In 2024, the intersection of stablecoins and payment cards has sparked a genuine revolution in how crypto users off-ramp into fiat. Instead of waiting days for wire transfers or dealing with intrusive KYC processes, users now have the option to spend stablecoins like USDC or USDT directly at millions of merchants worldwide. This paradigm shift is driven by a new generation of stablecoin cards that combine privacy, speed, and global acceptance, fundamentally reshaping what it means to move value from the digital to the traditional finance world.

Stablecoin Cards: The New Standard for Crypto Off-Ramps

The crypto off-ramp landscape has historically been fragmented and cumbersome. Bank transfers, legacy exchanges, and even P2P platforms often involve high friction, slow settlement, and privacy trade-offs. Enter stablecoin cards: these innovative solutions allow users to spend or withdraw their crypto holdings instantly, with minimal conversion hassle and strong privacy features. The five providers leading this charge in 2024 are Mural Pay, KAST Card, Offramp. xyz, Bitso Card, and Circle Card.

Each of these cards brings a unique approach to the table, but all share a common purpose: making private crypto-to-fiat conversion as seamless and accessible as possible. Whether you’re a DeFi power user, a privacy advocate, or simply looking for the lowest-fee path to spend your digital assets, these platforms are setting new standards for usability and security.

Spotlight on Innovation: What Sets the Top Five Apart?

Top 5 Stablecoin Card Providers Revolutionizing Off-Ramps in 2024

-

Mural Pay offers seamless crypto-to-fiat off-ramps with instant settlement and global reach. Standout features: Non-custodial wallet integration, real-time stablecoin conversion, and advanced privacy controls for user data protection.

-

KAST Card is a Visa-backed card supporting USDC, USDT, and USDe across multiple blockchains. Standout features: Multi-chain top-ups, SOL staking rewards, two-tier card options (Standard K and Premium X), and robust privacy measures with minimal KYC for lower tiers.

-

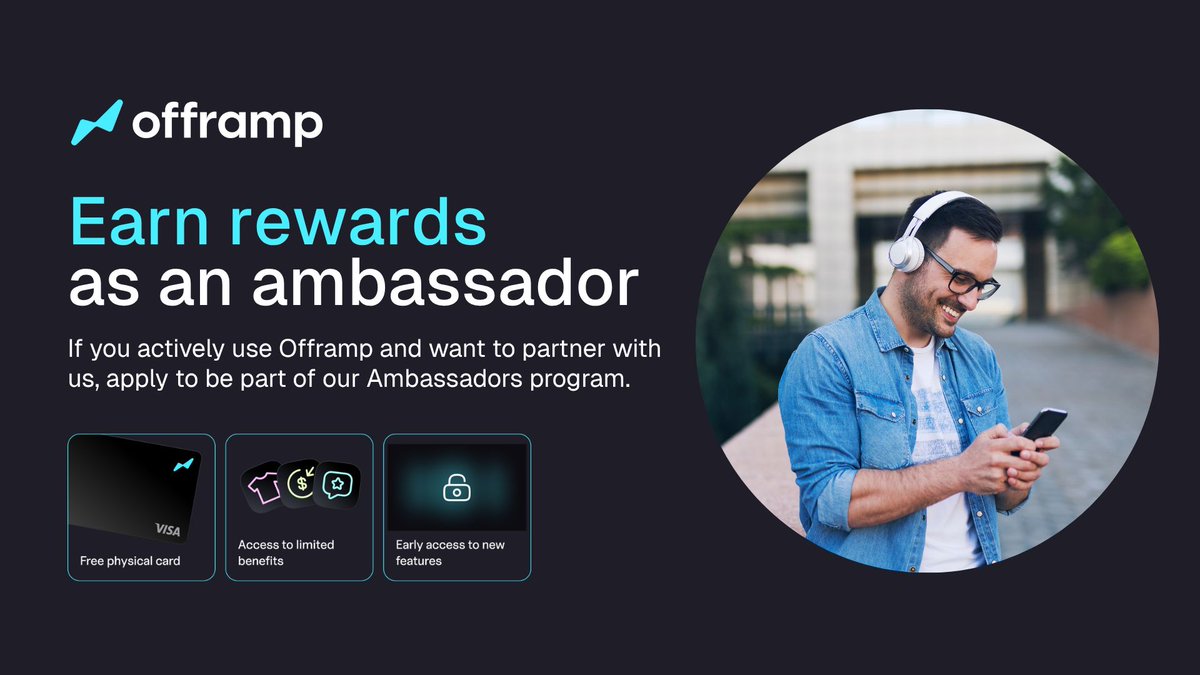

Offramp.xyz provides a virtual card instantly with no setup or maintenance fees, enabling users to pay anywhere with stablecoins. Standout features: Zero annual fees, instant issuance, and privacy-first onboarding with no unnecessary data collection.

-

Bitso Card bridges Latin American markets to global spending with direct stablecoin-to-fiat conversion. Standout features: Integration with Bitso’s crypto exchange, competitive FX rates, and privacy-focused transaction processing for local and international users.

-

Circle Card leverages the USDC stablecoin for fast, borderless payments. Standout features: Direct USDC spending, global merchant acceptance, and enhanced privacy through Circle’s compliance-first infrastructure.

Mural Pay has quickly become a favorite for global freelancers and remote workers. With support for multiple stablecoins and instant settlement to local currencies, Mural Pay’s card is accepted virtually everywhere Visa is. Its intuitive app interface and robust privacy controls make it a top choice for those seeking a frictionless crypto off-ramp in 2024.

KAST Card, launched by a Singapore-based fintech, stands out with its multi-chain support and enhanced rewards. Users can top up with USDC, USDT, or USDe across several blockchains and spend at over 100 million merchants globally. The Premium X tier offers exclusive perks such as higher cashback rates and SOL staking rewards, making it an attractive option for power users who want more than just basic spending functionality.

