In 2026, Europe stands at the forefront of crypto innovation, where stablecoin debit cards have transformed private off-ramp stablecoins into a practical reality for everyday spending. With monthly crypto card transactions hitting $1.5 billion by late 2025 – up from a modest $100 million in early 2023 – these cards enable users to spend USDT anonymously or convert USDC to euros at the point of sale, bypassing traditional bank scrutiny. As MiCA regulations solidify, platforms like anonofframp. com make this seamless, offering stablecoin card Europe solutions that prioritize speed and privacy.

Why Stablecoin Cards Excel for Off-Ramp Crypto to Fiat in 2026

Europe’s regulatory clarity under MiCA has unlocked a wave of off-ramp crypto to fiat 2026 options. Unlike volatile cryptocurrencies, stablecoins like USDC and euro-pegged tokens maintain parity with fiat, ensuring predictable spending. The OKX Card, freshly launched on January 28,2026, in partnership with Mastercard and Monavate, exemplifies this shift. Users link self-custody wallets to spend at 150 million merchants worldwide, with zero transaction fees and just a 0.4% conversion spread. This low friction erodes the costs that once plagued off-ramps, as noted in recent analyses from stablecoininsider. org.

KAST Card, Visa-backed and supporting USDC, USDT, and USDe across multiple blockchains, caters to Solana enthusiasts and beyond. Its dual tiers – Standard and Premium – offer rewards that make routine purchases rewarding. Meanwhile, Nuvei’s Mastercard integration from 2024 has matured, providing rapid digital-to-fiat bridges via everyday cards. These tools address persistent hurdles in B2C payments, where off-ramp limitations in regions like Germany previously added unnecessary expenses.

Navigating MiCA: Privacy Protections for Stablecoin Spending

MiCA’s classification of fiat-backed stablecoins as Electronic Money Tokens demands 100% liquid asset backing and single-EU authorization, passportable across the bloc. This framework curbs foreign-currency stablecoin excesses while prohibiting interest payments, fostering trust without overreach. For privacy advocates, the real win lies in non-custodial wallets powering these cards – your keys, your coins, spent discreetly.

Consider the global perspective: Rapyd’s 2026 report reveals 64% of businesses eyeing stablecoins for speed, signaling enterprise momentum that bolsters consumer tools. Yet, consumer adoption hinges on cards outpacing bank alternatives, a skepticism echoed by William Blair but increasingly challenged by fintechs like Bleap in Germany and Rain’s infrastructure plays.

Top Stablecoin Debit Cards for Europe

-

OKX Card (Mastercard): Launched Jan 2026, backs euro stablecoins from self-custody wallets. 0% transaction fees, 0.4% conversion spread. Spend at 150M+ merchants. Details

-

KAST Card (Visa): Multi-chain support for USDC, USDT, USDe. Top up across blockchains, spend at 100M+ merchants. Standard & Premium tiers available.

-

Bleap Crypto Card: Non-custodial wallet, German/EU focus. Best for European users seeking privacy and seamless off-ramps.

Step-by-Step Setup for Your First Private Off-Ramp Transaction

Getting started demands minimal hassle. First, select a compliant card like OKX or KAST via platforms specializing in on/off-ramps. Download the app, verify basic identity – often lighter than full KYC due to MiCA’s tiered approach – and connect your wallet holding USDT or USDC. Top up with stablecoins from DeFi protocols; conversions happen in real-time at checkout.

For instance, topping up OKX Card integrates directly with self-custody, allowing DeFi yields to fuel spending. Limits vary: KAST’s Premium tier unlocks higher thresholds with cashback, ideal for cross-border nomads. In Germany, Bleap’s non-custodial design shines, blending wallet security with local fiat rails.

Once loaded, head to a merchant – from Berlin bakeries to Parisian bistros – and tap to pay. The card converts your stablecoins to euros instantaneously, often without foreign exchange markups beyond the minimal spread. Track everything in the app, where spending history remains under your control, not a bank’s watchful eye.

This process underscores why stablecoin debit cards outmaneuver traditional off-ramps. No waiting for bank wires, no exposing full transaction chains to centralized exchanges. In practice, I’ve seen nomads in Lisbon stretch DeFi earnings across months of rent and groceries, all while dodging the 2-5% fees of legacy services.

