Stablecoins are rapidly reshaping the landscape of digital payments, and in 2025, the emergence of dedicated stable Layer-1 blockchains is setting a new standard for efficiency and usability. Among these, Stable: a Layer 1 blockchain purpose-built for Tether’s USDT, has garnered significant attention for its unique infrastructure and user-centric features. With USDT currently trading at $1.00 (Polygon Bridged USDT), Stable’s approach is changing how users and businesses interact with on/off-ramp services, stablecoin payments infrastructure, and private crypto ramp solutions.

Stable Layer-1: A Purpose-Built Blockchain for USDT

Launched in July 2025, Stable distinguishes itself by integrating USDT as its native gas token. This means that users pay transaction fees directly in USDT, eliminating the need to hold a volatile native token and removing a major point of friction for both retail and institutional users. The result is a familiar, dollar-denominated experience where fees and contracts are predictable, allowing businesses to budget more effectively and users to transact with greater confidence. This straightforward model is already attracting fintech innovators and payment processors seeking fast, reliable stablecoin to fiat conversion.

Unlike general-purpose blockchains, Stable is laser-focused on optimizing stablecoin flows. The chain offers sub-second transaction finality and minimal fees, making it exceptionally well-suited for high-frequency retail transactions and instant cross-border settlements. These features are not just incremental improvements, they represent a leap forward in practical usability for stablecoins in everyday finance.

Gas-Free USDT Transfers: Lowering Barriers for Global Payments

One of the most innovative features of the Stable blockchain is its support for gas-free USDT transfers using the LayerZero-powered USDT0 token. With this mechanism, users can send peer-to-peer payments without incurring network fees, a breakthrough that addresses one of the most persistent pain points in crypto payments. This not only benefits individual users but also opens up new possibilities for microtransactions, payroll, and remittance services, sectors where fee sensitivity can make or break adoption.

The implications are profound: by making stablecoin transactions virtually free and instant, Stable enables a new class of financial products that were previously impractical on legacy blockchains. For privacy advocates and those seeking a private crypto ramp, this means more accessible, cost-effective ways to move value globally without exposing sensitive transaction data or incurring excessive costs.