Offramp. xyz takes simplicity to another level. Instant virtual cards are issued with zero setup or maintenance fees, allowing users to pay anywhere that accepts Mastercard without any friction. The platform’s focus on privacy and fee transparency has made it especially popular among those who value control over their financial data.

Why Stablecoin Cards Are Winning: Privacy, Speed, and Global Reach

The appeal of these stablecoin debit cards is not just in their technological sophistication but also in their ability to address real user pain points:

- Instant Liquidity: No more waiting days for fiat withdrawals, spend your stablecoins instantly at point of sale or online.

- Global Acceptance: Backed by major payment networks like Visa and Mastercard, these cards work at millions of merchants worldwide.

- Privacy and Security: Many providers offer non-custodial options or enhanced privacy settings that minimize data exposure compared to traditional banks or exchanges.

- No Volatility Risk: By leveraging stablecoins pegged to fiat currencies, users avoid the wild price swings associated with Bitcoin or Ethereum-based cards.

This winning combination explains why adoption of stablecoin cards is surging among both retail users and businesses seeking modern payment solutions. For a deeper dive into how these products enable instant crypto-to-fiat transactions without KYC headaches, check out this guide on seamless off-ramping.

The Role of Regulation and Market Expansion

The rapid growth of this sector hasn’t gone unnoticed by regulators. With the passage of new frameworks like the U. S. GENIUS Act, which requires 100% reserve backing for payment stablecoins, providers are stepping up compliance while still prioritizing user privacy. This regulatory clarity is helping legitimize stablecoin off-ramps in mainstream finance while encouraging further innovation among leaders such as Bitso Card and Circle Card.

Both Bitso Card and Circle Card exemplify how regulatory readiness can coexist with user-centric innovation. Bitso Card, building on its Latin American exchange roots, enables users to off-ramp stablecoins into local fiat seamlessly, even in regions where traditional banking is restrictive or slow. Its partnership with major payment networks ensures that users enjoy the same convenience as any mainstream debit card, but with the added privacy and flexibility of crypto.

Circle Card, on the other hand, leverages Circle’s global USDC infrastructure to deliver a card that is both widely accepted and deeply integrated with DeFi wallets and protocols. Users benefit from instant conversion from USDC to fiat at the point of sale, plus advanced security features such as two-factor authentication and real-time spend notifications. Circle’s compliance-first approach also means users can have confidence in fund safety while still enjoying low fees and fast settlement.

What Makes Stablecoin Cards Essential for 2024?

The convergence of regulatory clarity, technical innovation, and user demand has made stablecoin cards more than just a niche product, they are now an essential bridge between digital assets and everyday spending. For privacy advocates, these cards offer a way to transact without exposing sensitive banking details. For freelancers and global nomads, they provide a frictionless path to access earned crypto income anywhere in the world.

Perhaps most importantly, these cards are democratizing access to modern finance. With products like Offramp. xyz’s no-fee virtual cards or KAST Card’s multi-chain top-ups, users are no longer bound by geography or legacy financial systems. The ability to move value instantly and privately, without waiting for bank approval, marks a definitive shift in financial empowerment.

Comparing Features: Which Stablecoin Card Fits Your Needs?

Selecting the best stablecoin off-ramp depends on your priorities, be it privacy, speed, global reach, or rewards. Here’s a quick comparison of what sets each provider apart:

Comparison of Leading Stablecoin Card Providers (2024)

| Provider | Supported Stablecoins | Fee Structure | Privacy Options | Rewards / Cashback | Notable Regions Served |

|---|---|---|---|---|---|

| Mural Pay | USDC, USDT, others | Low transaction fees, transparent pricing | Enhanced privacy controls, optional KYC for higher limits | Varies by card tier, up to 1.5% cashback | Global (focus on Europe, Americas) |

| KAST Card | USDC, USDT, USDe (multi-chain) | Standard: Low annual fee; Premium: Higher annual fee, lower transaction fees | Privacy mode available, advanced user controls | Standard: 0.5% cashback; Premium: Up to 2% SOL staking rewards | Worldwide (notably Asia, Europe) |

| Offramp.xyz | USDC, USDT, DAI | No setup/issuance fee, no maintenance fees, competitive FX rates | Virtual cards, minimal data required for basic use | No direct rewards, but low cost structure | Global (strong online presence) |

| Bitso Card | USDC, USDT, MXN-backed stablecoins | Low transaction and FX fees | Standard KYC, privacy-focused app | Up to 1% cashback on select purchases | Latin America (notably Mexico, Argentina, Colombia) |

| Circle Card | USDC | No annual fee, low transaction fees | Industry-standard privacy, robust compliance | Occasional promotions, up to 1% cashback | North America, Europe |

If you’re optimizing for low fees and ease of use, Offramp. xyz is hard to beat. For those seeking multi-chain flexibility or premium rewards (like SOL staking), KAST Card stands out. Meanwhile, Mural Pay, Bitso Card, and Circle Card each excel at regional accessibility and compliance, making them strong choices for users who value both trust and utility.

Looking Ahead: The Future of Crypto Off-Ramps

The ongoing evolution of stablecoin debit cards signals a broader trend toward borderless finance. As regulatory frameworks mature and payment networks deepen their crypto integrations, expect even greater interoperability across blockchains and fiat rails. Innovations like non-custodial card issuance or cross-chain settlement will further empower users seeking private crypto-to-fiat solutions.

The bottom line? In 2024 and beyond, stablecoin cards are not just revolutionizing crypto off-ramps, they’re setting new expectations for what modern money movement should look like: fast, private, compliant when needed, but always user-first.