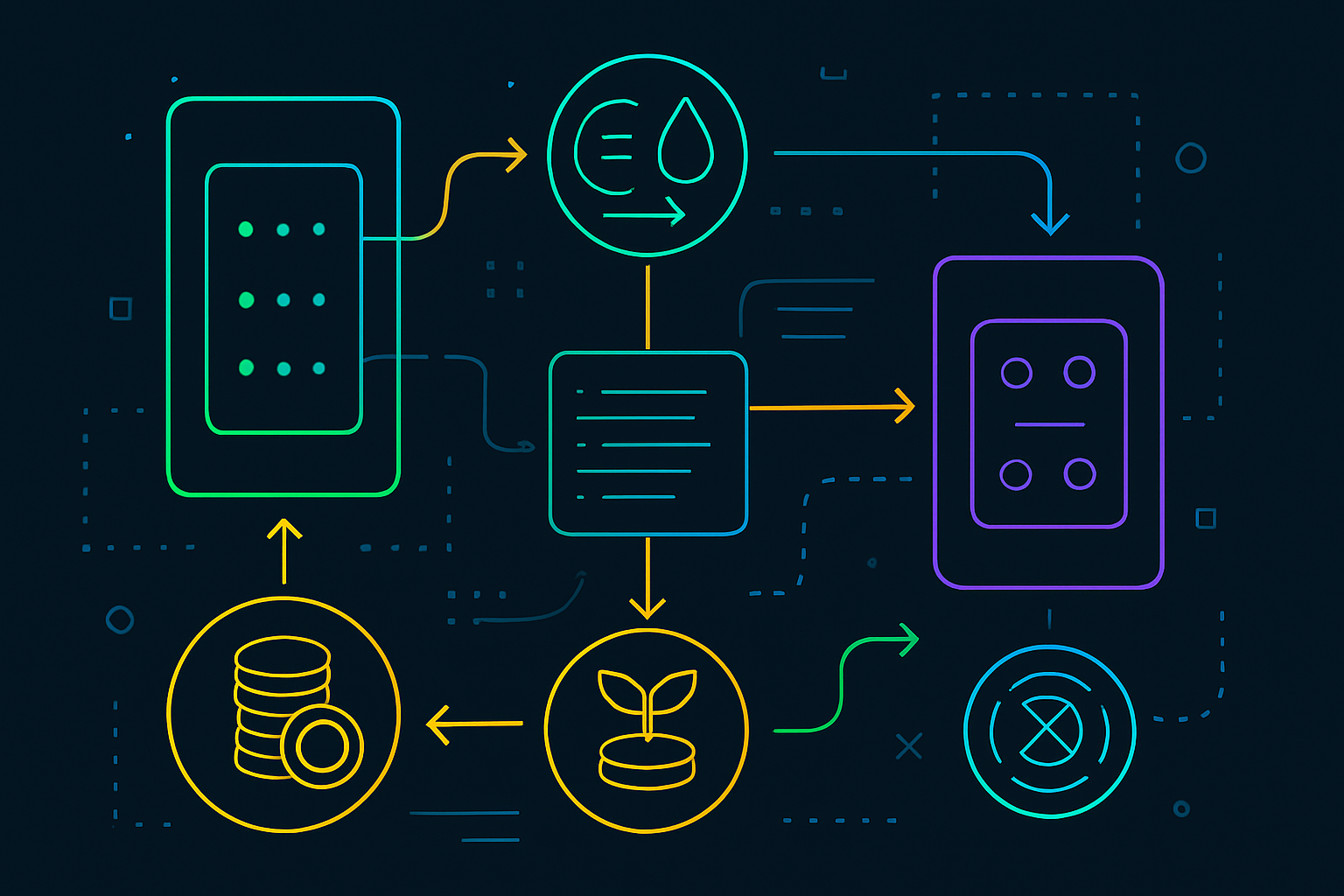

For years, stablecoins have been the backbone of crypto on/off-ramps, providing a bridge between volatile digital assets and the relative calm of fiat currencies. Yet as adoption accelerates and regulatory scrutiny increases, the infrastructure underpinning these conversions is evolving rapidly. Dedicated stablecoin blockchains, purpose-built for stablecoin settlement and transfer, are now at the heart of this transformation, delivering specialized solutions that address speed, cost, compliance, and privacy in ways that general-purpose networks cannot.

Why Stablecoins Became Essential for On/Off-Ramps

The core promise of stablecoins is simple: price stability. By pegging digital tokens to assets like the US dollar or euro, stablecoins eliminate most of the volatility that plagues cryptocurrencies like Bitcoin or Ethereum. This stability makes them ideal for on/off-ramp services, where users need to move funds between crypto and traditional finance without sudden price swings eroding their value.

But it’s not just about price. Stablecoins are programmable, settle in minutes rather than days, and can be transferred globally with minimal fees. According to recent analysis, these features have made them indispensable for remittances, payroll, e-commerce, and especially for those seeking privacy or financial autonomy. Still, until recently most of this activity relied on multi-purpose blockchains like Ethereum or Tron, networks not optimized for the unique demands of high-frequency stablecoin payments.

The Rise of Dedicated Stablecoin Blockchains

This is where dedicated stablecoin blockchains enter the picture. Platforms like Plasma are raising significant capital (over $20 million in recent rounds) to build chains tailored specifically for high-throughput, low-cost USDT transactions. These blockchains strip away unnecessary functionality and focus entirely on optimizing stablecoin settlement: think lower gas fees (often paid directly in USDT), faster block times, and enhanced privacy features.

