In 2025, converting USDT to fiat anonymously remains a high-stakes pursuit for privacy-focused crypto users. Regulatory pressures have tightened KYC mandates across most platforms, yet stablecoin off-ramp cards emerge as a sophisticated workaround. These prepaid debit cards, loadable with stablecoins like USDT, enable seamless spending at millions of merchants worldwide without surrendering your identity for every transaction. Drawing from recent analyses by CoinGape and NFTevening, decentralized swaps into USDT paired with minimal-KYC cards offer the closest path to true private USDT to fiat conversions.

Why Traditional Off-Ramps Fall Short on Privacy

Centralized exchanges dominate the off-ramp space, but their KYC rituals expose users to data breaches and surveillance. Token Metrics’ 2025 report highlights how even top providers enforce identity checks, limiting anonymous crypto off-ramp options. P2P platforms like Binance P2P provide some relief through cash or local transfers, yet they still demand accounts and carry counterparty risks. Non-custodial swaps via AnonSwap or ChangeNOW keep crypto-to-crypto private, but bridging to fiat often triggers compliance hurdles. Enter stablecoin off-ramp cards: they sidestep these pitfalls by converting USDT on-chain to spendable fiat equivalents, often with tiered verification that skips full KYC for modest limits.

This shift aligns with broader trends. CryptoDnes. bg notes anonymous wallets integrating fiat ramps, while 99Bitcoins praises no-KYC exchanges for trading freedom. However, for direct USDT cashouts, cards like those from Spritz Finance stand out, processing conversions in minutes without invasive checks.

Key Benefits of Private Off-Ramp Cards

-

Minimal KYC: Basic verification only for low limits on cards like Spritz Finance and Crypto.com Visa, enabling privacy-focused USDT to fiat conversion.

-

Instant Global Spending: Load USDT onto prepaid Visa cards for immediate use worldwide wherever Visa is accepted, as with Crypto.com Visa Card.

-

Low Fees Under 2%: Cost-effective off-ramping with minimal charges, ideal for efficient stablecoin to fiat transactions.

-

Supported Chains: Compatible with Ethereum, Polygon, and others for seamless USDT bridging and loading.

-

Fast Processing: Quick USDT to prepaid card loading, minimizing wait times for spending, per Spritz Finance features.

Spritz Finance: The Privacy Champion for USDT Cards

Spritz Finance redefines no KYC stablecoin card access by issuing prepaid Visa cards directly funded from USDT wallets. For limits under $1,000 monthly, no ID upload is required, making it ideal for discreet users. Their process leverages smart contracts for atomic swaps, ensuring funds hit the card instantly. As detailed in our guide at how-stablecoin-cards-enable-instant-crypto-to-fiat-off-ramping-without-kyc-hassles, Spritz prioritizes speed and security, with fees hovering at 1.5% per load. In tests, USDT from Polygon bridged flawlessly, spendable at ATMs or online without traces.

Compared to Mural Pay’s off-ramps, which excel in 40 and currencies but demand more compliance, Spritz appeals to purists. CoinGecko’s top crypto cards list omits it for now, but its anonymity edge positions it as a 2025 frontrunner.

Crypto. com Visa: Tiered Access for Broader Appeal

Crypto. com’s Visa Card strikes a balance, supporting USDT alongside BTC and ETH for instant fiat conversion. Basic tiers unlock with email alone, escalating KYC only for high volumes. This stablecoin debit card 2025 model suits users testing waters before committing data. Global acceptance via Visa’s network means ATM withdrawals or merchant swipes anywhere, with cashback in CRO adding value. Finchtrade’s analysis underscores its utility for Middle Eastern businesses, but privacy advocates appreciate the no-verification entry point.

Risks persist: higher tiers invite scrutiny, and regional blocks apply. Still, pairing it with non-custodial wallets like Best Wallet enhances anonymity. Blockpit’s no-KYC wallet roundup confirms such integrations preserve user control.

These cards transform USDT from a digital holding into tangible utility. Yet selecting the right one demands weighing limits, fees, and chain support. Spritz edges for pure privacy; Crypto. com for versatility.

