For privacy traders tired of bloated fees and sluggish bridges, Kraken’s native USDC on the XDC Network delivers a breath of fresh air. With zero withdrawal fees and transactions that settle almost instantly, this setup redefines low-cost stablecoin on-ramps. XDC’s current price hovers at $0.0369, up a modest 0.001850% in the last 24 hours, signaling steady interest amid broader market shifts.

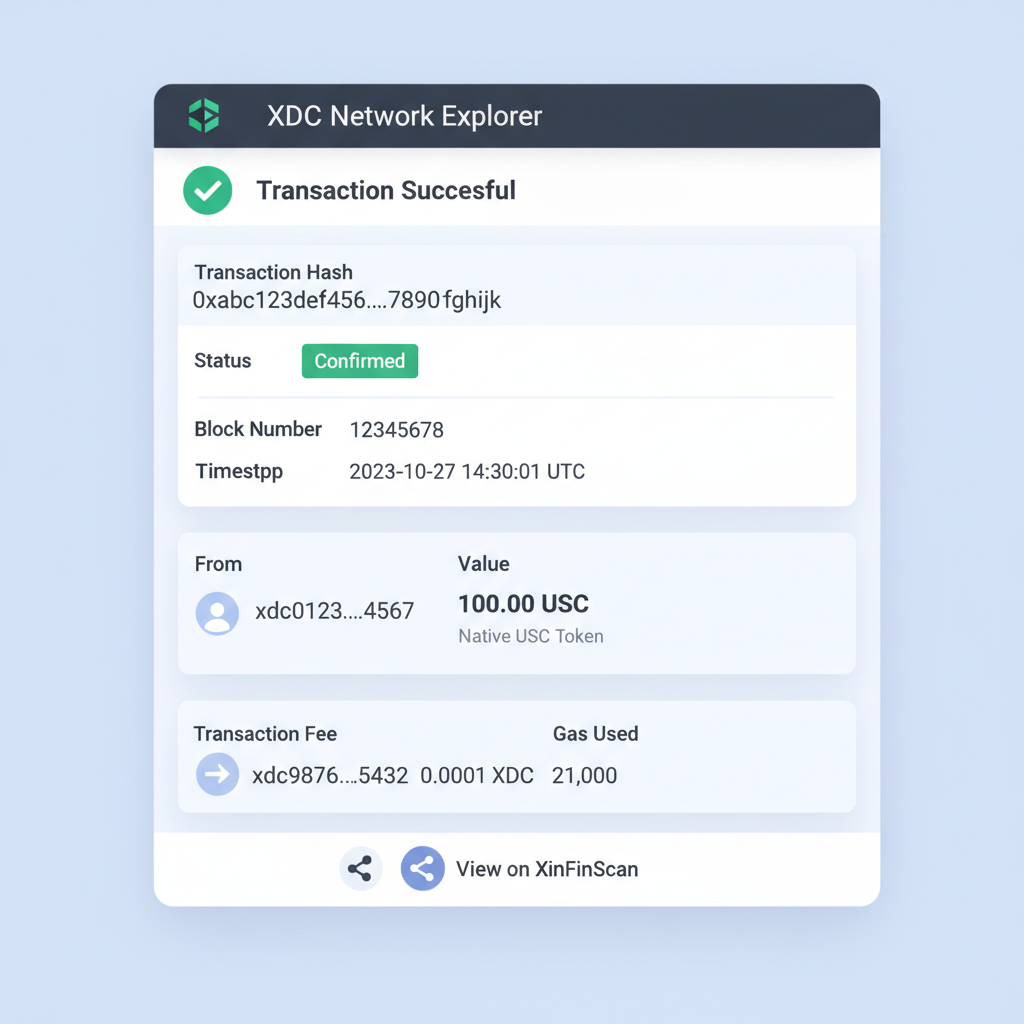

XDC Network, a Layer-1 blockchain fine-tuned for trade finance and real-world assets, blends EVM compatibility with high throughput at rock-bottom costs. In August 2025, Circle rolled out native USDC and CCTP V2 here, slashing the need for clunky bridges. By December, over $125.2 million in USDC had been issued on-chain, fueling DeFi and enterprise use cases alike. Kraken jumped in September, listing XDC for trading and partnering with Circle to supercharge USDC access. This isn’t just infrastructure; it’s a practical toolkit for traders who value speed and discretion.

