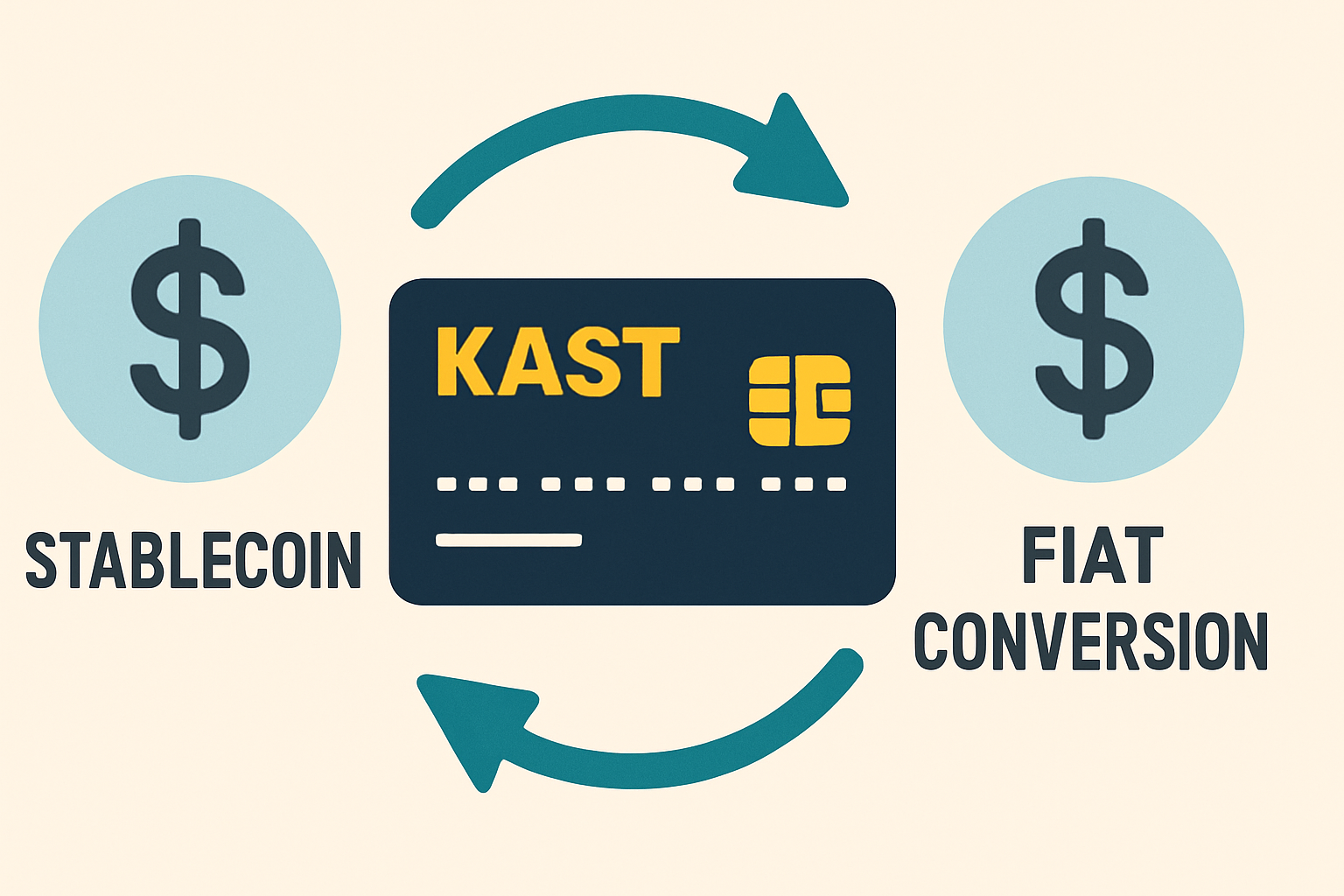

In 2025, the demand for privacy stablecoin cards has surged as crypto users worldwide seek seamless anonymous crypto off-ramps without compromising their financial sovereignty. These cards bridge the gap between stablecoins like USDC and USDT and everyday spending, allowing holders to convert digital assets to fiat privately at millions of merchants. While platforms like KAST lead with innovative features, emerging options like DeCard promise even greater anonymity, though details remain elusive. This guide unpacks their roles in private fiat conversion USDT, highlighting trade-offs in a regulatory-tightening landscape.

