Stablecoin cards have rapidly become essential tools for anyone seeking seamless, private, and efficient ways to bridge crypto and fiat. With so many options available in 2025, choosing the right provider can feel overwhelming. To help you navigate this space, we’re comparing the top five stablecoin card providers based on fees, spending limits, and privacy features. This guide is tailored for privacy advocates, active traders, and crypto newcomers alike who want to maximize their digital asset flexibility while minimizing risks and costs.

![]()

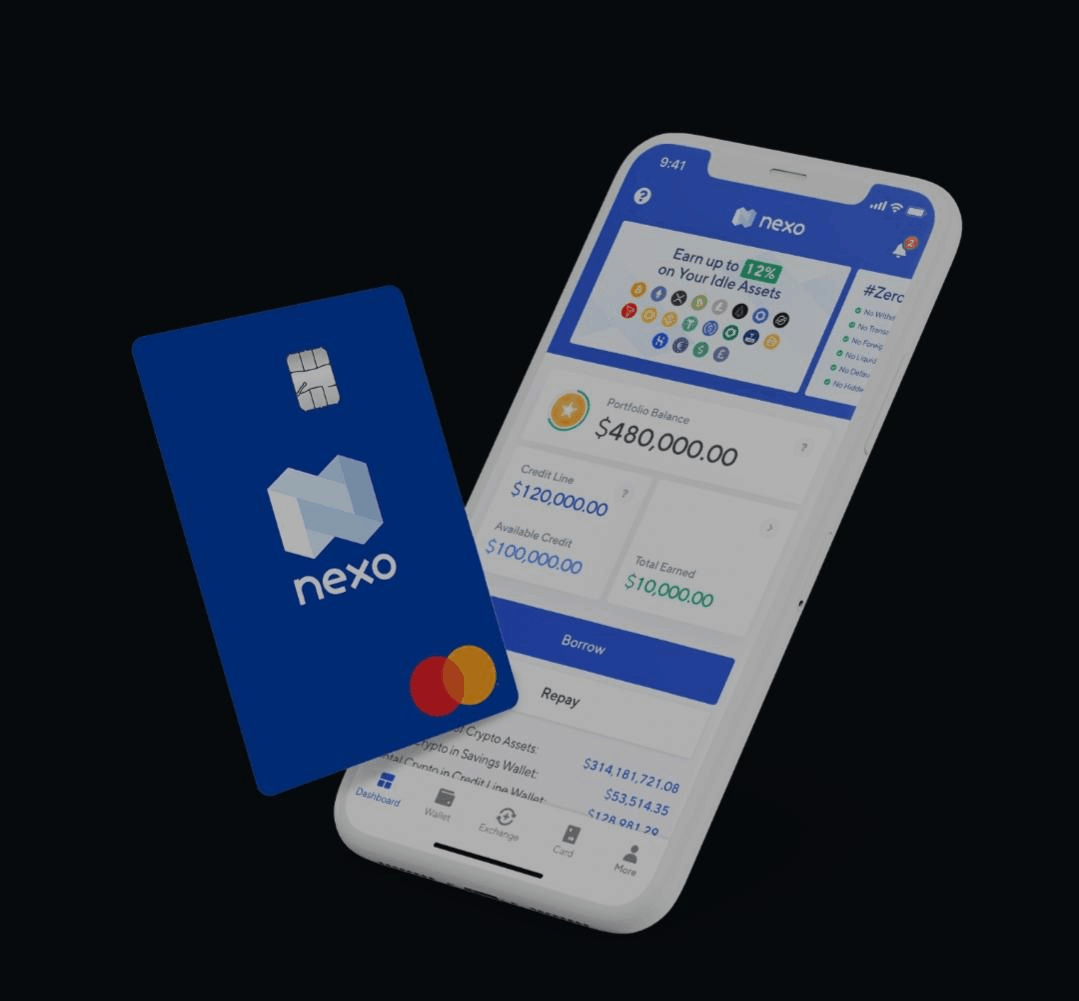

Nexo Card: A Leader in Low Fees and High Limits

The Nexo Card stands out as a favorite among stablecoin card providers for its no-nonsense fee structure. In debit mode, there are no monthly or inactivity fees, which is perfect if you don’t use your card regularly. Credit mode offers competitive rates starting at 2.9% APR. The Nexo Card supports popular stablecoins like USDC and USDT.

