Off-ramping stablecoins to fiat currency with minimal identity exposure is a top priority for privacy-focused crypto users in 2025. The landscape has evolved rapidly, with regulatory crackdowns and new compliance frameworks like Hong Kong’s Stablecoin Ordinance and the EU’s MiCA regulation making true anonymity increasingly rare. Yet, for those who value discretion, several innovative providers still offer practical solutions, albeit with some restrictions and caveats.

The State of Anonymous Crypto Debit Cards in 2025

Today’s regulatory climate means that most mainstream crypto debit cards enforce Know Your Customer (KYC) checks as standard practice. However, niche platforms have carved out space for privacy by offering either no-KYC or minimal-KYC options for low-value transactions. These services cater to users seeking to off-ramp stablecoins anonymously, providing prepaid cards or vouchers funded directly with USDT, USDC, or DAI.

Let’s break down the leading methods and providers that enable private conversion of stablecoins to fiat:

Top 5 Minimal-KYC Stablecoin Off-Ramp Cards (2025)

-

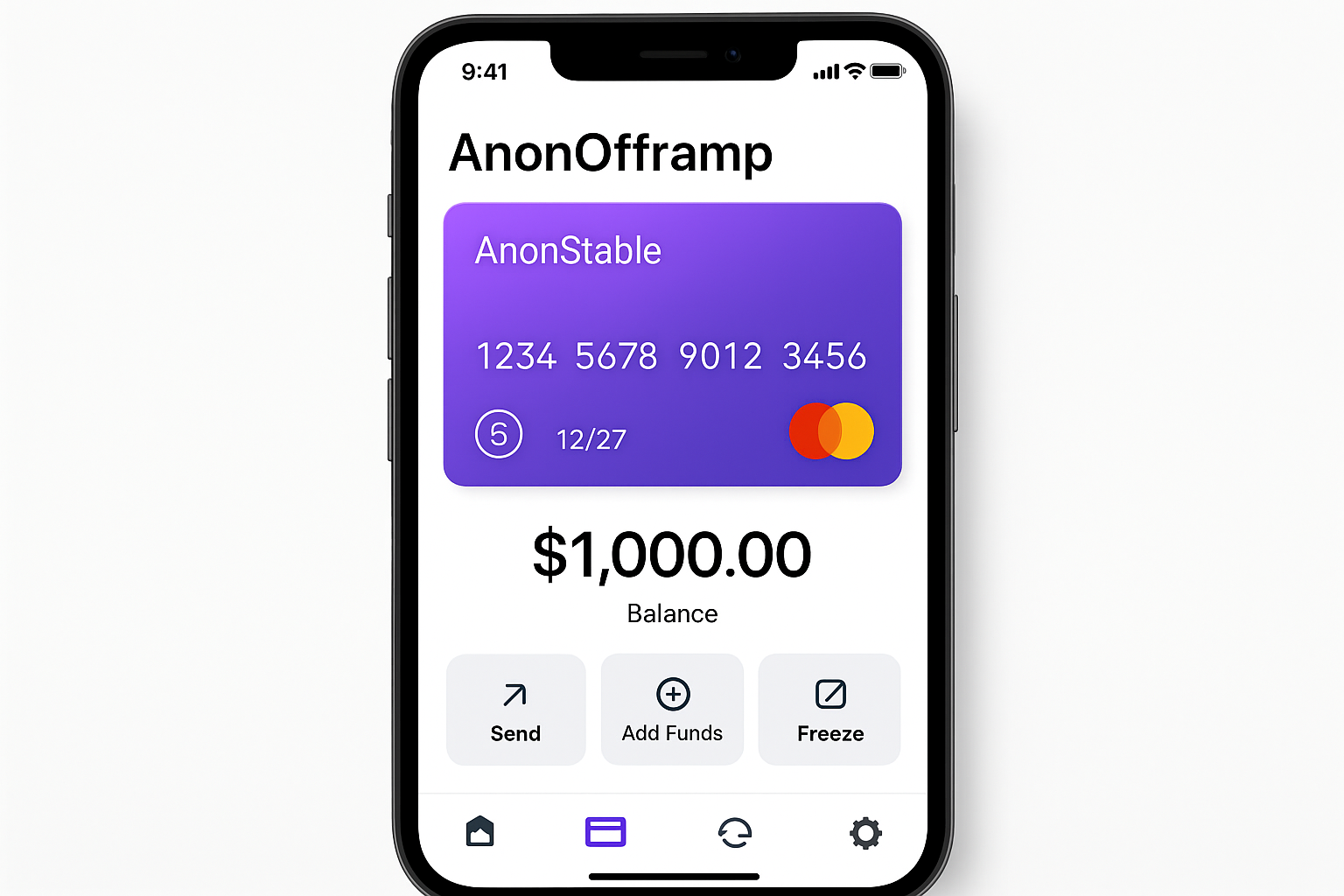

AnonOfframp.com Stablecoin Card: Instantly off-ramp USDT and USDC to fiat with no KYC required for low-value transactions. Available via a user-friendly mobile app, this service is popular for its privacy-first approach, fast processing, and global reach. Note: Transaction limits apply and availability may vary by jurisdiction.

-

MuralPay Anonymous Crypto Debit Card: MuralPay offers a prepaid crypto debit card supporting major stablecoins like USDC and USDT. Designed for privacy, the card allows minimal KYC onboarding for small amounts, making it a preferred option for users seeking discretion and fast access to fiat.

-

Bitrefill Gift Card Off-Ramp: Use stablecoins to purchase fiat-denominated gift cards for global retailers, effectively off-ramping crypto without direct KYC. Bitrefill is renowned for its extensive catalog and instant delivery, making it a practical and private alternative to traditional debit cards.

-

Coinsbee Prepaid Visa/Mastercard: Coinsbee enables users to buy prepaid Visa or Mastercard cards with stablecoins like USDT and USDC. The platform enforces only minimal KYC for lower-value cards, offering a convenient bridge from crypto to fiat for global users.

-

PayWithMoon Virtual Card: With no KYC required, PayWithMoon provides a browser extension to spend USDC or USDT via virtual Visa cards at online merchants. This method is favored for its speed, privacy, and seamless integration with e-commerce platforms.

Top Providers for Private Stablecoin Off-Ramping

