Imagine sending USDT to a friend, paying a merchant, or cashing out to fiat, all without worrying about gas fees or sluggish confirmations. That’s not a future fantasy – it’s exactly what Stablechain is bringing to the stablecoin table right now. As stablecoin infrastructure rapidly evolves, Stablechain’s dedicated Layer 1 for USDT is setting a new bar for seamless, efficient payments and real-world usability.

Stablechain’s Game-Changer: Gas-Free USDT Transfers

For years, stablecoin users have been at the mercy of unpredictable network fees and convoluted token juggling. Most blockchains require holding a separate, often volatile, token just to pay for gas. Stablechain flips this script by letting you use USDT as the native gas token. That’s right: you can send, spend, or swap USDT without ever touching ETH, SOL, or any other coin for fees.

How does Stablechain pull this off? The magic is in its implementation of EIP-7702 and Account Abstraction. These upgrades allow for gas-free peer-to-peer USDT transfers, with the protocol itself covering transaction costs for users. No more sweating over fee spikes or hunting for the right token to pay for gas – just pure, frictionless USDT movement.

Sub-Second Finality: Instant Payments, Zero Stress

Speed is king in both crypto and payments. Stablechain delivers sub-second block times and single-slot finality, meaning your USDT transfer is not only lightning-fast but also instantly settled. This is a massive leap from legacy blockchains where transactions can hang in limbo for minutes, or even hours during network congestion.

For businesses and traders, this means real-time settlement for everything from payroll to cross-border remittances and high-frequency trading. For everyday users, it’s the peace of mind that comes with knowing your payment is done and dusted the moment you hit send.

On/Off-Ramp Use Cases: Bridging Crypto and Fiat Without the Headache

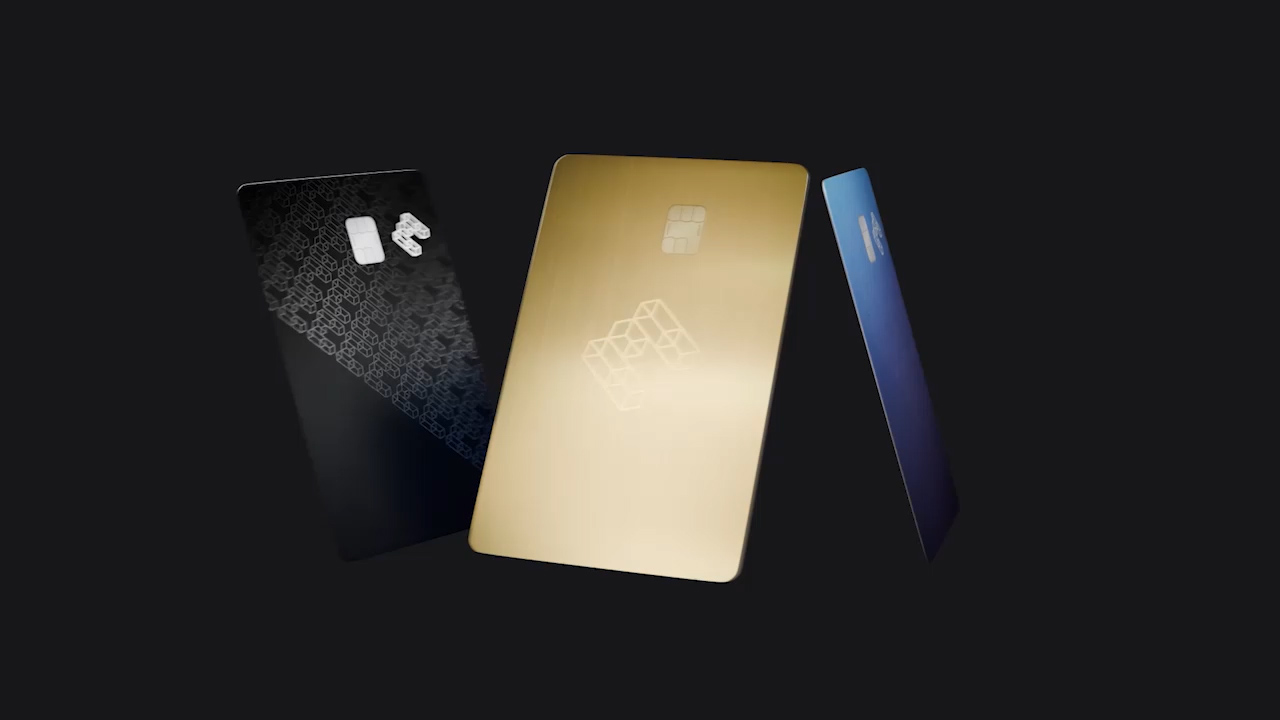

Stablechain isn’t just a tech flex for crypto nerds. Its real-world value shines in on/off-ramp scenarios – those crucial moments when you need to convert between crypto and fiat smoothly. With the Stable Wallet, users get human-readable wallet aliases and built-in fiat on-ramps. Translation: onboarding is dead simple, and moving funds between your bank account and your USDT wallet is no longer a multi-step ordeal.

Key Use Cases for Stablechain’s On/Off-Ramp Solutions

-

Instant Cross-Border Remittances: Stablechain enables gas-free, real-time USDT transfers across borders, letting users send and receive funds globally without worrying about network fees or delays.

-

Seamless Fiat On/Off-Ramps: With integrated fiat on-ramp partners in the Stable Wallet, users can easily convert between USDT and local currencies, making it simple to move funds between traditional bank accounts and stablecoins.

