Crypto users seeking privacy and flexibility in managing digital assets are increasingly exploring the world of stablecoin cards for off-ramping. These innovative cards act as a bridge between blockchain-based stablecoins and everyday fiat spending, allowing you to spend crypto like cash at millions of merchants worldwide. But how anonymous is this process, really? And what should you know before using a stablecoin card to convert crypto to fiat?

Stablecoin Cards: The Bridge Between Crypto and Traditional Finance

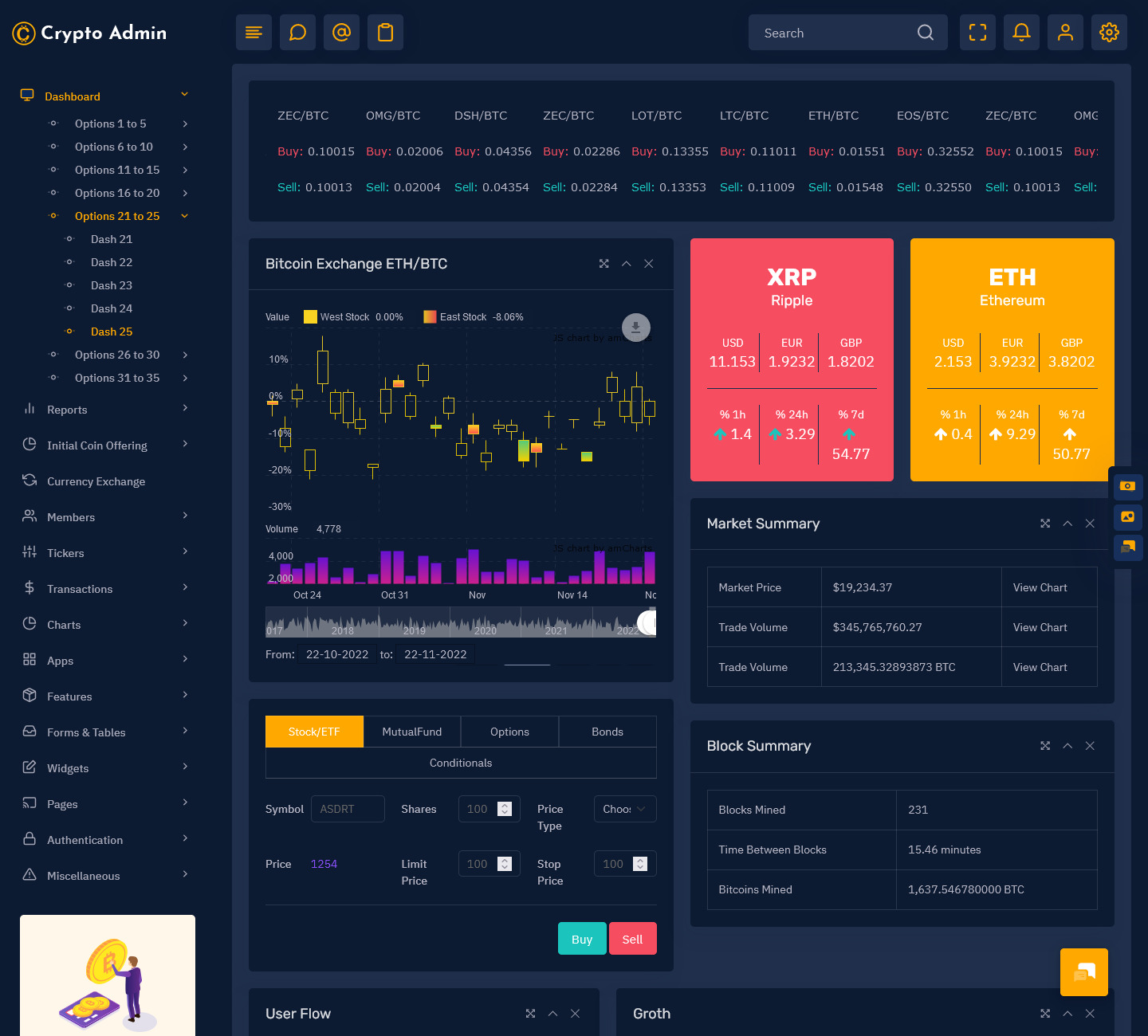

The rise of stablecoin-linked payment cards has transformed how users interact with both digital and traditional financial systems. With partnerships like Baanx and Visa, it’s now possible to spend USDC or other major stablecoins directly from your self-custodial wallet at any merchant that accepts Visa. The magic happens behind the scenes: when you swipe your card, your stablecoins are instantly converted to fiat currency in real time, completing the transaction seamlessly.

