The stablecoin payments landscape is undergoing a fundamental transformation as USDT emerges not just as a settlement asset, but as a native gas token on new, dedicated blockchains. With the launch of Stable: a Layer 1 blockchain purpose-built for USDT transactions, the paradigm of how digital dollars move across networks is changing rapidly. This shift toward stablecoin-native infrastructure is poised to remove many barriers that have long hindered mainstream adoption and institutional use of stablecoins for real-world payments.

USDT Gas Token: Eliminating Friction in Stablecoin Transactions

Traditionally, making a stablecoin payment on major blockchains like Ethereum or Polygon required users to hold both the stablecoin (such as USDT) and an additional, volatile native token (ETH or MATIC) to cover transaction fees. This dual-token requirement complicates onboarding, creates unnecessary friction at every step, and introduces unpredictable costs due to price volatility in gas tokens. For businesses and individuals seeking predictable dollar-denominated payments, this model falls short.

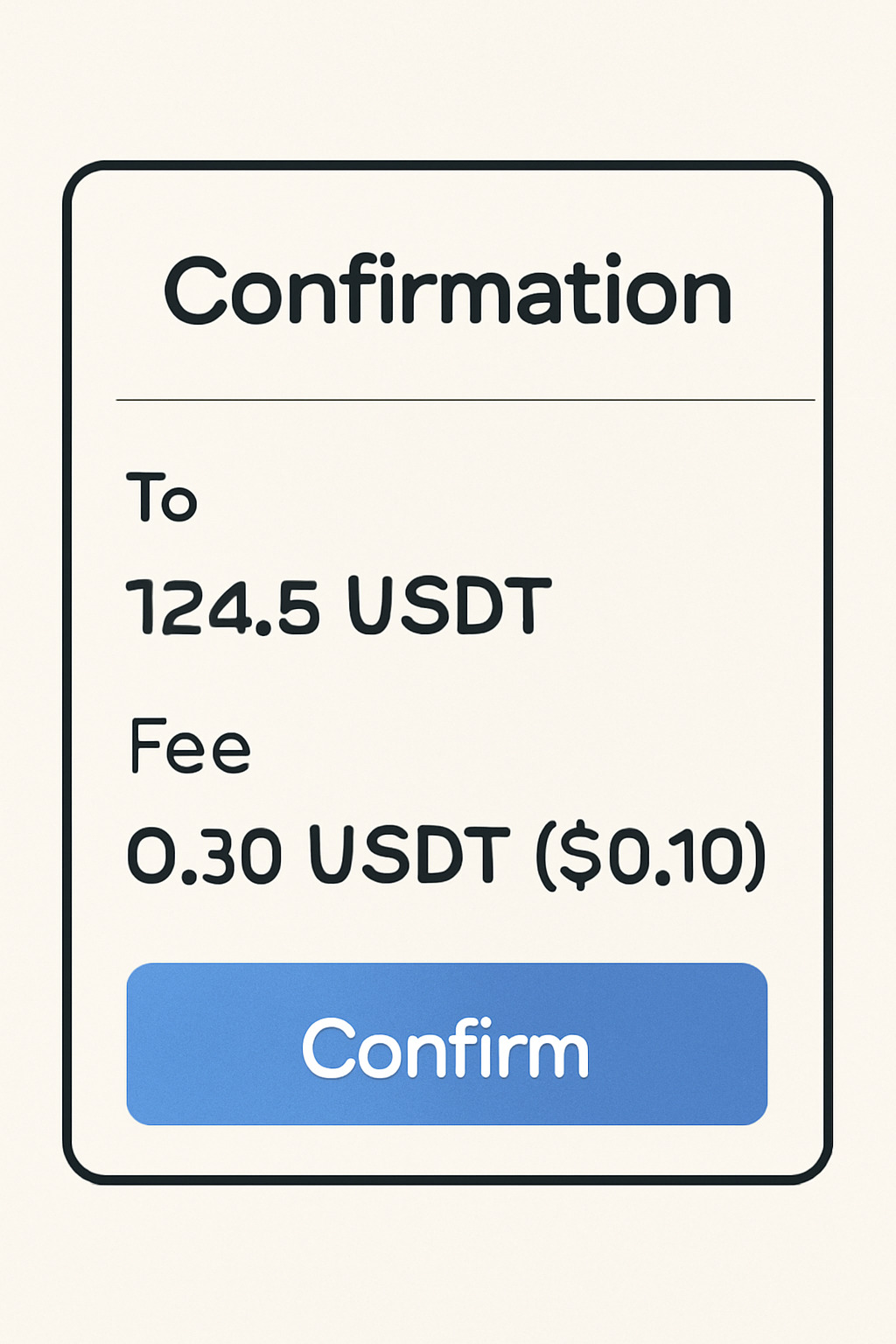

Stable’s architecture solves this by allowing users to pay all network fees directly in USDT, which is currently priced at $1.00 according to the latest Polygon Bridged USDT data. With gas paid in USDT, transaction costs become transparent and predictable, removing exposure to crypto market swings and streamlining the user experience for everyone from retail users to large institutions.

