In Latin America, stablecoin-powered cards are quietly taking over where cash once dominated. Most consumers don’t even realize it: when they tap to pay for groceries or scan a QR code at a café, their digital dollar balance is instantly converted into pesos, soles, or reais. The process is seamless, private, and increasingly popular in economies where currency volatility and financial exclusion are everyday realities.

From Cash to Crypto: Why Latin America Leads the Stablecoin Card Revolution

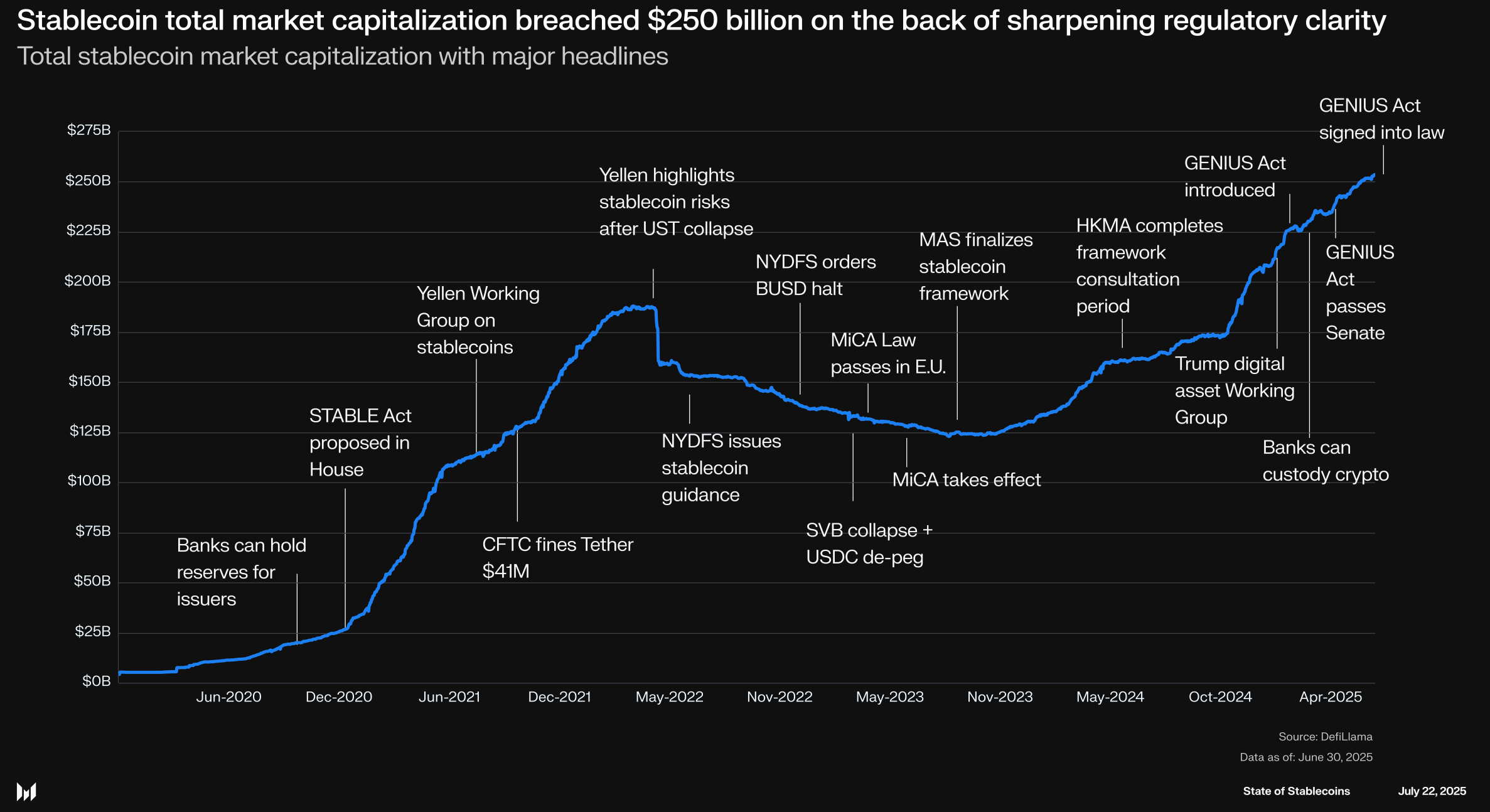

Latin America has long been ground zero for currency instability. In countries like Argentina and Venezuela, inflation regularly erodes the value of local savings. Even in more stable markets like Mexico and Brazil, millions remain unbanked or underbanked. Enter stablecoin cards: Visa and fintech partners such as Rain and Bridge now let users spend digital dollars (like USDT or USDC) directly at any merchant that accepts Visa, over 150 million locations globally.

According to data from Neira Jones, 71% of Latin American firms already use stablecoins for cross-border payments, far outpacing the global average of 49%. But the real story is on the street: stablecoin cards aren’t replacing bank cards, they’re replacing cash itself. For many users, these cards are their first step into formal finance, bypassing legacy banks entirely.

