Off-ramping crypto to fiat has never been more seamless than it is in 2025. With the rise of stablecoin debit cards, users can now convert their digital assets like USDT and USDC into spendable cash at millions of merchants worldwide, no more waiting for slow bank wires or battling with exchange withdrawal limits. This practical guide explores how to use the latest generation of crypto off-ramp stablecoin debit cards, focusing on privacy, speed, and real-world usability.

The Rise of Stablecoin Debit Cards: Why 2025 Is a Breakout Year

Stablecoin cards have rapidly matured, bridging the gap between digital assets and everyday spending. In 2025, competition among providers has led to lower fees, broader global acceptance, and innovative privacy features. The top players, like the KAST Multi-Chain Debit Card, Crypto. com Ruby Steel Card, and Coinbase Card (USDC): are setting new standards for convenience and flexibility.

The appeal is clear: instead of selling crypto for fiat on an exchange (and waiting days for settlement), you simply load your card with stablecoins and spend instantly, anywhere Visa or Mastercard is accepted. For privacy advocates and frequent travelers alike, this model offers both discretion and freedom from traditional banking friction.

Top 10 Crypto Debit Cards for Off-Ramping in 2025

Choosing the right card depends on your needs, whether it’s zero-KYC onboarding, high rewards, or multi-stablecoin support. Here’s how leading options stack up:

- KAST Multi-Chain Debit Card: Supports USDC, USDT, USDe across multiple blockchains. Spend at over 100 million merchants globally. Rewards range from 2% to a staggering 12%, depending on tier.

- Crypto. com Ruby Steel Card: Up to 2% cashback (with $25 monthly cap). Requires staking CRO tokens for higher rewards; be mindful of monthly fees eating into benefits.

- Coinbase Card (USDC): Directly linked to your Coinbase account. Regulated in US/EU markets with robust compliance; ideal for those prioritizing security and legal clarity.

- Binance Visa Card: Widely used in Europe/Asia with support for multiple cryptos including stablecoins. Known for low FX fees and simple wallet integration.

- Monolith Visa Debit Card (DAI/USDC): Non-custodial approach lets you retain control over your keys while spending DAI or USDC directly from your wallet.

- Wirex Mastercard (Stablecoin Support): Multi-currency support including top stablecoins; integrated app makes tracking spending a breeze.

- BitPay Mastercard (USDT/USDC): Popular in North America; fast conversion at point-of-sale with transparent rates.

- PlasBit Anonymous Crypto Card: Designed for privacy-focused users seeking minimal KYC requirements when off-ramping crypto to cash.

- Nexo Mastercard (Stablecoin Integration): Earn up to 2% back while spending; seamlessly integrates with Nexo’s lending platform for added utility.

- Uphold Mastercard (Multi-Stablecoin): Supports a broad basket of stablecoins plus precious metals, a unique choice for diversified digital asset holders.