This integration offers a level of convenience that was once unimaginable for crypto holders. Instead of waiting days for bank transfers or relying on centralized exchanges, you get immediate access to your funds wherever you are. Read more about these partnerships here.

The Challenges of True Anonymity with Stablecoin Cards

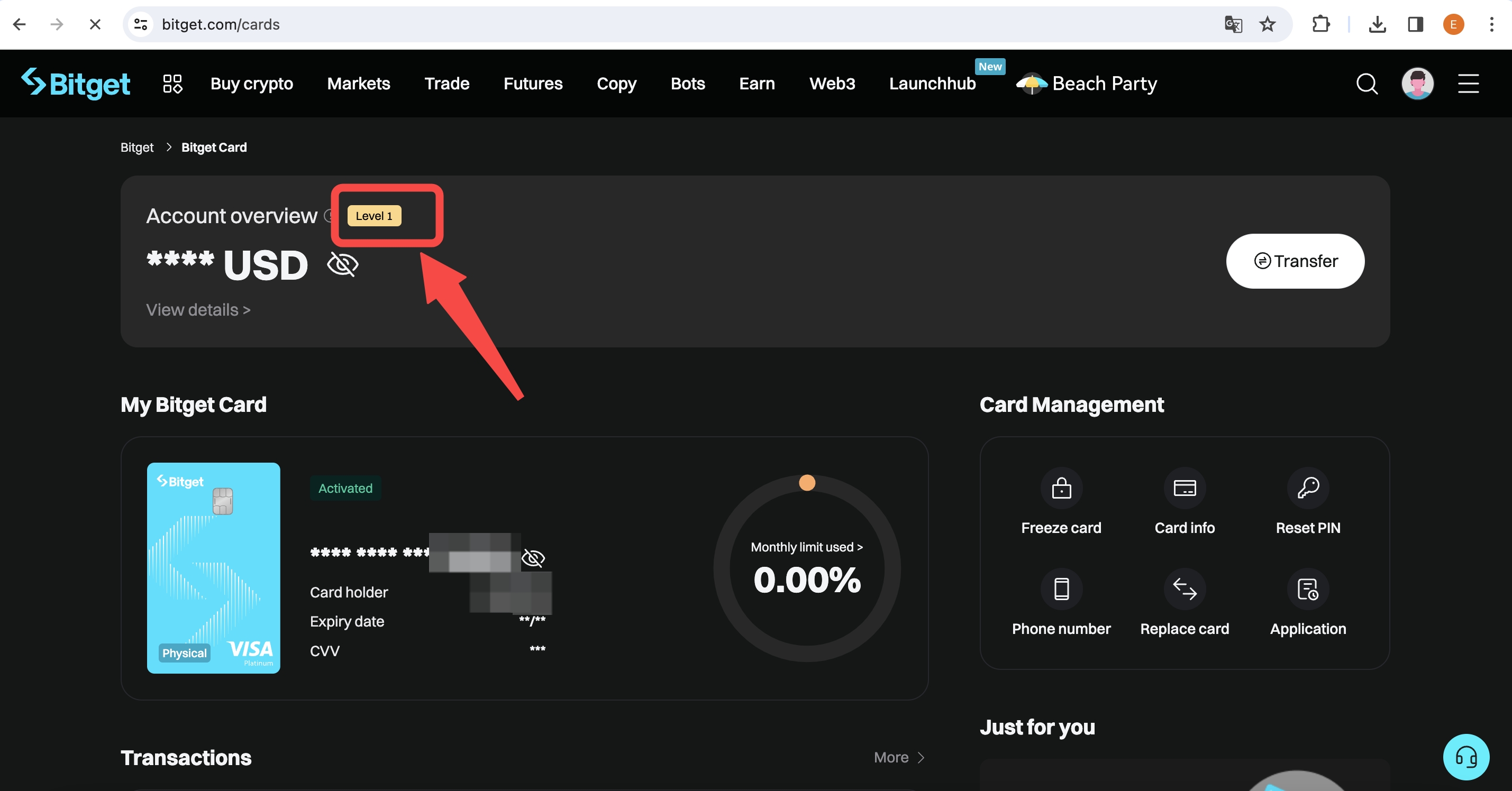

While the technology is impressive, achieving true anonymity when off-ramping via stablecoin cards remains elusive. Regulatory requirements force card issuers and payment networks to implement strict Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. This means that if you want to use a physical or virtual stablecoin card tied into the global Visa or Mastercard network, you’ll almost certainly have to provide personal information.

