In 2026, the dream of seamless, private USDC off-ramp cards is reality. Imagine holding stablecoins in your wallet, swiping a virtual Visa card for everyday spending, or routing funds straight to your bank account, all without KYC hurdles. These tools empower privacy advocates and everyday crypto users alike, turning volatile markets into steady cash flow with minimal friction. As Visa pioneers USDC settlements on Solana and Ethereum, the infrastructure for no KYC crypto off-ramp solutions has never been stronger.

Visa kicked off this shift back in 2023 by settling issuer transactions in USDC, expanding dramatically by late 2025 to include U. S. banks handling daily card volumes on Solana. No more sluggish wire transfers; banks now process Visa card settlements in USDC, slashing costs and boosting speed. This isn’t hype, it’s happening, as detailed in insights from Transak’s Stablecoin Playbook and insights4vc’s analysis. For users, it means private stablecoin to bank conversions feel native, not clunky.

Unlocking Instant Fiat Access Without Identity Sacrifice

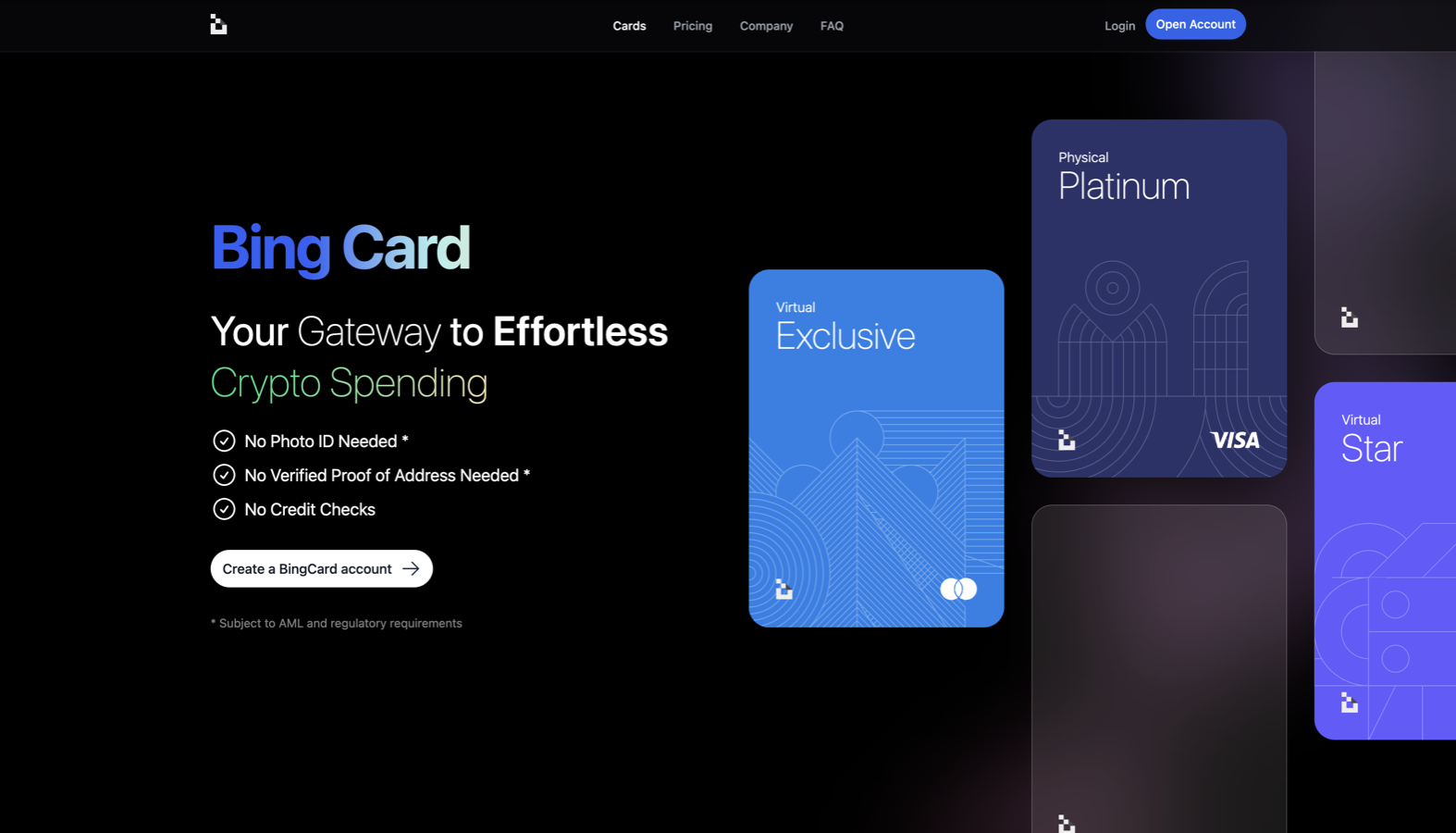

Traditional off-ramps demand passports and selfies, but 2026 flips the script. Platforms like Laso Finance deliver no-KYC crypto debit cards that convert USDC, USDT, or DAI into spendable Visa balances instantly. Load up via Apple Pay or Google Pay, shop globally, and maintain anonymity. Zypto takes it further with cards supporting over 100 cryptos, including USDC, for immediate fiat conversion wherever Visa flies. These aren’t gimmicks; they’re lifelines for the bankless lifestyle SpendNode champions, using privacy-first middleware to dodge KYC entirely.

Consider Card2Crypto’s gateway: merchants accept cards, Apple Pay, SEPA, or ACH, settling in USDC on Polygon with zero chargebacks. For individuals, it’s a portal to USDC to fiat 2026 without red tape. Adesic promises same-day USD bank deposits from USDC sends, while Rain excels in remittances, off-ramping to local currencies borderlessly. These services align with Forbes’ reports on stablecoins reshaping cross-border payments, from Ghana’s fintech pilots to everyday users dodging high fees.

