Imagine tapping your card at a café in Paris, paying for a ride in Singapore, or shopping online from anywhere in the world – all directly from your crypto wallet, with no hidden headaches. That’s the promise of stablecoin cards in 2025: seamless, borderless spending that transforms digital assets into real-world value in an instant. As stablecoins like USDT and USDC have cemented themselves as the backbone of the crypto economy, a new generation of crypto-to-fiat cards is redefining how we pay, travel, and save.

The Rise of Stablecoin Cards: Why Now?

The demand for easy crypto payments has never been higher. Stablecoins offer price stability pegged to fiat currencies like the U. S. dollar, making them ideal for everyday transactions. Yet until recently, spending stablecoins required clunky workarounds or costly conversions. Enter the new wave of stablecoin debit cards, which are bridging this gap by automatically converting your digital dollars into local currency wherever you go.

This isn’t just about convenience – it’s about unlocking global financial access. With major payment networks like Visa and Mastercard now supporting crypto cards, users can tap into over 100 million merchants worldwide. The latest offerings go far beyond basic functionality: they deliver instant settlements, low fees, privacy options, and even rewards for spending crypto as fiat.

Meet the Market Leaders: Top 10 Stablecoin Cards for 2025

Top 10 Stablecoin Cards for 2025: Spend Crypto Globally

-

KAST Card: Multi-chain card supporting stablecoins and major cryptocurrencies. Enhanced SOL staking rewards and global acceptance at over 100 million merchants. Offers seamless crypto-to-fiat conversion and real-time spending.

-

Bitget Wallet Card: Designed for stablecoin users seeking low fees and global spending. Supports USDT, USDC, and DAI with no conversion hassles. Accepted worldwide for both online and in-store purchases.

-

Wirex Card: Global crypto-fiat debit card offering up to 8% cashback in WXT. Supports multiple stablecoins and cryptocurrencies, with instant conversion and integration with mobile wallets.