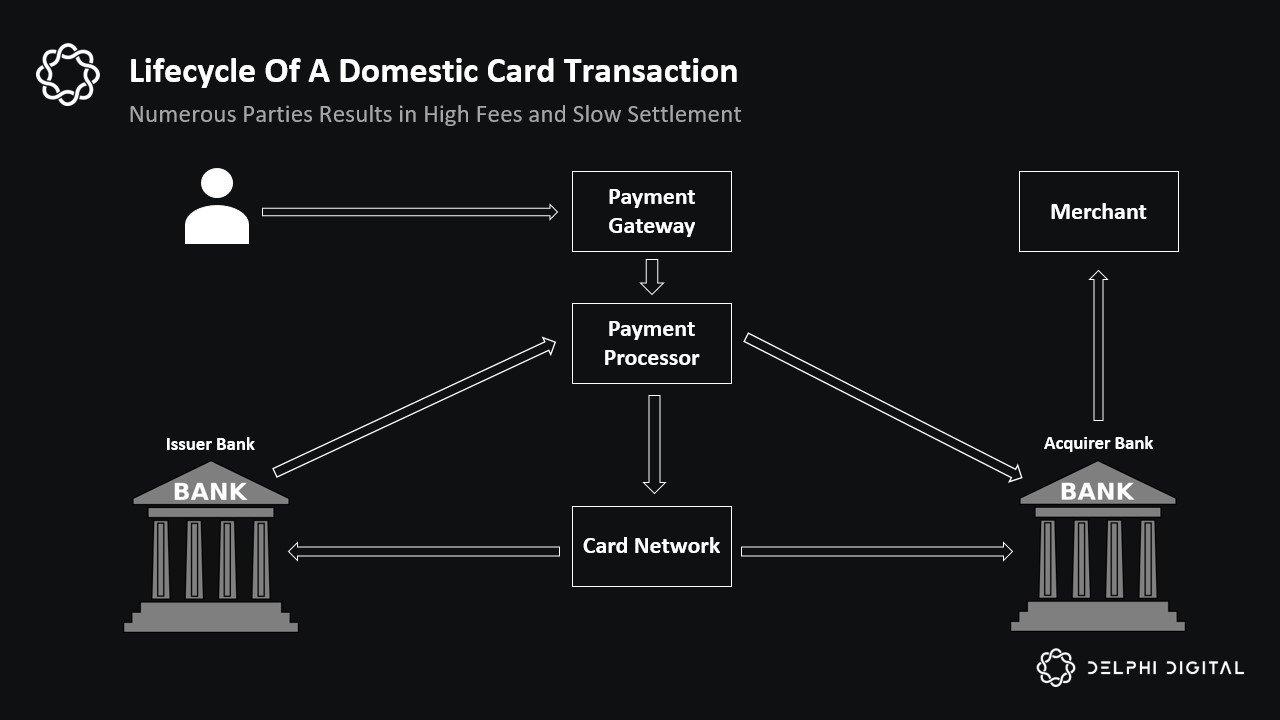

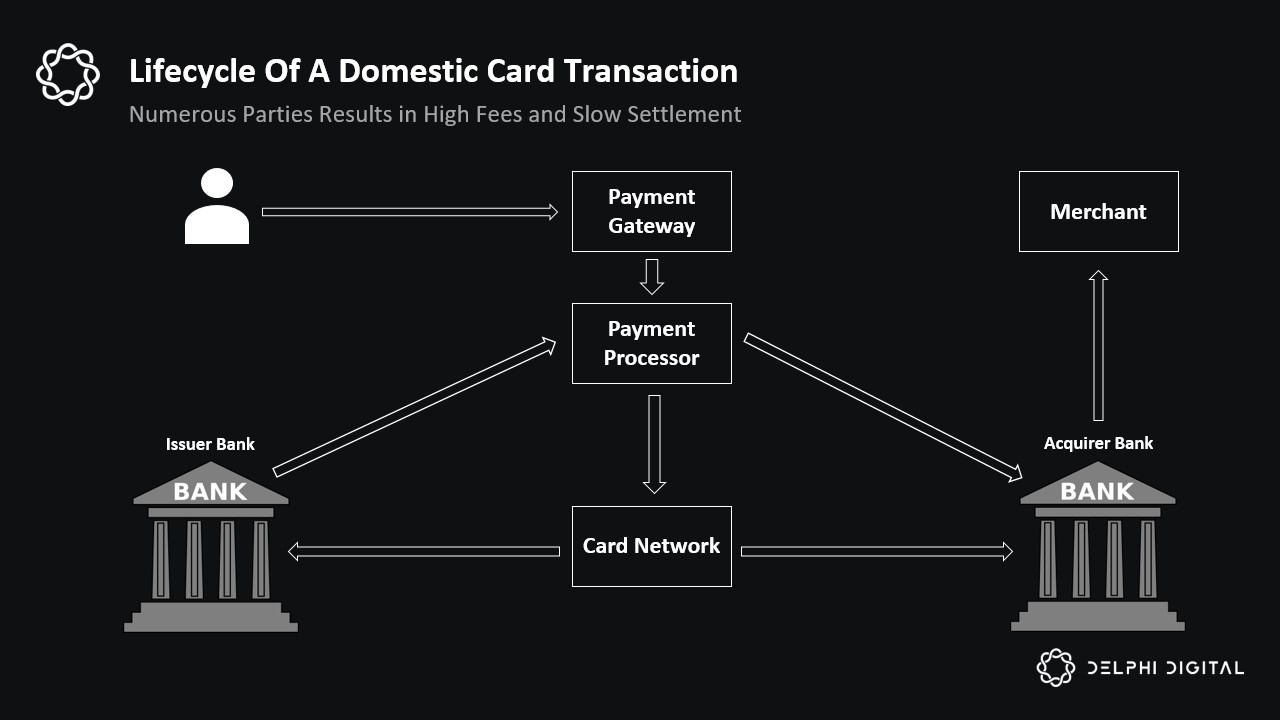

The Mechanics: How Stablecoin Cards Work at Checkout

The technical backbone enabling this shift is robust and largely invisible to end users. Platforms like Bridge (now part of Stripe) handle real-time conversion between digital assets and local currency at the point of sale. When you swipe a Rain Visa card loaded with USDC in Buenos Aires or Lima, your crypto balance is debited while the merchant receives Argentine pesos or Peruvian soles, no extra steps required.

This model eliminates the need for traditional banking infrastructure while delivering speed, privacy, and security. Transactions settle instantly on-chain in supported networks such as Solana or Tron before being bridged to fiat via established payment rails. As a result, even those without a bank account can access modern financial tools using only a smartphone and a prefunded wallet.

