Stablecoin cards have rapidly become the bridge between the crypto ecosystem and the traditional world of payments. With Visa Inc currently trading at $341.61, the payment giant’s embrace of stablecoins signals a new era for digital assets, one where spending crypto is as simple and seamless as swiping a card at your favorite café. But how do these innovative cards actually work, and what makes them so compelling for privacy-focused users and global crypto enthusiasts?

Seamless Spending: How Stablecoin Cards Operate

At their core, stablecoin cards allow you to spend digital dollars (like USDC) anywhere Visa is accepted, over 150 million merchant locations worldwide. The process is elegantly straightforward:

- Wallet Connection: First, you link your stablecoin card to your preferred digital wallet containing supported stablecoins.

- Purchase Initiation: When you make a purchase, the card works just like any debit or credit card at checkout.

- Real-Time Conversion: The moment you authorize the transaction, your stablecoins are instantly converted into local fiat currency at current market rates.

- Merchant Settlement: The merchant receives their local currency, no need for them to handle or even know about crypto on their end.

This real-time conversion is powered by partnerships between crypto platforms and established payment networks like Visa, ensuring transactions remain fast, secure, and invisible to merchants. You retain full control over your digital assets until the very moment of purchase, an important privacy feature for many users.

Pioneering Partnerships: Visa’s Role in Crypto Integration

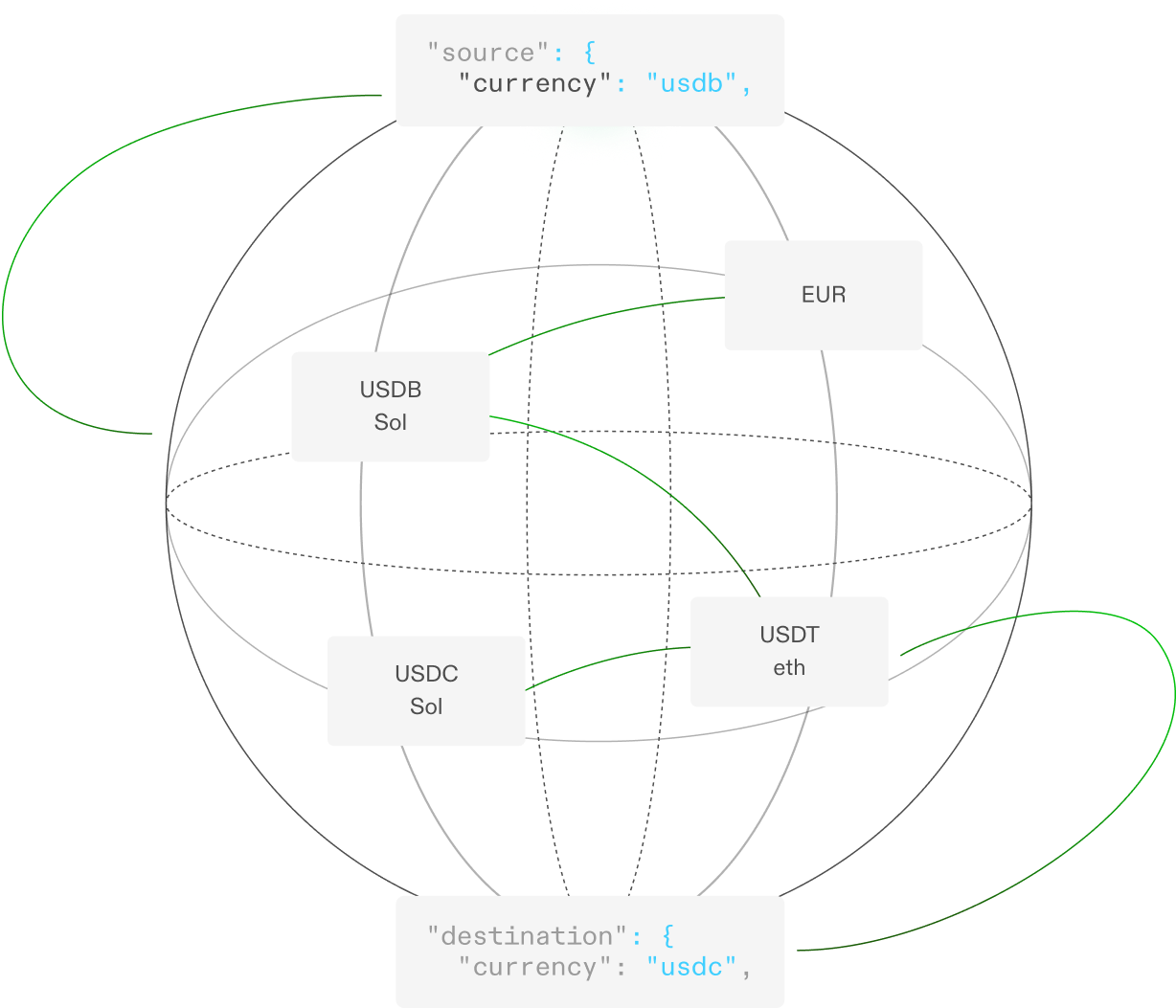

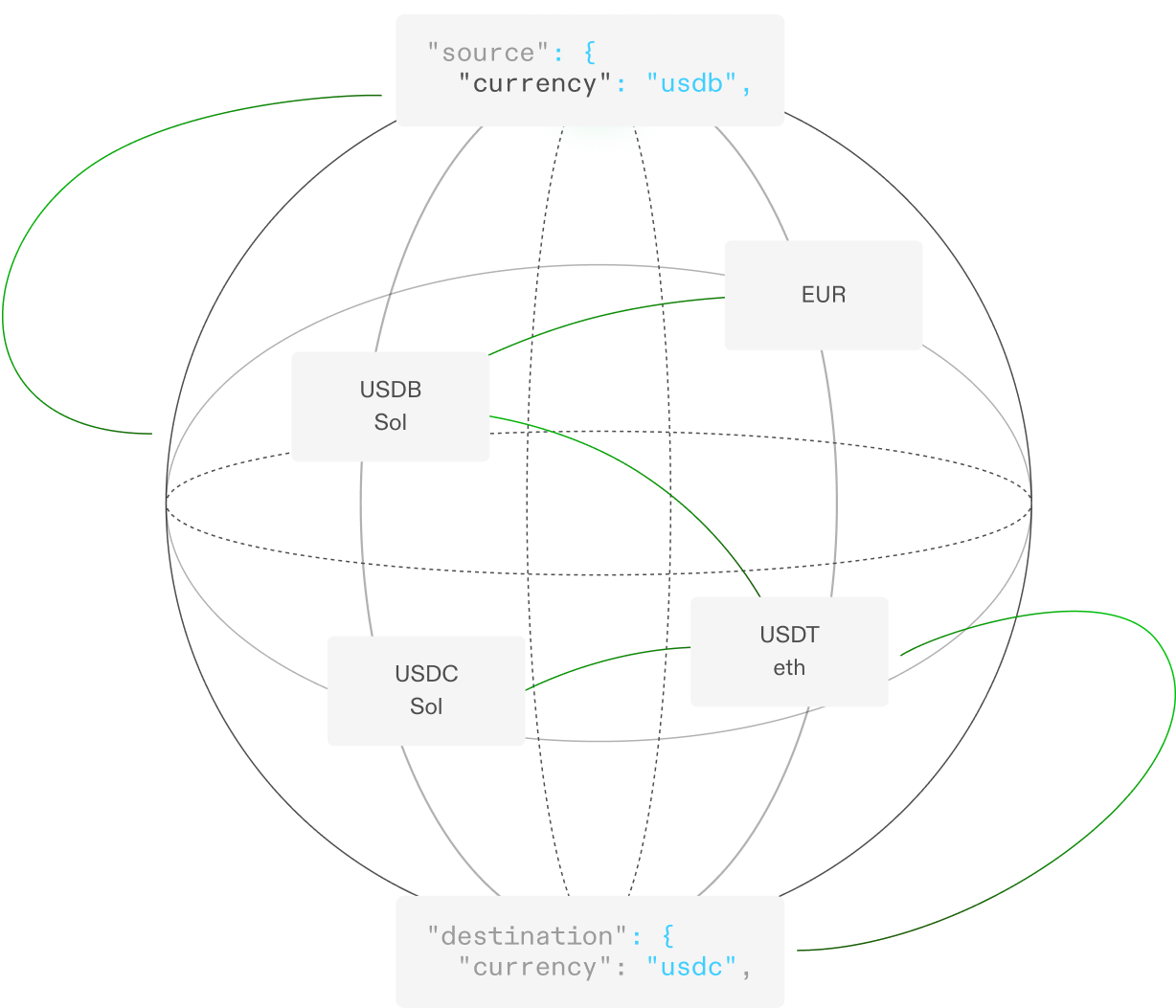

The latest market developments underscore just how quickly this landscape is evolving. In April 2025, Visa partnered with Bridge (a Stripe-owned platform) to launch stablecoin-linked cards across Latin America with plans for global expansion. These cards are programmatically issued via a single API, a technical leap that enables both fintechs and individuals to access crypto spending tools without complex backend integrations.

