Stablecoin on/off-ramp services have become the backbone of seamless crypto-to-fiat conversions, but as the ecosystem matures, so do the risks and mistakes users can make. Whether you’re a seasoned DeFi user or just dipping your toes into stablecoin cards and ramping solutions, steering clear of common pitfalls is essential for keeping your transactions secure, efficient, and compliant.

Top 5 Stablecoin On/Off-Ramp Mistakes to Avoid

Let’s break down the five most frequent errors that can trip up even experienced crypto users when moving between digital assets and fiat:

5 Key Pitfalls in Stablecoin On/Off-Ramping

-

Using Unregulated or Unlicensed On/Off-Ramp Providers: Choosing platforms that lack proper regulatory oversight—such as some lesser-known exchanges—can expose users to legal risks, sudden shutdowns, or loss of funds. Always verify that the provider is registered with relevant financial authorities (e.g., Coinbase, Kraken, and Binance are regulated in multiple jurisdictions).

-

Ignoring Slippage and Hidden Fees During Conversion: Some on/off-ramp services add hidden costs—like high spreads, withdrawal fees, or poor exchange rates—that can eat into your funds. Always check the full fee schedule and compare rates on reputable platforms like MoonPay or Ramp Network before transacting.

-

Relying on Algorithmic Stablecoins Without Assessing Stability Risks: Algorithmic stablecoins (like the now-defunct TerraUSD (UST)) have suffered dramatic depegging events. Stick to fiat-backed stablecoins with transparent reserves, such as USDC or USDT, and always research the underlying mechanism.