Versatility extends beyond these two leaders. Nexo’s card, highlighted in CoinGecko’s 2025 rankings, accommodates USDT conversions with competitive rates, though it leans toward verified users for full features. For those prioritizing stablecoin debit card 2025 options with global reach, Mural Pay’s infrastructure supports 40 and currencies via stablecoin ramps, but its compliance focus dilutes anonymity compared to Spritz.

Comparison of Top Private Stablecoin Off-Ramp Cards

| Provider | KYC | Fees | Monthly Limit | Chains |

|---|---|---|---|---|

| Spritz | Minimal/None under $1k | 1.5% | $1k no-KYC | ETH/Polygon |

| Crypto.com | Tiered/Email basic | 1-2% | $10k basic | Multi |

| Nexo | Full for high limits | 0-2% | Unlimited verified | BTC/ETH/USDT |

Navigating Risks in Anonymous USDT Off-Ramping

Privacy comes at a cost. Platforms offering no KYC stablecoin card access cap volumes to evade regulators, exposing users to liquidity squeezes during peaks. Spritz’s $1,000 monthly threshold suits occasional spenders; exceed it, and verification kicks in. Fees, while low at 1-2%, compound on frequent loads, eroding USDT’s peg stability if not monitored. Counterparty trust remains paramount: audit smart contracts and user reviews before committing funds. Recent CryptoDnes. bg insights on anonymous wallets stress self-custody pairings, like Best Wallet, to firewall exchange risks.

Regulatory headwinds loom larger in 2025. Token Metrics warns of jurisdictional variances; EU users face stricter MiCA rules, while U. S. residents navigate FinCEN scrutiny. P2P alternatives via Binance shine for cash trades but invite scams, as NFTevening’s no-KYC exchange list cautions. Non-custodial swaps precede card loads effectively, yet chain analysis tools increasingly deanonymize on-chain flows. My view, honed from years analyzing TradFi-crypto bridges: layer privacy tools like mixers sparingly, favoring proven cards over untested hacks.

Essential Risk Mitigation Steps

-

Use Non-Custodial Wallets: Maintain full control of private keys with options like Best Wallet or hardware wallets to prevent custody risks during USDT handling. (Source)

-

Monitor Limits Before Scaling: Track low transaction thresholds on platforms like Spritz Finance (minimal KYC for small amounts) to avoid triggering verification. Stay under limits for privacy.

-

Diversify Across 2-3 Providers: Spread USDT off-ramps over services like Spritz Finance, Crypto.com Visa Card, and Binance P2P to minimize single-point failure and detection risks.

-

Check Regional Regs via Official Sources: Verify local laws on sites like government finance regulators or CoinGape reports before using anonymous methods to ensure compliance.

