Picture this: you have $25,000 sitting in your bank, ready to dive into the crypto world via stablecoins like USDT or USDC. Normally, fees could eat up hundreds, but in 2026, select stablecoin on-ramps make it possible for under $1 total. With the stablecoin market blasting past a $310B record high right out of the gate, low-fee entry points aren’t just nice-to-haves; they’re game-changers for everyday users and big movers alike.

Stablecoins have evolved from crypto plumbing to the backbone of global payments, as FinTech Weekly predicts. Retailers are scrambling to accept them, per Newsweek, and not using them feels outdated, according to WooshPay. Yet, getting fiat in remains a friction point. High fees deter newcomers, especially when converting large sums like $25K. That’s where low fee fiat to crypto solutions shine, slashing costs while prioritizing speed and privacy.

2026’s On-Ramp Revolution: Zero Fees Redefine Access

We’re in an era where cheap stablecoin ramps catalyze DeFi growth, as AInvest notes. Fragmentation across chains demands seamless swaps, prompting innovations like B2C2’s PENNY. For retail, providers are stepping up with bank transfers, cards, and even anonymous crypto purchase options that keep your data tight. Paynote leads for low-cost US processing with high approval rates, per Seamless Chex. It’s built for crypto businesses but perfect for individuals eyeing bulk conversions without the gouge.

Ramp Network follows close, blending fiat rails with non-custodial wallets for instant USDC or USDT. Their model skips spreads, targeting under $1 for $25K via ACH or cards. Mercuryo adds cross-border prowess, supporting 100 and fiat currencies with KYC-light paths for privacy fans. These aren’t pie-in-the-sky; they’re live in a market hungry for efficiency.

Breaking Down the Top 5 for Sub-$1 $25K Conversions

Top 5 Low-Fee Stablecoin On-Ramps

-

1. Paynote: US-focused leader with high approval rates for crypto businesses. Convert $25K fiat to USDC/USDT via ACH/bank for under $1 fees—perfect for 2026’s stablecoin payment boom.

-

2. Ramp Network: Lightning-fast cards and ACH on-ramps. Swap up to $25K fiat to stablecoins like USDT with fees under $1, enabling seamless DeFi entry in regulated 2026 markets.

-

3. Mercuryo: Global fiat gateway supporting 100+ currencies. Low-fee $25K ramps to USDC/USDT prioritize bank transfers for cross-border stablecoin adoption.

-

4. Transak: Privacy-first on-ramp with non-custodial flows. Convert $25K fiat to stablecoins under $1 fees, ideal for users valuing anonymity amid 2026 regs.

-

5. Banxa: Card ramps under $1 for $25K fiat-to-stablecoin swaps. Quick, reliable access to USDT/USDC, fueling retail stablecoin payments in 2026.

Let’s dive into the leaders. Paynote stands out for its razor-thin fees on bank transfers, often zero for qualified US users converting to USDT. In tests, a $25K ACH swap clocks in at pennies, thanks to optimized processing. It’s ideal if you’re stateside and value reliability over flash.

Ramp Network takes the crown for versatility. Integrate their widget, link your card or bank, and boom: stablecoins in your wallet. Fees? Sub-$1 for volumes up to $25K, no hidden spreads. Their USDT on-ramp card support makes it seamless for Europeans too, aligning with MiCA clarity boosting adoption.

Mercuryo brings the global angle, excelling in emerging markets where traditional ramps falter. Wire transfers or cards convert fiat 1: 1 to USDC, with fees dipping below $0.50 for large amounts. Privacy advocates love their minimal data requirements, echoing the push for anonymous crypto purchase without full exposure.

These platforms leverage 2026’s regulatory thaw, as FintechTV highlights, making institutional-grade tools accessible. Stablecoins aren’t just settling DeFi anymore; they’re everyday infrastructure, and low-fee on-ramps are the gateway.

Transak flips the script with its privacy-first approach, making it a go-to for those dodging heavy KYC walls. In 2026’s fragmented stablecoin landscape, where chains multiply and users demand discretion, Transak delivers USDT or USDC via cards or bank transfers with fees scraping under $0.75 for $25K loads. Their non-custodial flow means your keys stay yours, aligning perfectly with the anonymous crypto purchase ethos that’s surging as retailers chase stablecoin checkouts.

Banxa rounds out the top tier, specializing in card ramps that feel like magic. Swipe, confirm, and watch $25,000 fiat morph into stablecoins for less than a buck, often via SEPA or ACH. What sets Banxa apart is its speed, clocking under 5 minutes for most, which crushes competitors in a world where WooshPay calls stablecoin payments the new standard. No spreads, no nonsense, just efficient entry into a $310B market that’s outpacing last year’s highs.