-

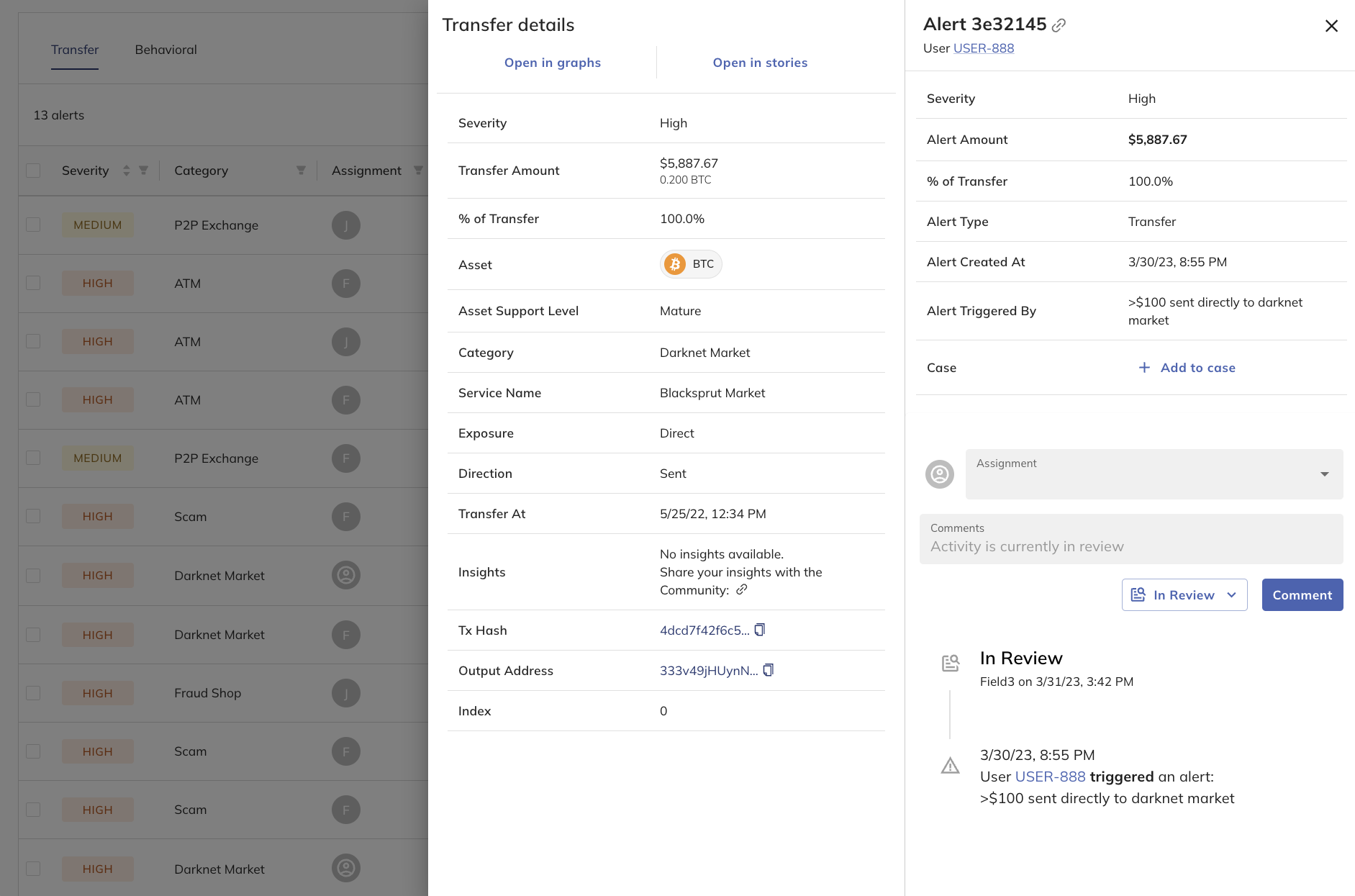

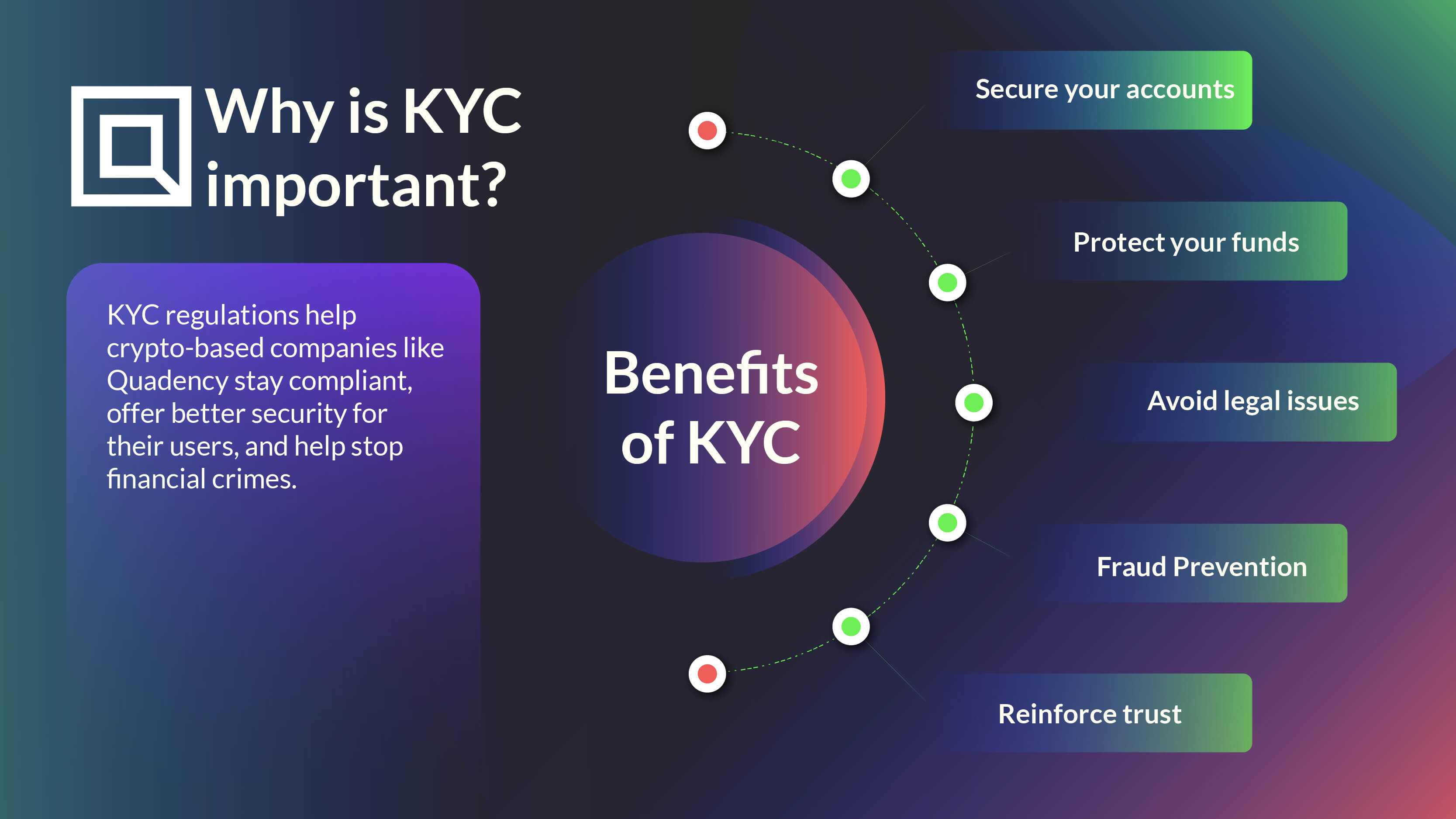

Neglecting KYC/AML Requirements and Privacy Implications: Most regulated on/off-ramp services require Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. Failing to comply can result in frozen funds or denied transactions. Understand what personal information is collected and how it’s stored—platforms like Kraken and Coinbase outline their privacy policies clearly.