-

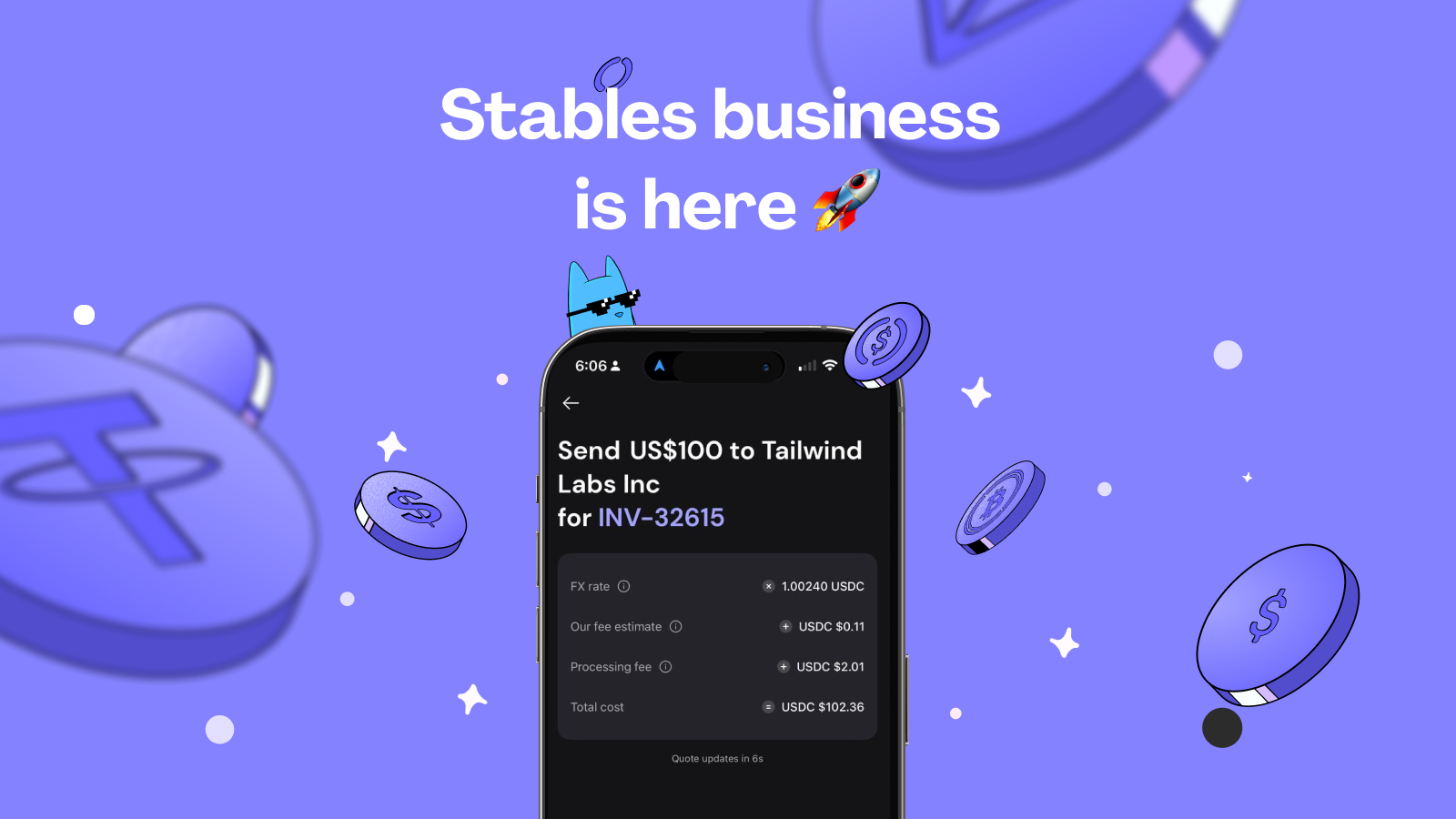

Stables Card: Spend USDT and USDC at over 140 million merchants globally. Enjoy up to 6% rewards, real-time conversions, and best rates. Compatible with Apple Pay and Google Pay for added convenience.

-

Crypto.com Visa Card: Popular card supporting major stablecoins and cryptocurrencies. Offers cashback rewards, airport lounge access, and no annual fees. Accepted by millions of merchants worldwide.

-

Binance Card: Spend stablecoins and crypto directly from your Binance account. Up to 8% cashback on eligible purchases, low fees, and broad merchant acceptance via the Visa network.

-

Nexo Card: Use stablecoins and crypto for everyday spending with up to 2% cashback. No monthly or annual fees, and supports both credit and debit-style transactions.

-

Bybit Card: Enables seamless spending of USDT, USDC, and other supported assets. Features real-time conversion, low fees, and global usability for both online and offline purchases.

-

Monolith Visa Debit Card: Non-custodial, Ethereum-based card supporting DAI and other ERC-20 tokens. Spend crypto as fiat at any merchant accepting Visa, with a focus on privacy and security.

-

ClubSwan Card: Premium card for high-net-worth individuals. Supports major stablecoins, multi-currency spending, luxury perks, and concierge services, making it ideal for frequent travelers and global users.

Let’s break down what makes these standout cards unique:

- KAST Card: A multi-chain powerhouse with enhanced SOL staking rewards and support for spending stablecoins at more than 100 million locations globally.

- Bitget Wallet Card: Designed for low-cost global payments using USDT, USDC, or DAI – perfect if you want to avoid conversion hassles while traveling or shopping online.

- Wirex Card: Offers up to 8% cashback in WXT tokens depending on your plan, plus seamless integration with both crypto and fiat balances.

- Stables Card: Spend USDT or USDC at over 140 million merchants worldwide; earn up to 6% rewards and enjoy real-time conversions with competitive rates (source).

- Crypto. com Visa Card: Known for its tiered cashback system and perks such as free Spotify or Netflix subscriptions when you stake CRO tokens.

- Binance Card: Supports multiple cryptocurrencies including major stablecoins; comes with up to 8% cashback on purchases (depending on BNB holdings).

- Nexo Card: Lets you spend without selling your crypto by borrowing against it instantly; supports popular stablecoins like USDT and USDC.

- Bybit Card: Offers fast settlement speeds and low fees when spending stablecoins across global merchants.

- Monolith Visa Debit Card: Built on Ethereum, this card allows direct spending of DAI and ETH without intermediaries.

- ClubSwan Card: Focuses on high-end users seeking privacy and concierge services while enabling global stablecoin spending.

The innovation here isn’t just technical – it’s about giving people true financial flexibility regardless of borders or banking status.

– Maya Thornton (@mayathornton)

The Mechanics: How Do Stablecoin Cards Work?

The magic lies in instant conversion. When you swipe one of these crypto payments cards, the provider deducts the equivalent amount from your stablecoin balance (say USDT), converts it into local fiat currency in real time, then settles the transaction just like any regular debit or credit card would. Merchants receive their preferred currency without ever touching crypto themselves – all while users retain control over their digital assets until the moment they spend them.

This model offers several advantages:

- No need to pre-convert assets before travel or online shopping;

- No exposure to volatile coins if you stick with major stables like USDT/USDC/DAI;

- Simplified tax reporting since each transaction is transparently recorded;

- The ability to earn rewards (cashback or staking) directly from your regular purchases.

Each card in the 2025 lineup brings its own flavor to the table, catering to a variety of user needs and preferences. Whether you’re chasing rewards, prioritizing privacy, or seeking the lowest fees, there’s a stablecoin debit card designed for your lifestyle.

Comparing Features: What Sets Each Card Apart?