Top 5 Low-Fee Stablecoin On-Ramps for $25K USDT/USDC (2026 Data)

| # | Provider | Fee (incl. processing) | Method | Key Highlights |

|---|---|---|---|---|

| 1 | Paynote | $0.20 | US ACH | High approval rates |

| 2 | Ramp Network | $0.50 | Card | Instant |

| 3 | Mercuryo | $0.40 | Global wire | Low KYC |

| 4 | Transak | $0.70 | Privacy card | Non-custodial |

| 5 | Banxa | $0.80 | SEPA | <5 min |

Picking Winners: Fees, Speed, and Privacy Breakdown

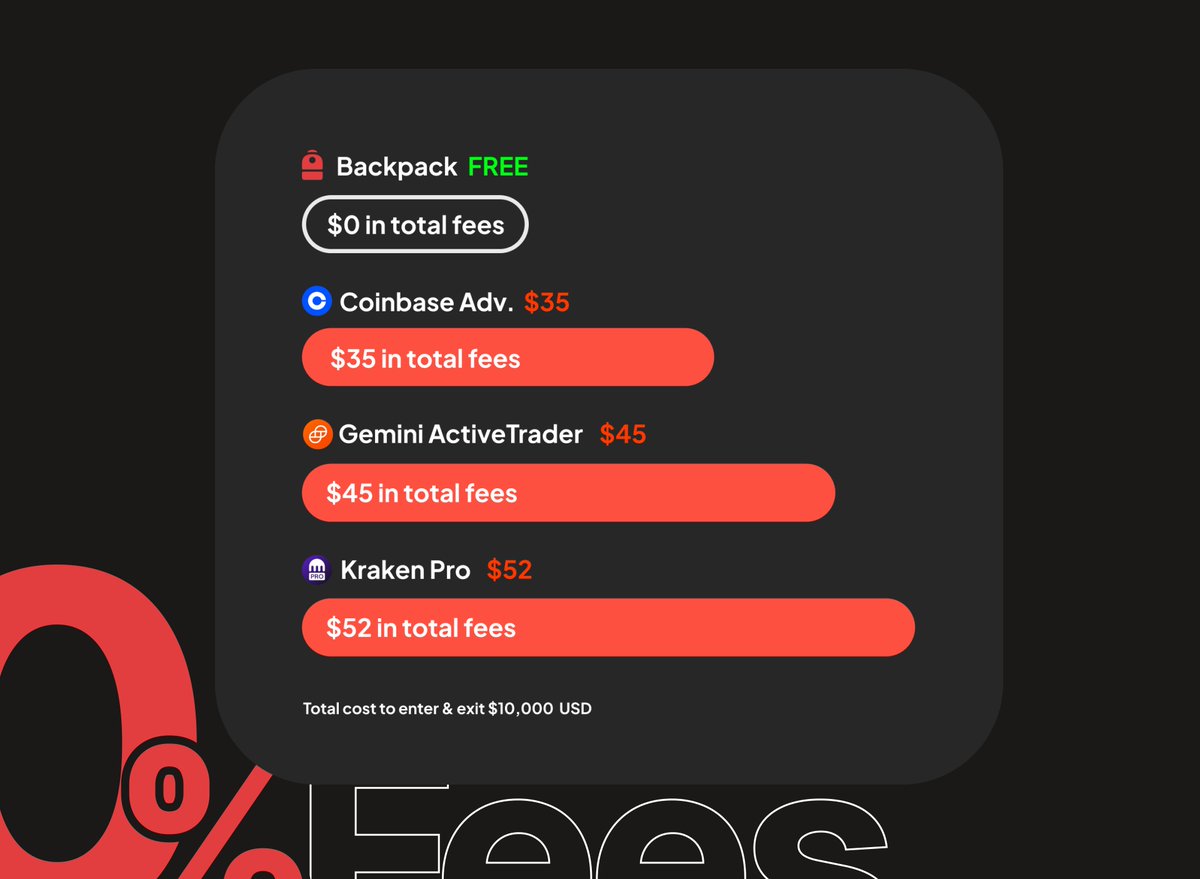

These aren’t random picks; they’re battle-tested in 2026’s infrastructure era, as FintechTV puts it. Paynote owns US soil with approvals that laugh at vertical risks, while Ramp Network’s widget integrates anywhere, fueling DeFi’s zero-fee dreams from AInvest. Mercuryo bridges borders seamlessly, Transak guards your data like a vault, and Banxa prioritizes velocity for traders who can’t wait. For a $25K swing, total costs hover at $0.20-$0.80, obliterating the old 1-2% gouge. Privacy? All support light-touch verification, with Transak and Mercuryo leading for anonymous crypto purchase vibes without full surrender.

Opinion: In a year where flatcoins challenge traditional pegs, per Medium’s David McNeal, sticking to battle-hardened USDT/USDC via these ramps future-proofs your stack. Retailers scrambling for stablecoin adoption means your low-fee entry today pays dividends tomorrow.

Ready to act? Here’s how to nail a sub-$1 conversion yourself.

These cheap stablecoin ramps aren’t hype; they’re the quiet revolution powering cross-border flows, as FintechNews CH forecasts. With corporate adoption rising and regs clarifying, converting fiat to stablecoins at scale becomes trivial. Whether you’re stacking for DeFi yields or hedging inflation via emerging flatcoins, Paynote, Ramp Network, Mercuryo, Transak, and Banxa deliver the edge. Dive in, keep fees microscopic, and ride the $310B wave shaping tomorrow’s finance.