Stablecoins have become the backbone of digital payments, offering a bridge between volatile cryptocurrencies and traditional fiat currencies. Yet, as their adoption accelerates, users and businesses still face persistent friction: unpredictable gas fees, slow settlements, and complex on/off-ramp processes. In this context, Stablechain is emerging as a transformative force, leveraging USDT as both a settlement and gas token to redefine stablecoin usability for on/off-ramp solutions.

Redefining Stablecoin On/Off-Ramps: The Stablechain Approach

Traditional stablecoin on/off-ramps are riddled with inefficiencies. Major exchanges typically charge users 0.1, 1% for fiat conversion, while specialized providers may levy even higher fees, especially in regions with limited banking infrastructure. Moreover, network congestion often leads to erratic gas fees and delayed confirmations, undermining the promise of seamless digital payments.

Stablechain addresses these pain points through a purpose-built Layer 1 blockchain that integrates USDT as the native gas token. This architecture eliminates the need for volatile native tokens and ensures that transaction fees remain predictable and denominated in a familiar, widely used stablecoin. For users, this means greater transparency and easier budgeting when moving funds across borders or converting between crypto and fiat.

USDT as Native Gas: Simplifying Fees and Settlements

The decision to use USDT as both the medium of exchange and the gas token is more than a technical upgrade, it’s a strategic shift that aligns with how people actually use stablecoins. According to recent research, stablecoins now facilitate more value transfer than Visa and Mastercard combined, yet their infrastructure often lags behind in user experience. Stablechain’s model removes a major source of confusion: users no longer need to hold or manage a secondary token just to pay for network fees.

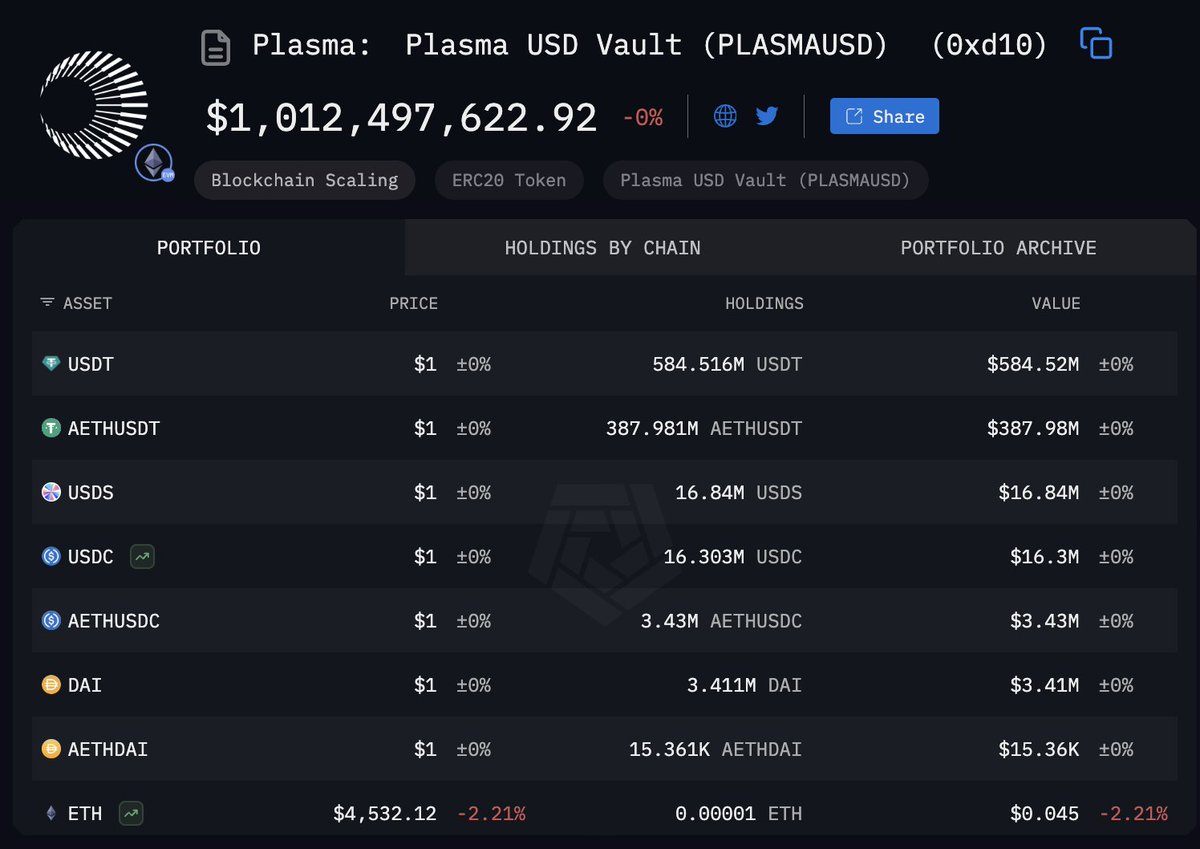

But Stablechain goes further. With the introduction of USDT0, a LayerZero-enabled variant of USDT, users can execute peer-to-peer transfers without incurring network fees at all. This innovation is particularly impactful for high-frequency traders, remittance services, and businesses with razor-thin margins. The result is a network where cost predictability and speed are not just marketing slogans, they’re built into the protocol’s DNA.

