDC, USDT, or other stablecoins into spendable cash almost anywhere on Earth.

Bitso Card, Crypto. com Visa, and Wirex: Off-Ramp Powerhouses for Global Citizens

Bitso Card has become a lifeline for users across Latin America. Its instant conversion from stablecoin to local currency at point of sale means you’re never stuck waiting for liquidity. For expats and digital nomads, this flexibility is more than convenience, it’s financial autonomy.

The Crypto. com Visa Card continues to stand out with its robust rewards program and no annual fees. Users can spend stablecoins worldwide while earning CRO rewards and enjoying perks like airport lounge access. It’s especially popular among those who want both lifestyle benefits and seamless off-ramping.

Wirex Card, meanwhile, offers real-time crypto-to-fiat conversion with up to 8% cashback in WXT tokens. Its support for multiple stablecoins and traditional currencies makes it a favorite for frequent travelers who refuse to pay hidden FX markups or ATM withdrawal fees.

Binance Card and Monolith Visa: Deep DeFi Integration Meets User Control

Binance Card leverages the world’s largest exchange liquidity pool, enabling instant conversion from stablecoins or other crypto balances directly at checkout. The integration with Binance Pay means you can top up your card within seconds from your spot wallet, no need to leave the ecosystem. For power users seeking speed and low fees, it’s tough to beat.

The Monolith Visa Card takes a different approach by prioritizing non-custodial control. Your assets remain in your Ethereum wallet until you choose to convert them for spending. This design appeals to privacy advocates and those who want true ownership over their funds while still accessing global merchant networks.

| Card Name | Main Feature | Privacy Level | Rewards/Cashback |

|---|---|---|---|

| KAST Solana Multi-Chain | SOL staking and multi-chain support | High (multi-chain privacy) | SOL staking bonuses |

| Nexo Card | Lending/borrowing vs selling assets | Moderate (KYC required) | Diverse cashback options |

| CoinJar Card | Simplicity and multi-crypto support | Moderate (regulated) | No hidden fees; app integration |

| Mural Pay Debit Card | Ultra-fast cross-border payouts | High (asset custody until spend) | No FX markup; business-friendly perks |

| Circle Mint Card | Tight USDC and DeFi integration | Moderate (compliant) | Smooth wallet-to-fiat flow |

| Bitso Card | LAC region local currency support | High (regional privacy laws) | No conversion delays; flexible use |

| Crypto. com Visa Card | CRO rewards and global reach | Moderate (KYC required) | CRO rewards; travel perks |

| Wirex Card | No FX fees; multi-currency support | Moderate (regulated) | Up to 8% cashback in WXT |

| Binance Card | |||

The Future: Private Crypto Cards as Everyday Tools?

The evolution of these stablecoin card providers signals that private crypto cards are no longer fringe tools, they’re practical instruments for anyone seeking fast, borderless finance without sacrificing privacy or security. As regulatory clarity increases thanks to the GENIUS Act, expect even more mainstream adoption by merchants and consumers alike.

If you’re ready to take control of your digital assets without compromise, and want a smoother path from stablecoin to cash, explore our step-by-step guide on how these cards work in real life: How Stablecoin Cards Work Seamlessly Spending Crypto Anywhere Visa Is Accepted.