![]()

Navigating Privacy Challenges in Crypto Off-Ramping

Global crypto adoption hinges on frictionless exits to fiat, yet traditional banks and exchanges impose strict KYC hurdles that expose user data. Stablecoin debit cards 2025 flip this script by leveraging Visa and Mastercard networks for instant conversions. According to recent rankings from CoinGecko and The Block, cards topping lists offer multi-chain support and staking rewards, but true privacy demands no-ID verification. KAST, for instance, integrates SOL staking yields while expanding into neobanking, yet its KYC for cards tempers anonymity claims. Privacy advocates in Europe and Asia favor no-KYC alternatives, pushing demand for cards that prioritize self-custody and minimal data trails.

Consider the broader ecosystem: no-KYC wallets like Best Wallet handle over 60 chains, and DEXs dominate private trading per Koinly’s 2025 list. Off-ramp platforms vary in fees and speed, with Cryptonews spotlighting top performers. Stablecoin cards stand out by enabling DeCard USDT spending directly, bypassing exchange bottlenecks. However, as KAST evolves into a global neobank serving 160 countries with USD accounts and SWIFT plans, it underscores a pivotal tension: convenience versus concealment.

Key Benefits of Privacy Stablecoin Cards

-

Instant fiat conversion without banks: KAST bridges stablecoins like USDC and USDT to fiat via Visa, enabling direct spending without traditional bank intermediaries.

-

Global merchant acceptance: KAST Visa cards work at over 100 million merchants worldwide, plus USD accounts in 160+ countries.

-

Staking rewards on holdings: Earn enhanced SOL staking rewards and high yields on stablecoin balances with KAST cards.

-

Multi-chain flexibility: KAST supports multiple chains for depositing USDC, USDT, and other assets seamlessly.

-

Reduced KYC exposure: While KAST requires KYC for cards, pairs with no-KYC wallets like Best Wallet for enhanced privacy in off-ramps.

KAST Stablecoin Card: Powerhouse with Nuanced Privacy

KAST redefines KAST stablecoin card utility, powering Visa spends across 100 million points worldwide. Launched as a multi-chain solution, it now accepts cash, USDC, USDT, and diverse cryptos into USD accounts, bridging on-chain rails to fiat systems. By late 2025, users in 80 and countries can send funds via phone or email, stake assets, or even secure crypto-backed mortgages. CoinSutra hails it as the premier Visa stablecoin card, with YouTube analysts like ItsRagnar ranking it among 2025’s top three alongside EtherFi and NEXO for rewards.

Yet, privacy purists pause: KAST mandates KYC for card issuance, per Stablecoin Insider reviews. This aligns with regulatory realities in major markets but dilutes anonymity for off-ramping. Rewards shine, especially enhanced SOL staking, making it ideal for yield-hungry users comfortable with light verification. Transak’s breakdowns confirm competitive fees and custody models, positioning KAST as a hybrid for global nomads blending DeFi yields with real-world utility. For those eyeing expansion, its neobank pivot signals stablecoin infrastructure maturing into everyday finance.

DeCard’s Elusive Edge in Anonymous Spending

Whispers of DeCard circulate in privacy circles as a potential no-KYC contender for DeCard USDT spending, touted for pure anonymity in stablecoin off-ramps. Unlike KAST’s verified path, DeCard aims to deliver prepaid Visa functionality without identity surrender, echoing RedotPay’s high-limit model but with rewards. Market chatter from Bleap and Blockpit ties it to no-KYC wallet trends, yet concrete details evade public scrutiny as of December 2025.

