Latin America is no longer just flirting with crypto adoption, it’s building real infrastructure that puts stablecoins at the center of everyday commerce. In a region where currency volatility and banking friction have long been the norm, stablecoin cards are now powering seamless dollar payments for millions. This isn’t about speculation; it’s about practical financial survival and growth. The numbers don’t lie: Latin America leads the world in stablecoin adoption, outpacing global peers in both readiness and volume.

Visa, Mercado Pago, Nubank: The Race to Stablecoin-Powered Payments

The last 18 months have seen a flurry of major launches that signal a paradigm shift in how Latin Americans pay, save, and move money. In April 2025, Visa teamed up with Bridge, now part of Stripe, to roll out stablecoin-linked Visa cards across Argentina, Colombia, Ecuador, Mexico, Peru, and Chile. These cards let users spend USDC directly at any Visa merchant. Bridge handles real-time conversion so merchants receive local currency instantly while users tap into dollar stability without ever touching a bank branch.

Meanwhile, Mercado Pago, the fintech juggernaut behind MercadoLibre, launched its own dollar-pegged stablecoin called Meli Dolar in Brazil. Accessible through the Mercado Pago app since August 2024, Meli Dolar offers Brazilians an escape hatch from real inflation risk while enabling fast digital transactions anywhere the app is accepted.

Nubank isn’t sitting on the sidelines either. In September 2025, Latin America’s largest digital bank announced its own pilot to integrate dollar-backed stablecoins into its credit card system. This move targets not just crypto enthusiasts but also mainstream consumers who want protection from peso or real depreciation when making everyday purchases or cross-border payments.

Cross-Border Payments Without Borders: Bitso’s Real-Time FXaaS

Ask any finance team or freelancer in Latin America about cross-border wires and you’ll get an earful about delays and high fees. That’s where Bitso comes in. Expanding aggressively into Chile and Peru this year, Bitso now offers FXaaS (Foreign Exchange as a Service) alongside “Pay with Bitso” solutions powered by USDT and USDC. The result? Real-time USD liquidity for businesses and individuals alike, and settlement times slashed from days to seconds.

This is more than hype: according to Rapyd research and recent Fireblocks data, finance teams across the region are ditching legacy rails for stablecoins to pay contractors instantly while sidestepping currency volatility and banking bottlenecks entirely.

Regulatory Clarity Fuels Mainstream Adoption

The regulatory backdrop is catching up fast too. In July 2025, the U. S. passed the GENIUS Act, a landmark law requiring all stablecoins to be backed by liquid assets with monthly public reserve disclosures. While not specific to LatAm markets directly, this move has had ripple effects globally by boosting confidence among institutional players and fintechs operating in dollarized corridors.

Local regulators are following suit or signaling openness to innovation as long as transparency is maintained, fueling further integration of stablecoin rails into daily life across Latin America.

Why Stablecoin Cards Are Winning Over Traditional Banking

The appeal is simple but powerful:

- No more waiting days for international wires

- Dollar-denominated savings insulated from local inflation

- Instant spending power anywhere Visa or Mastercard are accepted

- Lower fees compared to traditional banks or remittance services

This isn’t just fintech buzz; it’s rapidly becoming the new normal for businesses paying remote teams or families supporting loved ones across borders. For deeper insights on how these cards work under the hood, and why they’re changing on/off-ramp dynamics, see our breakdown at How Stablecoin Cards Are Changing On/Off-Ramp Crypto Payments in 2024.

We’re witnessing a rare convergence of user demand, regulatory clarity, and real-world infrastructure. Stablecoin cards aren’t just a crypto-native novelty anymore, they’re the connective tissue between Latin America’s dollarized aspirations and the realities of everyday commerce. The latest data from FXC Intelligence shows that stablecoins now move more value through cross-border payments in the region than many legacy rails, with settlement speeds measured in seconds instead of days. That’s not just an upgrade, it’s a total rewrite of how money moves.

Top Stablecoin Card Providers in Latin America

-

Visa x Bridge: Launched in April 2025, this partnership brings stablecoin-linked Visa cards to Argentina, Colombia, Ecuador, Mexico, Peru, and Chile. Users can spend stablecoins like USDC directly at any Visa merchant, with real-time conversion to local currencies.

-

Mercado Pago’s Meli Dolar: In August 2024, Mercado Pago introduced Meli Dolar, a dollar-pegged stablecoin, to its app in Brazil. Users can trade and transact with a stable digital dollar, reducing volatility and boosting financial stability.

-

Nubank Stablecoin Integration: Announced in September 2025, Nubank is piloting stablecoin support for its credit card payments, allowing millions of users to pay and save in digital dollars within Latin America’s largest digital bank ecosystem.

-

Bitso Cross-Border Solutions: Bitso’s FXaaS and Pay with Bitso products, launched in 2025, enable real-time USD liquidity and low-fee cross-border payments using USDT and USDC, now available in Mexico, Chile, and Peru.

-

GENIUS Act Regulatory Framework: Passed in July 2025, the GENIUS Act sets clear rules for stablecoin reserves and transparency, accelerating mainstream adoption and trust in stablecoin-backed payment cards across the region.

