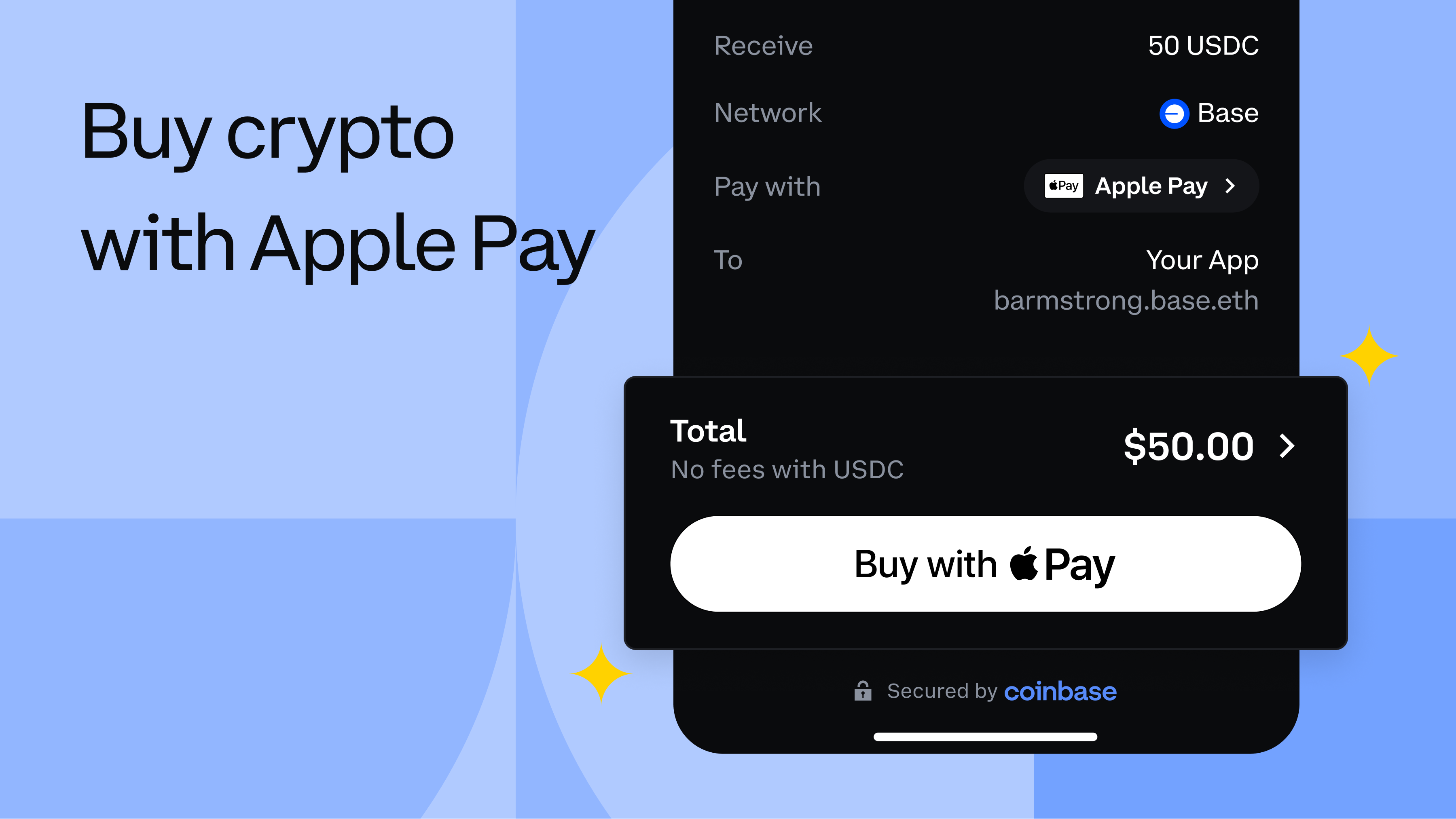

In an era where financial privacy is under siege from escalating regulatory demands, stablecoin cards emerge as a beacon for crypto users seeking frictionless paths to fiat. These innovative tools allow holders of assets like USDT or USDC to convert digital holdings into spendable currency via virtual or physical debit cards, often without the invasive Know Your Customer (KYC) processes that plague traditional exchanges. Platforms such as Rewcards and Laso Finance exemplify this shift, offering instant issuance and Apple Pay integration while prioritizing anonymity. This approach not only streamlines private crypto off-ramps but also sidesteps the vulnerabilities of centralized cashout services.

The allure lies in their simplicity: load your card with stablecoins from a non-custodial wallet, and suddenly your crypto becomes viable for everyday purchases anywhere Mastercard or Visa is accepted. No lengthy verifications, no data leaks to authorities. Yet, as Visa’s Onchain Analytics Dashboard highlights, the stablecoin ecosystem is maturing rapidly, with fiat-backed tokens dominating on-chain finance. Fireblocks notes their role in accelerating cross-border settlements, a trend that extends seamlessly to personal off-ramping.

Decoding the Mechanics of Stablecoin Cards for Off-Ramping

At their core, stablecoin cards off-ramp function through a layered architecture blending blockchain rails with traditional payment networks. Users transfer stablecoins to the card issuer’s smart contract or wallet address. The platform then mints a corresponding fiat-equivalent balance on the card, often converting via decentralized liquidity pools to minimize slippage and fees. Rewcards, for instance, supports instant virtual MasterCards loadable with multiple cryptos, bypassing KYC entirely. This process unfolds in minutes, far outpacing bank wires or exchange withdrawals that demand identity proofs.