This is not just an inconvenience; it’s by design. Financial regulators worldwide mandate these checks to prevent illicit activity. As such, anyone advertising fully anonymous off-ramp solutions via major card networks is either misleading or operating in a legal gray area.

Key Differences: KYC-Enabled vs. Anonymous Crypto Off-Ramps

-

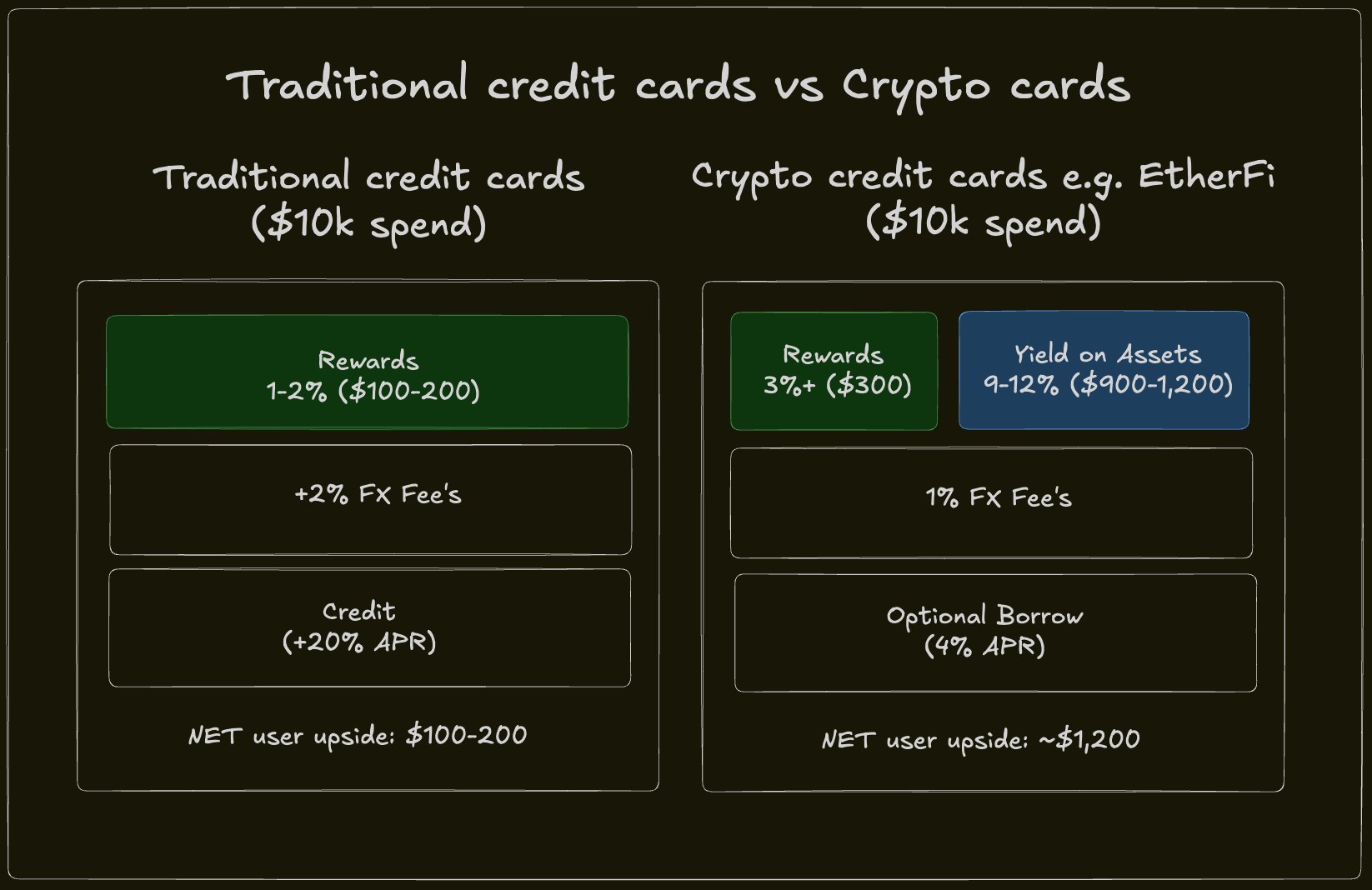

KYC Verification Requirements: KYC-enabled off-ramps—such as Visa/Baanx stablecoin cards—require users to submit personal identification to comply with regulatory standards. Anonymous methods (e.g., AnonSwap) allow crypto-to-fiat conversion with minimal or no identity checks, depending on transaction size and jurisdiction.

-

Transaction Limits and Accessibility: KYC-enabled platforms typically offer higher transaction limits and broader access to payment networks. Anonymous off-ramps often impose lower transaction caps and may restrict service based on region or compliance policies.

-

Privacy and Data Security: KYC-enabled methods store user data for compliance, potentially exposing it to third parties. Anonymous off-ramps prioritize user privacy and limit data collection, but may lack the consumer protections of regulated services.

-

Fees and Costs: Anonymous off-ramp services usually charge higher fees due to increased risk and operational complexity. KYC-enabled platforms, like Visa-backed stablecoin cards, often offer lower transaction fees and more transparent pricing.

-

Legal and Regulatory Risks: KYC-enabled off-ramps operate within established legal frameworks, reducing the risk of account freezes or legal issues. Anonymous methods may violate local laws or face sudden restrictions, exposing users to potential legal consequences.