-

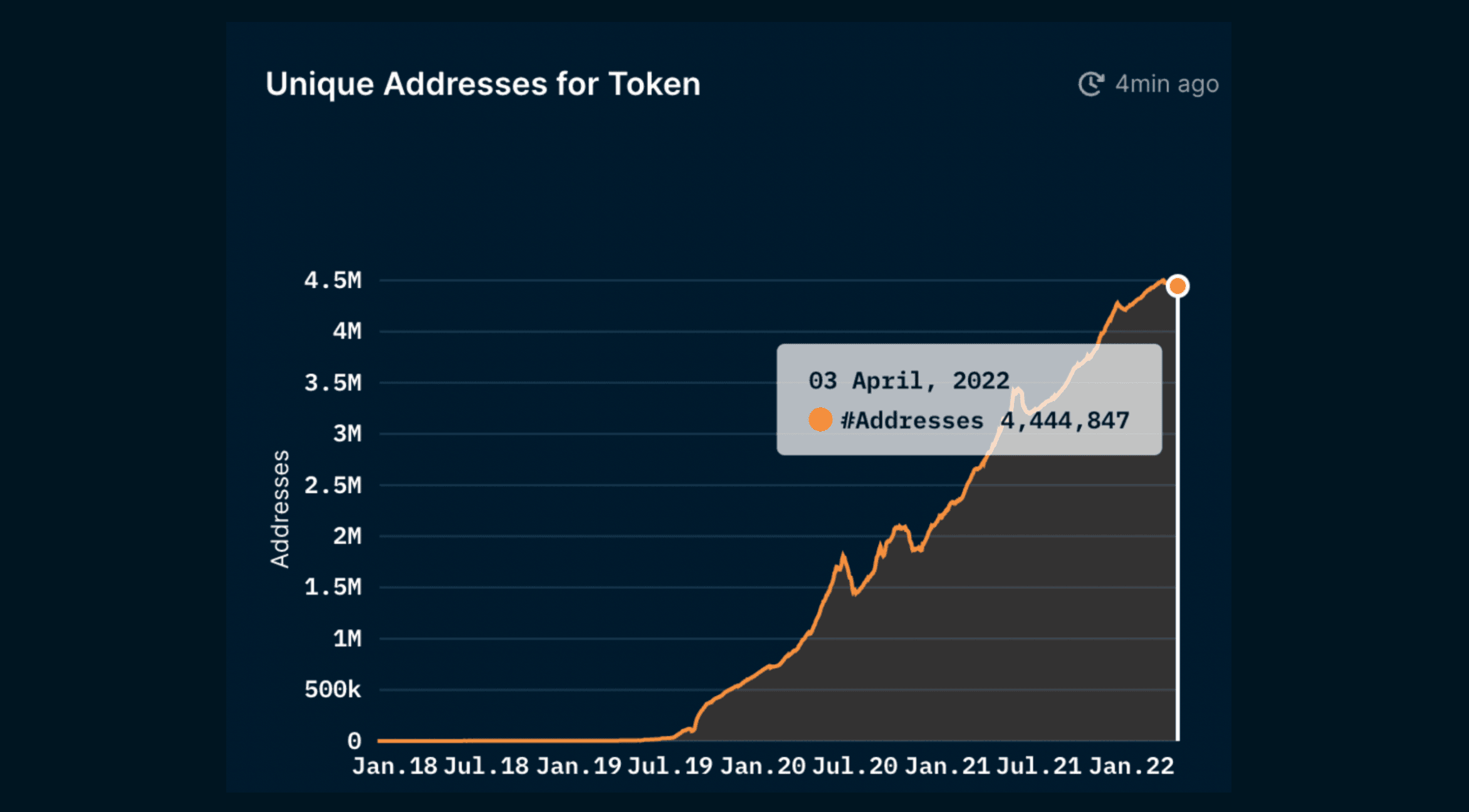

Failing to Verify Liquidity and Withdrawal Limits Before Large Transactions: Some platforms may have low liquidity or strict withdrawal caps, causing delays or unfavorable rates for large conversions. Always check liquidity pools and withdrawal policies on major platforms like Binance or Kraken before moving significant funds.