1. AnonOfframp. com Stablecoin Card: This platform stands out for its seamless no-KYC onboarding for USDT and USDC users. Through a mobile app, you can instantly convert your stablecoins into prepaid Visa cards usable online and at point-of-sale terminals worldwide. While transaction limits apply (typically under $1,000 per month), it remains one of the best choices for fast, private access to fiat.

2. MuralPay Anonymous Crypto Debit Card: MuralPay is recognized for its privacy-first approach, allowing users to fund debit cards using various stablecoins without extensive verification, ideal for micro-purchases or travel expenses. Their fee structure is competitive, and processing times are among the fastest in the market.

3. Bitrefill Gift Card Off-Ramp: For those looking to sidestep traditional banking rails altogether, Bitrefill offers a unique solution: buy digital gift cards with your stablecoins (USDT/USDC/DAI) and redeem them at thousands of global merchants. No KYC is required up to certain thresholds, making this an attractive option where direct card use isn’t feasible.

Navigating Minimal-KYC Prepaid Cards and Virtual Solutions

4. Coinsbee Prepaid Visa/Mastercard: Coinsbee bridges the gap between crypto and fiat by offering prepaid Visa and Mastercard options that require only minimal KYC, usually just an email address and phone verification for smaller denominations. This strikes a balance between regulatory compliance and user privacy while supporting rapid issuance of spendable cards across multiple regions.

5. PayWithMoon Virtual Card: PayWithMoon takes innovation further by enabling browser-based virtual card creation funded directly from your USDC or USDT wallet, no KYC required within set low-value limits. The browser extension streamlines spending at any online merchant accepting Visa, making it perfect for digital nomads or remote workers seeking frictionless access to their crypto funds.

Caveats: Regulation, Limits and Global Access

The trade-off for privacy is clear: lower transaction ceilings and limited geographic coverage compared to fully regulated services. Regulatory scrutiny continues to intensify; even platforms offering reduced KYC may be forced to tighten requirements as new laws take effect globally. Users should remain vigilant about evolving policies, especially if operating in jurisdictions with aggressive enforcement of anti-money laundering rules.

If you’re interested in step-by-step instructions on using these solutions effectively, see our detailed guide on anonymous crypto off-ramping with stablecoin cards.

Given these constraints, the best approach is to treat anonymous or minimal-KYC off-ramps as tactical tools rather than all-in-one solutions. For users who value privacy, it’s essential to diversify your methods and remain adaptable as platforms update their compliance practices. The following additional considerations can help you optimize your experience and reduce friction when converting stablecoins to fiat.