XDC’s Edge in Privacy-Focused Stablecoin Transfers

What sets Kraken USDC on XDC apart? Privacy-enabled stablecoins like this one, fully backed 1: 1 by USDC reserves, let you prove compliance without baring transaction details. Imagine verifying a transfer’s legitimacy while keeping amounts and counterparties under wraps; that’s the promise echoed in crypto communities. XDC’s scalable design handles this with low fees and near-instant settlement, outpacing many rivals bogged down by congestion or regulatory red tape.

For privacy traders, this means cleaner low cost stablecoin transfers. No more routing through expensive intermediaries or exposing data on public ledgers. Kraken sweetens the deal with up to 5% APR rewards on USDC holdings, letting your stack compound effortlessly. Park your funds, earn yield, and dip into XDC’s ecosystem when ready; it’s a seamless loop that builds portfolios without the usual friction.

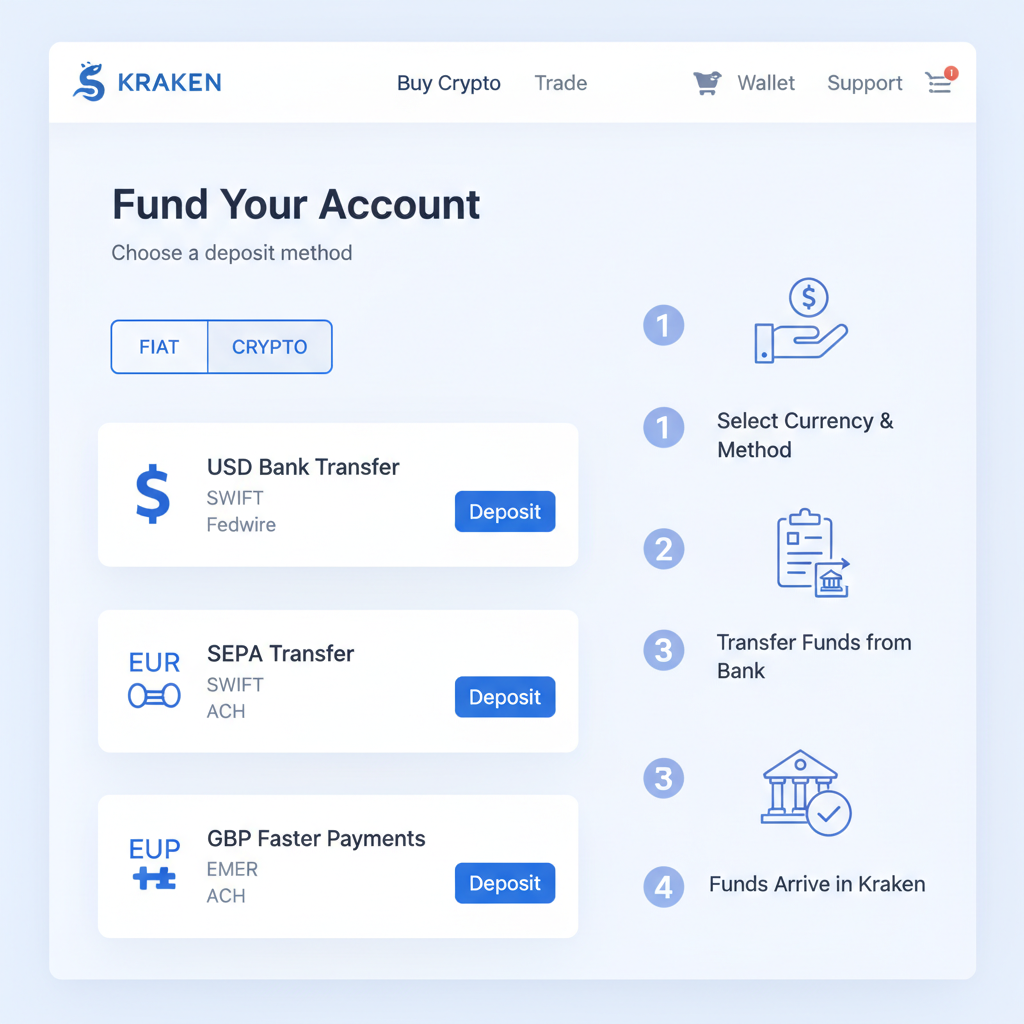

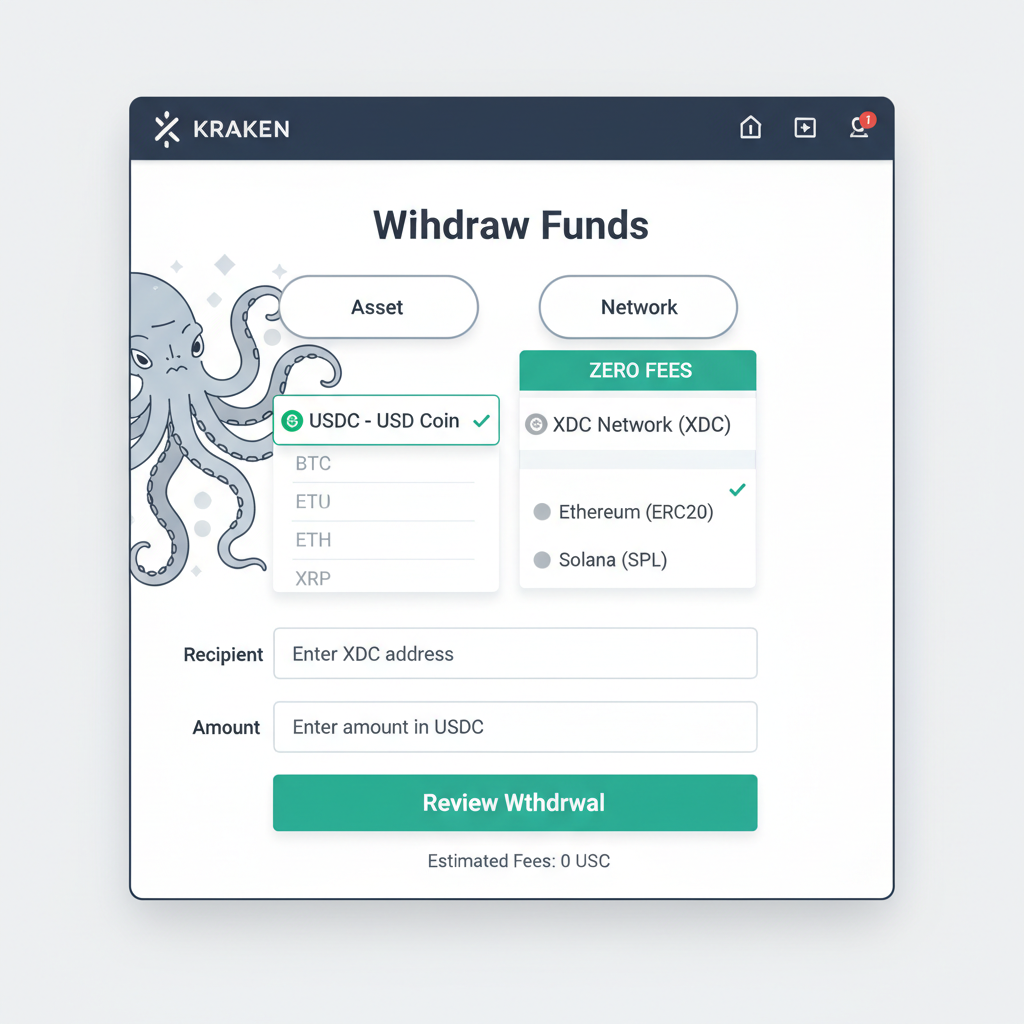

Kraken’s Zero-Fee Magic Unlocks Efficient On-Ramps

Zero withdrawal fees on USDC to XDC? That’s not hype; it’s a direct hit to the pain points of traditional on-ramps. Mastercard’s take rings true: smoother ramps accelerate adoption by making crypto participation faster and safer. Kraken’s move aligns perfectly, especially as U. S. regulatory progress bolsters native USDC’s credibility. Traders can now on-ramp fiat to USDC via Kraken, withdraw natively to XDC, and tap into multichain efficiency without bridge risks or extra costs.

Consider the numbers: XDC’s 24-hour range from $0.0365 to $0.0370 shows resilience, even as it trades at $0.0369 today. This stability pairs beautifully with USDC’s peg, offering a reliable base for privacy stablecoin ramps. I’ve advised institutions on blockchain adoption for years, and setups like this bridge retail accessibility with enterprise-grade reliability. It’s opinionated, but I’d argue XDC edges out flashier chains for real-world utility, especially in tokenizing assets or handling payments.