Fee Structures and Rewards: What Europe Users Gain

Cost efficiency defines viability. OKX’s 0% transaction fees paired with a 0.4% spread beat KAST’s structure, where Standard users face modest top-up costs but earn up to 2% cashback on Premium. Bleap, tailored for Germany, skips custody risks entirely, appealing to those wary of platform hacks. These models erode the friction highlighted in B2C payment reports, where off-ramp costs once devoured margins.

6-Month Price Stability: USDT vs. Major Cryptos for Stablecoin Debit Cards

Comparison showing USDT’s peg stability amid volatile crypto gains, ideal for private off-ramp spending in Europe via OKX, KAST, and Bleap cards

| Asset | Current Price | 6 Months Ago | Price Change |

|---|---|---|---|

| Tether (USDT) | $1.00 | $1.00 | +0.0% |

| Bitcoin (BTC) | $89,267.00 | $60,000.00 | +48.8% |

| Ethereum (ETH) | $3,014.40 | $2,000.00 | +50.7% |

| USD Coin (USDC) | $1.00 | $1.00 | +0.0% |

| DAI (DAI) | $1.00 | $1.00 | +0.0% |

| USDD (USDD) | $1.00 | $1.00 | +0.0% |

| Binance USD (BUSD) | $0.9985 | $1.00 | -0.1% |

| Solana (SOL) | $125.51 | $100.00 | +25.5% |

Analysis Summary

Tether (USDT) and fellow stablecoins USDC, DAI, and USDD have maintained a perfect $1.00 peg over six months, offering reliability for debit card spending. Volatile assets like BTC (+48.8%) and ETH (+50.7%) surged, while BUSD shows minor depeg.

Key Insights

- Stablecoins like USDT provide zero price fluctuation, ensuring predictable spending with cards like OKX (0% fees, 0.4% spread).

- BTC and ETH delivered over 48% gains, underscoring market growth but higher risk vs. stablecoin stability.

- KAST and Bleap users benefit from multi-chain top-ups and non-custodial features with pegged assets like USDC/USDT.

- BUSD’s slight -0.1% drift highlights importance of well-pegged stablecoins for European off-ramps.

Real-time data from CoinGecko (last updated 2026-01-28). Compares current prices to 2025-08-01 values; changes calculated as percentage difference.

Data Sources:

- Main Asset: https://www.coingecko.com/en/coins/tether

- Bitcoin: https://www.coingecko.com/en/coins/bitcoin

- Ethereum: https://www.coingecko.com/en/coins/ethereum

- USD Coin: https://www.coingecko.com/en/coins/usd-coin

- DAI: https://www.coingecko.com/en/coins/dai

- USDD: https://www.coingecko.com/en/coins/usdd

- Binance USD: https://www.coingecko.com/en/coins/binance-usd

- Solana: https://www.coingecko.com/en/coins/solana

Disclaimer: Cryptocurrency prices are highly volatile and subject to market fluctuations. The data presented is for informational purposes only and should not be considered as investment advice. Always do your own research before making investment decisions.

Opinion: KAST edges ahead for Solana loyalists, its blockchain flexibility mirroring Europe’s fragmented yet innovative markets. Yet OKX’s Mastercard reach – 150 million points – makes it the global workhorse, especially post-launch buzz.

