In the evolving landscape of crypto finance, where privacy meets practicality, Quantoz Payments has just flipped the script on stablecoin debit cards. As a Netherlands-based fintech powerhouse, Quantoz secured direct Visa principal membership on February 17,2026, unlocking the issuance of virtual Visa cards linked to its regulated stablecoins: USDQ, EURQ, and EURD. This move catapults stablecoins into everyday spending across the EEA, offering a private crypto off-ramp that’s both seamless and secure. Imagine topping up your wallet with stablecoins and swiping them at any Visa-accepting merchant, online or in-store, without the usual fiat conversion headaches.

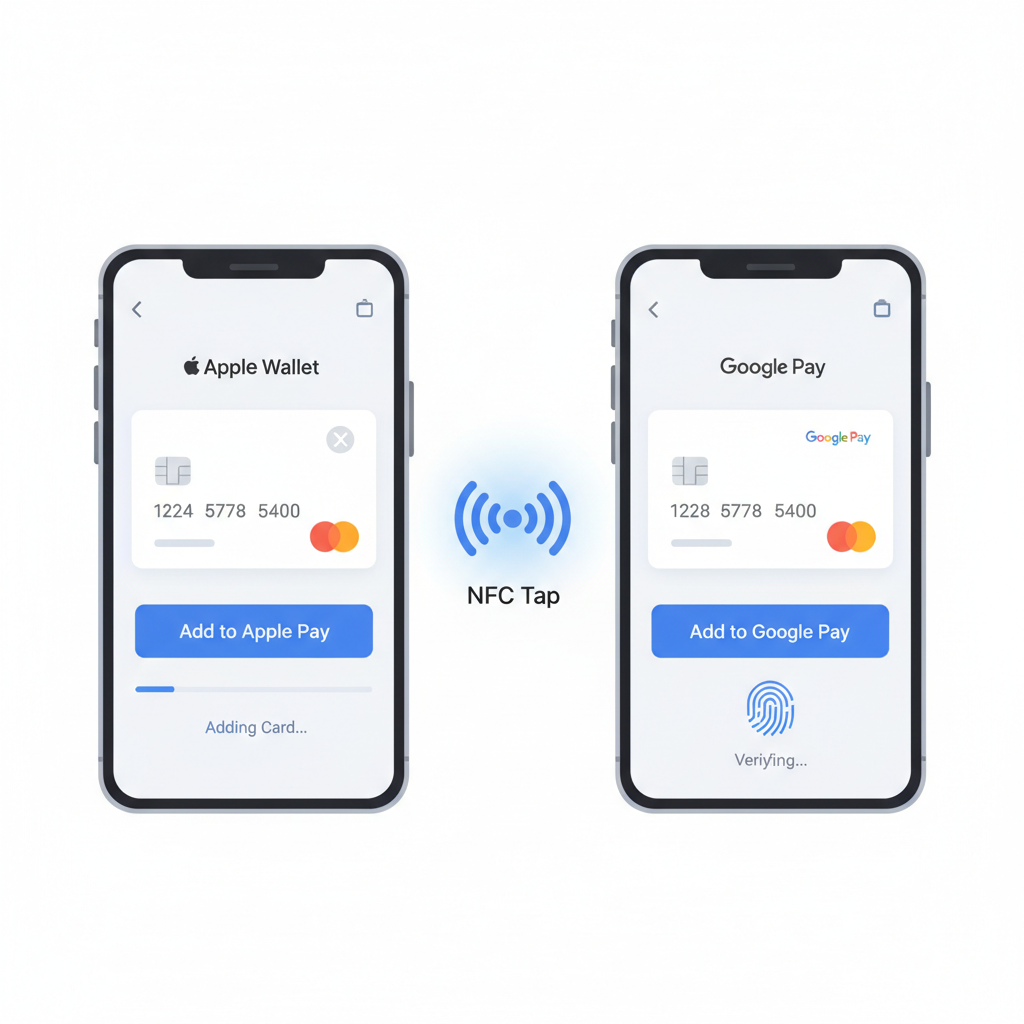

This partnership isn’t mere hype; it’s a calculated step toward mainstream adoption. Quantoz’s e-money tokens, fully compliant under European regulations, now fuel Visa-branded virtual cards compatible with Apple Pay and Google Pay. For users tired of clunky exchanges and KYC walls, this spells freedom. You hold digital assets, spend them globally, and maintain control over your financial footprint.

Quantoz’s Visa Edge: From Stablecoins to Spendable Assets

Quantoz didn’t stumble into this; they’ve been building regulated stablecoins tailored for efficiency. USDQ mirrors the USD, EURQ tracks the euro, and EURD adds e-money flexibility, all backed by segregated reserves and blockchain transparency. Becoming a Visa principal member lets Quantoz issue cards directly tied to these balances, bypassing intermediaries that often dilute privacy.