Top Platforms Powering Anonymous Stablecoin Cards

Top No-KYC USDC Off-Ramp Cards

-

Laso Finance virtual Visa: Convert USDC/USDT/DAI to anonymous spendable balances instantly. Works with Apple Pay, Google Pay. Learn more

-

Zypto crypto cards: Instant USDC-to-fiat conversion, load with 100+ cryptos, spend globally on Visa. No traditional banking needed. Learn more

-

Card2Crypto Polygon settlements: Merchants accept cards (Visa/MC/Apple Pay), settle instantly in USDC on Polygon, no KYC, 100% chargeback protection. Learn more

Laso Finance stands out for its mobile wallet integration, letting you top up anonymous stablecoin cards and spend without a trace. Zypto’s edge? Lightning-fast loads from USDC, no banking middlemen. Paymonei and Coast complement this with competitive rates for bank wires, supporting instant USDC-to-fiat. Simplex even pushes off-ramps to Visa cards in Europe, blending crypto speed with card convenience. Off Ramp and Stably round out options for businesses and nonprofits paying via USDC wallets.

Yet balance tempers enthusiasm. TRM Labs’ 2026 Crypto Crime Report flags illicit trends, reminding us privacy tools demand vigilance. Always align with local regs, as these platforms stress compliance beneath the no-KYC surface.

USD Coin (USDC) Price Prediction 2027-2032

Bullish stablecoin adoption scenarios featuring no-KYC off-ramp cards, Visa integrations, and seamless bank transfers

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $0.80 | $0.95 | $1.10 | +5,490% |

| 2028 | $0.92 | $0.98 | $1.04 | +3.2% |

| 2029 | $0.96 | $0.99 | $1.02 | +1.0% |

| 2030 | $0.98 | $1.00 | $1.02 | +1.0% |

| 2031 | $0.99 | $1.00 | $1.01 | +0.0% |

| 2032 | $0.99 | $1.00 | $1.00 | +0.0% |

Price Prediction Summary

USDC is projected to swiftly recover from its 2026 depeg near $0.017, regaining its $1 peg by 2030 in bullish adoption scenarios. Enhanced infrastructure like no-KYC cards and Visa settlements drives arbitrage and demand, stabilizing prices long-term with minimal deviations amid market cycles and regulatory tailwinds.

