Crypto users have long faced hurdles when moving between digital assets and fiat currency. High fees, slow settlement times, and privacy concerns have made traditional on/off-ramp solutions less than ideal, especially for those who value efficiency and autonomy. The emergence of dedicated stablecoin blockchains, such as Stable, is now reshaping this landscape by offering purpose-built infrastructure for seamless, low-cost, and private transactions.

Stable: The Rise of USDT-Native Blockchains

Stable, the new Layer 1 blockchain incubated by Tether and Bitfinex, stands out as a prime example of how dedicated stablecoin blockchains are transforming on/off-ramp solutions. Unlike general-purpose chains, Stable is engineered specifically for stablecoin transactions. Its most innovative feature is the “USDT native gas” model, which lets users pay network fees directly in Tether (USDT) rather than a separate blockchain token. This seemingly small change dramatically reduces friction for high-frequency users and institutions alike.

By allowing USDT to serve as both the transactional asset and the fuel for network operations, Stable eliminates the need for users to juggle multiple tokens or worry about swapping assets just to cover fees. This model is particularly attractive for those using stablecoin cards or seeking private crypto ramp services, as it simplifies every step of the conversion process. For a deeper look at how this works in practice, see our detailed breakdown.

Efficiency and Cost Savings: Why Stablechains Matter

The efficiency gains offered by dedicated stablecoin blockchains are not just theoretical, they’re being realized right now by users and businesses around the globe. Traditional banking rails can be slow and expensive, especially for international transfers or high-volume transactions. In contrast, platforms built on chains like Stable offer near-instant settlement and significantly lower fees.

For example, with USDT as the native gas token on Stable, zero-fee peer-to-peer transfers are now possible for many use cases. This has major implications for remittances, payroll, and global commerce where minimizing costs is critical. Moreover, the stability of assets like USDT or USDC means users aren’t exposed to the wild price swings that can undermine other crypto on/off-ramp strategies.

These benefits extend to specialized services such as stablecoin cards and on/off-ramp cards, which enable seamless crypto to fiat conversion at payment terminals or ATMs worldwide. The result is a practical bridge between digital assets and everyday spending, a crucial step toward mainstream adoption of crypto finance.