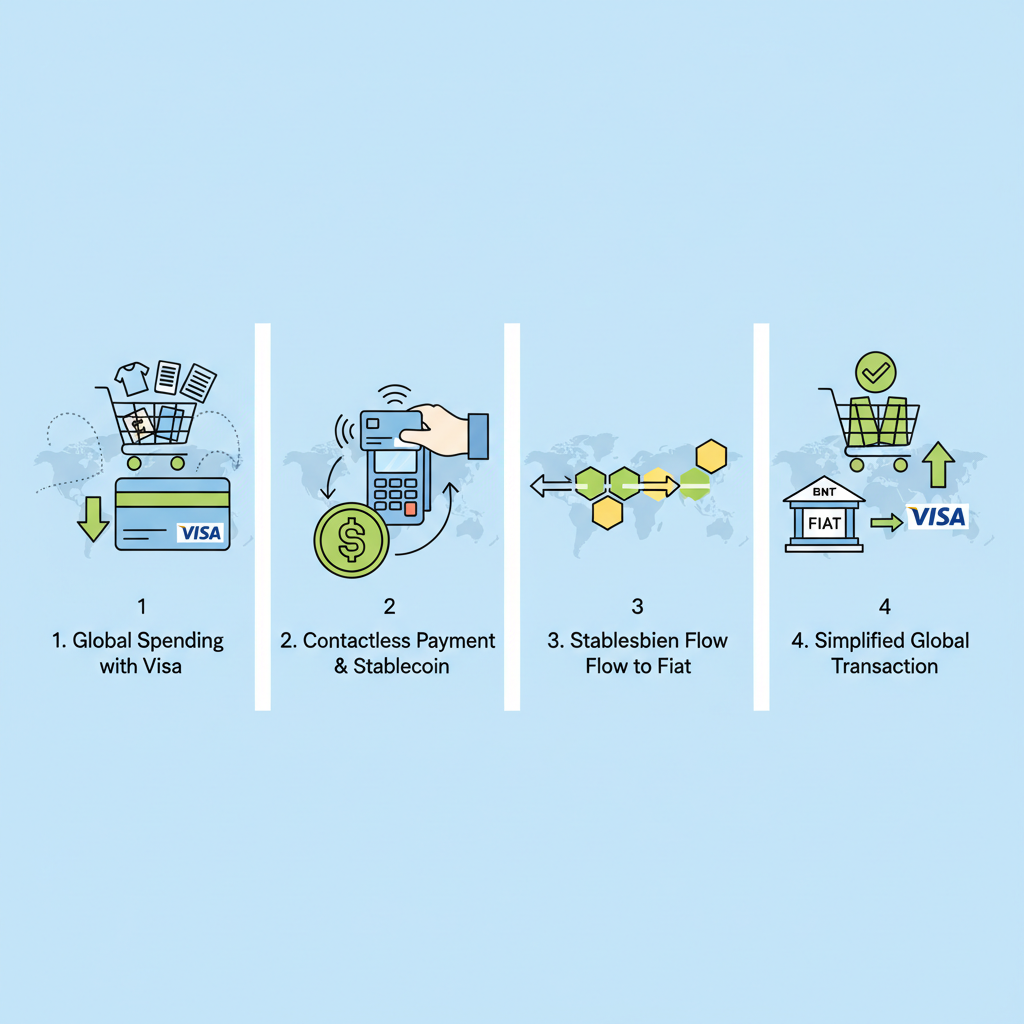

Think about the mechanics: Users deposit crypto into Quantoz wallets, convert to stablecoins instantly, and activate virtual cards. Spend at millions of locations worldwide. Refill effortlessly via P2P transfers or cross-border payouts. This setup shines for stablecoin Visa cards EEA users, where local regulations demand compliance without sacrificing speed. Quantoz also steps up as a BIN sponsor, empowering other fintechs to launch branded cards on their rails, amplifying the ecosystem.

I’ve watched similar integrations falter under regulatory scrutiny, but Quantoz’s Dutch roots and MiCA alignment position them strongly. Their stablecoins bridge blockchain’s promise with Visa’s ubiquity, turning volatile crypto holdings into stable, spendable power.

Privacy-First Off-Ramps Without the Trade-Offs

For privacy advocates, anonymous fiat conversion stablecoins have long been the holy grail. Quantoz delivers by minimizing touchpoints. No need for full bank onboarding per transaction; stablecoin balances fund cards pseudonymously where possible. Virtual cards rotate easily, reducing tracking risks, while EEA compliance ensures funds aren’t frozen in gray zones.