Key Factors Affecting USD Coin Price

- Visa USDC settlements with U.S. banks on Solana/Ethereum boosting liquidity and trust

- No-KYC off-ramp cards from Laso Finance, Zypto, and others enabling private spending

- Instant USDC-to-fiat conversions via Adesic, Rain, Coast reducing friction and increasing utility

- Regulatory sandboxes for stablecoin remittances in Ghana/Nigeria expanding global use cases

- Privacy middleware and decentralized swaps countering KYC barriers

- Growing market cap and competition with USDT favoring regulated USDC in payments ecosystem

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Diving deeper, these cards thrive because off-ramps are crypto’s choke points, per SDK. finance and DECTA guides. CoinGape ranks decentralized swaps as KYC-free alternatives, but cards win for direct bank links. In a world where Multichain Bridged USDC (Fantom) holds at $0.0169, up 0.0133% in 24 hours, stability anchors trust. Users link wallets to banks seamlessly, as INXY Payments notes, making instant crypto-to-fiat a snap.

Why 2026 Marks the Tipping Point for Privacy

Regulatory sandboxes in places like Nigeria signal broader acceptance, per Forbes. Stablecoininsider. org compares ramps, highlighting bank transfers as premier off-ramp destinations. For tech-savvy folks, this means ditching KYC fatigue; for newcomers, it’s an encouraging entry. Diversity in options drives innovation, as I always say. Whether remittances or daily spends, private USDC off-ramp cards deliver without compromise.

Practical integration starts with picking the right tool for your needs. For cross-border hustlers, Rain’s borderless payouts shine, converting USDC to local fiat instantly. Businesses eyeing freelancers? Off Ramp’s USDC wallet payments via Circle keep things compliant and swift. Stably’s fiat ramps pair well for hybrid flows, blending stablecoins with everyday banking.

Comparing Your No-KYC Options Side-by-Side

Top No-KYC USDC Off-Ramp Cards Comparison (2026)

| Provider | Key Features | Fees | Speed | Limits |

|---|---|---|---|---|

| Laso Finance | Virtual Visa cards, Apple Pay/Google Pay/Samsung Pay, supports USDC/USDT/DAI | Not specified | Instant ⚡ | Not specified |

| Zypto | Supports 100+ cryptos incl. USDC, global Visa spend | Not specified | Instant ⚡ | Not specified |

| Card2Crypto | Polygon USDC settlements, ACH/SEPA, Apple Pay/Google Pay | Not specified | Instant ⚡ | Not specified |

| Rain | Remittances/payouts to local fiat, borderless payments | Not specified | Instant ⚡ | Not specified |

| Coast | Bank transfers/wires | Not specified | Fast | Not specified |

Fees hover low across the board, often under 1%, with speeds from instant to same-day. Limits vary, but most scale with usage, suiting both retail users and power players. This table underscores why anonymous stablecoin cards outpace traditional banks: no paperwork, global reach, and crypto-native efficiency. Yet, I urge balance; test small amounts first to gauge reliability.

Simplex’s EEA-focused Visa payouts add a regional twist, while Adesic’s same-day USD nails U. S. needs. Paymonei’s competitive rates make it a daily driver for USDC to fiat 2026 conversions. These aren’t one-size-fits-all, but their diversity sparks real innovation, empowering women-led startups and underserved regions alike.

Navigating Risks in a Privacy-First World

Privacy comes with responsibility. TRM Labs highlights scams and hacks, so stick to audited platforms and hardware wallets. Volatility? USDC’s peg holds firm, with Multichain Bridged USDC (Fantom) steady at $0.0169, up 0.0133% over 24 hours from a low of $0.0167. Local laws matter; no-KYC works where regs allow, but over-the-line moves invite trouble.

Enhance security by layering tools: use VPNs, multi-sig wallets, and privacy coins for hops. SpendNode’s bankless guide nails it, advocating middleware that masks your trail. For financial inclusion, these cards bridge gaps in places like Nigeria, where stablecoin pilots flourish.

Getting started mirrors simplicity itself. Connect your wallet, select USDC, choose bank or card output, confirm, and watch funds land. Platforms like Zypto load in seconds; Laso integrates seamlessly with mobile payments. This frictionless loop turns crypto into cash flow, no gatekeepers required.

As adoption swells, expect more Visa-Solana synergies, per insights4vc. CoinGape’s off-ramp rankings favor these cards over swaps for usability. I’ve seen firsthand how they level the field, letting diverse voices in crypto thrive without identity barriers. With Multichain Bridged USDC (Fantom) trading at $0.0169, the foundation for private stablecoin to bank flows solidifies daily.

Embrace these tools thoughtfully, and 2026 becomes your year of unhindered crypto freedom. Load up, spend smart, stay private, and let stablecoins fuel your path forward.