Real Adoption: From Unbanked Populations to Everyday Shoppers

The impact goes beyond convenience. In Mexico, Chipi Pay leverages Starknet’s Layer 2 scaling to offer ultra-low-cost stablecoin transactions aimed directly at unbanked populations. Nubank, the region’s largest digital bank, is piloting credit card payments denominated in dollar-pegged stablecoins across Brazil and Colombia as consumer demand soars.

This isn’t just about tech-savvy early adopters anymore; it’s about millions using digital dollar cards as their primary payment method in daily life. Stablecoin-powered onramp and off-ramp solutions make it possible for anyone, from gig workers to small merchants, to move seamlessly between crypto and local currency with minimal fees and friction.

What’s striking is how quietly this transition is happening. Stablecoin cards are not a speculative play for most users, they’re a lifeline. In countries where the local currency can lose double-digit value in a single month, the ability to hold and spend in USDT or USDC provides real purchasing power and shields against hyperinflation. Merchants, meanwhile, benefit from near-instant settlement and lower transaction fees compared to legacy card networks.

Platforms like Rain have capitalized on this demand by settling 100% of card payment volume directly in stablecoins on the Visa network. The backend complexity, bridging across Solana, Tron, or Ethereum, is abstracted away from both consumers and merchants. All that’s left is a frictionless payment experience that feels like magic but is powered by robust crypto infrastructure under the hood.

Challenges and Opportunities: What’s Next for Stablecoin Cards in Latin America?

Despite rapid adoption, hurdles remain. Regulatory clarity is still evolving across Latin America, with some governments eyeing tighter controls over digital assets even as others embrace them for financial inclusion. Liquidity and off-ramp solutions are improving but not yet universal, especially in rural regions where cash remains king.

Yet momentum is undeniable. Nubank’s pilot of dollar-pegged stablecoin credit card payments signals that mainstream banks are watching closely. More fintechs are launching crypto onramp cards targeting freelancers and gig workers who earn online but need to spend locally without costly conversions or banking headaches.

Top Benefits of Stablecoin Cards Over Cash in Latin America

-

Protection from Local Currency Volatility: Stablecoin cards let users hold and spend dollar-pegged assets, shielding them from inflation and rapid currency devaluation common in countries like Argentina and Venezuela.

-

Seamless Everyday Spending: With Visa-backed stablecoin cards (e.g., from Rain and Bridge), users can pay at over 150 million merchants—just like with traditional cards, but funded by stablecoins instead of cash.

-

Instant, Low-Cost Cross-Border Transactions: Stablecoin cards enable fast and affordable payments across borders, bypassing traditional remittance fees and delays. Latin America leads globally, with 71% of firms using stablecoins for cross-border payments.

-

Financial Inclusion for the Unbanked: Platforms like Chipi Pay in Mexico use stablecoin-powered wallets to provide digital payments access to unbanked populations, leveraging scalable blockchains like Starknet for low-cost transactions.

-

Familiar Experience, Crypto-Powered: Most users don’t realize their purchases are powered by stablecoins—merchants receive local currency, while users enjoy the benefits of digital assets, making adoption frictionless.

The infrastructure continues to mature as well. With platforms like Chipi Pay leveraging Starknet’s scalability and Bridge (via Stripe) managing seamless conversion at checkout, we’re seeing the emergence of a true stablecoin payment infrastructure. This makes private stablecoin payments accessible not just to urban elites but to anyone with a smartphone, even those previously excluded from formal finance.

For more on how these trends are reshaping daily commerce across the region, and why stablecoins could soon outpace cash entirely, see our deep dives at How Stablecoin Cards Are Quietly Disrupting Cash Payments in Latin America and How Stablecoin Cards Are Powering Dollar Payments in Latin America: Real World Adoption and Infrastructure.

The bottom line: Stablecoin-powered cards aren’t just replacing cash, they’re redefining financial freedom for millions across Latin America.