Cross-border warriors benefit too. Instant settlements to suppliers or wallets sidestep SWIFT delays, with optional local currency off-ramps. In a world of rising surveillance, this Quantoz Payments stablecoin approach feels like a quiet rebellion: use crypto privately, spend fiat publicly, all under one regulated umbrella.

Quantoz Visa Card Benefits

-

Instant Global Spending: Virtual Visa cards linked to USDQ, EURQ, and EURD stablecoins, spendable online, in-store, and via mobile wallets wherever Visa is accepted.

-

EEA Regulatory Compliance: Issued by Netherlands-based Quantoz Payments as a Visa principal member, ensuring full European Economic Area compliance for secure usage.

-

Privacy via Virtual Cards: Disposable virtual Visa cards provide enhanced privacy for transactions without exposing full financial details.

-

P2P and Cross-Border Support: Facilitates instant P2P payouts to wallets and seamless cross-border payments with blockchain efficiency.

-

Apple Pay/Google Pay Compatibility: Seamless integration with popular mobile wallets for convenient, contactless spending worldwide.

Critics might nitpick virtual-only issuance, but that’s the genius. Physical cards could follow, yet this prioritizes digital natives who value speed over plastic. Paired with anonofframp. com’s ethos, it’s a toolkit for modern asset managers navigating fiat-crypto chasms.

Why EEA Users Are Gaining the Upper Hand

The EEA’s fragmented yet stringent regs have stifled innovation elsewhere, but Quantoz thrives here. Their stablecoins, supervised by De Nederlandsche Bank, offer on-chain collateralization with real-world assets, per ESRB guidelines. This isn’t wild-west DeFi; it’s fortified finance.

Users tap into Visa’s network for in-store buys at local cafes or online hauls from global retailers. For off-ramping, convert crypto to stablecoins privately, spend or withdraw as needed. It’s the frictionless loop we’ve craved, especially as platforms like ours emphasize instant crypto-to-fiat without KYC hassles.

Quantoz’s model supports third-party growth too. Fintechs can white-label these cards, embedding stablecoin rails into apps seamlessly. This scalability hints at broader adoption, where stablecoins aren’t niche but normative.

Picture a freelancer in Berlin receiving USDQ payments from a U. S. client, instantly converting to EURQ, and funding a virtual Visa card for weekend groceries. Or a trader in Madrid off-ramping BTC privately into EURD, then hitting Apple Pay for seamless checkout. Quantoz makes these scenarios routine, not revolutionary.

Hands-On with Quantoz: Activating Your Private Off-Ramp

To harness this power, the process unfolds with deliberate simplicity, prioritizing user control from the outset. Quantoz’s platform integrates stablecoin wallets with Visa issuance, ensuring EEA residents access stablecoin debit cards compliant yet agile.

This flow underscores the private crypto off-ramp ethos: minimal data trails, instant liquidity, and regulatory armor. No endless verifications; onboard once, transact freely. For those eyeing deeper integration, Quantoz’s BIN sponsorship opens doors for platforms like anonofframp. com to layer on custom tools.

Breaking Down the Stablecoin Arsenal

Quantoz’s trio of tokens isn’t arbitrary. Each serves distinct needs in the EEA payment maze, blending stability with blockchain speed.

Quantoz Stablecoins: Features and Visa Debit Card Integration

| Stablecoin | Pegged To | Primary Focus | Blockchain | Reserves | Key Use Cases | Visa Debit Cards |

|---|---|---|---|---|---|---|

| USDQ | USD | Global transfers | Ethereum/Polygon | Segregated | P2P payouts, cross-border payments, suppliers/customers | ✅ Virtual Visa cards (online, in-store, Apple Pay/Google Pay) |

| EURQ | EUR | EEA focus | Ethereum/Polygon | Segregated | P2P payouts, instant global transfers | ✅ Virtual Visa cards (online, in-store, Apple Pay/Google Pay) |

| EURD | E-money token | Flexible spending | Ethereum/Polygon | Segregated | P2P, cards, payouts | ✅ Virtual Visa cards (online, in-store, Apple Pay/Google Pay) |

USDQ excels for dollar-denominated flows, dodging FX volatility. EURQ anchors local euro spends, while EURD’s e-money status unlocks nuanced fiat bridges. Together, they form a versatile kit for stablecoin Visa cards EEA, backed by DNB oversight and MiCA readiness.

From my vantage as a portfolio manager, this lineup mitigates risks inherent in uncollateralized alternatives. Reserves in segregated accounts mean your balance mirrors fiat safety, audited transparently on-chain. It’s the hybrid strategy crypto needs: yield potential without the rug-pull dread.

Layer in Visa’s fraud detection and global reach, and you’ve got a bulwark against common pitfalls like chargebacks or regional blocks. Users report near-instant authorizations, vital for time-sensitive buys.