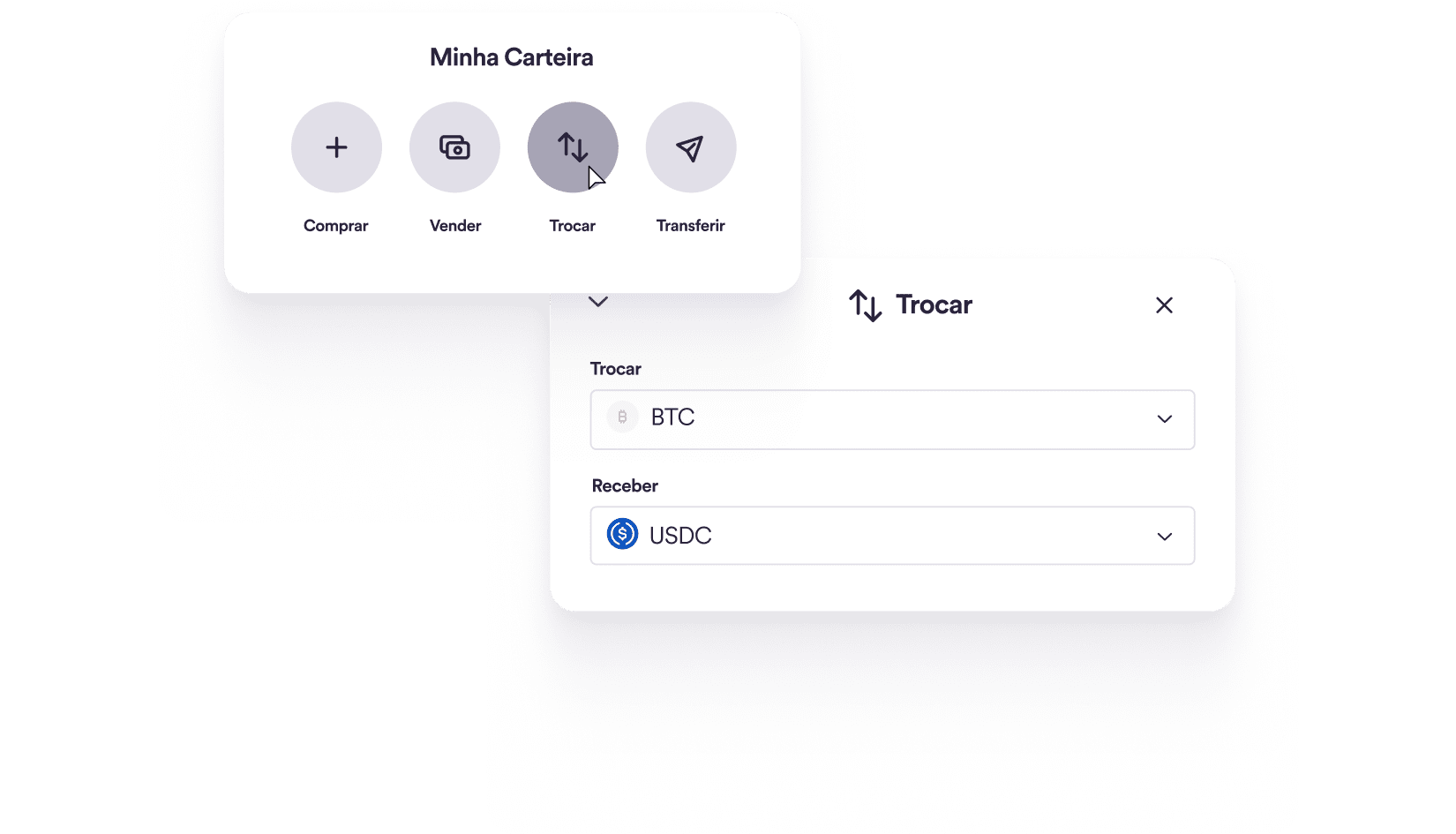

For retail users, the experience is seamless: load USDC or USDT onto your card, tap to pay at any merchant that accepts Visa or Mastercard, and walk away with instant settlement, no hidden FX markups, no surprise delays. For businesses and freelancers alike, stablecoin cards are unlocking new models for payroll, supplier payments, and treasury management that simply weren’t possible under old banking regimes.

The momentum is visible on every front. Mercado Pago’s Meli Dolar is gaining traction among Brazilian merchants who want to hedge against inflation. Bitso’s FXaaS pipeline is already handling millions in monthly flows for SMEs exporting services to the United States or Europe. Nubank’s pilot could bring stablecoin-powered credit to tens of millions more users within a year.

What’s Next?Stablecoin Infrastructure Goes Mainstream

The next phase will be about scale and integration. As on/off-ramp solutions mature, letting users move between fiat and stablecoins without friction, the lines between traditional finance and crypto will blur even further. Expect more partnerships like Visa-Bridge, deeper wallet integrations (see our guide on Integrating Stablecoin Cards with DeFi Wallets for Seamless Transactions), and continued regulatory progress as governments realize the economic upside of dollar-pegged rails.

But there are still hurdles ahead: merchant education, user onboarding UX, local tax treatment of crypto transactions, all these factors will shape how quickly mass adoption takes hold. Yet with major fintechs doubling down on stablecoins as core infrastructure rather than speculative assets, Latin America is poised to become a global case study for practical crypto-powered payments.

Key Takeaways for Crypto Users and Finance Teams

- Stablecoin cards offer real-time USD spending power across borders, no bank required

- Major players like Visa, Mercado Pago, Nubank, and Bitso are driving rapid ecosystem growth

- Regulatory clarity (GENIUS Act) boosts institutional confidence and adoption rates

- On/off-ramp providers are critical for seamless transitions between fiat and digital dollars

If you’re looking to harness these tools for your own business or personal finances, and want privacy-first options, explore our deep dive into how stablecoin-powered cards are transforming private on/off-ramp crypto payments.