Private Alternatives: Non-Custodial Swaps and Minimal-KYC Off-Ramps

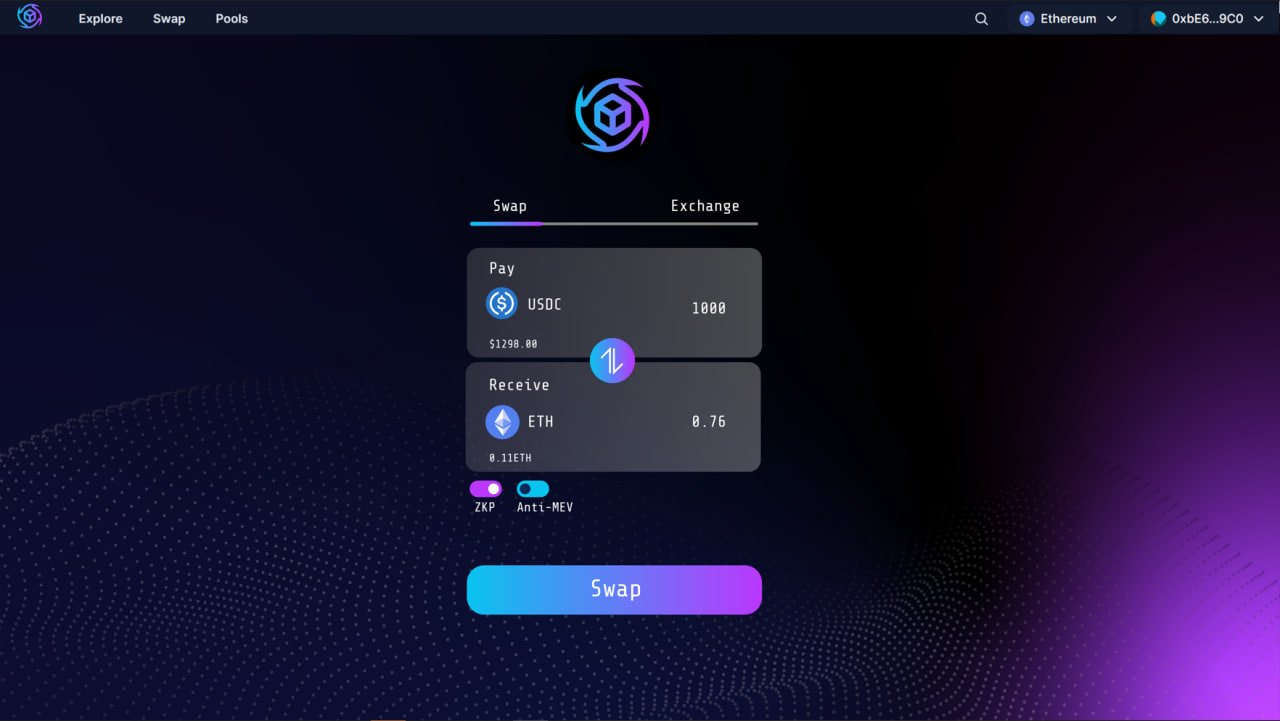

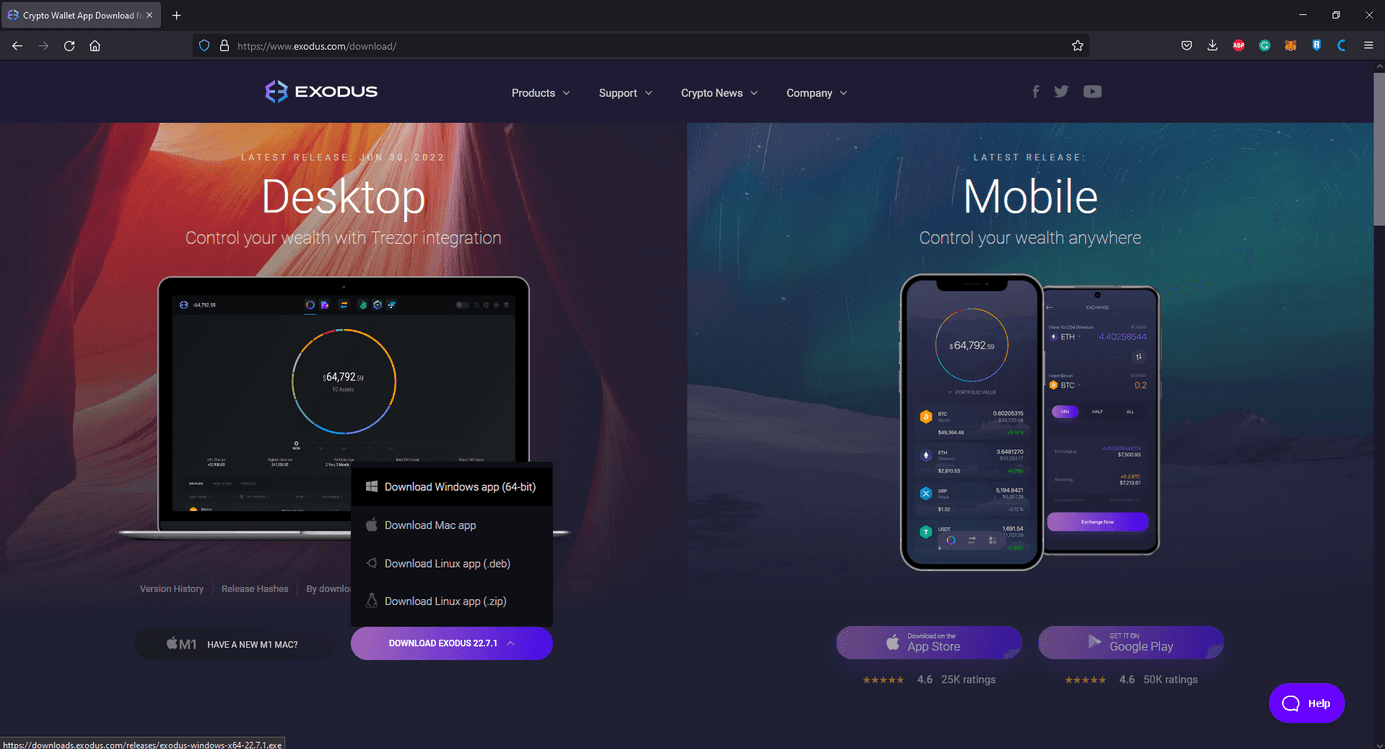

If privacy is your top priority, alternative methods exist outside the mainstream card ecosystem. Non-custodial no-KYC exchanges like AnonSwap let users swap cryptocurrencies anonymously; some platforms also facilitate minimal-KYC off-ramps depending on transaction size and jurisdictional rules. For example, combining AnonSwap’s anonymous swaps with platforms like ChangeNOW can allow partial privacy when moving from crypto into fiat – but always check current local regulations before proceeding.

It’s important to note these private options often come with trade-offs including higher fees, smaller transaction limits, slower processing times, or even legal risks depending on where you live. Privacy advocates should weigh these factors carefully before choosing their preferred method.