-

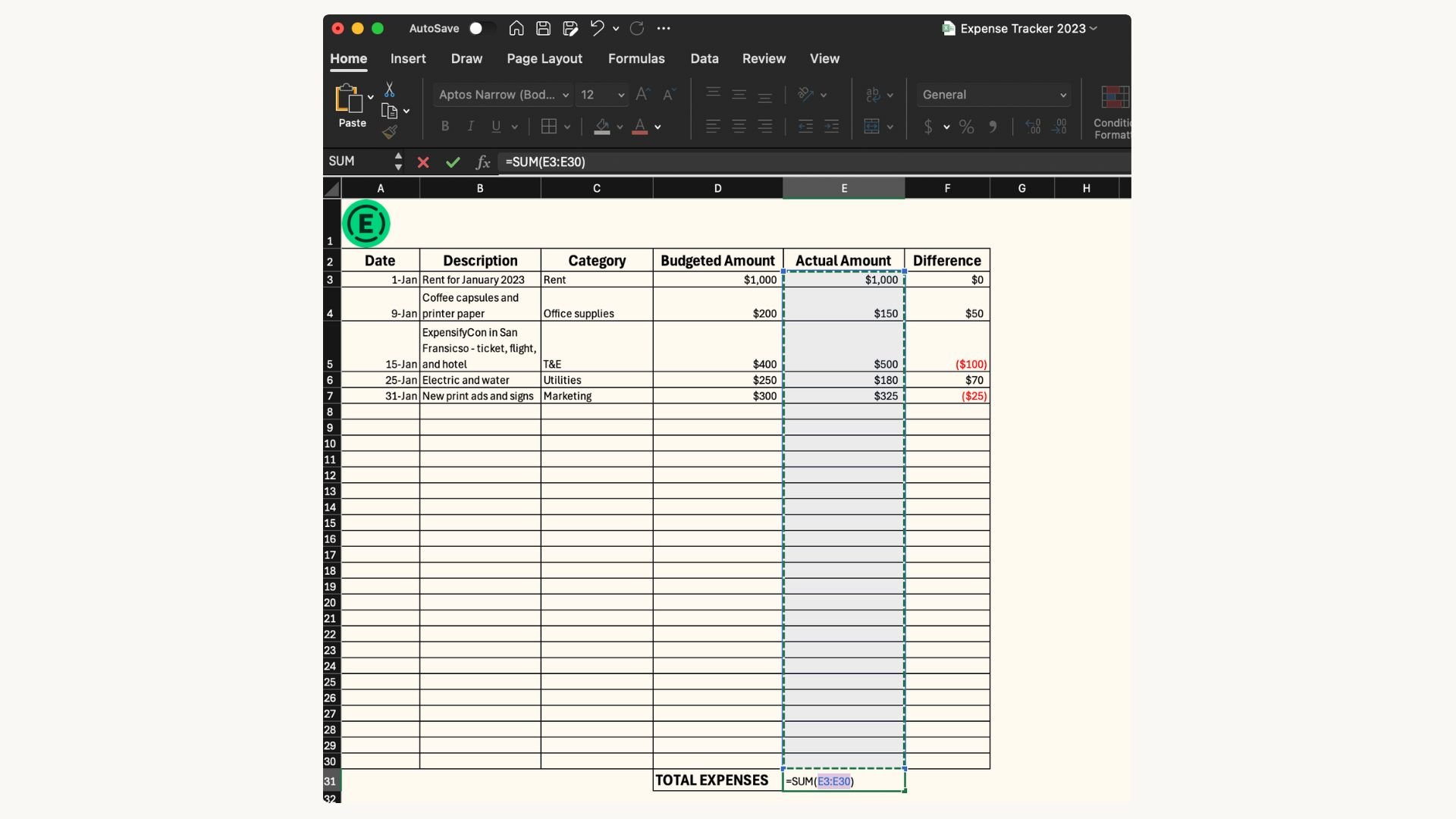

Audit Fees with a Spreadsheet: Use Excel or Google Sheets to compare fees, limits, and spreads across providers like ChangeNOW for optimal cost efficiency.

Step-by-Step: Loading USDT Anonymously

Execution demands precision. Start with a no-KYC wallet holding USDT on Polygon for cheap gas. Connect to Spritz or Crypto. com’s dApp, approve the swap, and load the virtual card. Minutes later, spend via Apple Pay or withdraw at ATMs. For enhanced privacy, route through decentralized swaps first, as CoinGape endorses for off-ramp prep. Our detailed walkthrough at how-to-instantly-off-ramp-usdt-and-usdc-to-fiat-with-stablecoin-cards-in-2025 covers edge cases, from gas optimization to multi-chain bridging.

Real-world yields vary. A $500 USDT load on Spritz nets a functional Visa balance minus 1.5%, spendable globally sans traces. Crypto. com adds CRO rebates, nudging effective costs negative for loyalists. 99Bitcoins’ non-KYC exchange data aligns: such paths preserve autonomy better than full banks.

Looking ahead, stablecoin cards evolve with zero-knowledge proofs, promising verifiable privacy without exposure. Platforms like anonofframp. com pioneer this fusion, delivering anonymous crypto off-ramp tools tailored for discerning users. As adoption surges, expect tighter integration with DeFi yields, turning idle USDT into earning, spendable assets. Privacy endures not through evasion, but innovation; these cards mark the vanguard.

Equip yourself with these strategies, and USDT transcends holdings to become your silent financial ally in an surveilled world.