This opacity invites scrutiny: in a field crowded by EtherFi and NEXO, DeCard’s value lies in verifiable non-custodial ops and zero-data logs. If realized, it could dominate stablecoin cards transforming off-ramps, offering untraced USDT-to-fiat flows. Early adopters might pair it with anonymous wallets for layered privacy, but until launches clarify, KAST remains the benchmark. Investors note: true anonymity demands auditing on-chain transparency, a hurdle few clear.

Balancing these profiles reveals a market tilting toward hybrid solutions. KAST’s robust infrastructure suits users prioritizing rewards and global reach, while DeCard’s rumored no-KYC appeal targets pure privacy seekers. Pairing either with no-KYC exchanges from Koinly’s list amplifies private fiat conversion USDT, yet demands vigilance on chain analysis tools tracking flows.

KAST vs. DeCard: Feature Face-Off

Side by side, KAST dominates in execution; its V3 neobank upgrade delivers USD accounts in 160 countries, stablecoin deposits, and upcoming SWIFT transfers to 80 nations. Users borrow against holdings or stake for yields, per Stabledash reports, outpacing DeCard’s vaporware status. DeCard, absent from CoinGecko or Cryptonews rankings, hinges on unproven anonymity claims, potentially mirroring RedotPay’s fee-heavy model without KAST’s multi-chain perks like SOL rewards.

KAST vs. DeCard: Stablecoin Cards Comparison

| Feature | KAST | DeCard | Winner |

|---|---|---|---|

| KYC Required | Yes | No (Rumored) | DeCard |

| Rewards | SOL Staking and Enhanced Rewards | Unknown | KAST |

| Global Reach | 160 Countries | Unknown | KAST |

| Fees | Competitive | High? | KAST |

| Anonymity | Moderate | High? | DeCard |

This table underscores KAST’s edge for practical users, but DeCard could disrupt if it launches with audited zero-knowledge proofs. For now, integrate KAST with DEX off-ramps for layered privacy, as EtherFi and NEXO trail in anonymity per YouTube breakdowns.

Maximizing Anonymity with Stablecoin Cards

To optimize stablecoin debit card 2025 for off-ramps, layer tools: fund via no-KYC wallets like Best Wallet or Zengo, then load cards minimally. KAST’s phone/email sends add cross-border utility without full exposure, ideal for Asia-Europe corridors tightening regs. Avoid over-reliance on one platform; rotate with Transak’s on-ramps for diversified trails. Security hinges on self-custody pre-load, hardware wallets, and VPNs during setup. Opinion: in 2025’s scrutiny, KAST’s KYC is a fair trade for 100 million merchant taps, but DeCard’s promise fuels innovation pressure.

Regulatory winds shift globally; EU’s MiCA and U. S. clarity favor verified rails, sidelining pure anonymity. Yet, demand persists in emerging markets, where stablecoins evade capital controls. CryptoDnes highlights wallet privacy as foundational, so cards excel as the final fiat hop.

KAST-Decard-EtherFi comparisons reveal no perfect anonymity, but strategic use bridges worlds effectively.

Future-Proofing Your Off-Ramp Strategy

Looking ahead, expect stablecoin cards to embed zero-knowledge tech, blending KAST’s scale with DeCard ideals. Platforms like anonofframp. com streamline this via tailored on/off-ramps, prioritizing speed and seclusion. Test small: load $100 USDT, spend locally, monitor yields. For nomads, KAST’s mortgages signal crypto’s fiat fusion; privacy hawks, await DeCard proofs or pivot to prepaid DEX hybrids.

Users worldwide wield these tools to reclaim control, converting stablecoins to spendable power without surrender. KAST sets the pace; DeCard may chase. Stay agile in this evolving arena.