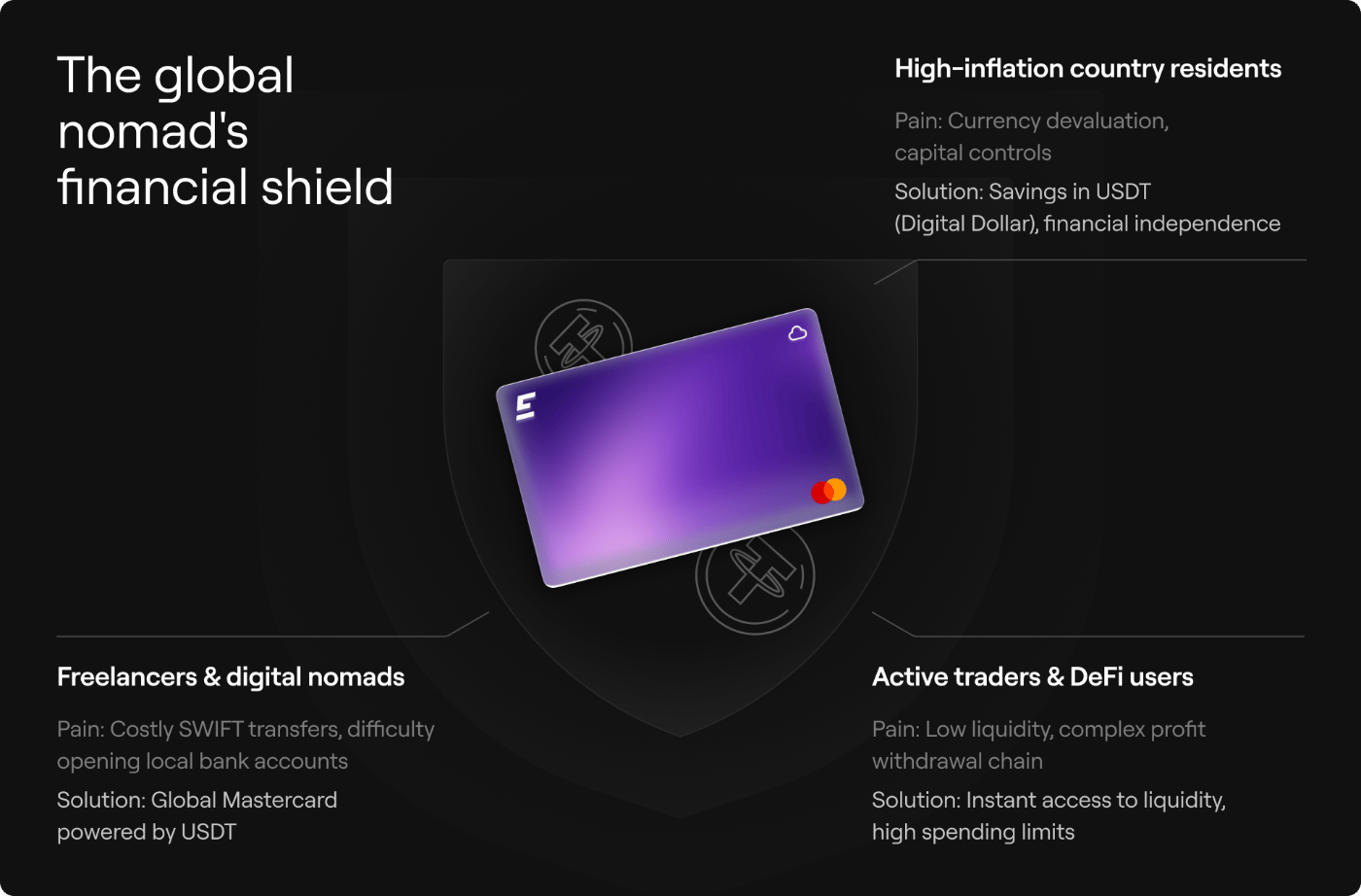

In a world where digital assets promise borderless freedom, the quest for private stablecoin off-ramp cards remains a beacon for privacy advocates. Imagine loading your wallet with USDT or USDC, then spending that value as fiat at any merchant worldwide, all without surrendering personal data to centralized gatekeepers. These cards bridge crypto’s volatility-free stablecoins to everyday purchases, offering seamless fiat conversion that feels as natural as swiping a traditional debit card. Yet, as we step into 2026, this vision confronts a transformed reality shaped by evolving regulations.