Why Stablecoins Are Central in Modern Off-Ramping

Stablecoins, such as USDC or USDT, combine the best aspects of fiat stability with blockchain speed and accessibility. This makes them ideal for anyone looking to move value across borders quickly without volatile price swings associated with Bitcoin or Ethereum.

The growing infrastructure around stablecoins – including wallets, payment gateways, and on/off-ramp services – points toward a future where moving between decentralized assets and traditional money becomes ever more seamless.

As the ecosystem matures, stablecoin cards are becoming a vital tool for crypto holders who value both efficiency and global access. Yet, for those seeking maximum privacy, the landscape is nuanced. While mainstream stablecoin cards offer speed and convenience, true anonymity often requires stepping outside conventional rails into the realm of peer-to-peer trades or low-KYC platforms.

For many, the decision comes down to risk tolerance and priorities. If your primary goal is to quickly convert crypto to fiat for daily spending, a stablecoin card linked to Visa or Mastercard is hard to beat. You’ll benefit from instant conversion, widespread merchant acceptance, and robust customer protections, but at the cost of sharing personal information with issuers and payment processors.

Navigating Compliance and Privacy in 2025

It’s crucial to understand that regulatory scrutiny is only increasing as crypto adoption grows. Stablecoin card providers must comply with anti-money laundering directives and international standards like ISO 20022 for seamless interoperability (source). This means that even innovative solutions are constrained by evolving laws, especially in regions where regulators are tightening their grip on digital asset flows.

For users determined to maintain privacy during off-ramping, consider these key strategies:

Top Tips for Maximizing Privacy When Off-Ramping Crypto

-

Use Non-Custodial, No-KYC Crypto Exchanges: Platforms like AnonSwap and ChangeNOW allow users to swap cryptocurrencies with minimal or no identity verification, depending on transaction size and jurisdiction. This can help preserve privacy when converting crypto to fiat, but always review local regulations before proceeding.

-

Limit Transaction Sizes to Avoid Triggering KYC: Many platforms only require KYC for transactions above certain thresholds. By keeping off-ramp amounts below these limits, you may reduce the need to provide personal information. However, be aware that splitting transactions to circumvent rules can be flagged as suspicious activity.

-

Utilize Self-Custodial Wallets Linked to Stablecoin Cards: Using stablecoin cards (such as those offered via Baanx and Visa partnerships) from self-custodial wallets gives you more control over your funds. While KYC is still required, self-custody minimizes exposure to third-party custodians and enhances privacy compared to custodial solutions.

-

Consider Peer-to-Peer (P2P) Off-Ramping Methods: Platforms like LocalBitcoins and Paxful facilitate P2P crypto-to-cash exchanges, sometimes with limited KYC requirements. Meeting in person or using cash-based methods can increase privacy, but always prioritize safety and verify counterparties.

-

Research Local Regulations and Legal Risks: Privacy-focused off-ramping methods may be subject to additional scrutiny or legal restrictions in some jurisdictions. Stay informed about local laws and ensure compliance to avoid unintended consequences.

1. Use non-custodial wallets where you control your keys.

2. Explore decentralized exchanges (DEXs) that require no account registration.

3. Limit transaction sizes to stay below KYC thresholds, where legal.

4. Research local laws before using P2P cash trades or minimal-KYC services.

5. Always weigh extra fees against your desired level of anonymity.

Balancing Speed, Security, and Anonymity

The best approach often blends several tools: a stablecoin card for everyday flexibility, paired with selective use of anonymous swaps or P2P deals when privacy is paramount. Remember that while stablecoins add a layer of stability compared to volatile cryptocurrencies, every off-ramp method carries trade-offs between security, cost, speed, and privacy.

Pro Tip: Always move small amounts first when testing new platforms or methods, especially if they promise no KYC or enhanced anonymity.

The future of private crypto-to-fiat conversion will likely be shaped by ongoing regulatory developments as well as technological innovation in wallet design and decentralized finance protocols. As more merchants accept digital assets directly, and as compliance frameworks mature, users may find it easier than ever to choose their preferred balance between transparency and privacy.

No matter which route you choose, staying informed about evolving regulations and platform reputations is essential. The world of private crypto withdrawals continues to evolve rapidly; those who keep learning will be best positioned to manage their assets securely, and on their own terms.