Interoperability and Financial Institution Integration

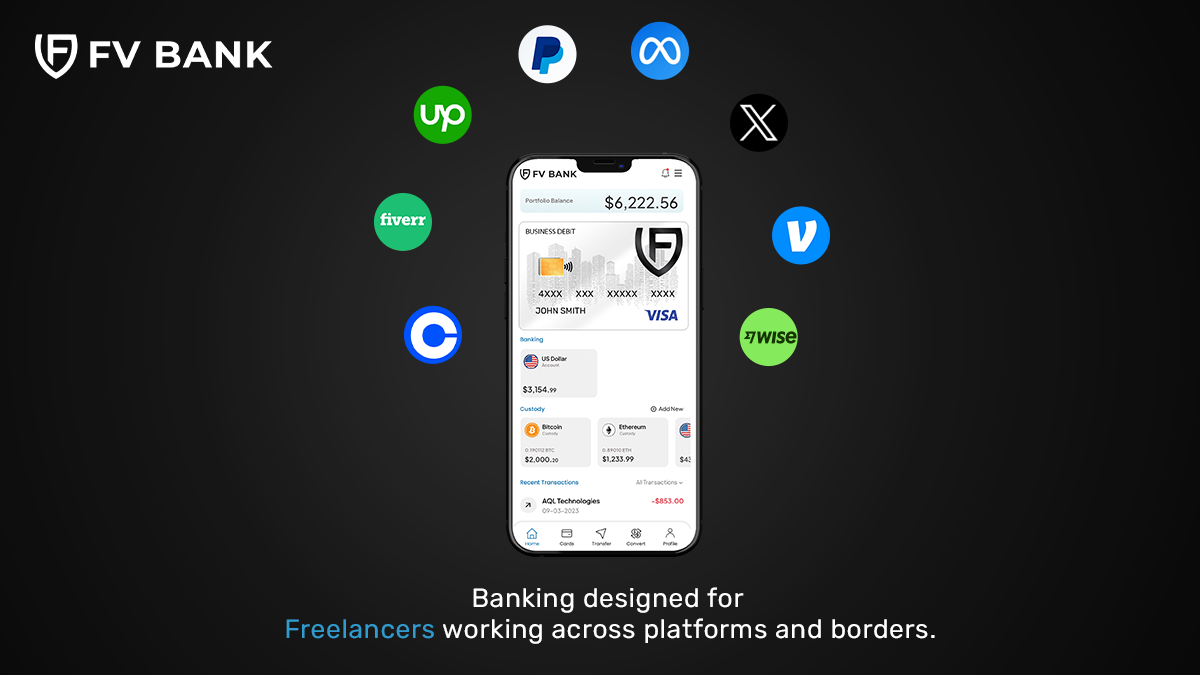

The impact of dedicated stablecoin blockchains goes beyond retail users. Financial institutions are increasingly integrating these platforms to streamline cross-border payments and settlements. Banks like FV Bank now support direct USDT deposits, bypassing legacy wire transfer systems and reducing operational costs. As more fintechs and banks adopt stablecoin-based infrastructure, users benefit from faster access to funds and a reduction in hidden fees.