Why Privacy Traders Are Flocking to XDC Network Off-Ramps

Off-ramps matter as much as on-ramps, and XDC shines here too. With deeper liquidity from $125.2 million in issued USDC, converting back to fiat or other assets feels fluid. Privacy advocates appreciate how confidential transactions shield details while maintaining verifiability, a nod to growing demands for compliant yet discreet finance. Kraken’s stablecoin support, spanning USDC’s proven track record, adds trust; it’s regulated, reserved, and battle-tested against volatility.

XDC Network (XDC) Price Prediction 2027-2032

Forecasts incorporating Kraken’s native USDC support, low-cost stablecoin on-ramps, privacy features, and enterprise adoption from a 2026 base price of $0.0369

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.040 | $0.075 | $0.140 | +103% |

| 2028 | $0.060 | $0.120 | $0.250 | +60% |

| 2029 | $0.090 | $0.200 | $0.450 | +67% |

| 2030 | $0.130 | $0.320 | $0.800 | +60% |

| 2031 | $0.200 | $0.500 | $1.40 | +56% |

| 2032 | $0.300 | $0.750 | $2.20 | +50% |

Price Prediction Summary

XDC Network is positioned for robust growth through 2032, fueled by native USDC integration on Kraken, zero-fee withdrawals, and expanding use in trade finance, RWA tokenization, and DeFi. Conservative estimates show steady increases to $0.300 minimum by 2032, while bullish scenarios project up to $2.20 amid market cycles and adoption surges.

Key Factors Affecting XDC Network Price

- Native USDC and CCTP V2 integration providing instant, low-cost, bridge-free transfers and $125.2M in issuance by late 2025

- Kraken listing of XDC and USDC support with zero withdrawal fees, enhancing accessibility for privacy-focused traders

- Enterprise-grade features for global trade finance, payments, and RWA tokenization on EVM-compatible Layer-1

- Regulatory tailwinds including U.S. progress for stablecoins and Circle’s multichain expansion

- Crypto market cycles with potential bull runs driving altcoin multiples

- Competition from other L1s and broader market volatility as key risks

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

These predictions hinge on continued USDC inflows and XDC’s utility in trade finance, but even at today’s $0.0369 price, the network’s momentum feels undervalued. Privacy traders get ahead by leveraging this now, before broader adoption pushes XDC higher.

