Stablecoins have become the backbone of digital asset markets, with USDT and USDC accounting for a staggering 88% of the total stablecoin market cap as of January 2025. Yet, even as stablecoins like USDT maintain a tight peg to the US dollar, trading at $1.00 on Polygon, users and platforms have long struggled with friction in moving between crypto and fiat. Enter the new era of Layer 1 stablechains, purpose-built to optimize stablecoin flows and revolutionize on/off-ramp solutions.

Why Stablechains Are the Missing Link in Crypto On/Off-Ramps

Traditional blockchains, even those with thriving stablecoin ecosystems, were not designed with stablecoins as native assets. This means users often need to juggle volatile tokens for gas fees, navigate unpredictable transaction costs, and face congestion or high latency during network spikes. For anyone seeking seamless, private, and predictable stablecoin on/off-ramp experiences, these are major hurdles.

Layer 1 stablechains like Stable are flipping the script. By making USDT the native token for both gas and settlements, Stable eliminates the need to ever touch a volatile asset just to move your stablecoins. Users pay fees in USDT, not in an unrelated network token, making costs transparent and predictable. For privacy advocates and cross-border operators, this is a game-changer.

This architecture also enables sub-second finality and fees below one cent, making microtransactions, retail payments, and international remittances both viable and cost-effective. The result: a frictionless bridge between the crypto economy and the real world, with stablecoin onramp solutions finally matching the speed and reliability of legacy payment rails.

How Stable L1 Is Changing the Game for USDT Users

The launch of Stable, a Bitfinex-backed, EVM-compatible Layer 1, marks a pivotal moment for stablecoin infrastructure. Unlike general-purpose blockchains, Stable is purpose-built for USDT, leveraging deep liquidity and direct integration with the Tether ecosystem. Its features include:

- USDT as the universal gas token: No more swapping to ETH, MATIC, or other volatile assets to cover fees.

- High throughput: Thousands of transactions per second, with no risk of congestion.

- Developer-friendly toolkits: SDKs, APIs, and human-readable wallet aliases to simplify onboarding and app creation.

- Integrated fiat on-ramps: The Stable Wallet enables direct fiat-to-USDT onboarding, smoothing the user journey.

By focusing on the needs of both users and developers, Stable is quickly becoming the primary venue for USDT transactions, whether for cross-chain transfers, payments, or DeFi applications. Its backing by Bitfinex and the Tether development team ensures strong network effects, deep liquidity, and rapid adoption.

Stable’s Role in the Battle for Stablecoin Blockchain Dominance

The rise of Layer 1 stablechains like Stable is not happening in a vacuum. Competing blockchains such as Plasma, also Bitfinex-backed, are pursuing zero-fee USDT transfers and high throughput, but Stable’s unique approach, using USDT as the native gas token, sets it apart. This design addresses longstanding inefficiencies, making it easier than ever to move funds in and out of the crypto ecosystem.

For industries like iGaming, global e-commerce, and emerging markets, Stable’s deep USDT liquidity and predictable fee structure are major advantages. Operators can now build private stablecoin offramps that rival traditional banking rails in speed and reliability, while maintaining the privacy and programmability unique to crypto-native solutions. For a deeper dive into the technical innovations behind Stable, see how Layer 1 stablechains like Stable are transforming stablecoin on/off-ramps in 2025.

Tether (USDT) Price Prediction 2026–2031

Projected USDT Price Ranges Amid Layer 1 Stablechain Innovations and Evolving Stablecoin Markets

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | Annual % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | +0% | USDT maintains its peg due to robust adoption on Stable and Plasma L1s; minor depegs possible during high volatility. |

| 2027 | $0.97 | $1.00 | $1.03 | +0% | Integration of USDT as native gas on Stable/Plasma boosts liquidity; possible regulatory scrutiny could cause brief volatility. |

| 2028 | $0.96 | $1.00 | $1.04 | +0% | Global cross-border adoption grows, but competition from CBDCs and algorithmic stablecoins introduces pricing pressure. |

| 2029 | $0.95 | $1.00 | $1.05 | +0% | Regulatory clarity in key markets supports USDT’s use; LayerZero cross-chain compatibility expands use cases. |

| 2030 | $0.94 | $1.00 | $1.06 | +0% | USDT’s role as default settlement asset on stablechains strengthens, but market cap growth slows as sector matures. |

| 2031 | $0.93 | $1.00 | $1.07 | +0% | Potential for minor depegs from black swan events; otherwise, USDT remains the dominant stablecoin with high stability. |

Price Prediction Summary

USDT is expected to maintain its 1:1 peg to the US Dollar through 2031, with minor deviations possible during periods of extreme market stress or regulatory intervention. The emergence of Layer 1 stablechains like Stable and Plasma, combined with deep liquidity and new on/off-ramp infrastructure, reinforces USDT’s dominant position. However, increased competition from CBDCs and evolving regulatory frameworks may introduce short-term volatility or depegging risks.