-

Payroll and Mass Payouts: Businesses can leverage Stablechain’s sub-second finality and zero-fee USDT transfers to pay employees or contractors instantly, anywhere in the world, with predictable settlement and no hidden costs.

-

Merchant Payments and Point-of-Sale: Merchants can accept USDT payments via Stablechain with gas-free transactions and human-readable wallet aliases, making crypto payments as easy as using a credit card.

-

Institutional Treasury Management: Stablechain’s Guaranteed Blockspace and USDT Transfer Aggregator provide institutions with reliable, high-throughput settlement rails for managing large-scale USDT flows and optimizing treasury operations.

Features like the USDT Transfer Aggregator (which bundles transactions for efficiency) and Guaranteed Blockspace (ensuring institutions always have room to settle) make Stablechain a powerful backbone for both individual users and enterprises. The result? A stablecoin ecosystem that finally delivers on the promise of fast, cheap, and reliable payments for everyone.

Why This Matters for Modern Crypto Finance

Stablecoin adoption has often been held back by clunky user experiences, unpredictable fees, and the hassle of converting to and from fiat. Stablechain addresses these pain points head-on. By making USDT the heart of both payments and gas fees, and by offering sub-second finality, it paves the way for stablecoins to become a true alternative to traditional banking rails.

Want to dig deeper into how Stablechain is changing the stablecoin game? Check out this deep dive on Stablechain’s USDT-native design or see how it compares to other Layer 1s at DeFi Coverage.

Stablechain’s approach isn’t just a technical upgrade – it’s a shift in how we think about stablecoin payments and the entire on/off-ramp experience. By making USDT the singular asset for both value transfer and network fees, users don’t have to worry about juggling multiple tokens or getting hit with surprise costs. This is a huge leap for privacy advocates and regular users alike, as your transaction history remains streamlined and your interactions are less exposed to third-party tracking.

Let’s break down some of the real-world use cases that are already benefiting from Stablechain’s unique architecture:

Real-World Scenarios Where Stablechain’s Gas-Free USDT Shines

-

Cross-Border Remittances: Sending money abroad is faster and cheaper with Stablechain’s gas-free USDT transfers and sub-second finality. Families and workers can instantly move funds across borders without worrying about high fees or slow settlement.

-

Payroll for Global Teams: Companies can pay employees and contractors worldwide in USDT—no gas fees, no delays. Stablechain’s instant settlement ensures staff receive their earnings on time, every time.

-

Merchant Payments: Retailers and online shops can accept USDT payments with zero network fees. Stablechain’s seamless on/off-ramps make it easy for businesses to convert crypto to fiat and vice versa.

-

High-Frequency Trading & Arbitrage: Traders can move USDT between exchanges in seconds, capitalizing on price differences without being slowed down by network congestion or fees, thanks to Stablechain’s sub-second finality.

-

Peer-to-Peer Payments: Everyday users can send USDT to friends or family instantly, without needing to manage gas tokens or pay extra fees—just simple, direct transfers.

Payroll Distribution: Companies can now pay employees or contractors in USDT, instantly and with zero gas fees. No more waiting for banking hours or paying excessive wire costs. Sub-second finality means funds are available the moment payroll is sent, even across borders.

Cross-Border Remittances: Migrant workers and international families can send funds home without losing a chunk to fees or waiting days for settlement. Stablechain’s gas-free model ensures every cent of value arrives, and instant confirmation means no anxious waiting.

Merchant Payments: Online stores and point-of-sale merchants can accept USDT payments that settle in less than a second, with no backend headaches or volatile token exposure. This opens the door for stablecoin adoption at the cash register – a milestone that’s eluded most blockchains until now.

But Stablechain isn’t stopping there. Its Guaranteed Blockspace feature is a game-changer for institutions and enterprises. By ensuring reliable throughput and predictable settlement, it removes a major barrier for businesses looking to integrate stablecoins into their payment flows. The USDT Transfer Aggregator further boosts efficiency, bundling multiple transactions to keep things humming even during periods of high demand.

What about privacy? Stablechain’s architecture naturally reduces unnecessary data exposure by eliminating the need to hold or move multiple assets just to pay for gas. That’s a big win for privacy-conscious users who want their financial activity to remain as discreet as possible.

Curious how Stablechain stacks up against other stablecoin blockchains? The difference comes down to predictability, speed, and simplicity. With USDT as the native gas token and sub-second confirmation, Stablechain outpaces most Layer 1s and L2s still stuck on legacy fee models or slow settlement.

For anyone serious about crypto to fiat stablecoin integration, this is the missing link. Imagine topping up a stablecoin card, cashing out to your local bank, or sending money abroad – all without the usual friction. That’s exactly the experience Stablechain is delivering.

Looking Ahead: The Future of Stablecoin Payments

As the stablecoin landscape matures, users and enterprises alike are demanding solutions that just work – fast, cheap, and private. Stablechain’s purpose-built design for USDT payments sets a new standard for what’s possible in digital finance. If you’re ready to explore seamless on/off-ramping or want to see how sub-second finality feels in action, it’s time to take a closer look at what Stablechain offers.

For a deeper technical breakdown, check out how Stablechain’s USDT-native blockchain changes on/off-ramping or read the latest industry analysis at DeFi Coverage. The future of stablecoin payments isn’t just coming – with Stablechain, it’s already here.