Top 5 Benefits of Using Stablechain for Stablecoin On/Off-Ramps

-

USDT as Native Gas Token: Stablechain uses Tether’s USDT for both transaction fees and settlements, eliminating the need for volatile native tokens. This ensures predictable, dollar-denominated fees and simplifies the user experience.

-

Gas-Free Transactions with USDT0: Through USDT0, a LayerZero-enabled version of USDT, Stablechain enables peer-to-peer transfers without network fees. This feature makes stablecoin transactions more cost-effective and accessible for all users.

-

High Performance and Scalability: Stablechain delivers sub-second transaction finality and supports thousands of transactions per second. This high throughput is ideal for both retail and institutional stablecoin users.

-

Developer-Friendly Ecosystem: The platform offers a comprehensive suite of SDKs and APIs, empowering developers to build stablecoin-centric payment and DeFi applications efficiently.

-

Simplified On/Off-Ramp Experience: By integrating USDT as the core settlement and gas asset, Stablechain streamlines the process of moving between fiat and stablecoins, reducing friction and enhancing user confidence in stablecoin-based payments.

Performance, Privacy, and Developer Empowerment

Beyond fee efficiency, Stablechain is engineered for high throughput and low latency. With sub-second finality and support for thousands of transactions per second, it caters to both retail users and institutional-grade applications. This scalability is crucial as the global stablecoin market surpasses $230B and regulatory clarity paves the way for mainstream adoption.

For developers, Stablechain offers robust SDKs and APIs that accelerate the creation of stablecoin-centric apps, from private stablecoin ramps to innovative payment cards. By reducing technical barriers and supporting privacy-focused use cases, Stablechain aligns with platforms like anonofframp. com, which prioritize user control, speed, and anonymity in crypto-fiat conversion workflows.

Stablechain’s architecture also addresses a persistent challenge in the stablecoin ecosystem: the need for seamless, low-cost exits and entries between crypto and fiat. As highlighted by recent industry data, the ability to rapidly on-ramp and off-ramp stablecoin payments is now a critical requirement for both retail and institutional users. By leveraging USDT as the native gas token, Stablechain not only streamlines fee structures but also removes the volatility and complexity associated with dual-token networks.

For privacy advocates and users in restrictive banking environments, this is a game-changer. The predictability and transparency of USDT-denominated fees allow for straightforward budgeting and compliance, while the option for gas-free transactions via USDT0 further reduces friction. These features make Stablechain a natural fit for platforms like anonofframp. com, which specialize in private stablecoin ramps and stablecoin cards, tools designed for users who demand both efficiency and discretion.

Strategic Implications for Modern Crypto Finance

The implications of Stablechain’s innovations extend beyond individual transactions. As stablecoins become a preferred medium for global payments, the infrastructure supporting them must evolve to offer not just speed, but also reliability and regulatory compatibility. Stablechain’s high throughput and developer-friendly environment position it as a foundational layer for the next wave of DeFi, remittance, and payment applications.

Platforms integrating Stablechain can offer users a radically improved experience: instant settlement, no surprise fees, and a familiar asset (USDT) as the core utility and gas. This is particularly significant for regions where traditional banking is slow or cost-prohibitive, and for businesses managing high payment volumes or frequent cross-border flows. By removing technical and financial bottlenecks, Stablechain supports a more inclusive, accessible digital finance ecosystem.

5 Ways Stablechain Empowers Privacy-Focused Users & Developers

-

USDT as the Native Gas Token: Stablechain enables users to pay transaction fees directly in Tether’s USDT, eliminating the need for volatile native tokens. This streamlines transactions and enhances privacy by reducing the number of assets users must manage.

-

Gas-Free Peer-to-Peer Transfers with USDT0: Through USDT0, a LayerZero-enabled version of USDT, Stablechain offers zero-fee peer-to-peer transfers. This feature minimizes traceable fee payments, supporting greater transaction privacy and cost efficiency.

-

Predictable and Transparent Fee Structure: By standardizing fees in USDT, Stablechain removes the unpredictability of fluctuating gas prices. This clarity empowers both users and developers to forecast costs and maintain privacy in budgeting and operations.

-

High Performance with Sub-Second Finality: Stablechain’s infrastructure delivers sub-second transaction finality and high throughput, reducing exposure time and the risk of data interception, which is crucial for privacy-focused applications.

-

Developer Tools for Privacy-Centric Applications: With comprehensive SDKs and APIs, Stablechain equips developers to build privacy-focused stablecoin apps and DeFi solutions, accelerating innovation in secure, user-centric financial services.

As the stablecoin market matures, with total capitalization now above $230B, infrastructure choices like Stablechain’s USDT gas model are shaping the industry’s direction. The rise of gas-free transfers and stablecoin-specific Layer 1s signals a move toward user-centric design, where cost, speed, and privacy are not trade-offs but baseline expectations.

For those navigating the intersection of crypto and fiat, whether through stablecoin cards, private ramps, or global payments, the emergence of Stablechain marks a pivotal shift. It is not just about incremental improvements in fees or speed; it’s about redefining what seamless, secure, and private stablecoin on/off-ramp experiences should look like in 2025 and beyond.