Stablecoin cards are not just a trend in 2024 – they are the new backbone of crypto on/off-ramps, transforming how digital assets flow into and out of everyday life. As crypto adoption accelerates and regulatory clarity increases, these cards have become the ultimate bridge between decentralized finance and traditional payment rails. Whether you’re a seasoned DeFi user or someone simply seeking a private, seamless way to spend your stablecoins, the current landscape is rich with innovation and opportunity.

Why Stablecoin Cards Are Taking Center Stage

Until recently, moving funds between crypto and fiat was a headache. Users had to rely on centralized exchanges, tedious withdrawal processes, and frequent KYC bottlenecks. Stablecoin cards have flipped the script. With major launches like Visa’s partnership with Bridge in Latin America and the rapid expansion of platforms such as anonofframp. com, users can now spend USDT, USDC, and other stablecoins directly at millions of merchants worldwide. The card handles conversion to local currency in real time, making the experience indistinguishable from traditional debit cards – but with all the privacy and speed that crypto users demand.

This shift is about more than convenience. It’s about financial inclusion. In regions where banking infrastructure is weak or access to USD is limited, stablecoin payment cards empower people to participate in global commerce without friction or exclusion.

Key Developments Shaping the Market in 2024

The past year has seen a flurry of strategic moves that have set the tone for stablecoin card dominance:

Top 5 Stablecoin Card Launches & Partnerships in 2024

-

Visa & Bridge Stablecoin Card Launch (April 2025): Visa partnered with Bridge to launch stablecoin-linked Visa cards in Latin America, enabling users to spend stablecoins like USDT and USDC at any Visa-accepting merchant. Bridge handles real-time conversion to local currencies, making stablecoin spending seamless across Argentina, Colombia, Ecuador, Mexico, Peru, and Chile.

-

JPMorgan & Coinbase Credit Card Integration (July 2025): JPMorgan joined forces with Coinbase to let customers use Chase credit cards for crypto purchases on Coinbase, marking a major U.S. bank’s embrace of digital assets and simplifying crypto on-ramps for millions of users.

-

Global Stablecoin Network & USDG Launch (November 2024): A consortium including Robinhood, Kraken, and Galaxy Digital launched the USDG stablecoin and a global network to promote stablecoin adoption, offering new card-linked payment options and challenging established stablecoins like USDT and USDC.

-

Ripple’s Acquisition of Rail (August 2025): Ripple acquired Rail, a Toronto-based stablecoin payments platform, for $200 million. This move aims to enhance Ripple’s cross-border stablecoin card and payment solutions, strengthening its position in the global payments ecosystem.