Institutional-Grade Features: Speed, Privacy, and Reliability

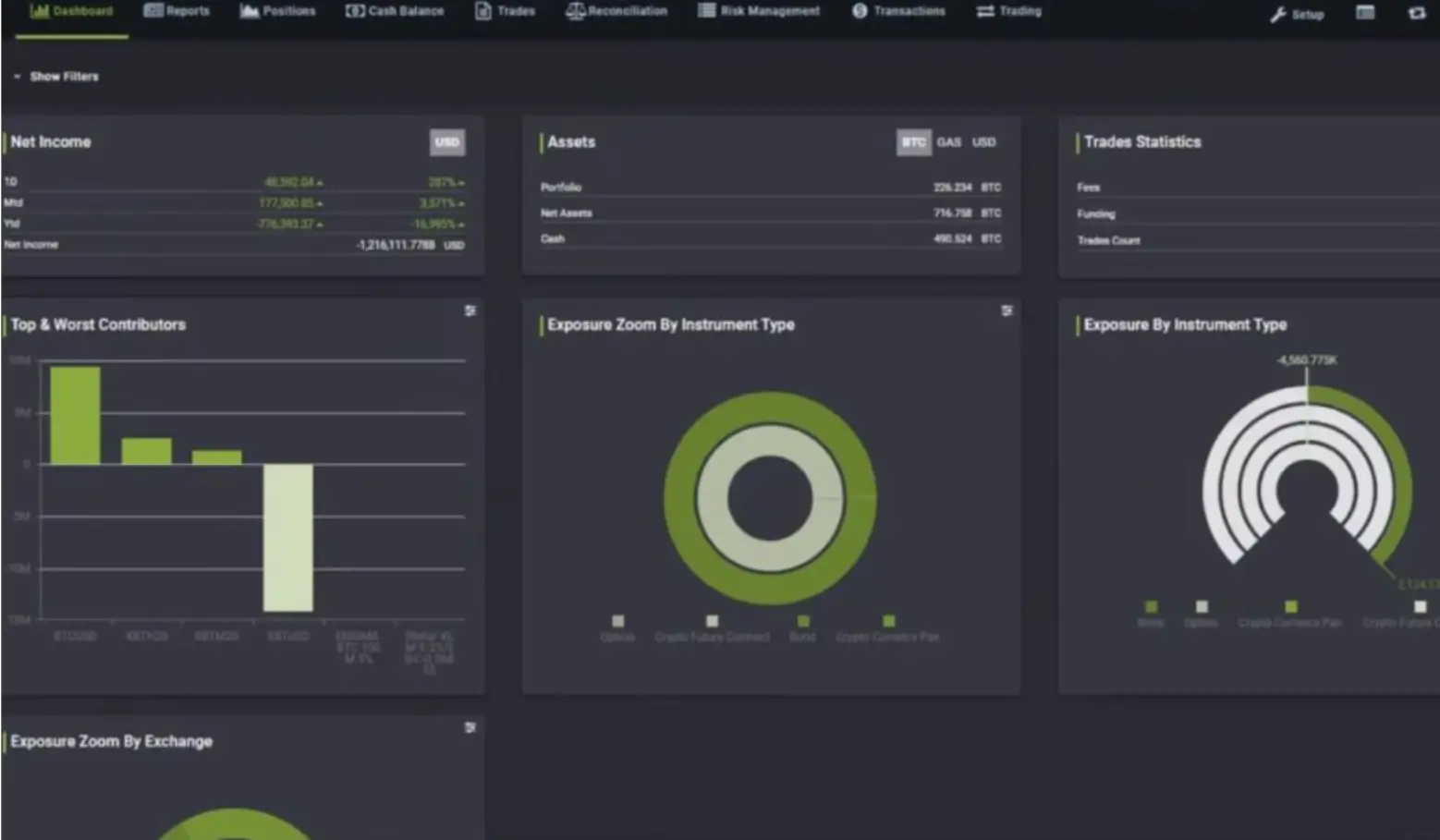

Stable is not just about retail efficiency; it has been architected with institutional needs in mind. Key features include guaranteed blockspace allocation, ensuring that high-priority transactions are never delayed, batch transaction processing for bulk settlements, and confidential transfer options that strike a balance between user privacy and regulatory compliance. These capabilities position Stable as a compelling choice for enterprises looking to streamline treasury operations or launch new payment services with stablecoins at their core.

The technical roadmap for Stable is equally ambitious. Future upgrades will introduce optimistic parallel execution to further enhance throughput, as well as a transition to a Directed Acyclic Graph (DAG)-based consensus mechanism for even greater speed and resilience. This forward-thinking approach ensures that Stable will remain at the forefront of stablecoin payments infrastructure as adoption accelerates.

Tether (USDT) Price Stability & Layer-1 Adoption Prediction (2026–2031)

USDT price projections considering Stable Layer-1 blockchain integration, market adoption, and regulatory trends.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $0.98 | $1.00 | $1.02 | 0.0% | Layer-1 adoption expands, USDT maintains strong peg; minor volatility during regulatory events. |

| 2027 | $0.97 | $1.00 | $1.03 | 0.0% | Cross-border payments increase; competition from other stablecoins rises, but USDT dominance holds. |

| 2028 | $0.96 | $1.00 | $1.04 | 0.0% | Regulatory clarity improves; institutional adoption grows, minor de-pegs possible in extreme events. |

| 2029 | $0.96 | $1.00 | $1.04 | 0.0% | Layer-1 upgrade (DAG consensus) boosts throughput; USDT on/off-ramps become global standard. |

| 2030 | $0.95 | $1.00 | $1.05 | 0.0% | Global stablecoin regulations implemented; USDT retains market lead, but faces tech-driven volatility. |

| 2031 | $0.95 | $1.00 | $1.05 | 0.0% | USDT solidifies as foundation for digital payments; stability maintained despite macroeconomic shocks. |

Price Prediction Summary

USDT is expected to maintain its $1.00 peg due to robust market demand, innovative Layer-1 technology (Stable), and growing integration across payment systems. Minimum and maximum ranges reflect potential short-term volatility from regulatory, technological, or macroeconomic stress. Average price remains at $1.00, indicating continued trust in USDT as a stable asset for digital transactions and on/off-ramps.

Key Factors Affecting Tether Price

- Adoption of Stable Layer-1 blockchain for efficient, low-fee USDT transactions.

- Global regulatory developments and compliance frameworks for stablecoins.