Stablecoin off-ramp cards handle the intricate dance of wallet integrations, real-time conversions, and merchant acceptance, often through Visa or Mastercard networks. Sources like insights4vc highlight how they manage KYC/AML at the spend moment, but the holy grail for users has always been bypassing those checks entirely. Platforms once touted no KYC stablecoin cards, enabling anonymous USDT to fiat flows via self-custody models or peer-to-peer swaps. YouTube channels like Crypto Explorer spotlighted options such as AnoCard for spending crypto anonymously, while CoinGape noted swapping to USDC/USDT as a KYC-free off-ramp prelude.

The Allure of Frictionless Privacy in Crypto Spending

What draws tech-savvy users to these tools? Speed and sovereignty. Traditional off-ramps demand bank settlements, exposing users to delays and scrutiny. Off-ramp cards, by contrast, convert stablecoins on-demand, pegged rewards like 8% cashback in USDT keeping value steady as per OpenExO’s top crypto cards list. For privacy enthusiasts, evading KYC preserves autonomy amid rising surveillance. Anonofframp. com embodies this ethos, prioritizing anonofframp privacy ramps that minimize friction in entering or exiting crypto ecosystems.

This timeline underscores a pivotal shift. Stablecoins ascended from niche to infrastructure in 2025, per Transak’s playbook, fueling enterprise adoption but inviting oversight. CoinGecko’s top 10 crypto cards for 2026 affirm their role in daily life, yet regulators like those cited in SDK. finance insist on KYC before fiat touchpoints.

Regulatory Headwinds Reshaping No-KYC Dreams

Enter the GENIUS Act of July 2025, a watershed mandating only permitted issuers handle payment stablecoins with strict reserves and disclosures. As of February 2026, this has curtailed truly anonymous solutions. TRM Labs’ 2026 Crypto Crime Report analyzes illicit trends, justifying heightened AML/CTF measures that now envelop off-ramp cards. Platforms like Digitap persist with no-KYC on-ramps for fiat-to-crypto, but off-ramps to spendable fiat demand verification, settling to cards or accounts as ChainUp describes.

Providers adapted swiftly. Self-custody cards emerge as hybrids, allowing stablecoin loads without full identity surrender, though spending triggers light checks. This balances usability with compliance, educating users on sustainable privacy over risky evasion. Forward-thinking investors see opportunity: as regs solidify, compliant private fiat conversion stablecoins could dominate, blending security with discretion.

Emerging Strategies for 2026 Privacy Preservation

Despite constraints, innovation thrives. Swapping crypto to stablecoins remains a no-KYC gateway, per CoinGape’s best off-ramps, followed by card issuance. Check out how stablecoin cards enable instant crypto-to-fiat off-ramping, a tactic evolving under new rules. Anonofframp. com leads with cards optimized for minimal data, leveraging layer-2 scaling for faster, cheaper conversions. Educate yourself on wallet-agnostic integrations that prioritize user control, ensuring your stablecoins fluidly become fiat without unnecessary exposure.