-

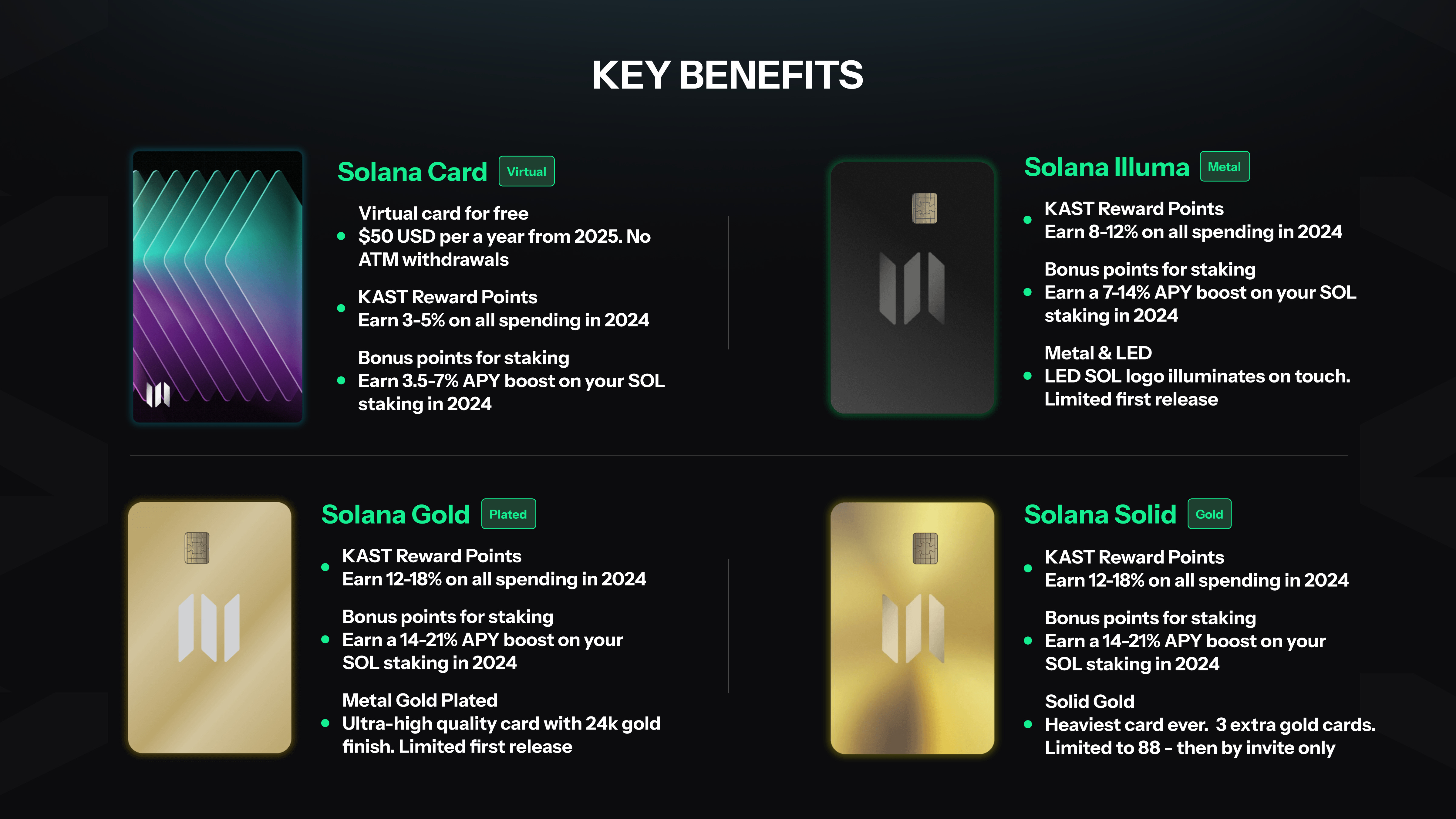

KAST Multi-Chain Stablecoin Card Expansion (2024): KAST expanded its multi-chain card program, allowing users to spend stablecoins and other cryptocurrencies at over 100 million merchants worldwide, with enhanced features like SOL staking rewards and broad network support.

- Visa x Bridge: Stablecoin-linked Visa cards are now live across six Latin American countries, allowing direct USDT/USDC spending at any Visa merchant.

- JPMorgan x Coinbase: In a landmark move, Chase credit cards now enable seamless crypto purchases on Coinbase, signaling Wall Street’s growing embrace of digital assets.

- USDG Consortium: Robinhood, Kraken, and Galaxy Digital launched USDG to challenge USDT/USDC dominance and expand global stablecoin usage.

- Ripple Acquires Rail: Integrating Rail’s cross-border tools strengthens Ripple’s stablecoin payments network for both individuals and businesses.

- anonofframp. com: Pioneering privacy-first on/off-ramp solutions with non-custodial stablecoin cards that require minimal user data.

How Stablecoin Cards Simplify Crypto On/Off-Ramps

At their core, stablecoin on/off-ramp cards eliminate unnecessary steps between your digital wallet and real-world spending. Here’s how:

- Direct Top-Ups: Load your card from multiple networks (Arbitrum, Polygon, Solana) or send crypto directly from any wallet.

- Instant Spending: Use your stablecoins anywhere major cards are accepted – no manual conversions or delays.

- Privacy by Design: Many providers, like anonofframp. com, offer non-custodial models that minimize data collection and protect user privacy.

- Global Reach: From Buenos Aires to Berlin, stablecoin payment cards work wherever you travel.

Want a deep dive into how these cards enable instant crypto-to-fiat off-ramping without KYC hassles? Check out our guide: How Stablecoin Cards Enable Instant Crypto-to-Fiat Off-Ramping Without KYC Hassles.

Who’s Leading the Charge? Top Stablecoin Card Providers for 2025

With competition heating up, users now have a range of options tailored to different needs – from high-limit power user cards to low-fee global off-ramps. According to leading sources like CoinGecko and Mural Pay, platforms such as KAST (with SOL staking rewards), Offramp. xyz (multi-chain top-ups), and Zypto (high limits, low fees) are setting new standards for versatility and user experience.

For those prioritizing privacy and speed, anonofframp. com continues to stand out with its commitment to non-custodial solutions and seamless integration with DeFi wallets. As more users demand instant access to their crypto for everyday spending, expect this space to evolve rapidly.

