Stablecoins have exploded in popularity, reshaping how people around the world manage, move, and spend money. In 2024 alone, global stablecoin transactions topped $27.6 trillion, a figure that’s only expected to grow as more mainstream payment rails embrace digital assets. For global crypto users, the ability to spend stablecoins with cards is a game-changer, sidestepping volatility, bank restrictions, and excessive fees. But what’s the fastest, most private way to turn your USDT or USDC into everyday purchases? Enter stablecoin virtual cards.

Why Stablecoin Virtual Cards Are Revolutionizing Payments

Traditional crypto-to-fiat solutions often involve delays, high friction, and privacy trade-offs. Stablecoin virtual cards solve these pain points by letting you instantly convert your digital dollars into local currency at any merchant that accepts Visa or Mastercard, online or in-store. This means you can pay for coffee in Paris, shop online in Lagos, or book hotels in Buenos Aires with your stablecoins, all while maintaining control over your funds and personal information.

The market is responding fast: Visa has partnered with leading fintechs to enable stablecoin-linked cards globally; Mastercard is rolling out new integrations; and platforms like Binance and AnonOfframp. com are making it easier than ever to move seamlessly between crypto and fiat.

The Top 3 Platforms for Instant Stablecoin Spending (2025)

If you’re searching for the best stablecoin card 2024, these three providers stand out for their privacy features, speed of settlement, and broad merchant acceptance:

Top Stablecoin Virtual Card Providers for Global Users

-

Binance Virtual Card: Spend USDT and BUSD instantly worldwide. The Binance Virtual Card allows users to convert and spend their stablecoin balances at any merchant that accepts Visa, both online and in-store. With real-time conversion and no annual fees, it supports seamless transactions in multiple currencies and is available to users in select regions.

-

AnonOfframp.com Stablecoin Virtual Card: Private, fast, and global USDT/USDC spending. AnonOfframp.com offers a virtual card solution designed for privacy-focused users, enabling instant spending of stablecoins with minimal personal information required. The card can be topped up with USDT or USDC and used at millions of Visa-accepting merchants worldwide, making it ideal for those prioritizing anonymity and speed.

-

Wirex Multi-Currency Card: Seamless crypto-to-fiat payments with stablecoin support. The Wirex card lets users spend stablecoins like USDT and USDC alongside traditional currencies. It features automatic conversion at point of sale, supports both Visa and Mastercard networks, and offers rewards for every purchase. Wirex is available in over 130 countries, making it a versatile choice for global users.

1. Binance Virtual Card: Spend USDT and BUSD Instantly Worldwide

The Binance Virtual Card empowers users to spend their USDT or BUSD balances directly at any merchant accepting Visa worldwide. With real-time conversion from crypto to fiat at the point of sale, there’s no need to pre-convert funds or wait for manual withdrawals. The card integrates seamlessly with your Binance account, making it an excellent choice if you already use the platform for trading or savings.

- Supported Currencies: USDT, BUSD (with plans for more)

- Network: Visa (global acceptance)

- Main Benefits: Speedy settlements; no annual fee; robust security controls within the Binance app

- User Profile: Ideal for active traders and those seeking direct integration with a major exchange

2. AnonOfframp. com Stablecoin Virtual Card: Private, Fast, and Global USDT/USDC Spending

If privacy is paramount, and you value flexibility across regions, the AnonOfframp.com Stablecoin Virtual Card is purpose-built for you. This card enables instant spending of both USDT and USDC anywhere Visa is accepted worldwide while prioritizing user anonymity throughout onboarding and transactions. With minimal KYC requirements (depending on jurisdiction), rapid issuance times (often under five minutes), and support for seamless on-ramps/off-ramps between crypto and fiat, it’s a favorite among privacy advocates.

- Supported Currencies: USDT and amp; USDC (multi-chain support)

- Network: Visa (broad international coverage)

- Main Benefits: Enhanced privacy options; ultra-fast card creation; works globally, even in high-demand regions like Nigeria or Latin America

- User Profile: Perfect for digital nomads, freelancers paid in crypto, or anyone seeking discreet access to their funds