Consider the workflow: from a privacy-focused wallet like Best Wallet or Zengo – both lauded in 2026 reviews for no-KYC DeFi access – you bridge USDT across chains if needed, then deposit. The card activates immediately, ready for online shopping or ATM withdrawals. Laso Finance extends this with support for DAI and others, ensuring broad compatibility. Such efficiency addresses a pain point in crypto: the ‘last mile’ to fiat, where KYC hurdles often deter users from realizing gains.

Key No-KYC Stablecoin Card Advantages

-

Instant Issuance: Rewcards provides immediate virtual MasterCards, enabling quick access without delays.

-

Multi-Stablecoin Support: Load cards with USDT, USDC, or DAI, as offered by Laso Finance.

-

Apple Pay Integration: Rewcards supports seamless contactless payments via Apple Pay.

-

Global Acceptance: MasterCard-backed cards usable worldwide at millions of merchants.

-

Zero Identity Verification: No KYC required, preserving user privacy on platforms like Rewcards and Laso Finance.

Why Privacy Advocates Champion No-KYC Stablecoin Cashouts

For those prioritizing sovereignty over their funds, no KYC stablecoin cashout options represent a paradigm shift. Traditional off-ramps expose users to surveillance, with exchanges like those listed in Koinly’s 2026 roundup of 20 no-KYC platforms offering partial relief via trading but faltering on direct spending. Stablecoin cards bridge this gap, enabling anonymous USDT to fiat conversions without compromising usability. Nuvei’s solutions underscore the backend: real-time stablecoin-to-fiat rails that merchants already leverage, now democratized for individuals.

This privacy edge proves vital amid rising scrutiny. Credit unions, per Filene Research, are adapting to stablecoin inflows at POS systems, converting instantly to fiat – a model mirrored in consumer cards. Yet, opinion divides here: while speed and anonymity thrill, skeptics warn of untested recourse. Platforms mitigate via insurance funds or audits, but users must vet rigorously. Still, for privacy hawks, the trade-off favors control; after all, why surrender data when tech permits otherwise?

