Stablecoin-backed debit cards have become a practical bridge between the crypto ecosystem and everyday spending, but the reality of anonymous crypto withdrawal and private stablecoin card use is increasingly shaped by global regulatory pressures. As of September 2025, most card providers require users to undergo Know Your Customer (KYC) verification, directly impacting how much you can spend or withdraw – and how privately you can do so.

![]()

Understanding Stablecoin Card Limits in 2025

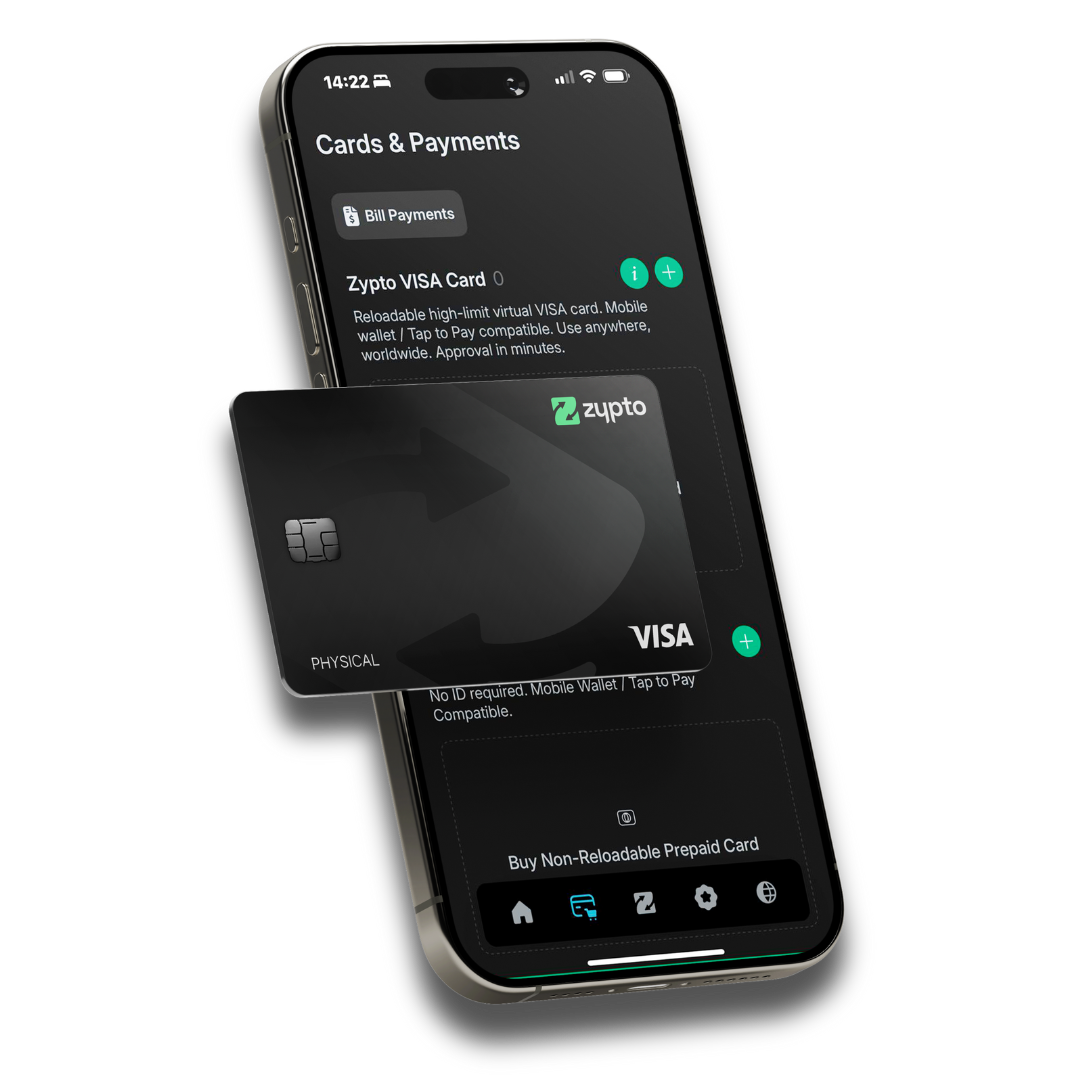

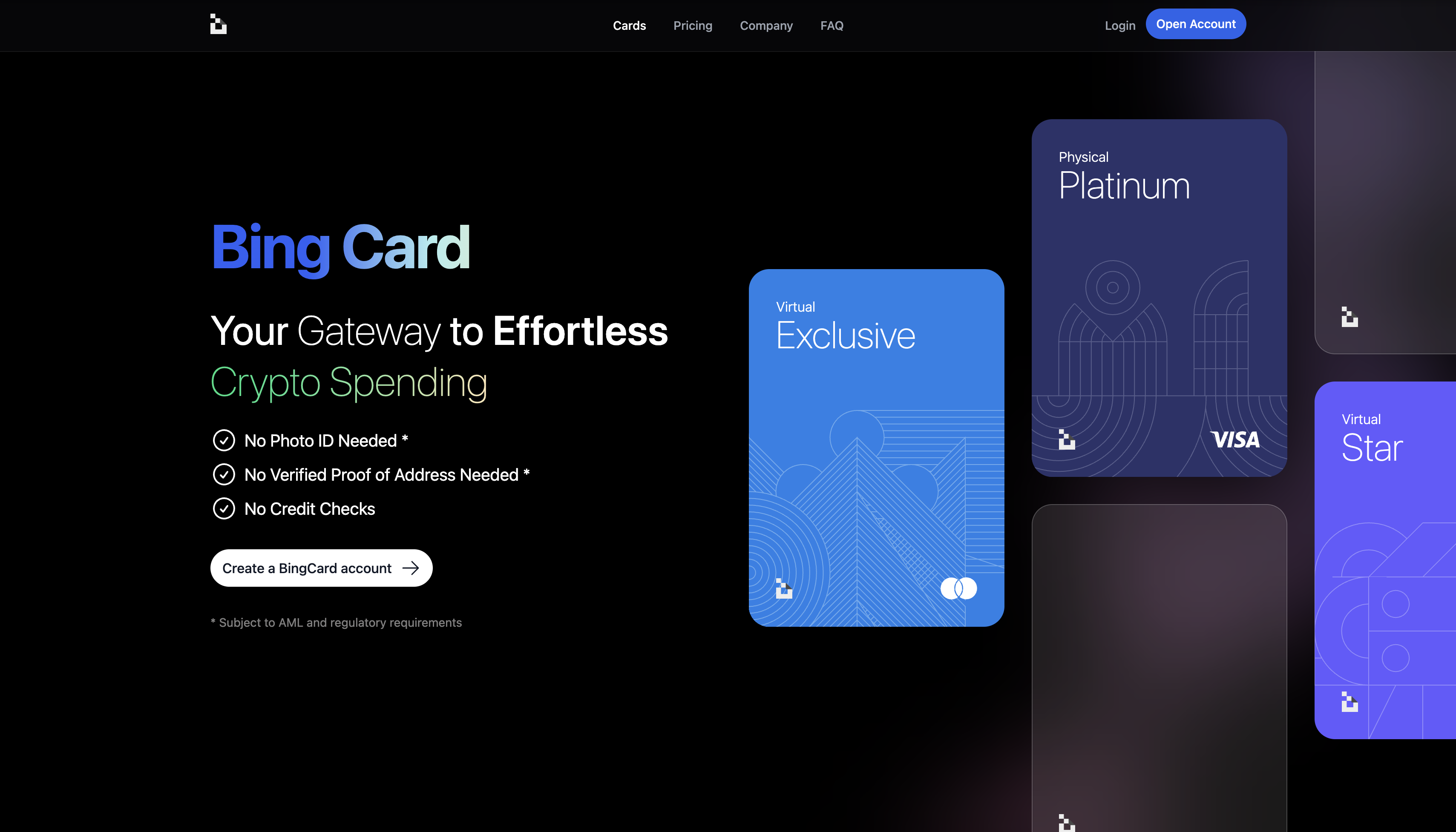

The allure of stablecoin cards lies in their ability to convert digital assets like USDC or USDT into spendable fiat currency almost instantly. However, the landscape has shifted. Regulatory bodies now enforce strict anti-money laundering (AML) rules, so stablecoin card limits are often tied directly to your level of identity verification.

No-KYC Cards: Some platforms still offer limited no-KYC options for privacy advocates. For example, according to recent research on Bitcoin. com, most no-KYC crypto cards cap lifetime spending at around €2,500. These restrictions aim to balance user privacy with compliance obligations but significantly curtail utility for high-volume users.

KYC-Required Cards: Major providers like BasedApp Card and Coinbase Card have embraced full KYC policies. The BasedApp Card supports USDC and XSGD deposits, with daily spending limits ranging from S$3,000 for Standard tiers up to $30,000 USD for Gold tiers. The Coinbase Card, meanwhile, offers a daily spending limit of £10,000/€10,000 and a daily ATM withdrawal cap of £500/€500 – but both require full identity checks before activation.