Key Factors Affecting Tether Price

- Adoption of Layer 1 stablechains (Stable, Plasma) as USDT-native settlement layers

- Expansion of global on/off-ramps and fiat integration

- Regulatory developments impacting stablecoin reserves and transparency

- Potential for increased competition from other stablecoins and CBDCs

- Technological improvements in speed, cost, and cross-chain interoperability

- Market confidence in Tether’s reserve backing and transparency

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Stable’s emergence as a Layer 1 stablechain USDT solution is more than a technological upgrade, it’s a reimagining of the user experience for stablecoin onramp solutions. By removing friction points and aligning incentives for both users and developers, Stable is setting a new standard for what seamless, secure, and private stablecoin infrastructure should look like.

What Sets Stable Apart for On/Off-Ramp Users?

For individuals and businesses seeking reliable on/off-ramps, Stable’s architecture offers several tangible benefits:

Key Advantages of Stable L1 for USDT On/Off-Ramping

-

Native USDT Gas & Settlement: Stable L1 allows users to pay transaction fees and settle directly in USDT, eliminating the need for volatile native tokens and simplifying the on/off-ramp process.

-

Ultra-Low Transaction Costs: With fees reportedly below one cent per transaction, Stable L1 offers cost-effective USDT transfers, making it ideal for cross-border payments and high-frequency use cases.

-

Sub-Second Finality & High Throughput: The blockchain achieves sub-second transaction finality and supports thousands of transactions per second, ensuring fast and reliable USDT on/off-ramping even during peak network activity.

-

Integrated Fiat On-Ramps: The Stable Wallet features built-in fiat on-ramp options, streamlining user onboarding and making it easier to move between traditional finance and USDT on-chain.