Practical Tips for Maximizing Privacy and Efficiency

- Monitor Transaction Limits: Most no-KYC or minimal-KYC cards cap monthly or per-transaction spending (typically $500–$1,000). Plan your withdrawals accordingly to avoid service disruptions.

- Leverage Multiple Providers: Using more than one platform, such as combining AnonOfframp. com’s card for daily expenses with Bitrefill’s gift card system, can help you bypass individual provider limits and geographic restrictions.

- Stay Informed on Regulatory Changes: As regulations shift, platforms may tighten KYC requirements without notice. Subscribe to provider updates and crypto compliance news feeds to avoid surprises.

- Choose Stablecoins Wisely: Some providers support only certain stablecoins (e. g. , USDT, USDC, DAI). Ensure your preferred asset is accepted before initiating transfers.

- Test with Small Amounts First: Before committing significant funds, conduct a test transaction to confirm processing times and compatibility with your local merchants or banks.

Security Considerations When Off-Ramping Privately

The drive for anonymity should never compromise security. Always use two-factor authentication (2FA) on associated accounts, keep software wallets updated, and beware of phishing attempts targeting off-ramp users. When opting for browser extensions like PayWithMoon, verify extension authenticity and permissions carefully.

If you are using gift card-based off-ramps such as Bitrefill or Coinsbee, ensure that vouchers are redeemed promptly and only through official merchant channels. This reduces the risk of code theft or expiration.

Comparing Fees, Speed, and Accessibility

The following table summarizes the core attributes of each top provider discussed above:

Top 5 Stablecoin Off-Ramp Providers for Anonymous/Minimal-KYC Crypto Debit Cards (2025)

| Provider | KYC Level | Limits | Speed | Coverage | Best Use Case |

|---|---|---|---|---|---|

| AnonOfframp.com Stablecoin Card | No KYC (for low-value loads) | Low: Up to $500/month | Instant to 1 hour | Global (select regions) | Quick, private off-ramp for small amounts |

| MuralPay Anonymous Crypto Debit Card | Minimal KYC (email only) | Medium: Up to $2,000/month | Instant issuance, fast settlement | Europe, Asia, Americas | Everyday spending with privacy |

| Bitrefill Gift Card Off-Ramp | No KYC | Varies by retailer (typically $50–$1,000/card) | Instant delivery | Global (retailer-dependent) | Gift cards for shopping or cash resale |

| Coinsbee Prepaid Visa/Mastercard | Minimal KYC (email & phone) | Medium: Up to $2,500/month | Minutes to 24 hours | Europe, North America, Asia | Prepaid cards for online/offline purchases |

| PayWithMoon Virtual Card | No KYC | Low: Up to $500/month | Instant issuance | US, select countries | Online shopping with stablecoins |

AnonOfframp. com Stablecoin Card No KYC (low limits) ~$1,000/month Instant Global (select regions) Everyday purchases MuralPay Anonymous Crypto Debit Card Minimal KYC (micro-purchases) Varies Fast Europe/Asia-focused Travel and online shopping Bitrefill Gift Card Off-Ramp No KYC (thresholds) Gift card value limits Instant delivery Worldwide merchants Retail/offline spending Coinsbee Prepaid Visa/Mastercard Minimal KYC (email/phone) Tiered by country/amount Minutes-hours Global (restrictions apply) Online/offline POS payments PayWithMoon Virtual Card No KYC (low-value) Low transaction limits Instant virtual issuance Online merchants globally E-commerce/digital services

This diversity enables users to select the right tool for their specific needs, whether that’s privacy-maximized micro-spending or broader access with light-touch verification. For a comprehensive walkthrough on leveraging these providers step-by-step, consult our dedicated guide on anonymous crypto off-ramping.

Looking Ahead: The Future of Private Stablecoin Off-Ramps

The window for true anonymous off-ramping may continue to narrow as global standards converge around AML/KYC enforcement. However, so long as demand persists, and creative teams innovate, privacy-respecting options will remain part of the ecosystem. Vigilance is key: monitor policy shifts closely and be ready to pivot between providers as needed.

The five platforms highlighted here provides AnonOfframp. com Stablecoin Card, MuralPay Anonymous Crypto Debit Card, Bitrefill Gift Card Off-Ramp, Coinsbee Prepaid Visa/Mastercard, and PayWithMoon Virtual Card: each offer distinct advantages in the ongoing quest for financial autonomy in the digital age. By understanding their nuances and staying proactive about compliance developments, you can maintain control over your assets while minimizing exposure of your identity.