Navigating Risks and Realities in the Stablecoin Debit Card Landscape

Despite their promise, stablecoin debit card privacy isn’t risk-free. Absent KYC, disputes hinge on platform goodwill, and regulatory tsunamis could clamp down swiftly. Digitap. app’s optional no-KYC on-ramps hint at a bifurcated future: compliant paths for the timid, anonymous for the bold. White-label providers like HollaEx signal institutional buy-in, potentially stabilizing the sector. Users counter risks by diversifying loads, sticking to audited issuers, and monitoring on-chain flows via tools like Visa’s dashboard.

Empirical data bolsters confidence: 2026’s top anonymous wallets from Cryptonews integrate fluidly with these cards, forming a robust privacy stack. The result? A ecosystem where crypto’s volatility yields to stable spending power, unencumbered by bureaucratic chains. As adoption swells – evidenced by Fireblocks’ payments guide – these cards aren’t just tools; they’re the vanguard of user-centric finance.

Explore how stablecoin cards enable instant crypto-to-fiat off-ramping without KYC hassles

Selecting the right stablecoin debit card privacy solution demands a discerning eye. Rewcards stands out with its instant virtual MasterCards, supporting a spectrum of cryptocurrencies beyond just stablecoins, all without a whisper of KYC. Load up via USDT from your no-KYC wallet, and you’re spending at Starbucks or online retailers in under five minutes. Laso Finance pushes boundaries further, accommodating USDC, DAI, and more, with seamless Apple Pay linkage that feels native to iOS users. These aren’t gimmicks; they’re engineered for the privacy-conscious trader who values velocity over validation.

Benchmarking Leading No-KYC Stablecoin Card Providers

Platforms vary in nuance, but leaders cluster around core metrics: issuance speed, supported assets, fee structures, and geographic reach. Rewcards edges competitors on sheer immediacy – no waiting periods, no caps on initial loads for most users. Laso Finance counters with deeper DeFi integrations, pulling from protocols like Aave for yield-bearing deposits pre-conversion. Both sidestep the KYC quagmire that ensnares giants like Binance or Coinbase, aligning with Koinly’s curated no-KYC exchanges for upstream trading.

Comparison of Top No-KYC Stablecoin Cards

| Provider | Card Type | Supported Stablecoins | Fees | Geographic Focus | Key Features |

|---|---|---|---|---|---|

| Rewcards | Instant Virtual Mastercard 💳 | USDT/USDC/DAI | 1-2% | Global 🌍 | No KYC, Apple Pay integration, instant issuance |

| Laso Finance | Apple Pay compatible 🛒 | USDT/USDC/DAI + multi-chain | 0.5-1.5% | EU/US focus | Anonymous loading, instant crypto-to-fiat conversion |

| White-Label Options (e.g., HollaEx, AlphaPoint) | Custom virtual/physical cards | Various (USDT/USDC/DAI) | Varies (1-3%) | Global | Emerging customizable solutions, fast launch, merchant-focused |

Fees merit scrutiny: expect 1-2% on loads, competitive against exchange withdrawal bites of 3-5%. Limits start modest – $1,000 daily for new cards – scaling with usage proofs like on-chain history, not passports. This tiered trust model fosters sustainability without compromising anonymity, a clever pivot from rigid KYC gates.

In practice, pair these with Blockpit-endorsed wallets like Best Wallet for airtight flows. Transfer USDT via Polygon or Solana for pennies, load the card, spend. Merchants see fiat; you retain opacity. Nuvei’s enterprise-grade conversions validate the tech stack, proving scalability from POS to personal.

Ultimately, stablecoin cards off-ramp mechanisms empower users to dictate terms. In a world of mandatory disclosures, these tools reclaim agency, fusing blockchain’s promise with fiat’s practicality. As adoption curves steepen – fueled by 2026’s anonymous wallet surge – expect refinements: biometric secures sans KYC, AI-optimized loads, broader fiat outputs. For now, they deliver the holy grail: anonymous USDT to fiat at scale, positioning your portfolio for unhindered expression.

Discover how to off-ramp stablecoins to fiat without KYC: privacy-preserving solutions