-

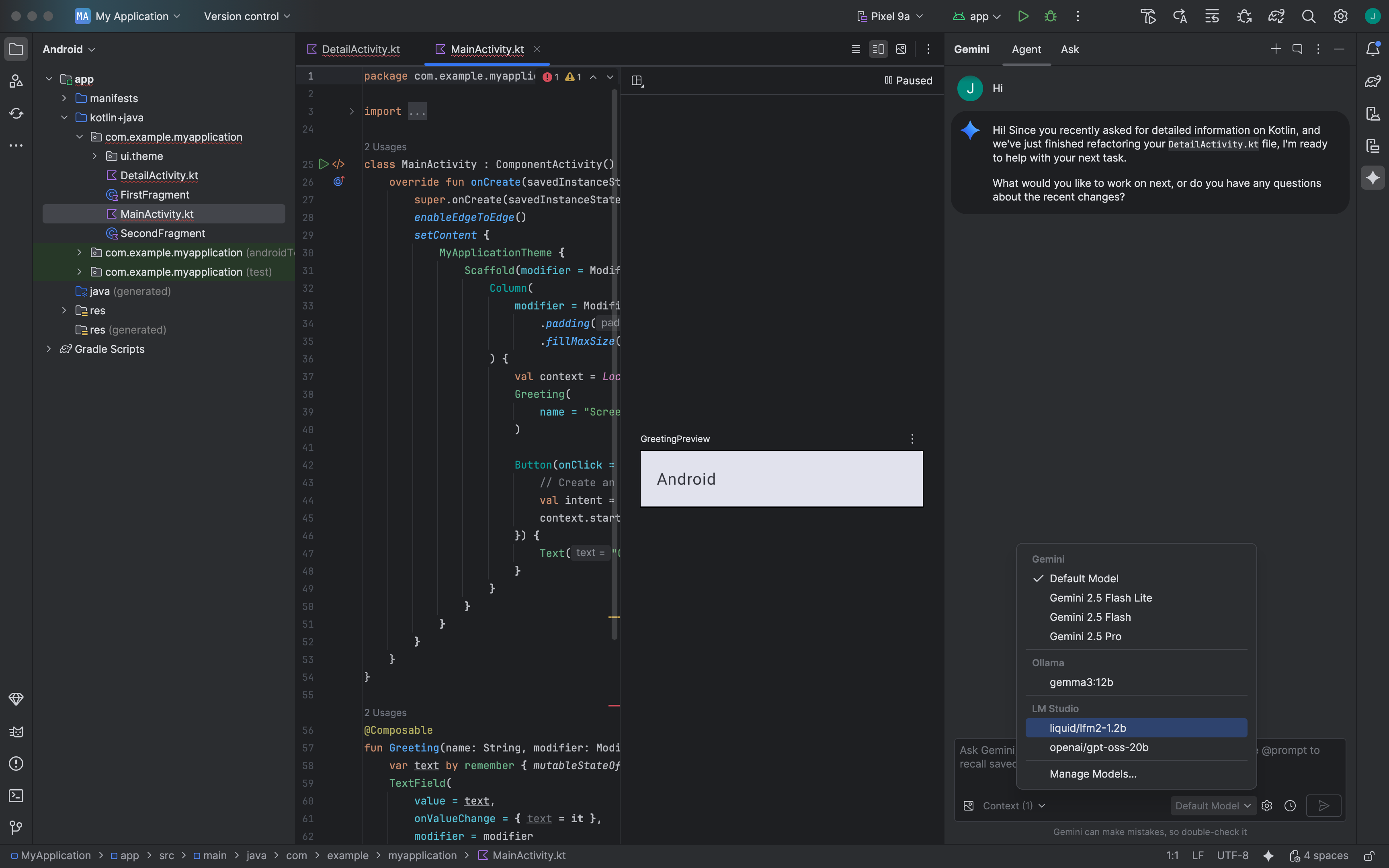

Developer-Friendly Ecosystem: Stable provides a robust SDK and APIs for building USDT-centric applications, empowering developers to create seamless payment, lending, and DeFi solutions.

-

Enhanced Interoperability: Backed by Bitfinex and leveraging LayerZero’s cross-chain messaging, Stable enables seamless USDT transfers across multiple blockchain ecosystems.

1. True cost transparency: With USDT as the gas token and a current price of $1.00, users always know their transaction costs, no more guessing or hedging against volatility.

2. Sub-second settlement: Funds are available almost instantly, supporting everything from payroll and remittances to high-frequency trading.

3. Enhanced privacy: Stable’s infrastructure is compatible with privacy-focused wallets and off-ramp providers, helping users maintain control of their financial footprint.

4. Direct fiat integration: On-ramp and off-ramp flows are streamlined, with built-in support for fiat onboarding and withdrawal through the Stable Wallet.

These features are particularly attractive for operators in emerging markets, cross-border e-commerce, and anyone who values the predictability and stability of USDT. As stablecoin-powered payments become more mainstream, the demand for private stablecoin offramps will only grow.

Interoperability and the Future of Stablecoin Liquidity

Stable’s integration with LayerZero’s messaging protocol and USDT0 cross-chain transfer technology is a leap forward for interoperability. Users can now move assets across multiple blockchains without complicated bridging steps or liquidity fragmentation. This not only improves user experience but also deepens the liquidity pools available for on/off-ramp providers.

For those building the next generation of DeFi apps, payment platforms, or even gaming ecosystems, Stable’s robust SDKs, APIs, and human-readable wallet aliases lower the barrier to entry. Developers can focus on product innovation rather than infrastructure headaches.

What Does This Mean for the Broader Crypto Ecosystem?

The rise of Stable blockchain Bitfinex and similar Layer 1 stablechains signals a maturation of the stablecoin market. As users demand more utility, privacy, and predictability from their digital dollars, platforms like Stable are uniquely positioned to deliver. The days of juggling multiple tokens for simple transfers are numbered.

For a closer look at how USDT-native blockchains are changing the on/off-ramp landscape, check out how Stablechain is transforming stablecoin on/off-ramps with USDT gas fees.

Navigating the New Rails: What Comes Next?

With USDT holding steady at $1.00 and Stable’s mainnet now live, we’re witnessing the start of a migration to purpose-built stablecoin infrastructure. For privacy advocates, global businesses, and everyday users, this means faster, cheaper, and more private access to the crypto economy, without the headaches of legacy blockchains.

As competition heats up among Layer 1 stablechains, expect further innovation in fee structures, privacy features, and cross-chain liquidity. The next wave of stablecoin adoption will be driven not just by speculation, but by utility and ease of use. Stable is already leading the charge.