Baanx has also collaborated with Visa to bring self-custodial wallet support into play, letting users spend USDC directly from their own wallets using smart contracts for real-time settlement (see more here). This approach not only preserves user autonomy but also aligns with privacy-centric values by minimizing third-party custodianship.

The Benefits: Why Stablecoin Cards Are Gaining Traction

The advantages of stablecoin cards are more than just technical, they’re practical and deeply relevant in today’s global economy:

- Spend Stablecoins Globally: From Buenos Aires to Berlin, use your crypto wherever Visa is accepted.

- Cushion Against Currency Volatility: In regions where local currencies fluctuate wildly, holding funds in USDC or similar assets can provide much-needed stability.

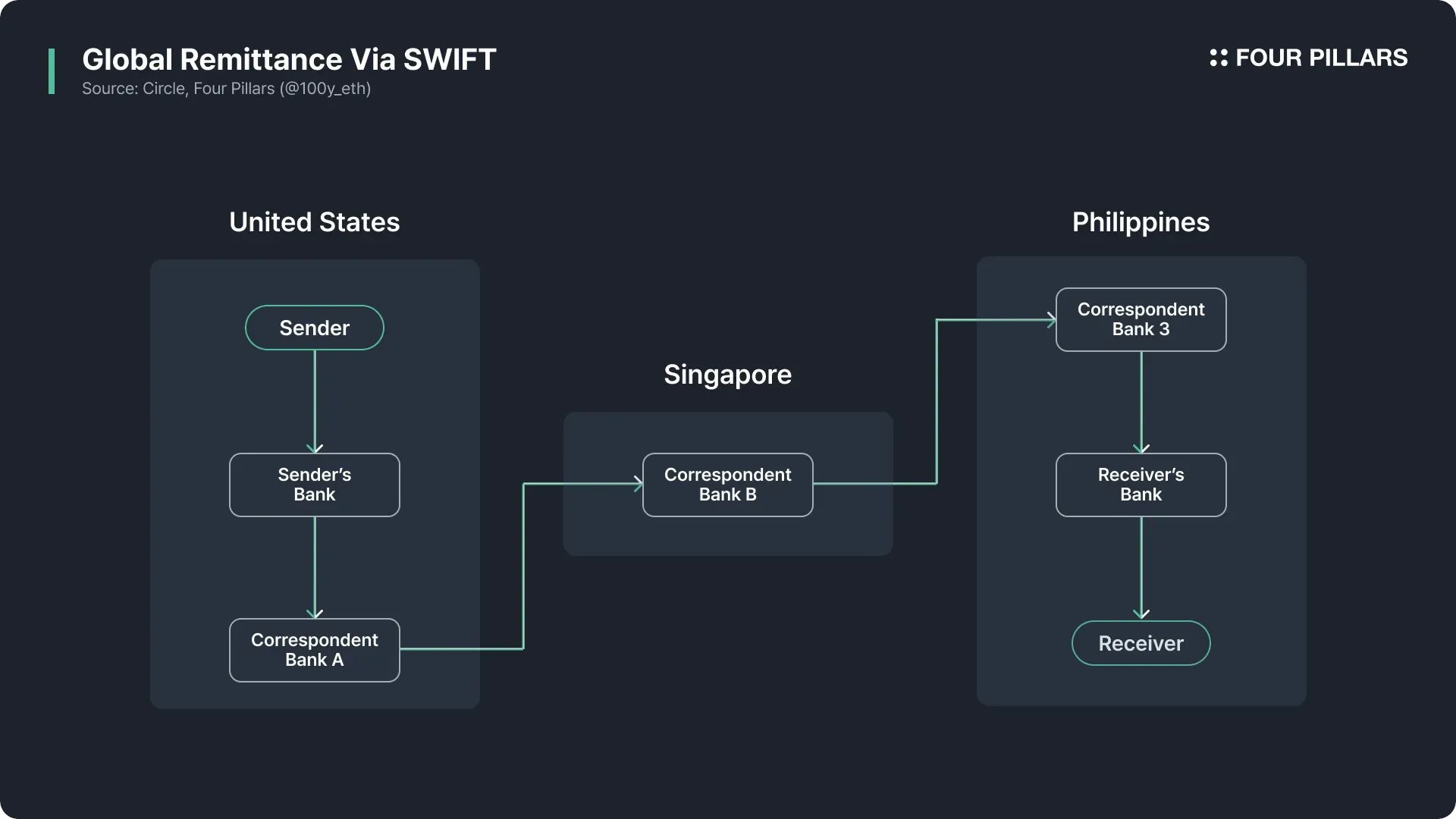

- Simplified Cross-Border Payments: Traditional remittance fees can be exorbitant; stablecoin cards reduce friction and cost when moving money internationally.