This innovation is more than a technical tweak; it fundamentally aligns the mental model of digital dollars with how end-users expect money to work. There’s no longer a need to manage multiple assets just to send funds, one simply holds USDT, pays in USDT, and receives USDT.

The Rise of Dedicated Stablechains

The emergence of dedicated stablechains like Stable represents a significant leap forward for global payments infrastructure. By optimizing every layer, from consensus mechanisms to fee structures, for stablecoins as the primary medium of exchange, these networks offer several advantages:

- Predictable Fees: No more guessing gas prices or worrying about network congestion spikes; fees are denominated in stablecoins at $1.00 per unit.

- Simplified On/Off-Ramping: Users can move between fiat and crypto with fewer steps since there’s no need for intermediary conversions into native chain tokens.

- EVM Compatibility: Stable maintains compatibility with existing Ethereum tools and wallets, lowering integration barriers for developers and businesses.

- Gas-Free Transfers via LayerZero: With innovations like USDT0, users can send peer-to-peer transfers without incurring any network fees, a breakthrough for microtransactions and remittances.

This architecture is already attracting significant institutional attention: Stable recently closed a $28 million seed round led by prominent crypto investors (source). The influx of capital underscores growing confidence that dedicated stablechains can serve as foundational rails for next-generation digital finance.

The Impact on Privacy and Efficiency in Crypto Payments

Beyond usability improvements, using USDT as a native gas token also enhances privacy and efficiency, two critical concerns for both individuals and enterprises operating in digital finance. By eliminating the need for secondary tokens that can be traced across exchanges or wallets, users gain an added layer of transactional privacy when making cross-border payments or on/off-ramping funds through platforms like anonofframp. com.

This streamlined approach also reduces operational risk: fewer moving parts mean fewer points of failure or compliance headaches when managing digital assets at scale. For privacy advocates and institutional treasurers alike, this model offers an attractive blend of transparency (every transaction visible on-chain) paired with simplicity (no more juggling volatile assets just to pay network fees).

Tether (USDT) Price Stability Prediction Table: 2026-2031

Professional forecast of USDT price stability and volatility as stablecoin adoption accelerates with dedicated Layer 1 stablechains (e.g., Stable) and native USDT gas payments.

| Year | Minimum Price | Average Price | Maximum Price | Annual Deviation (%) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.995 | $1.00 | $1.005 | ±0.5% | Continued dominance as the stablecoin of choice; minor depegs possible during rare liquidity events |

| 2027 | $0.994 | $1.00 | $1.006 | ±0.6% | Stablechain and USDT as gas token gain traction; increased institutional adoption, but regulatory scrutiny rises |

| 2028 | $0.993 | $1.00 | $1.007 | ±0.7% | Global payment rails expand; competition from CBDCs and other stablecoins intensifies, but USDT maintains $1 peg |

| 2029 | $0.992 | $1.00 | $1.008 | ±0.8% | Advanced cross-border settlements; regulatory clarity improves, but isolated stress events could cause minor volatility |

| 2030 | $0.991 | $1.00 | $1.009 | ±0.9% | Matured stablecoin market; technological upgrades maintain peg, but occasional depegs possible during market shocks |

| 2031 | $0.990 | $1.00 | $1.010 | ±1.0% | USDT remains core to global digital payments; long-term stability with rare, brief deviations from peg |

Price Prediction Summary

USDT is projected to maintain its $1.00 peg with high confidence through 2031, supported by technological innovations like native gas payments on stablechains and increasing global adoption. Minor deviations from the peg (typically within ±1%) may occur during liquidity crunches or market shocks, but overall, USDT will remain the most stable and liquid dollar-denominated stablecoin.

Key Factors Affecting Tether Price

- Widespread adoption of Layer 1 stablechains leveraging USDT as a native gas token, simplifying user experience and reducing volatility.

- Continued regulatory scrutiny and evolving global frameworks for stablecoins, which could impact market confidence or liquidity.

- Technological improvements (e.g., gas-free transfers, interoperability) that support stablecoin utility and price stability.

- Competition from other stablecoins and central bank digital currencies (CBDCs), which may affect USDT’s market share but not its peg.

- Institutional and cross-border payment adoption, driving demand for predictable, dollar-pegged assets.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The implications are far-reaching not only for retail remittances but also for B2B settlements, payroll disbursements, and even government-backed aid programs seeking fast, low-cost distribution channels without currency conversion risks. As stablecoins continue their march toward mainstream acceptance, with dedicated chains leading the charge, the vision of seamless digital dollars may finally be within reach.