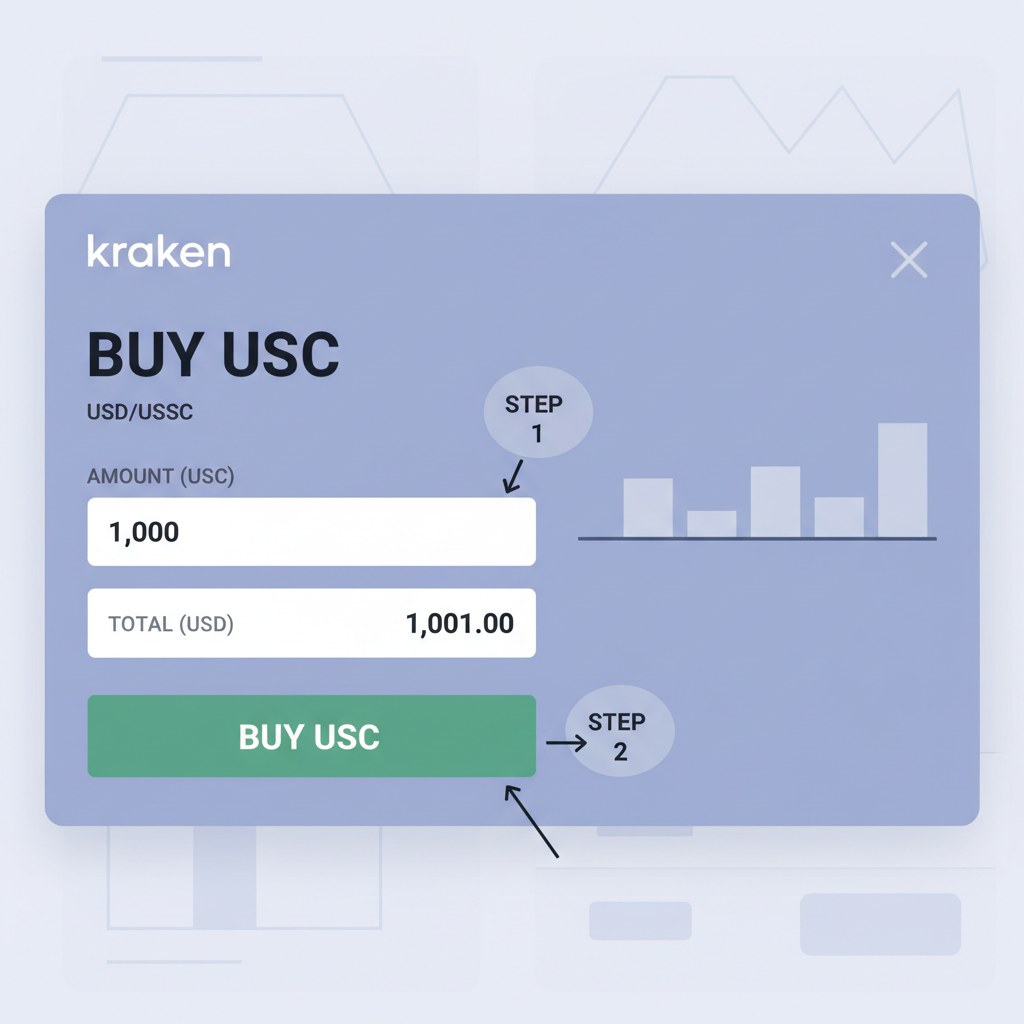

Streamlining Your Workflow: A Practical Guide

Putting Kraken’s native USDC on XDC to work is straightforward, stripping away the guesswork from stablecoin on-ramp XDC processes. Start with fiat deposits on Kraken, snag USDC at a tight spread, then withdraw directly to XDC with no fees eating your margins. This chain specializes in efficient XDC network off-ramp options too, letting you cycle funds back to fiat or other assets without bridge headaches. For those juggling portfolios, it’s a game-changer; I’ve seen similar integrations cut costs by 80% in institutional setups.

Once on-chain, tap into XDC’s 175 and apps for tokenization or payments. The $125.2 million USDC supply ensures liquidity won’t falter, even during volatility. Pair it with Kraken’s rewards program, and your idle USDC earns up to 5% APR, compounding quietly in the background. It’s not flashy, but for privacy stablecoin ramps, reliability trumps hype every time.

Advantages That Stack Up for Privacy Traders

Key Kraken USDC on XDC Benefits

-

Zero withdrawal fees for major cost savings on transfers to XDC Network.

-

Instant settlement with native USDC and CCTP V2 for bridge-free speed.

-

Confidential transactions with verifiable compliance for privacy.

-

EVM compatibility enables easy DeFi access and dApp use.

-

Up to 5% APR rewards on USDC holdings to grow your portfolio.

This lineup addresses the real friction points. Traditional ramps often tack on 1-2% fees plus gas, but Kraken USDC XDC sidesteps that entirely. XDC’s 24-hour low of $0.0365 and high of $0.0370 underscore its steadiness, a solid anchor when pegged assets like USDC hold firm. Privacy layers mean you control visibility, shielding strategies from prying eyes while regulators nod at the reserves. In my experience advising on digital assets, this balance is rare; most chains sacrifice one for the other.

Think bigger: as U. S. regulations mature, native USDC’s transparency bolsters trust without compromising discretion. Traders can verify 1: 1 backing on-chain, then execute low cost stablecoin transfers that settle in seconds. Kraken’s stablecoin lineup, from USDC’s regulatory armor to multichain reach, positions it as a hub for global flows. For off-ramps, liquidity depth turns quick exits into reality, fueling everything from portfolio rebalancing to real-world spends.

Addressing Common Hurdles Head-On

Safety questions linger in crypto, but USDC’s track record shines through audits and reserves. Kraken’s platform adds institutional-grade security, making it a safe bet over riskier alternatives. Yield seekers love the passive growth, while active traders exploit XDC’s throughput for high-volume plays. At $0.0369, entering now captures upside from enterprise adoption, like trade finance tokenization that’s already live.

Privacy traders, this ecosystem equips you to navigate 2026’s landscape with precision. Low barriers invite experimentation, whether stacking yield or tokenizing assets discreetly. XDC’s design, amplified by Kraken, crafts a toolkit that’s efficient, secure, and forward-thinking. Dive in, and watch how seamless ramps transform your approach to digital finance.