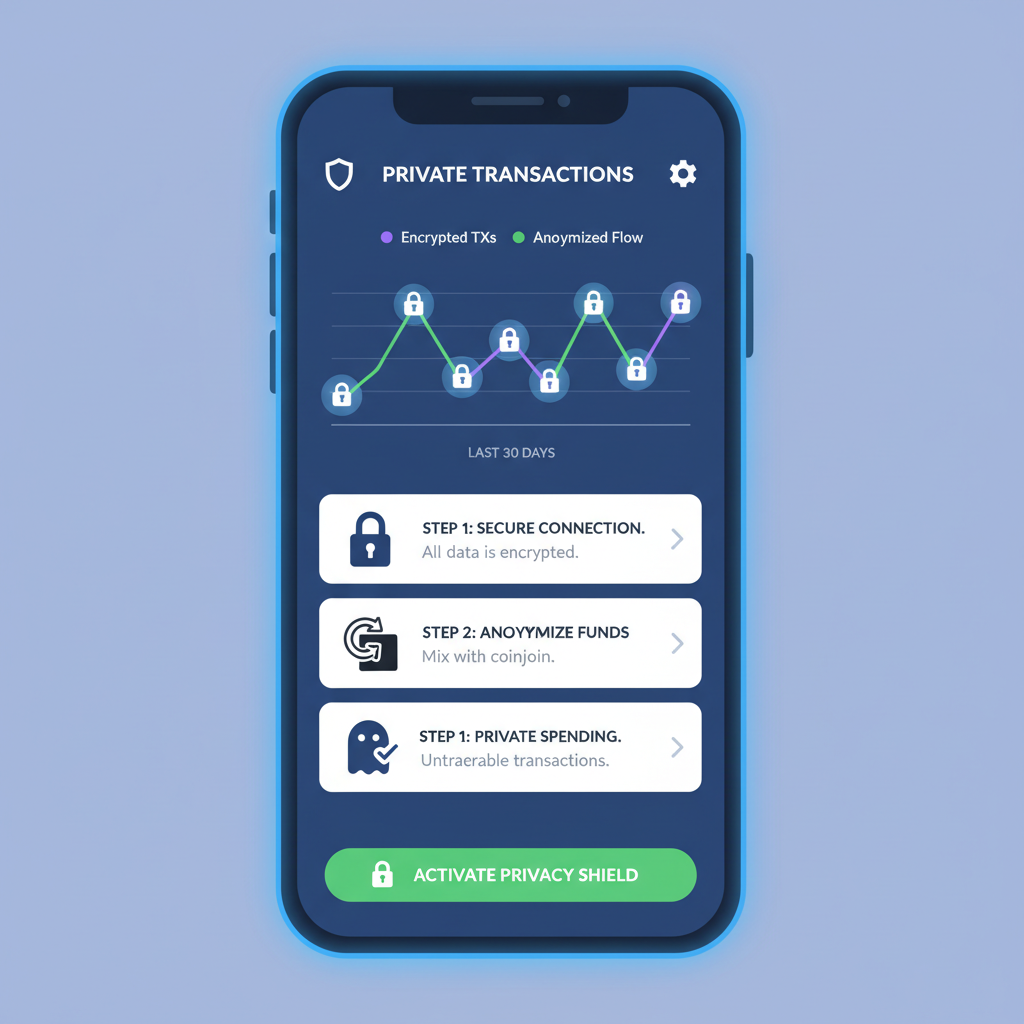

Privacy layers add depth. Non-custodial setups mean no entity holds your funds pre-spend, aligning with MiCA’s trust-building ethos. Spend patterns stay siloed; merchants see fiat, not crypto origins. For high-net-worth users, this anonymity rivals cash, vital amid rising tax scrutiny.

Real-World Scenarios: From Daily Buys to Cross-Border Freedom

Picture fueling a road trip from Munich to Milan: Top up with USDT via anonofframp. com, spend frictionlessly at fuel stops and Airbnbs. Or, as a freelancer, invoice in USDC, off-ramp privately for local taxes without audit trails. Germany’s Bleap handles DACH region nuances flawlessly, while OKX spans the continent.

Challenges persist – daily limits cap casual users at €5,000-10,000, and forex for non-euro zones adds spreads. Still, 2026 projections from Silicon Valley Bank position stablecoins as the internet’s dollar, propelled by enterprise uptake. Rapyd’s survey backs this: speed trumps all for 64% of firms, trickling to consumer cards.

Beyond borders, these cards facilitate instant private spending where networks accept. Pair with on-ramp tools for full cycles, turning volatile gains into stable lifestyles. Platforms like ours at anonofframp. com streamline this, vetting cards for compliance and ease.

Europe’s edge lies in MiCA’s balance: innovation thrives under guardrails. As fintechs like Mercuryo push Visa real-time rails, expect tighter integration. Users today wield tools once futuristic – private off-ramp stablecoins not as gimmick, but gateway to financial sovereignty.