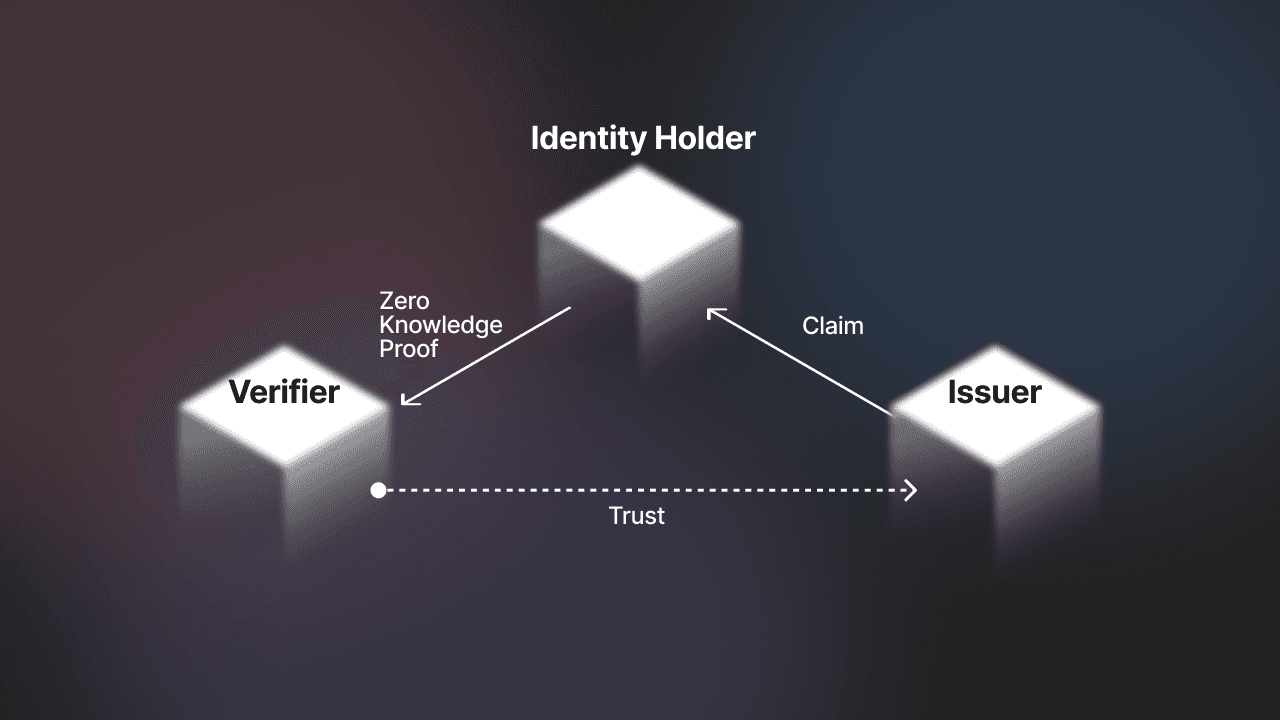

Looking ahead, decentralized identity protocols may restore no-KYC purity, verifying humanity sans personal details. Until then, selective KYC on high-value spends protects while enabling most transactions privately. This nuanced path forward empowers users to navigate 2026’s landscape purposefully.

Hybrid models like these represent the maturation of stablecoin off-ramp cards, where privacy meets practicality. Providers now layer zero-knowledge proofs into card issuance, proving solvency without revealing identities for routine spends. This shift, informed by TRM Labs’ scrutiny of illicit flows, fosters trust while curbing abuse. Forward-thinkers at Anonofframp. com pioneer these anonofframp privacy ramps, integrating seamless wallet connects that prioritize self-custody from load to spend.