For crypto enthusiasts and institutional users alike, the ability to transact using only USDT, without worrying about holding or acquiring an additional volatile asset for gas, marks a turning point in the evolution of stablecoin infrastructure. This is especially relevant for cross-border payments, where predictability, speed, and cost-efficiency are paramount. With Stable’s Layer 1 chain, all fees remain anchored at $1.00 per USDT unit, regardless of network conditions. This removes a persistent source of friction that has plagued earlier blockchain payment systems.

Institutions now have the foundation to build programmable money flows, payroll automation, and on/off-ramp solutions that are both compliant and user-friendly. The predictability of USDT-denominated gas fees simplifies accounting and treasury management, while EVM compatibility ensures that existing Ethereum-based tools can be ported over with minimal effort. Developers gain a familiar environment but with lower barriers to entry for their users.

Key Advantages of Stablechain Payments

Key Benefits of USDT as a Gas Token on Stablechains

-

Eliminates Volatile Gas Tokens: Users pay transaction fees directly in USDT, removing the need for separate, volatile utility tokens. This simplifies the process and shields users from unpredictable token price swings.

-

Predictable, Dollar-Denominated Fees: Transaction costs are always denominated in USDT ($1.00), ensuring stable and transparent fees for both users and institutions.

-

Simplified User Experience: Holding only USDT is required for both payments and network fees, streamlining onboarding and reducing friction for end users.

-

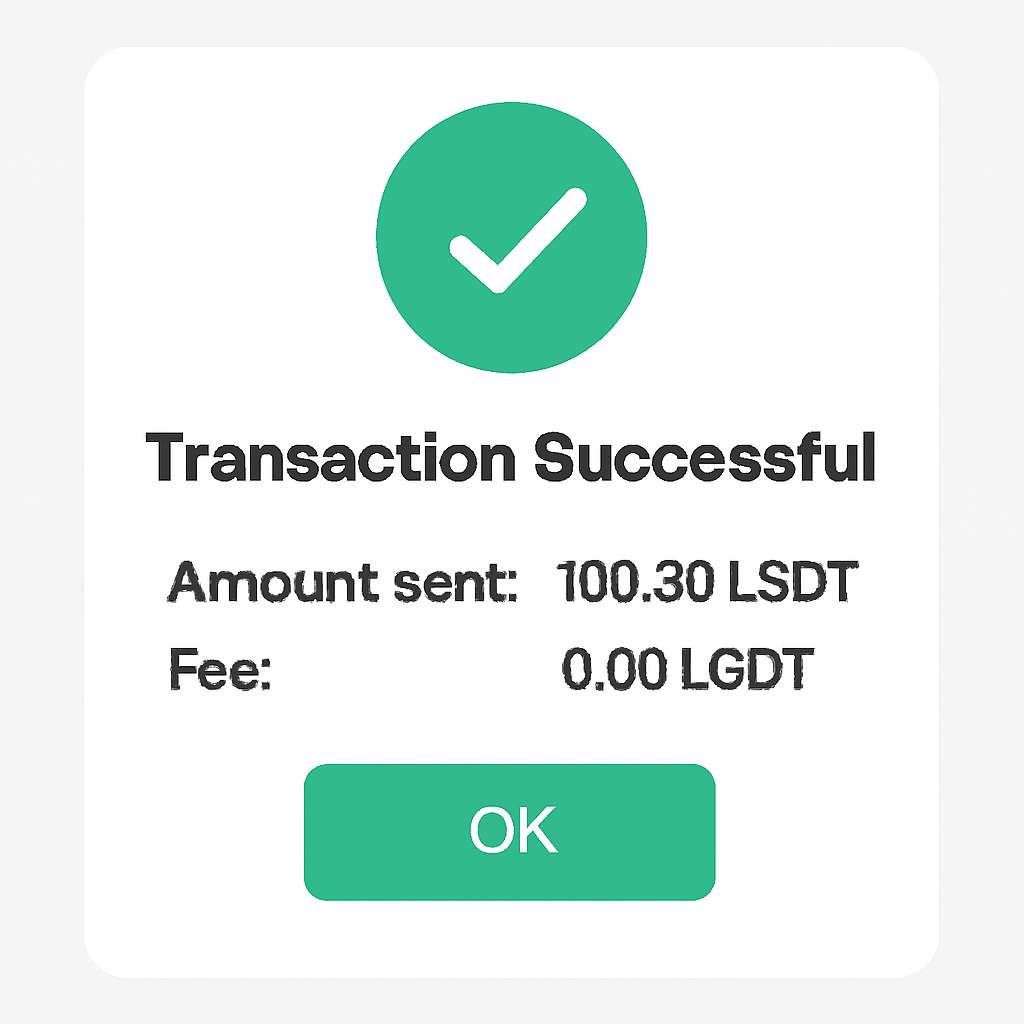

Gas-Free USDT Transfers: Stable offers USDT0 (LayerZero-enabled USDT) for peer-to-peer transfers without network fees, enabling instant and costless USDT transactions.