- No Bank Account Required: For millions unbanked or underbanked worldwide, these cards offer direct access to global commerce, no legacy banking needed.

- Anonymity and Privacy Options: Some providers offer anonymous stablecoin card issuance or enhanced privacy features for users who prioritize discretion in their financial lives.

This combination of flexibility and security is driving adoption among both everyday spenders and those seeking alternatives to legacy payment rails. As regulatory frameworks evolve and more providers enter the space, expect further innovation around privacy crypto cards and streamlined on/off-ramp experiences.

With these advancements, the distinction between digital assets and traditional money is blurring. Stablecoin cards are not just a technical novelty, they’re actively reshaping how people think about spending, saving, and even earning across borders. The ability to spend stablecoins globally without the usual headaches of currency conversion or excessive fees is a game-changer for freelancers, remote workers, and travelers alike.

Key Features That Distinguish Stablecoin Cards

-

Direct Spending of Stablecoins: Stablecoin cards, such as those powered by Visa and partners like Bridge and Baanx, allow users to spend stablecoins (e.g., USDC) directly from their digital wallets at any Visa-accepting merchant, eliminating the need for prior conversion to fiat.

-

Real-Time Crypto-to-Fiat Conversion: Transactions are processed instantly, with stablecoins converted to local currency at the point of sale. This ensures merchants receive payments in fiat, while users enjoy a seamless crypto spending experience.

-

Global Acceptance Through Visa Network: Unlike most crypto cards limited to select merchants, stablecoin cards can be used at over 150 million Visa-accepting locations worldwide, offering true global reach.

-

Reduced Cross-Border Fees: Stablecoin cards leverage blockchain infrastructure to minimize the high fees typically associated with international transactions, making cross-border spending faster and more cost-effective.

-

Protection Against Local Currency Volatility: By holding and spending stablecoins, users can shield themselves from the risks of local currency devaluation—an advantage especially relevant in regions with unstable economies.

-

Financial Inclusion for the Unbanked: These cards empower individuals without traditional bank accounts to participate in the global economy, providing access to digital payments and online commerce through stablecoin balances.

-

Programmatic Card Issuance and API Integration: Platforms like Bridge (by Stripe) enable fintechs to issue stablecoin-linked Visa cards across multiple countries via a single API, streamlining deployment and scaling.

For privacy advocates, the emergence of anonymous stablecoin card options is especially significant. Select providers now enable users to obtain cards with minimal personal information, leveraging decentralized KYC processes or tiered verification models. This empowers users in restrictive jurisdictions or those who simply value discretion.

Considerations for Users: Navigating Fees, Limits, and Regulation

Despite their promise, it’s important to approach stablecoin cards with an informed perspective. Fees can vary widely, some providers charge monthly maintenance fees, while others impose transaction or withdrawal costs. Always review the fee structure before committing to a card.

Regional availability remains another key factor. Regulatory stances on crypto-to-fiat conversion differ by country and can affect both card issuance and usage limits. For example, while Visa’s partnership with Bridge has opened doors in Latin America, expansion into Europe and Asia will depend on evolving local frameworks (learn more here). Staying updated on your jurisdiction’s rules ensures uninterrupted access to your funds.

Security is paramount. Most reputable stablecoin card providers employ robust encryption standards and offer two-factor authentication to protect user funds. However, as with any financial tool linked to digital assets, always safeguard your wallet credentials and be wary of phishing attempts.

The Future: Stablecoin Cards in Everyday Life

The trajectory is clear: as more people seek efficient ways to bridge crypto holdings with real-world expenses, demand for seamless on/off-ramp solutions will accelerate. Visa’s current price at $341.61 reflects strong confidence in the payment network’s adaptability, embracing stablecoins isn’t just about new technology; it’s about meeting users where they are.

Looking ahead, expect continued innovation at the intersection of privacy tech and mainstream finance. Features like programmable spending limits via smart contracts or instant cashback in stablecoins could soon become standard offerings. As competition heats up among providers, each vying for speed, security, and user control, the ultimate beneficiary will be consumers seeking choice without compromise.

The rise of crypto Visa cards, privacy-focused options, and real-time stablecoin to fiat conversion marks a pivotal shift towards user empowerment in digital finance. Whether you’re hedging against volatility or simply want frictionless global access to your assets, stablecoin cards offer a practical path forward, one swipe at a time.