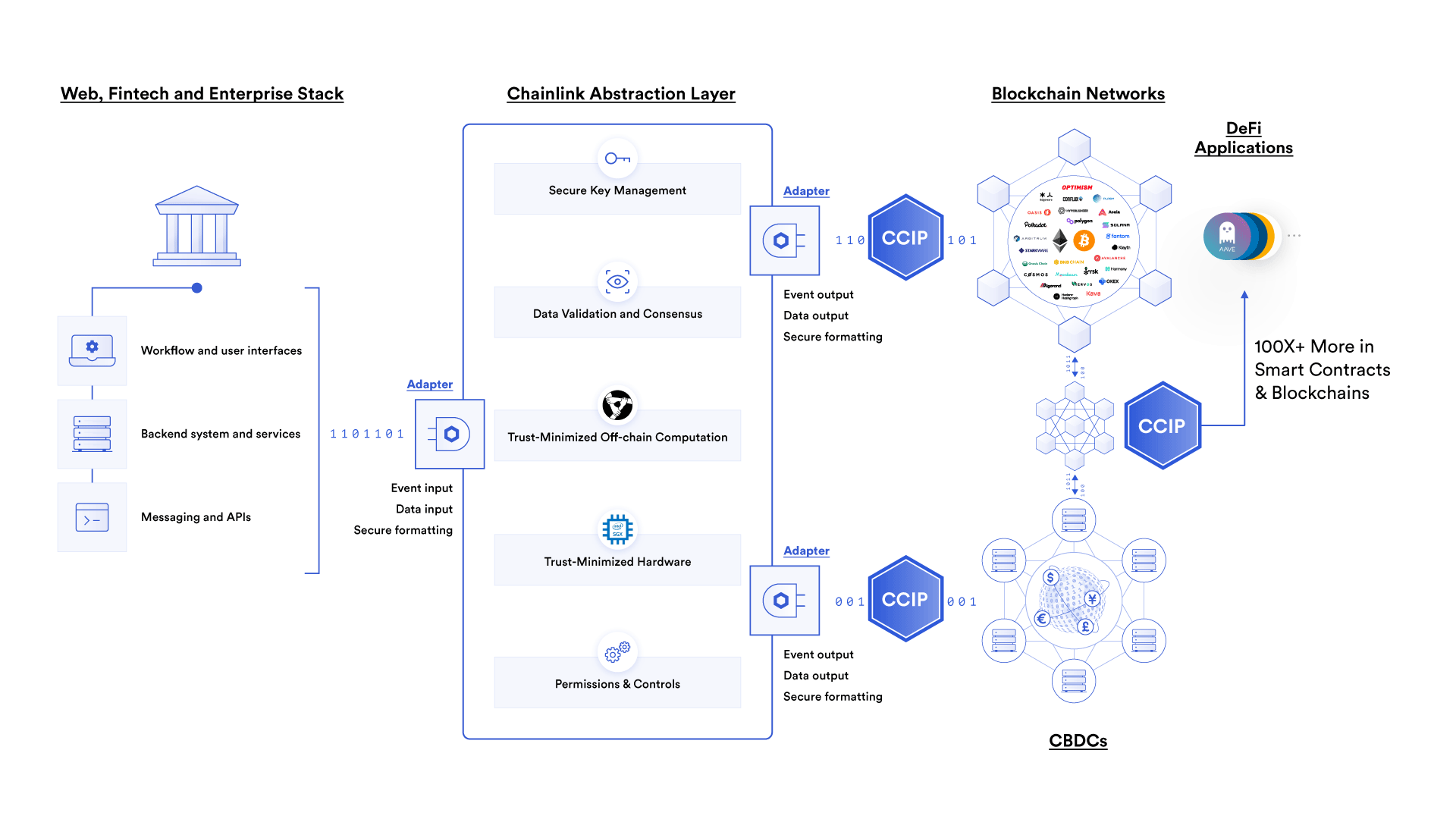

Advancements in blockchain interoperability further amplify these effects. Technologies such as Chainlink’s Cross-Chain Interoperability Protocol (CCIP) allow stablecoins to move seamlessly across networks, minimizing reliance on third-party bridges and enhancing security. This interoperability is essential for creating a truly global stablecoin infrastructure that supports both private crypto ramp needs and large-scale institutional flows.

The stage is set for dedicated stablecoin blockchains like Stable to become foundational pillars of modern financial systems. As on/off-ramp providers continue to innovate on top of these networks, crypto users can expect an ecosystem that is faster, cheaper, and more accessible than ever before. In the next section, we’ll dive deeper into how these changes are powering new levels of privacy, autonomy, and real-world usability for digital asset holders.

Privacy and autonomy have become defining demands in the evolving crypto landscape, and dedicated stablecoin blockchains are rising to the challenge. Platforms like Stable are not only lowering costs and speeding up settlements, but also enabling a new generation of privacy-first on/off-ramp solutions. Users can now leverage stablecoin cards and off-ramp services that allow for discreet crypto to fiat conversions, reducing reliance on centralized exchanges that require extensive personal data.

For privacy advocates, this marks a significant shift. By transacting directly on a USDT-native blockchain, users maintain greater control over their financial footprint. The ability to pay network fees in stablecoins eliminates the need for extra token holdings or convoluted swaps, streamlining the process while minimizing exposure to third-party surveillance. These features are particularly valuable for individuals operating in regions with restrictive financial policies or for those simply seeking more autonomy over their assets.

Top Benefits of Dedicated Stablecoin Blockchains for On/Off-Ramps

-

Faster and Cheaper Transactions: Dedicated stablecoin blockchains like Stable allow users to send and receive stablecoins such as USDT with lower fees and faster settlement times compared to traditional banking or legacy blockchains.

-

USDT as Native Gas Token: On the Stable chain, USDT is used as the native gas token, eliminating the need to manage multiple cryptocurrencies for fees and reducing friction for on/off-ramp transactions.

-

Enhanced Cross-Border Accessibility: Financial institutions like FV Bank now support direct USDT deposits, making international transfers simpler and more cost-effective for users and businesses worldwide.

-

Robust Interoperability: Protocols such as Chainlink CCIP enable stablecoins to move seamlessly across different blockchains, improving liquidity and reducing risks associated with third-party bridges.

-

Seamless Integration with Fintech Platforms: Services like Blockradar and MetaMask provide user-friendly on/off-ramp solutions, allowing easy conversion between fiat and stablecoins across multiple networks.

The expansion of zero-fee peer-to-peer stablecoin transfers is another game-changer. For freelancers, remote workers, and global businesses, sending and receiving payments without incurring prohibitive costs is now a reality. This efficiency is not just theoretical, real-world adoption is accelerating as more users discover the advantages of stablecoin infrastructure. The integration of stablecoin on/off-ramp services into everyday fintech products, like debit cards or mobile wallets, is quickly closing the gap between digital assets and traditional finance.

As interoperability protocols mature, users are no longer locked into a single chain or ecosystem. Cross-chain stablecoin transfers ensure liquidity can move freely wherever it’s needed, reducing bottlenecks and empowering users to access the best rates or services available. This flexibility also supports the growing trend of multi-chain stablecoin on/off-ramps, where users can interact with different networks without friction, a crucial factor for both retail and institutional adoption.