Navigating Compliant Privacy: Actionable Tactics

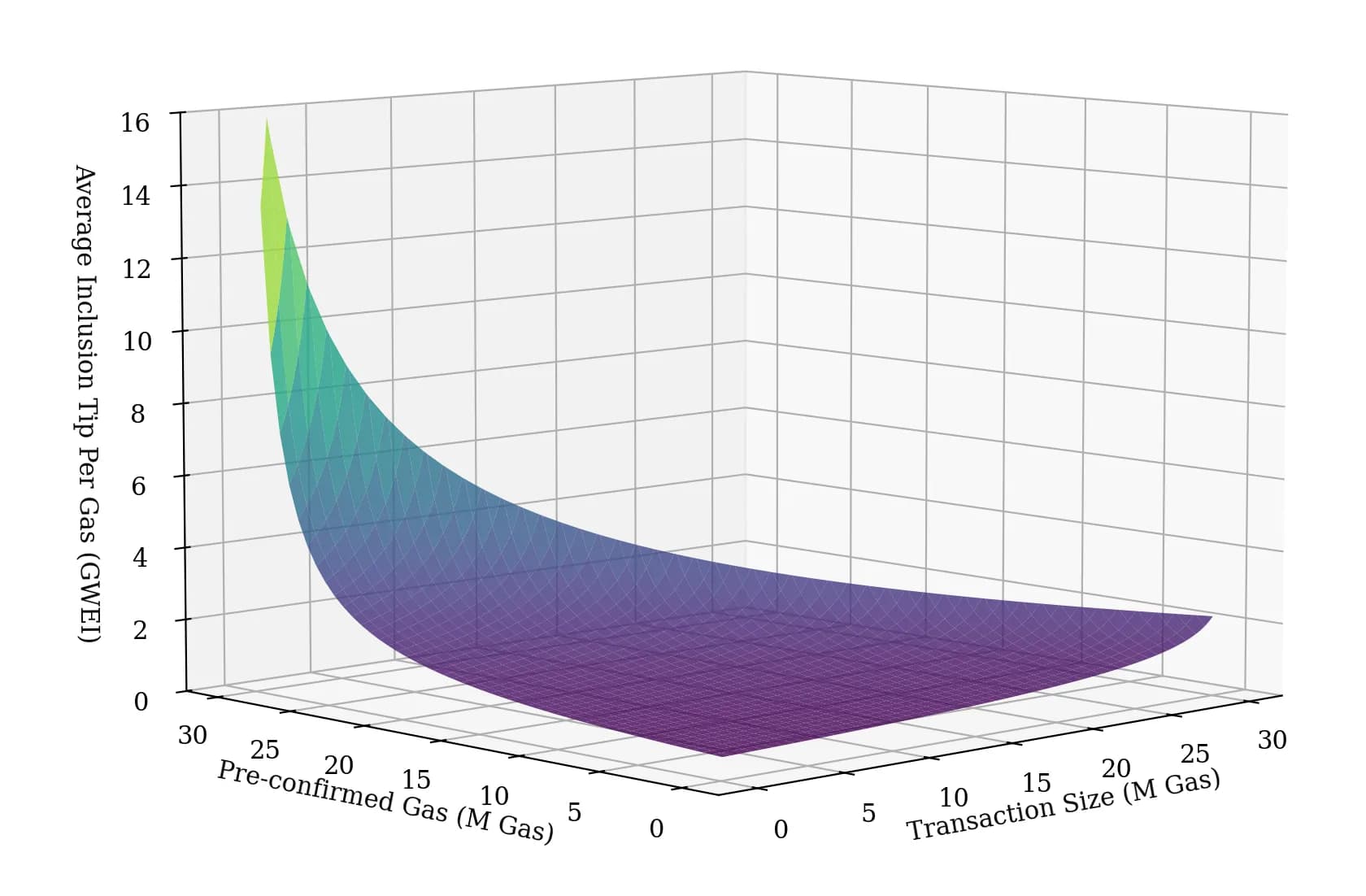

Users can still achieve near-anonymous private fiat conversion stablecoins by segmenting activities. Load cards with modest amounts under regulatory radar thresholds, then rotate across multiple virtual cards. Insights from CoinGecko’s 2026 rankings reveal top performers offering stablecoin cashback without upfront KYC for low-volume users, evolving into light-touch verification only on escalation. Pair this with layer-2 networks for sub-second conversions, slashing fees to pennies and dodging chain analysis.

Max Privacy Tactics for 2026 Cards

-

Self-Custody Wallets: Control keys with Ledger or Trezor hardware wallets, avoiding custodial risks amid GENIUS Act compliance.

-

Virtual Card Rotation: Generate disposable virtual cards via AnoCard or similar, limiting exposure per spend cycle.

-

ZK-Proof Verification: Use zero-knowledge proofs in protocols like Semaphore for privacy-preserving attestations without full data reveal.

-

Low-Volume Thresholds: Stay under $3,000 daily limits to evade enhanced AML scrutiny per TRM Labs 2026 trends.

-

L2 Conversions: Convert via Arbitrum or Optimism for cheaper, less traceable stablecoin-fiat bridges.

Self-custody reigns supreme here. Unlike custodial debit cards that hold your keys, non-custodial options like those hinted in Crypto Explorer’s reviews let you retain control, signing transactions peer-to-peer before fiat bridging. This empowers anonymous USDT to fiat at POS terminals, with platforms handling merchant settlement invisibly. Yet, education is key: understand your jurisdiction’s nuances, as EU’s MiCA extensions demand transparency even in hybrids.

Compare this to legacy banking off-ramps, where weeks-long ACH transfers expose trails. Off-ramp cards compress this to instants, per ChainUp’s guide, making stablecoins viable for rent, groceries, or travel. Anonofframp. com’s suite exemplifies this, blending on-ramp fluidity with off-ramp discretion for holistic crypto-fiat mobility.

Future-Proofing Your Stablecoin Strategy

By 2027, expect decentralized oracles and soulbound tokens to redefine verification, enabling no KYC stablecoin cards compliant by design. Transak’s playbook forecasts stablecoins underpinning 20% of global remittances, pressuring regulators toward privacy-friendly standards. Investors should position now in protocols bridging this gap, favoring those with audited reserves and modular compliance.

Embrace this evolution purposefully. Start small, diversify providers, and monitor regulatory pulses via resources like privacy-preserving off-ramp solutions. In doing so, you harness stablecoins’ stability for real-world utility, safeguarding autonomy amid institutional convergence. The bridge from crypto isolation to fluid finance strengthens daily, rewarding the informed navigator.

Anonofframp. com stands ready as your conduit, delivering cards that convert intent to impact without compromise. Act with foresight; your portfolio’s sovereignty depends on it.