Let’s take a closer look at how these top stablecoin cards stack up on key criteria:

Top 10 Stablecoin Cards for 2025: Feature Comparison

| Card Name | Supported Stablecoins | Global Acceptance | Fees | Rewards | Privacy | Unique Perks |

|---|---|---|---|---|---|---|

| KAST Card | USDT, USDC, SOL, DAI, more | 100M+ merchants (Visa/Mastercard) | Low conversion & transaction fees | Enhanced SOL staking rewards | Standard KYC/AML | Multi-chain support, high staking APY |

| Bitget Wallet Card | USDT, USDC, DAI | Global (Visa) | Very low fees | Cashback up to 3% | Privacy mode for select transactions | No conversion hassles, direct stablecoin spending |

| Wirex Card | USDT, USDC, DAI, BTC, ETH, more | Global (Visa/Mastercard) | Low to moderate, depends on plan | Up to 8% cashback (WXT) | Standard KYC/AML | Flexible plans, crypto & fiat spending |

| Stables Card | USDT, USDC | 140M+ merchants (Visa) | Low fees, real-time conversion | Up to 6% rewards | Standard KYC/AML | Add to Apple/Google Pay, best rates |

| Crypto.com Visa Card | USDT, USDC, DAI, BTC, ETH, CRO | Global (Visa) | Low to moderate, tiered | Up to 5% cashback (CRO) | Standard KYC/AML | Airport lounge access, Spotify/Netflix rebates |

| Binance Card | USDT, USDC, BUSD, BTC, ETH, BNB | Global (Visa) | Low, no annual fee | Up to 8% cashback (BNB) | Standard KYC/AML | Spend from Binance wallet, instant conversion |

| Nexo Card | USDT, USDC, DAI, BTC, ETH, NEXO | Global (Mastercard) | No monthly/annual fees | Up to 2% crypto/cashback | Standard KYC/AML | No credit checks, spend without selling crypto |

| Bybit Card | USDT, USDC, BTC, ETH | Global (Mastercard) | Low fees | Up to 2% cashback | Standard KYC/AML | Seamless integration with Bybit exchange |

| Monolith Visa Debit Card | DAI, ETH | Europe (Visa) | No monthly fees, some transaction fees | No direct rewards | Enhanced privacy features | Non-custodial, spend directly from wallet |

| ClubSwan Card | USDT, USDC, BTC, ETH, EUR, GBP | Global (Visa) | Tiered fees, depends on membership |

KAST Card stands out for multi-chain flexibility and enhanced SOL staking rewards, ideal if you’re already active in the Solana ecosystem. Bitget Wallet Card is all about low fees and simplicity for stablecoin spenders who want frictionless global access. Wirex Card leans into generous cashback (up to 8% in WXT), making it a favorite among high-frequency users who value ongoing rewards.

The Stables Card, with its real-time conversion and up to 6% rewards (source), has become a go-to option for travelers and digital nomads who demand both flexibility and savings. Meanwhile, Crypto. com Visa Card attracts users with its tiered perks, think free streaming subscriptions and airport lounge access when you stake CRO.

If you’re after maximum crypto support and high cashback potential, Binance Card is hard to beat, especially if you hold BNB. The Nexo Card offers a unique twist: spend without selling your crypto by borrowing against it instantly. For those focused on privacy or DeFi integration, Monolith Visa Debit Card (built on Ethereum) and ClubSwan Card (with concierge services) are compelling choices.

Privacy and Security: The Anon Edge

An emerging trend in 2025 is the push toward greater user privacy. Cards like ClubSwan cater to high-net-worth individuals seeking discretion alongside global spending power. For everyday users, many providers now offer robust security features such as two-factor authentication, virtual card numbers for online purchases, and even anonymous onboarding options where regulations permit.

This focus on privacy doesn’t mean sacrificing convenience. In fact, most leading stablecoin cards allow seamless integration with Apple Pay or Google Pay, so you can spend USDT globally from your phone while keeping personal details protected.

The Future of Crypto-to-Fiat Spending

The landscape for crypto payments cards is evolving rapidly as adoption grows worldwide. With regulatory clarity improving in key markets and payment giants like Visa piloting new stablecoin initiatives (read more here), mainstream use of these tools is only set to accelerate.

If you’re considering jumping in, remember that not all cards are created equal. Compare fee structures carefully, some charge for ATM withdrawals or currency conversion while others include perks that may offset costs if used strategically. Also consider which stablecoins are supported; most leading options focus on USDT, USDC, or DAI due to their liquidity and stability.

Getting Started: Choosing Your Stablecoin Card

Selecting the right card comes down to your priorities:

- If you value rewards: Look at Wirex or Binance for high cashback rates.

- If low fees matter most: Bitget Wallet Card or Stables Card offer competitive pricing for frequent spenders.

- If privacy is paramount: ClubSwan or Monolith deliver advanced security features without sacrificing usability.

- If flexibility is key: KAST’s multi-chain support ensures compatibility across ecosystems.

The bottom line? The best stablecoin debit card isn’t just about spending, it’s about empowering your financial independence wherever life takes you. As crypto continues its march toward mainstream finance, these cards are quietly turning digital assets into everyday money, one tap at a time.