Spending limits are generous – Platinum tier users can withdraw up to €10,000 monthly from ATMs. While rewards are modest (up to 2% cashback in NEXO tokens or 0.5% in Bitcoin), the lack of hidden costs makes this card attractive for high-volume users. Privacy-wise, Nexo requires full KYC verification; expect to provide standard ID documentation.

Bybit Card: High Rewards with Transparent Foreign Exchange Fees

The Bybit Card has quickly gained traction due to its strong rewards program – offering up to 10% cashback on purchases when using supported stablecoins like USDT and USDC. There’s no annual fee, but keep an eye on the foreign exchange costs: a 0.5% FX fee plus a 0.9% transaction fee applies when spending outside your base currency.

Spending limits vary depending on your verification level but are generally suitable for both everyday spending and larger purchases. As with most major providers, Bybit enforces KYC requirements for all users to comply with global regulations.

Bitget Card: Balancing Low Fees with Daily Caps

The Bitget Card is a popular choice for those who value low domestic fees combined with robust security features. Most transactions incur minimal charges domestically; international use may be subject to additional fees depending on the region.

A key consideration is the daily spending cap – typically ranging from $2,500 to $5,000 per day – as well as separate ATM withdrawal limits that vary by jurisdiction. Bitget’s privacy policy aligns with industry standards: KYC verification is mandatory before issuance but your transaction history remains protected by strong encryption protocols.

Top 5 Stablecoin Card Providers in 2025

-

Nexo Card: No monthly, annual, or inactivity fees. Earn up to 2% cashback in NEXO tokens or 0.5% in Bitcoin. Enjoy high monthly ATM withdrawal limits (up to €10,000 for Platinum tier). KYC required for account setup.

-

Bybit Card: Up to 10% cashback on purchases. No annual fees and competitive foreign exchange fees (0.5% FX fee). Spending limits vary by verification level. KYC verification required for access.

-

Bitget Card: Low domestic fees with 2% + $0.25 per transaction, 1% deposit fee, and $2.50 ATM fee. Daily spending caps typically range from $2,500 to $5,000. KYC required for activation.

-

Crypto.com Visa Card: Up to 5% cashback (with CRO staking). No annual fees and flexible spending limits based on card tier and staking. KYC verification required for issuance.

-

KASTA Card: High rewards structure—2-6% cashback on Standard, 5-12% on Premium (paid in KAST points or crypto). Annual fee for Standard ($20) and Premium ($1,000) cards. Spending limits vary by tier. KYC required for onboarding.

Crypto. com Visa Card: Tiered Rewards with CRO Staking Benefits

The Crypto. com Visa Card is well-known for its tiered reward system that can reach up to 5% cashback if you stake CRO tokens (the platform’s native asset). Supported stablecoins include USDC and USDT – making it highly versatile for crypto spenders globally.

This card has no annual fees but does require users to lock up CRO tokens for maximum benefits. Spending limits depend on both your staking amount and chosen card tier; higher tiers mean higher limits but also require more significant upfront commitment.

KYC is required at all levels – expect ID checks during registration – but once set up, users enjoy instant conversions between crypto balances and fiat at competitive rates.

KASTA Card: Premium Privacy Meets Flexible Rewards

The KASTA Card, sometimes referred to as the KAST or KASTA X Card depending on tier selected, caters directly to privacy-conscious users who still want access to premium perks. Standard cards carry a $20/year fee while premium options climb as high as $1,000/year – but these unlock substantial rewards (up to 12%) paid in KAST points or crypto assets.

KYC verification is required across all tiers, though the platform emphasizes robust data protection measures throughout their process. Spending limits scale with your chosen plan; higher annual fees grant access to much larger caps suitable for power users or business travelers.