Using Unregulated or Unlicensed On/Off-Ramp Providers

It’s tempting to chase lower fees or faster service from lesser-known platforms, but using unregulated or unlicensed providers is one of the biggest risks in stablecoin ramping. These platforms often lack oversight, making them prone to sudden shutdowns, frozen funds, or compliance crackdowns. Regulatory bodies worldwide are tightening their grip on crypto-fiat conversion points (see more). Always verify that your chosen provider adheres to local laws and holds proper licensing for money transmission. This simple step can save you from legal headaches and loss of access to your assets.

Ignoring Slippage and Hidden Fees During Conversion

The allure of fast swaps between USDT, USDC, or DAI and your local currency can mask real costs. Many users overlook slippage, the difference between expected and actual conversion rates, especially during volatile periods. Add in hidden fees (often buried in terms or disguised as processing charges), and your final balance may surprise you. Major exchanges generally charge 0.1-1%, while specialized providers can go higher (details here). Before pulling the trigger on any transaction, double-check fee structures and use platforms offering transparent pricing dashboards.

Relying on Algorithmic Stablecoins Without Assessing Stability Risks

Algorithmic stablecoins promise decentralization without traditional reserves, but they come with unique hazards. If an algorithmic coin loses its peg due to market stress or flawed design (think infamous meltdowns), users can be left holding assets worth far less than expected (learn more). Before using these coins for major conversions or off-ramping large sums, research their track record, peg mechanisms, and whether there are robust contingency plans if things go south.

Neglecting KYC/AML Requirements and Privacy Implications

Many users prioritize privacy when using stablecoin on/off-ramp services, but overlooking Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements can backfire. While some platforms offer minimal verification for small transactions, most reputable providers require identity checks to comply with global regulations. Failing to complete KYC can result in frozen funds or denied withdrawals, particularly if your activity triggers compliance alerts. On the flip side, sharing sensitive documents with untrustworthy providers exposes you to privacy breaches. Strike a balance by choosing ramps that clearly state their data handling policies and only request necessary information. If anonymity is crucial, look for solutions that combine robust privacy practices with regulatory compliance.

Failing to Verify Liquidity and Withdrawal Limits Before Large Transactions

Liquidity is the lifeblood of any effective on/off-ramp service. Attempting to move significant sums without first checking platform liquidity or withdrawal caps is a recipe for delays and disappointment. Smaller or newer ramps may not have the reserves needed for high-volume conversions, leading to partial payouts or extended waiting periods. Some services also impose daily or weekly withdrawal limits, sometimes buried deep in their FAQs, that can trap your funds mid-transfer (see infrastructure insights). Always review platform liquidity stats and withdrawal policies before initiating large transactions, especially if time sensitivity matters.

Best Practices: Secure Stablecoin Ramping in 2025

Dodging these five pitfalls isn’t just about protecting your digital assets, it’s about building confidence in the evolving world of crypto finance. Here are some actionable tips:

- Research every provider: Look for licensing details, user reviews, and regulatory disclosures before trusting any ramp with your money.

- Use fee calculators: Many top platforms offer transparency tools so you can preview slippage and total charges up front.

- Diversify your stablecoins: Don’t put all your eggs in one algorithmic basket; keep reserves in multiple well-audited coins.

- Prepare documents early: Completing KYC ahead of time ensures smoother transactions when speed counts.

- Test liquidity: Start with smaller transfers to gauge how quickly funds settle before sending larger amounts.

The crypto-to-fiat bridge is getting stronger every year, but as always, vigilance pays off. By staying alert to these classic errors, using unregulated providers, ignoring hidden fees/slippage, over-trusting algorithmic coins, neglecting compliance/privacy tradeoffs, and failing to check liquidity, you’ll keep your ramping experience smooth and secure. The future of digital asset management belongs to those who learn from others’ missteps, and never stop asking questions as the landscape evolves.