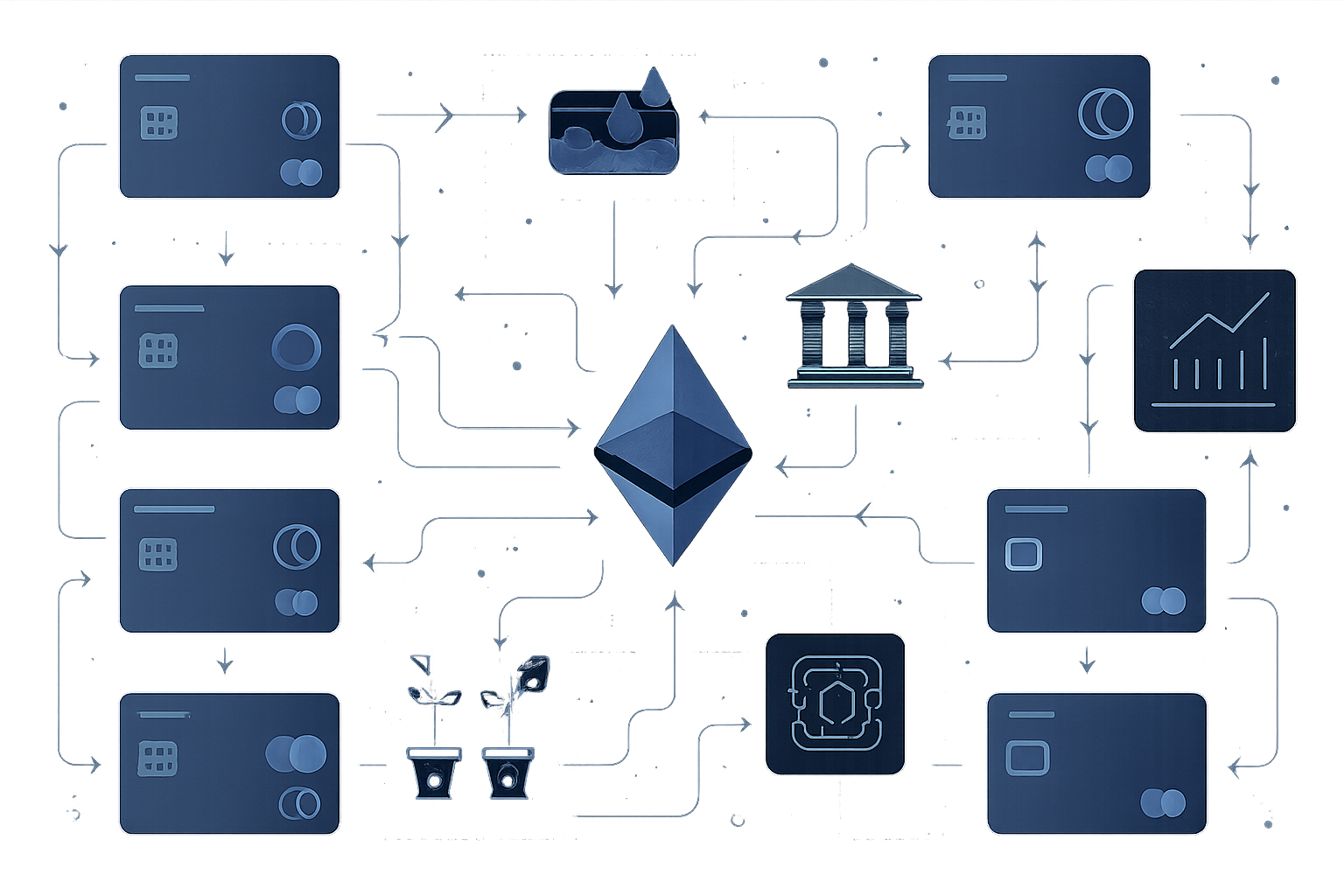

The Mechanics: How Stablecoin Cards Convert Crypto to Fiat Instantly

The process is elegantly simple but technologically sophisticated. Here’s how most leading cards work:

- Select your preferred card based on supported coins, rewards structure, region, and privacy requirements, see our curated list above for guidance.

- Create an account via the provider’s app or website. Some cards like PlasBit offer zero-KYC onboarding options (learn more about zero-KYC solutions here). Others require standard identity verification due to regulatory coverage in certain jurisdictions.

- Add funds by transferring USDT, USDC, or DAI from your personal wallet or exchange account directly onto the card platform. Top-up methods now include MetaMask and other Web3 wallets as well as centralized exchanges such as Binance or Coinbase.

- Your balance is held in stablecoins until you make a purchase. At checkout, whether online or at a physical retailer, the card provider instantly converts the required amount into local fiat currency at competitive rates. The merchant receives cash; you see an immediate deduction from your crypto balance plus any earned rewards credited back automatically.

This instant conversion model means users enjoy both volatility protection (thanks to stablecoins) and liquidity without lengthy withdrawal processes, a game-changer compared to legacy off-ramp solutions.

Beyond convenience, stablecoin debit cards are rapidly evolving to address the nuanced needs of global crypto users. Privacy, multi-chain compatibility, and reward innovation have become core differentiators. For instance, the PlasBit Anonymous Crypto Card has gained traction among privacy advocates seeking a zero-KYC stablecoin card: a major step forward for those who value financial sovereignty. Meanwhile, cards like KAST Multi-Chain and Nexo Mastercard are introducing tiered rewards and seamless lending integrations, catering to both spenders and yield-seekers.

Comparing Features: Which Stablecoin Card Suits Your Needs?

The diversity in today’s stablecoin card market means there’s no one-size-fits-all solution. Let’s break down how the top 10 contenders stack up across key criteria:

Top 10 Crypto Debit Cards for 2025: Stablecoin Off-Ramp Comparison

| Card Name | Supported Stablecoins | Rewards Rate | Privacy/KYC Level | Annual/Monthly Fees | Global Acceptance |

|---|---|---|---|---|---|

| KAST Multi-Chain Debit Card | USDC, USDT, USDe | 2% – 12% (tiered) | Standard KYC | $20 – $5,000/year (tiered) | Visa, 100M+ merchants |

| Crypto.com Ruby Steel Card | USDC, USDT, CRO, BTC, ETH | 2% cashback (up to $25/mo) | KYC Required | Monthly fee (varies by tier) | Visa, Global |

| Coinbase Card (USDC) | USDC, BTC, ETH | 1% – 4% (varies by asset) | KYC Required | No annual fee, transaction fees apply | Visa, Global |

| Binance Visa Card | USDT, BUSD, BTC, ETH, BNB | Up to 8% cashback | KYC Required | No annual fee, FX fees apply | Visa, Global |

| Monolith Visa Debit Card (DAI/USDC) | DAI, USDC | No cashback | KYC Required | No annual fee, network fees apply | Visa, Europe/UK |

| Wirex Mastercard (Stablecoin Support) | USDC, USDT, DAI, BTC, ETH | Up to 2% Cryptoback™ | KYC Required | No annual fee, transaction fees apply | Mastercard, Global |

| BitPay Mastercard (USDT/USDC) | USDT, USDC, BTC, BCH, ETH | No cashback | KYC Required | No annual fee, load fees apply | Mastercard, US only |

| PlasBit Anonymous Crypto Card | USDT, USDC, BTC, ETH | No rewards | No KYC (anonymous tier) | Issuance fee, monthly fee (varies by tier) | Visa, Global |

| Nexo Mastercard (Stablecoin Integration) | USDT, USDC, BTC, ETH | Up to 2% cashback | KYC Required | No annual fee | Mastercard, Global |

| Uphold Mastercard (Multi-Stablecoin) | USDC, USDT, DAI, BTC, XRP | 1% cashback | KYC Required | No annual fee, transaction fees apply | Mastercard, US/UK/EU |

KAST Multi-Chain Debit Card stands out for its high rewards (up to 12%) and broad blockchain support, ideal for power users who want flexibility and maximum cashback. Crypto. com Ruby Steel Card, while offering modest cashback (2%), is best suited for users already integrated into the Crypto. com ecosystem or those staking CRO tokens. If regulatory clarity is your priority when you convert crypto to cash in 2025, the Coinbase Card (USDC) offers robust compliance in US/EU markets.

The Binance Visa Card, with its low FX fees and wide regional coverage (especially in Europe/Asia), appeals to frequent travelers. For DeFi purists who prefer non-custodial solutions, the Monolith Visa Debit Card (DAI/USDC) lets you retain control of your private keys while spending directly from your wallet. Meanwhile, the Wirex Mastercard, BitPay Mastercard, and Nexo Mastercard all offer varying levels of integration with lending platforms or multi-currency support, blurring the lines between spending and earning on your assets.

Practical Tips: Getting the Most from Your Crypto Off-Ramp Stablecoin Debit Card

The optimal card depends on your location, spending habits, preferred stablecoins, and privacy needs. Here are a few expert recommendations for maximizing value:

- Diversify Your Cards: Many advanced users hold more than one card, for example, a PlasBit Anonymous Crypto Card for private purchases alongside a Coinbase Card (USDC) for regulated transactions.

- Avoid Unnecessary Fees: Watch out for dormant account charges or foreign exchange markups on certain cards like Crypto. com Ruby Steel or Wirex Mastercard.

- Tune Into Rewards: Cards such as KAST offer higher cashback tiers if you’re willing to pay an annual fee or lock up tokens; calculate whether these rewards outweigh costs based on your projected usage.

- Sustain Security: Always enable two-factor authentication on your card accounts and use hardware wallets where possible when topping up balances.

- Pursue Zero-KYC Options When Needed: For those prioritizing anonymity when off-ramping USDT or USDC to fiat, explore options like PlasBit, read more about instant off-ramping without KYC hassles at our dedicated guide: How Stablecoin Cards Enable Instant Crypto-to-Fiat Off-Ramping Without KYC Hassles.

The Future of Off-Ramping: Trends and What Comes Next

The evolution of stablecoin debit cards is far from over. We’re seeing rapid progress toward frictionless integration with Web3 wallets (MetaMask/Rabby/Phantom), direct NFT marketplace spending capabilities, and even tokenized loyalty programs that further incentivize everyday use. Regulatory clarity is also improving globally, cards like Uphold Mastercard now offer multi-stablecoin support plus commodities exposure under clear frameworks.

This landscape empowers users to move fluidly between digital assets and traditional finance, whether you’re looking to spend USDT at a local café or instantly convert crypto to cash during international travel. As adoption accelerates into late 2025 and beyond, expect competition among providers to drive even lower fees, broader merchant acceptance, and ever-greater user control over privacy settings.

If you want an even deeper dive into practical strategies for using these tools, or need help choosing between zero-KYC options versus high-reward platforms, check our resource hub including guides like How to Instantly Off-Ramp USDT and USDC to Fiat With Stablecoin Cards in 2025.