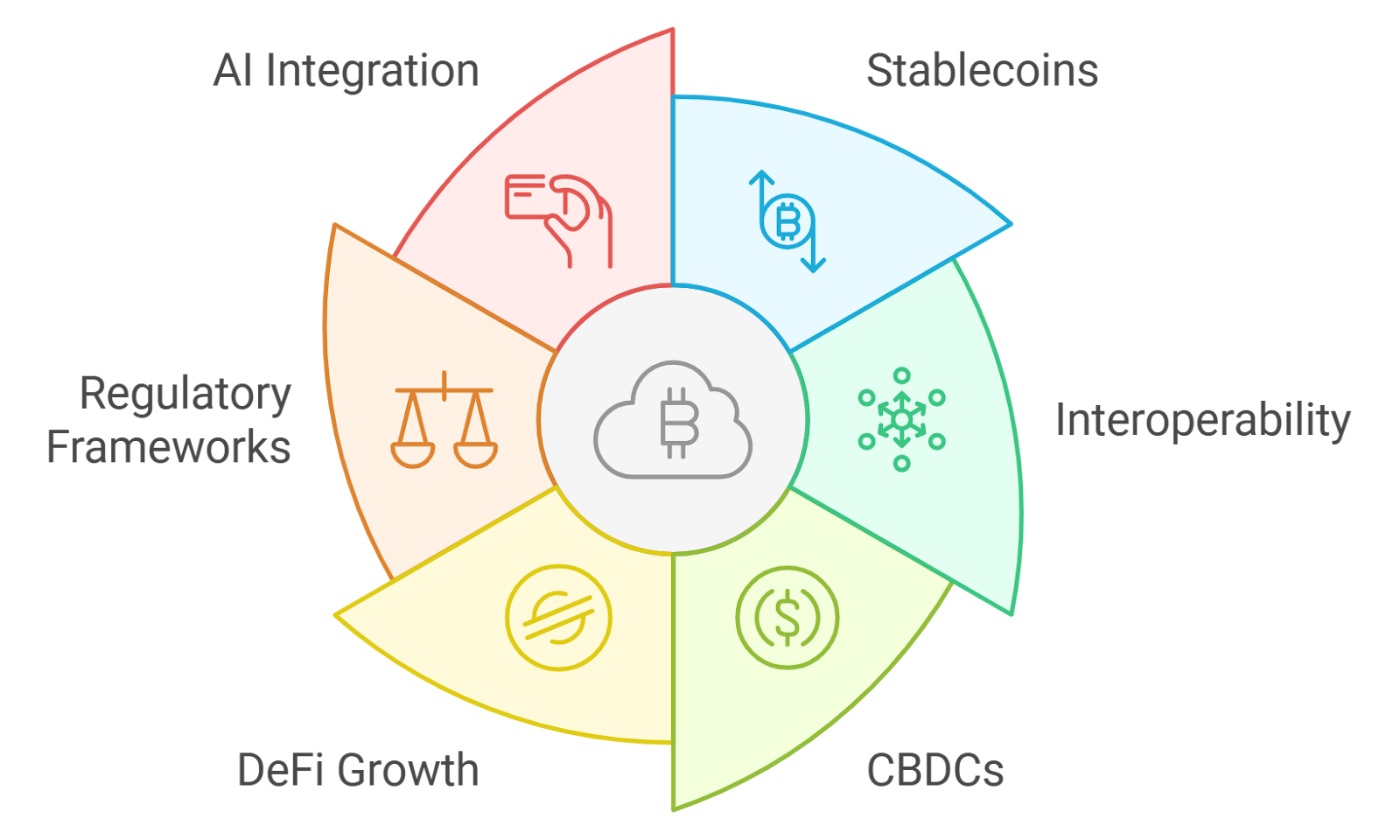

Looking ahead, dedicated stablecoin blockchains will continue to power innovation across payment rails, remittances, payroll, and global commerce. As new use cases emerge, such as programmable money for automated business payouts or privacy-enhanced peer-to-peer lending, these networks will serve as the backbone for a more open and efficient financial future.

For those seeking to understand how these underlying shifts translate into real-world usability, our coverage on Stablechain’s impact on private crypto ramps offers a closer look at the latest advancements. The momentum behind dedicated stablecoin blockchains is undeniable, setting a new standard for what users can expect from on/off-ramp stablecoin solutions.

Whether you’re a seasoned crypto user or just beginning your journey into digital assets, understanding how platforms like Stable are changing the game is critical. With the rise of USDT-native chains and the proliferation of seamless on/off-ramp options, the barriers between crypto and traditional finance are rapidly dissolving. This is more than a technical upgrade, it’s a reimagining of how money moves in a borderless world.