The result? A more efficient foundation for on/off-ramp providers and end-users alike. For example:

- Stable chain USDT on-ramp: Users can deposit fiat via bank transfer or card purchase directly into native USDT wallets on a dedicated blockchain, no need to traverse multiple chains or pay high bridging fees.

- Stable crypto cards: Issuers leverage these specialized networks to offer instant loading and spending with near-zero delays or conversion costs.

- Private stablecoin conversion: Enhanced network-level privacy tools help shield user identities when moving between fiat and crypto, a growing demand among privacy advocates worldwide.

Integration With Banks and Corporate Finance: The New Frontier

The impact isn’t limited to retail users. Major banks such as FV Bank now support direct deposits in popular stablecoins like USDT, streamlining cross-border payments by bypassing slow SWIFT rails entirely. Regulatory clarity from measures like the U. S. GENIUS Act has pushed household names, Bank of America, Citigroup, Walmart, to explore launching their own dollar-backed tokens atop dedicated blockchains.

This corporate adoption signals a new era where stablecoin-powered Layer 1s could become critical infrastructure not just for crypto natives but also for global commerce. The seamless integration with traditional finance is making it easier than ever to convert between fiat cash and digital dollars, in some cases with settlement times measured in seconds rather than days.

The Expanding Ecosystem: Wallets and Off-Ramp Innovations

User experience is also improving rapidly as wallet providers expand their support for these new networks. MetaMask’s partnership with Transak now enables off-ramping from over 10 different blockchains directly into local bank accounts or cards, a dramatic simplification compared to even two years ago. Uniswap’s integration with Robinhood and MoonPay further blurs the line between DeFi protocols and everyday banking services.

This convergence means that whether you’re a high-frequency trader looking for efficiency or an individual seeking private access to global finance tools, dedicated stablecoin blockchains are setting a new standard for what’s possible in digital asset management, and they’re just getting started.

Yet, as with any technological leap, the rise of dedicated stablecoin blockchains introduces new questions around risk management, user privacy, and regulatory adaptation. While these networks offer unmatched efficiency and lower costs, their rapid adoption is pressuring both compliance teams and regulators to keep pace. The GENIUS Act has established a much-needed federal framework, but the global nature of crypto flows means that cross-border harmonization remains a work in progress.

For users, this presents both opportunity and responsibility. On one hand, platforms like Stable are making it easier than ever to move between fiat and crypto with minimal friction. On the other hand, understanding which providers offer true private stablecoin conversion, how fees are structured on each chain, and what protections exist against de-pegging or technical failures is more important than ever. As always in digital finance: trust must be earned through transparency and robust risk controls.

Benefits and Trade-Offs: What Users Should Know

Dedicated stablecoin blockchains deliver on several fronts:

Key Benefits of Dedicated Stablecoin Blockchains for On/Off-Ramp Users

-

Faster and More Secure Transactions: Platforms like Plasma are building blockchains specifically for stablecoin payments, enabling near-instant settlements and enhanced security compared to general-purpose networks.

-

Lower Costs for Cross-Border Payments: Banks such as FV Bank now support direct USDT deposits, reducing reliance on traditional wire transfers and minimizing transaction fees for international users.

-

Improved Regulatory Clarity: The passage of the U.S. GENIUS Act has provided a federal framework for stablecoins, encouraging adoption by major corporations like Bank of America and Walmart and increasing user confidence in on/off-ramp operations.

-

Seamless Integration with Fiat Services: Wallet providers like MetaMask and Uniswap have expanded their fiat off-ramp services, supporting multiple blockchain networks and making it easier for users to convert between crypto and traditional currencies.

-

Enhanced Accessibility and User Experience: Dedicated stablecoin blockchains streamline onboarding and offboarding processes, allowing users to move funds with fewer steps and less friction, as seen with integrations involving Robinhood, MoonPay, and Transak.

Speed: Settlement times are often measured in seconds thanks to optimized consensus mechanisms.

Cost: Lower gas fees, often payable in USDT or another native stablecoin, mean smaller transaction sizes remain economical.

Privacy: Some chains offer built-in privacy layers or shielded transactions for those seeking discretion.

Simplicity: Fewer hops between chains reduce the risk of lost funds or accidental exposure to volatile tokens.

The trade-offs? Users must stay vigilant about counterparty risk (including the stability of the underlying asset), evolving compliance requirements, and chain-specific vulnerabilities. Not all blockchains are created equal; due diligence into uptime history, audit results, and community support is essential before moving significant sums.

Looking Ahead: The Future of Stablecoin On/Off-Ramps

The momentum behind dedicated stablecoin blockchains is unmistakable. With major players from fintech to retail embracing these networks for their superior performance and compliance features, we’re entering an era where stablecoin on/off-ramp solutions will become as intuitive as using a debit card or sending an email.

This evolution isn’t just about convenience; it’s about widening access to financial services globally. For individuals in emerging markets or underbanked regions, instant conversion between digital dollars and local fiat can mean everything from cheaper remittances to safer savings. For institutions managing treasury flows across borders, it promises real-time settlement without legacy bottlenecks.

The next wave will likely see further integration with payment processors, more robust privacy options for those who demand it, and continued advances in cross-chain interoperability, making it possible for users to move value seamlessly regardless of their preferred ecosystem.

If you’re considering leveraging these innovations for your own crypto journey, or your business’s treasury operations, now is the time to start exploring dedicated stablecoin blockchains. As always: manage downside first by understanding your provider’s tech stack, legal standing, and security posture before entrusting them with significant assets.