Choosing among these leading stablecoin card providers ultimately comes down to your personal priorities: Are you seeking the absolute lowest fees, the highest spending limits, or do you place a premium on privacy and rewards? Each of the top five cards brings something distinct to the table, so let’s break down their comparative strengths in a clear overview.

Comparison of Top 5 Stablecoin Card Providers (2025)

| Card Provider | Fees | Spending Limits | Rewards | Privacy Features |

|---|---|---|---|---|

| Nexo Card | No monthly, annual, or inactivity fees | Up to €10,000 monthly ATM withdrawals (Platinum tier) | Up to 2% cashback in NEXO or 0.5% in Bitcoin | Requires KYC verification |

| Bybit Card | No annual fees; 0.5% foreign exchange fee | Varies by user verification level | Up to 10% cashback | Requires KYC verification |

| Bitget Card | No annual fees; foreign exchange fees may apply | Daily spending limits typically $2,500-$5,000; ATM limits vary | Rewards available (varies by promotion) | Requires KYC verification |

| Crypto.com Visa Card | No annual fees; some fees based on card tier and staking | Varies by card tier and CRO staking amount | Up to 5% cashback (with CRO staking) | Requires KYC verification |

| KASTA Card | Standard K Card: $20/year; Premium X Card: $1,000/year | Varies by card tier | 2-6% (Standard), 5-12% (Premium), paid in KAST points or crypto | Requires KYC verification |

Key Considerations When Selecting a Stablecoin Card

Fees: If minimizing costs is your top concern, Nexo Card’s lack of monthly or inactivity fees is hard to beat. Bitget also keeps domestic charges low but pay attention to international use. Bybit’s transparent FX and transaction fees are easy to calculate in advance. Crypto. com Visa requires CRO staking for optimal rewards but maintains a fee-free annual structure. KASTA’s premium tiers have higher upfront costs but deliver some of the most generous reward rates available.

Spending Limits: For active spenders and frequent travelers, both Nexo (with up to €10,000/month ATM withdrawals for Platinum users) and Crypto. com Visa (higher tiers with more staking) offer substantial flexibility. Bitget’s daily caps are sufficient for most users but may be restrictive for larger purchases. KASTA scales its limits according to tier, higher annual fees unlock higher daily and monthly caps.

Privacy Features: Privacy remains a sticking point in 2025, almost all mainstream providers require KYC verification due to regulatory pressure. However, platforms like KASTA emphasize data security throughout their onboarding process. While none of these top five cards are fully anonymous (unlike some niche competitors), they do strike a balance between compliance and user confidentiality by employing encryption and robust internal controls.

If total anonymity is your goal above all else, you may need to explore alternative single-load or non-reloadable card options outside this mainstream list, but be prepared for higher fees and limited usability.

User Experience: What Matters Most?

The user experience varies widely between providers. Nexo offers a seamless app interface with real-time notifications, a favorite among traders who want instant updates on transactions. Bybit is praised for its responsive customer service and quick onboarding process. Bitget’s platform appeals to those who want straightforward controls without surprises at checkout.

Crypto. com Visa stands out with its global reach, making it an excellent choice for digital nomads or anyone spending across borders. Meanwhile, KASTA has carved out a loyal following among privacy-focused users looking for enhanced rewards without sacrificing too much convenience.

The Verdict: Matching Cards to User Profiles

- Nexo Card: Best for high-volume spenders who want low fees and high ATM limits

- Bybit Card: Ideal for those chasing high cashback rewards with clear fee structures

- Bitget Card: Great entry-level choice balancing low domestic fees with reasonable daily caps

- Crypto. com Visa Card: Suits global users willing to stake CRO for maximum benefits

- KASTA Card: Appeals most to privacy-conscious power users seeking flexible rewards

No matter which provider you choose from this list of leading stablecoin card providers in 2025, always review their latest terms carefully as policies can change rapidly in response to evolving regulations. For crypto enthusiasts who value speed, security, and flexibility in managing digital assets, these cards represent the cutting edge of everyday crypto finance.