Security and compliance are also top of mind as the stablecoin card market matures. Regulatory frameworks are catching up, but the best providers have already built robust systems for fraud prevention, transaction monitoring, and user protection. This means you can enjoy the agility of crypto with the peace of mind of traditional finance, no more trading privacy for usability. Instead, platforms like anonofframp. com are proving that private crypto to fiat solutions can be both compliant and user-centric.

Rewards and perks are another battleground. Some providers, like KAST, offer enhanced staking rewards for SOL holders, while others focus on cashback in stablecoins or zero-fee global transactions. The race to attract users is driving real innovation, with features like instant notifications, multi-currency support, and integrations with DeFi protocols. For a closer look at how stablecoin cards are changing the crypto payments game, see our practical guide: How Stablecoin Cards Are Changing Crypto Payments: A Practical Guide for 2024.

What to Watch: Trends Shaping the Next Wave

The future of crypto on/off-ramps is being written in real time. Here are the trends to keep your eye on as we move into 2025:

Emerging Trends in Stablecoin Card Technology (2024-2025)

-

Biometric Authentication for Enhanced Security: Leading stablecoin card providers like Visa (via Bridge) and Coinbase are integrating biometric authentication—such as fingerprint and facial recognition—into their card and app experiences, making transactions more secure and user-friendly.

-

DeFi Wallet Integration: Platforms including Offramp.xyz and MoonPay are enabling direct integration with DeFi wallets, allowing users to spend stablecoins from non-custodial wallets and access DeFi features directly through their cards.

-

Cross-Border Instant Settlements: With Ripple’s acquisition of Rail and the launch of the Global Stablecoin Network (USDG) by Robinhood, Kraken, and Galaxy Digital, stablecoin cards now facilitate near-instant, low-cost cross-border payments, greatly benefiting users in regions with limited banking infrastructure.

-

Multi-Chain & Multi-Asset Support: Cards like the KAST Card and Mural Pay support spending stablecoins across multiple blockchains (including Solana, Polygon, and Arbitrum), providing users with flexibility and access to a broad range of assets.

-

Real-Time Crypto-to-Fiat Conversion: Providers such as Circle and Coinbase offer cards that automatically convert stablecoins to local fiat currencies at the point of sale, streamlining the spending process and eliminating manual conversions.

-

Expanded Merchant Acceptance: The Visa and Bridge partnership has enabled stablecoin cardholders to spend at millions of merchants worldwide, dramatically increasing the utility of stablecoins for everyday purchases.

-

Advanced Compliance & KYC Features: Firms like Fireblocks and Zero Hash are powering stablecoin card platforms with robust compliance, KYC, and anti-fraud tools, ensuring regulatory adherence and user safety.

-

Rewards & Staking Integration: Cards such as the KAST Card offer enhanced staking rewards (notably for SOL), incentivizing users to hold and spend stablecoins while earning additional crypto benefits.

-

Seamless Top-Ups from Multiple Networks: Platforms like Offramp.xyz enable users to top up their stablecoin cards from various networks, making it easier to move assets and maintain card balances.

-

Bank Partnerships for Direct Crypto Purchases: The JPMorgan and Coinbase collaboration allows customers to use Chase credit cards for direct crypto purchases, signaling deeper integration between traditional banks and stablecoin card ecosystems.

- Biometric Authentication: Expect fingerprint and facial recognition to become standard for card security, raising the bar for both convenience and safety.

- DeFi Wallet Integration: Seamless syncing with non-custodial wallets allows users to move assets instantly between DeFi protocols and their stablecoin cards.

- Cross-Border Instant Settlements: New protocols are enabling real-time, fee-minimized transactions across continents, making remittances and business payments frictionless.

- Customizable Privacy Levels: Users will soon be able to choose their preferred balance between anonymity and compliance, tailoring cards to their unique risk profiles.

- Programmable Spending Controls: Features like spending limits, merchant whitelists, and time-based restrictions will give users more control than ever before.

The bottom line? Stablecoin cards are no longer a niche tool, they are quickly becoming the default way to bridge digital assets and real-world spending. Whether you’re looking for a private crypto to fiat solution, low-fee global payments, or simply a faster way to access your digital wealth, the options have never been better. For those ready to take the next step, integrating your stablecoin card with a DeFi wallet can unlock even greater flexibility and autonomy. Learn more in our guide: Integrating Stablecoin Cards with DeFi Wallets for Seamless Transactions.

The revolution is here, and it’s powered by stablecoin cards that put users first, wherever they are in the world.