Answering the Big Questions

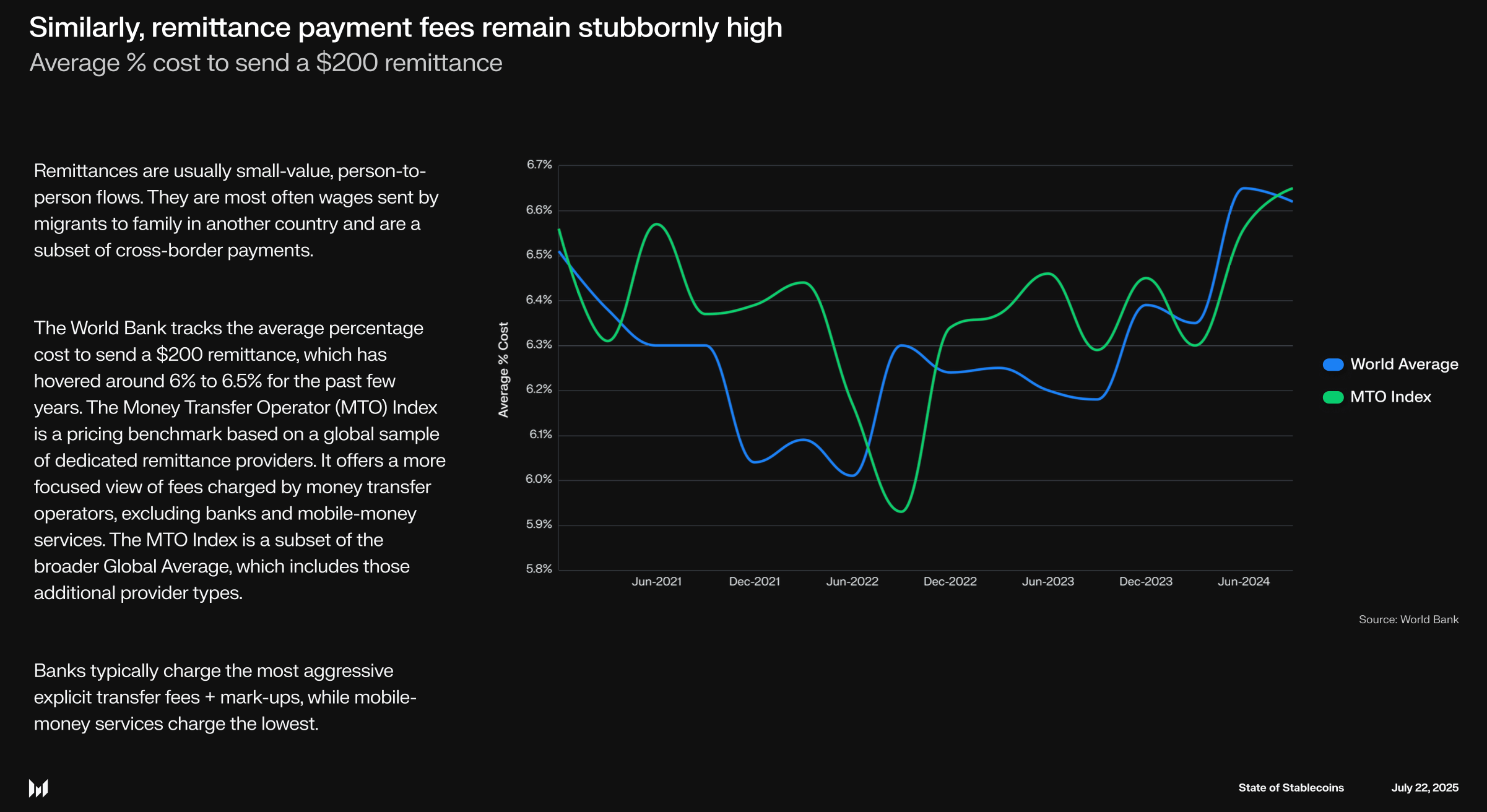

These clarifications cut through noise, affirming Quantoz’s fit for privacy-focused users. Compare to legacy banks: slower settlements, higher fees, zero anonymity. Here, anonymous fiat conversion stablecoins thrive under compliance veils.

As Quantoz Payments stablecoin infrastructure matures, expect ecosystem ripple effects. Third-party apps will embed these cards natively, much like how stablecoin cards enable instant private spending anywhere Mastercard or Visa is accepted. For anonofframp. com users, it’s an extension of our core mission: frictionless entry-exit points with privacy intact.

Stepping back, Quantoz redefines off-ramps not as exits, but gateways. Crypto holders gain fiat utility without surrender. Privacy stays paramount, speed unmatched, security ironclad. In an era of tightening regs, this Dutch innovation charts a path where stablecoins power daily life, quietly reshaping finance from the edges in.