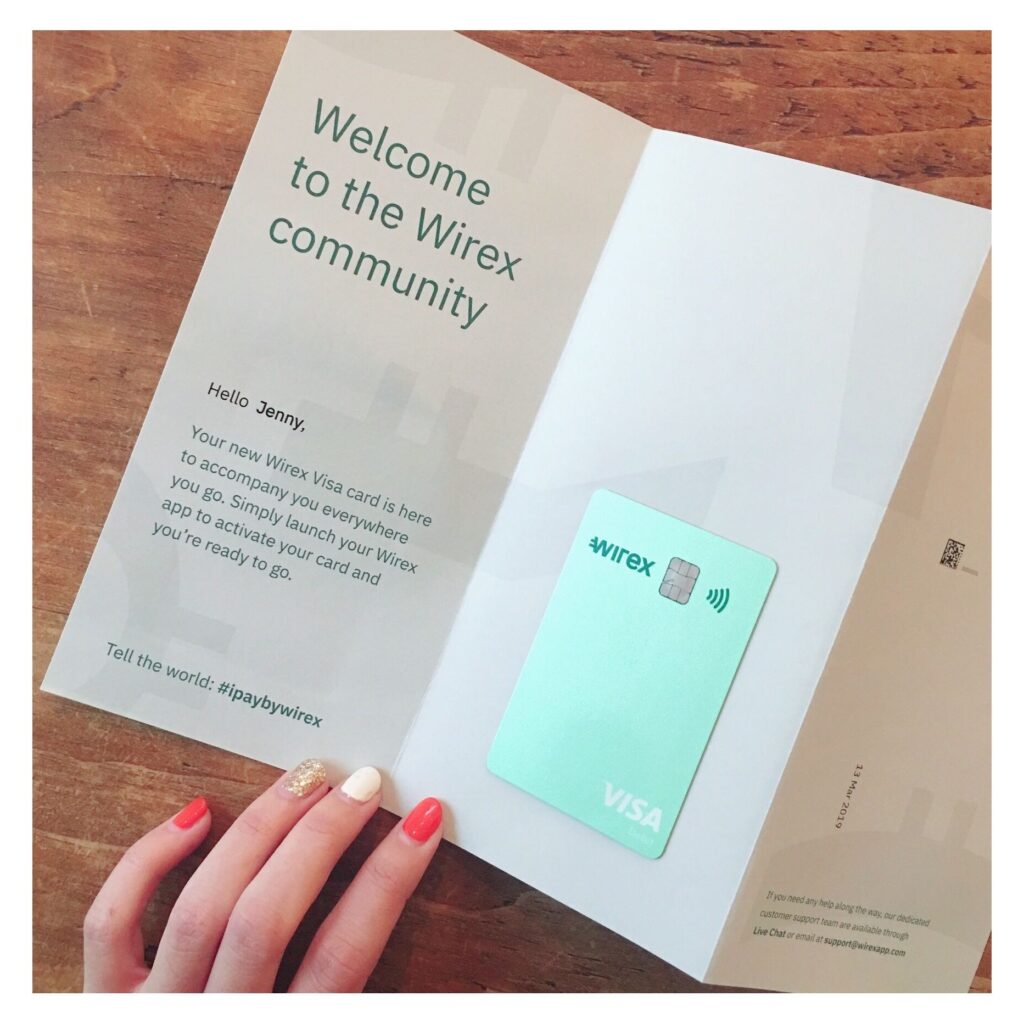

3. Wirex Multi-Currency Card: Seamless Crypto-to-Fiat Payments with Stablecoin Support

The Wirex Multi-Currency Card bridges traditional finance with cutting-edge crypto payments by supporting both fiat currencies and popular stablecoins such as USDT and USDC. Users can hold multiple currencies on one card, and instantly convert between them at competitive rates, making global travel or cross-border e-commerce effortless.

- Supported Currencies: Multiple fiat currencies plus major stablecoins (USDT and amp; USDC)

- Network: Mastercard and amp; Visa (region-dependent)

- Main Benefits: Multi-currency wallet; automatic conversion at POS; cashback rewards on spending

- User Profile: Great fit for frequent travelers or anyone managing both traditional money and amp; digital assets side-by-side

For users in regions facing strict banking controls or high remittance fees, these virtual cards are more than a convenience, they’re a lifeline. Stablecoin card solutions like Binance, AnonOfframp. com, and Wirex are helping to democratize access to global commerce, allowing anyone with digital assets to participate in the mainstream economy without the usual hurdles.

Pro tip: Always check the latest supported countries and KYC requirements for your chosen card provider. Regulatory landscapes shift quickly, so what works today might change tomorrow.

Making the Most of Your Stablecoin Card

Once you’ve secured your virtual card, maximizing its benefits means understanding a few key practices:

- Monitor Fees: Each provider structures fees differently, look for transparent conversion rates and avoid cards with hidden maintenance or inactivity charges.

- Top Up Strategically: Stablecoins like USDT and USDC can be topped up via several blockchains. Choose networks with lower fees (such as Tron or Solana) when possible.

- Leverage Rewards: Some cards (like Wirex) offer cashback or spending incentives. Take advantage of these for extra value on everyday purchases.

The privacy aspect is especially critical for users in emerging markets or those valuing discretion. With AnonOfframp. com’s minimal KYC options, you can avoid oversharing personal data while still enjoying full-featured payment capabilities. For many, this peace of mind is as valuable as the convenience itself.

Real-World Use Cases: From Coffee Shops to Cross-Border E-commerce

The versatility of stablecoin virtual cards is on full display across diverse scenarios:

- Everyday Shopping: Pay at supermarkets or coffee shops in local currency, your stablecoins convert instantly at checkout.

- Online Subscriptions: Use your card for streaming services, cloud software, or online marketplaces that accept Visa/Mastercard globally.

- Payouts and Payroll: Freelancers and remote workers can receive crypto payments and spend them directly without waiting for lengthy fiat withdrawals.

- E-commerce and Dropshipping: Buy inventory from international suppliers using stablecoins without worrying about bank transfer delays or excessive FX fees.

Why This Matters in 2025, and Beyond

The rapid adoption of stablecoin cards isn’t just about tech-savvy early adopters anymore. In 2025, mainstream payment giants like Visa and Mastercard are doubling down on stablecoin integrations. According to McKinsey and Visa’s latest reports, stablecoins are driving a material shift across the payments industry, especially in cross-border transactions where traditional rails fall short. As regulations mature and infrastructure improves, expect even tighter integration between DeFi wallets and consumer spending tools worldwide.

If you’re serious about managing your digital assets efficiently, or simply want to buy pizza with USDT, these platforms offer an unprecedented blend of speed, security, privacy, and flexibility.