-

Optimized for Cross-Border Payments: Dedicated stablechains like Stable enable efficient, low-cost, and rapid cross-border settlements using USDT, supporting global payments infrastructure.

-

EVM Compatibility: Stable is EVM-compatible, allowing seamless integration with existing Ethereum tools and wallets for easier adoption and developer access.

The move toward stablecoin-native blockchains also unlocks new privacy paradigms. By reducing the number of transactional touchpoints (and thus data leaks), users can conduct business or personal transfers with greater discretion. For privacy advocates, this is not just a technical upgrade, it’s a philosophical alignment with the core ethos of decentralized finance.

Furthermore, innovations like gas-free transfers via LayerZero-enabled USDT0 are beginning to blur the line between traditional digital payment rails and blockchain settlements. Peer-to-peer transactions can now occur instantly with no network fees, a development that could have profound implications for remittances, charitable disbursements, and microtransactions worldwide.

What Comes Next? Institutional Adoption and On/Off-Ramp Integration

The next wave of adoption will likely be driven by platforms that can integrate these stablechain features into fiat on/off-ramps seamlessly. Services like anonofframp. com are already positioned to leverage this infrastructure for clients seeking fast, private transitions between crypto and traditional currencies, without exposure to unpredictable fees or complex token management.

Read more about how Stable’s Layer 1 is changing on/off-ramping with stablecoins here.

As more payment processors and financial institutions recognize the operational efficiencies offered by dedicated stablecoin blockchains, predictable pricing at $1.00 per transaction unit, instant settlement finality, enhanced privacy, the competitive advantages will become difficult to ignore.

Tether (USDT) Price Prediction 2026-2031

Professional Forecast: Projected Stability of USDT as a $1.00 Stablecoin Amid Dedicated Stablechain Adoption

| Year | Minimum Price | Average Price | Maximum Price | Potential Deviation (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.995 | $1.00 | $1.005 | ±0.5% | USDT remains highly stable, with minor deviations due to liquidity events or regulatory news. Stablechain adoption cements USDT’s role in payments. |

| 2027 | $0.994 | $1.00 | $1.006 | ±0.6% | Increased stablechain integration and cross-border payment use. Potential regulatory clarity enhances trust, keeping volatility minimal. |

| 2028 | $0.993 | $1.00 | $1.007 | ±0.7% | Continued growth in institutional adoption of stablecoin infrastructure. Isolated volatility possible during global financial events. |

| 2029 | $0.992 | $1.00 | $1.008 | ±0.8% | Competition from other stablecoins rises, but USDT’s established network effect maintains its peg. Technology improvements further reduce transaction friction. |

| 2030 | $0.991 | $1.00 | $1.009 | ±0.9% | Ongoing regulatory evolution and possible new compliance requirements. USDT’s peg stability remains strong due to robust market demand. |

| 2031 | $0.990 | $1.00 | $1.010 | ±1.0% | Global adoption of stablecoins in mainstream finance. Occasional deviations possible during periods of systemic risk but peg expected to hold. |

Price Prediction Summary

USDT is projected to maintain its $1.00 peg with extremely low volatility through 2031, supported by technological innovation, increasing adoption of stablechains, and regulatory maturation. While minor deviations may occur during periods of market stress or systemic events, Tether’s robust liquidity and network effects are expected to preserve price stability, making USDT a reliable medium for payments and settlements.

Key Factors Affecting Tether Price

- Adoption of stable-focused Layer 1 blockchains like Stable, enabling USDT-native gas and reducing friction for users.

- Growth in cross-border payments and institutional use of stablecoins.

- Regulatory clarity and oversight of stablecoin issuers and reserves.

- Competition from other stablecoins (e.g., USDC, algorithmic stables) and new payment rails.

- Technological improvements (e.g., gas-free transfers, EVM compatibility) enhancing the utility and resilience of USDT.

- Macro-financial events that could stress-test the stablecoin’s peg or liquidity mechanisms.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The question is no longer whether stablecoins will play a major role in global payments, it’s how quickly these purpose-built networks can scale to meet demand across retail, enterprise, and sovereign use cases. With capital flowing into projects like Stable and technical innovations accelerating at every layer of the stack, the future of digital dollar payments looks increasingly frictionless.