- Competition from other stablecoins and CBDCs (Central Bank Digital Currencies).

- Technological upgrades (e.g., DAG-based consensus, gas-free transfers) improving speed and resilience.

- Expansion of on/off-ramp infrastructure and integration with traditional finance.

- Market sentiment and liquidity events impacting short-term peg stability.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

For a deeper dive into how USDT-native blockchains like Stable are transforming crypto on/off-ramps, see this detailed analysis.

By addressing the core inefficiencies of legacy blockchains, Stable is laying the groundwork for a new era in stablecoin to fiat conversion and seamless financial integration. The ability to transact in USDT at exactly $1.00 per token, with negligible or zero fees, is not just a technological improvement – it is a paradigm shift for both individuals and enterprises seeking predictable, low-friction access to digital dollars.

Frictionless On/Off-Ramps: Stablecoin Cards and Real-World Utility

The impact of Stable’s architecture is especially apparent when considering the next generation of stablecoin cards and on/off-ramp solutions. Platforms like anonofframp. com can leverage Stable’s sub-second finality and gas-free transfers to deliver near-instant card top-ups, merchant payments, and ATM withdrawals. For users, this means loading a card with USDT at $1.00 and spending it globally with the speed and familiarity of traditional finance, but with the privacy and autonomy of crypto.

For businesses, the predictability of USD-denominated fees on Stable eliminates the headaches of volatile transaction costs, while batch processing and blockspace guarantees ensure that even high-volume operations run smoothly. This is especially relevant for payment processors, payroll providers, and remittance platforms that demand reliability at scale.

Privacy and Compliance: A Nuanced Approach

One of the most compelling aspects of Stable’s design is its nuanced approach to privacy. While confidential transfers provide individuals with the ability to transact discreetly, institutional tools allow for selective transparency when required by regulators. This duality is vital as the regulatory landscape evolves: users retain control over their data, while enterprises can meet compliance obligations without sacrificing efficiency.

This balance is particularly attractive to privacy-focused users who value anonymity in their on/off-ramp activities. Platforms that integrate Stable can offer a private crypto ramp experience that rivals the privacy of cash, but with the auditability and programmability of digital assets. For more on how these privacy features are influencing the broader ecosystem, see this analysis.

Looking Ahead: Scaling Stablecoin Payments Infrastructure

The future of stablecoin payments will be defined by speed, security, and accessibility. As Stable moves toward optimistic parallel execution and a DAG-based consensus, throughput will increase further, supporting everything from high-frequency trading to everyday purchases. The flexibility of gas-free USDT transfers and programmable privacy sets the stage for new financial products that bridge the gap between traditional banking and decentralized finance.

For tech-savvy users, privacy advocates, and enterprises alike, the emergence of Stable as a dedicated USDT Layer-1 marks a significant milestone in the evolution of stablecoin payments infrastructure. It enables a world where digital dollars move as freely as information – instantly, securely, and at minimal cost.

Explore more: To understand how stablecoin-powered Layer-1 chains are changing on/off-ramp payments in 2025, visit this resource.

Key Benefits of Using Stable Layer-1 for USDT On/Off-Ramps

-

Direct USDT Gas Payments: Stable Layer-1 allows users to pay transaction fees directly in USDT, eliminating the need to hold volatile native tokens and simplifying the on/off-ramp process.

-

Sub-Second Finality & Minimal Fees: Transactions on Stable Layer-1 settle in under a second with negligible fees, making it ideal for cross-border payments and high-volume retail use.

-

Gas-Free Peer-to-Peer Transfers: With LayerZero-powered USDT0, users can send USDT without incurring network fees, streamlining peer-to-peer transactions and improving accessibility.

-

Institutional-Grade Features: Stable offers guaranteed blockspace, batch transaction processing, and confidential transfer options, catering to businesses and compliance needs.

-

Enhanced Scalability & Resilience: The roadmap includes optimistic parallel execution and a shift to DAG-based consensus, promising even greater throughput and network reliability for USDT ramps.

-

USD-Denominated Fees & Budgeting: With fees and contracts denominated in USD, businesses can easily budget and manage costs without exposure to crypto price volatility.

-

Improved User Experience: By integrating USDT as the native token and offering seamless on/off-ramp solutions, Stable Layer-1 reduces friction for both retail and institutional users.