Anonymous Crypto Withdrawal: What’s Realistic?

The promise of truly private crypto transactions via debit cards is now largely theoretical for most users. While some services market themselves as “anonymous, ” the fine print usually reveals low spending thresholds or restricted features. For instance:

Key Differences: KYC vs No-KYC Stablecoin Card Limits

-

Spending Limits: KYC-verified cards (e.g., Coinbase Card, BasedApp Card, KAST Card) allow higher daily and monthly spending—up to $30,000 per day for premium tiers. No-KYC cards typically cap lifetime spending at around €2,500 or equivalent, severely limiting their utility for large purchases.

-

Withdrawal Limits: KYC-verified cards offer higher ATM withdrawal limits (e.g., £500/€500 daily with Coinbase Card), while no-KYC cards often restrict daily or monthly withdrawals to much lower amounts, sometimes as little as a few hundred dollars, or may not support ATM withdrawals at all.

-

Verification Process: KYC-verified cards require submission of identity documents and sometimes proof of address, ensuring compliance with anti-money laundering (AML) regulations. No-KYC cards may only require an email or phone number, but this comes at the cost of much stricter limits and reduced functionality.

-

Geographic Availability: KYC-verified cards are usually available in more countries, with clear regulatory compliance (e.g., KAST Card in 150+ countries). No-KYC cards may be restricted or unavailable in regions with strict AML laws, such as the United States, India, or China.

-

Privacy vs. Functionality Trade-off: No-KYC cards offer greater privacy but at the expense of lower limits and fewer features. KYC-verified cards provide full functionality and higher limits but require users to sacrifice anonymity.

This means that if you want higher withdrawal or spending power – such as accessing the $10,000 daily ATM withdrawal limit noted by Transak – you’ll almost always need to complete KYC verification.

The Trade-Offs: Privacy vs Functionality

The current regulatory climate forces users to weigh privacy against flexibility and convenience. Here’s what you need to know:

- No-KYC cards: Offer a degree of anonymity but impose strict lifetime or monthly limits (often €2,500 or less).

- KYC-required cards: Unlock higher daily/monthly spending (up to $30,000 USD on premium tiers), but your identity is linked to all transactions.

- Jurisdiction matters: Availability varies; some cards exclude U. S. , India, or China residents entirely due to local regulations.

- Fees apply: Expect ATM withdrawal fees around 2% per transaction once free limits are surpassed (see Nexo’s policy as an industry benchmark).

If privacy is your top priority when using stablecoins for everyday expenses, be prepared for lower limits and fewer features compared to fully verified accounts.