Privacy is the new gold standard in crypto, and nowhere is this more crucial than when moving between fiat and digital assets. As regulatory scrutiny tightens and mainstream adoption accelerates, users are seeking on/off-ramp solutions that don’t just promise speed and convenience, but also robust anonymity. If you’re exploring a privacy crypto on-ramp or an anonymous crypto off-ramp, here’s what should be at the top of your checklist.

No-KYC or Minimal KYC Requirements

The cornerstone of any true privacy-focused ramp is its approach to Know Your Customer (KYC) regulations. While traditional finance rails demand full identity disclosure, some platforms are pioneering alternatives. Solutions like Mt Pelerin offer minimal KYC thresholds, letting users transact up to certain daily, monthly, or yearly limits without submitting invasive personal documentation. This approach balances compliance with user privacy, making it possible to buy or sell crypto with limited exposure.

Even more cutting-edge are platforms leveraging zero-knowledge proofs (ZKPs), such as ZKP2P, which allow users to prove transaction validity without revealing any sensitive details at all. The result? You get the liquidity you need without leaving a digital paper trail for prying eyes.

Non-Custodial Wallet Integration

If you don’t hold your keys, you don’t truly own your coins – that’s been the mantra since Bitcoin’s inception. Privacy-centric ramps increasingly integrate with non-custodial wallets, ensuring users maintain full control over their assets throughout every step of the conversion process. Instead of trusting a third party with your funds (and your data), you can transact directly from wallets where only you possess the private keys.

This model not only reduces counterparty risk but also minimizes data leakage – there’s simply less information for bad actors or authorities to compromise. For those serious about operational security and sovereignty over their funds, non-custodial wallet support is non-negotiable.

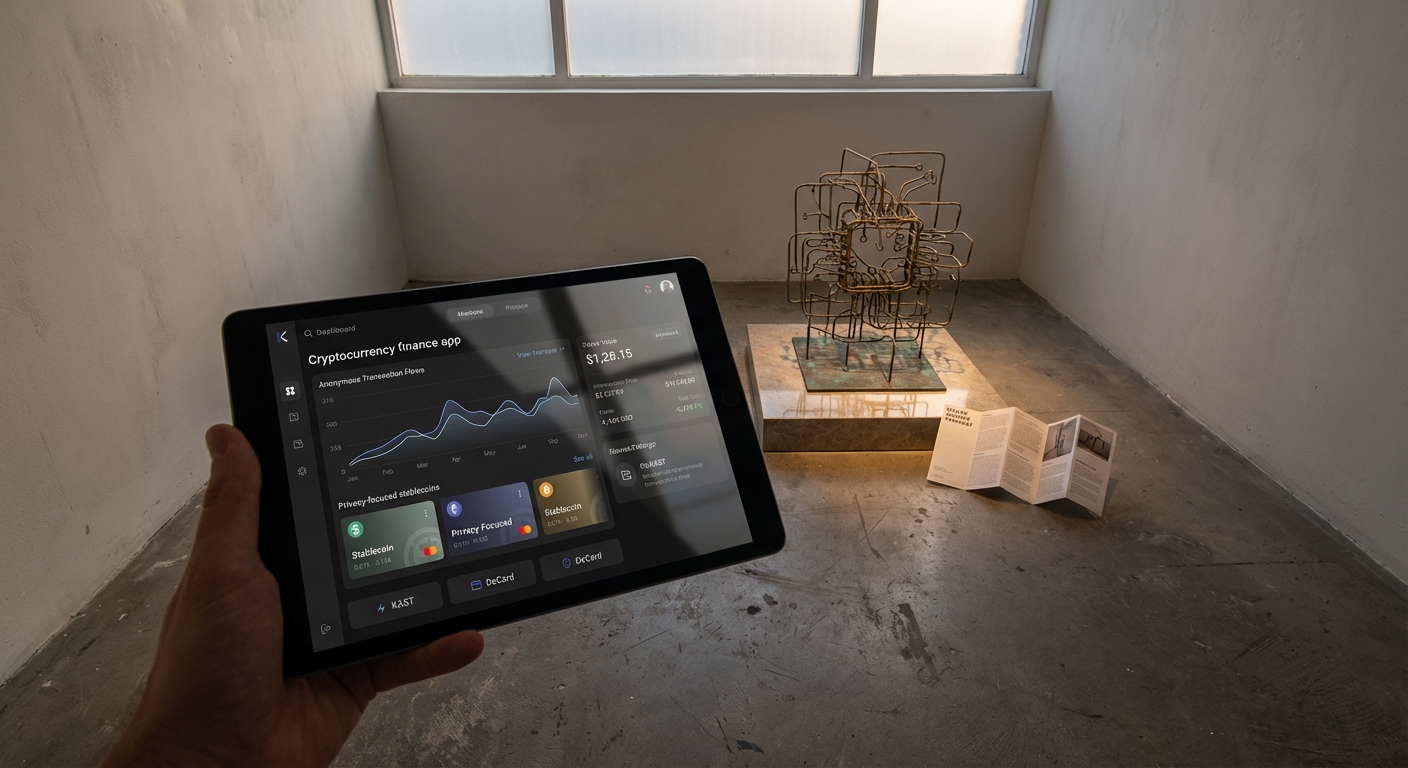

Support for Privacy Coins and Stablecoins

A truly private on/off-ramp goes beyond Bitcoin and Ethereum by supporting assets designed specifically for confidentiality. Platforms that accept privacy coins like Monero (XMR) or Zcash (ZEC) empower users to move value off-chain without exposing sender/receiver details or transaction amounts. These coins use advanced cryptography to keep every transfer untraceable – ideal for anyone prioritizing discretion.

At the same time, stablecoins like USDT or USDC remain essential for those who want price stability while moving between fiat and crypto ecosystems. The best ramps offer a seamless bridge between privacy coins and stablecoins so users can balance discretion with market predictability.

Essential Features of Privacy-Focused Crypto On/Off-Ramps

-

No-KYC or Minimal KYC Requirements: Choose platforms like Mt Pelerin or ZKP2P that allow users to buy and sell crypto with little to no identity verification, helping preserve user privacy while adhering to regulatory thresholds.

-

Non-Custodial Wallet Integration: Opt for solutions that support non-custodial wallets such as MetaMask and Trust Wallet, ensuring users retain full control over their private keys and funds during on/off-ramp transactions.

-

Support for Privacy Coins and Stablecoins: Look for platforms that facilitate transactions with privacy coins like Monero (XMR) and Haven Protocol (XHV), as well as stablecoins such as Tether (USDT) and USD Coin (USDC), offering both anonymity and price stability.

-

End-to-End Encryption and Data Protection: Select platforms employing robust encryption standards and privacy-preserving technologies like SquareFi (with Multi-Party Computation) to safeguard transaction data and user information at every step.

Why Stablecoin Support Matters in 2025

The current market context shows stablecoins are more relevant than ever as bridges between traditional finance and DeFi. With platforms like Adesic supporting both major cryptocurrencies and stablecoins through diverse payment rails (see Adesic’s offering here), it’s now possible to stay private without sacrificing utility.

End-to-End Encryption and Data Protection

Privacy doesn’t stop at the transaction layer. The most robust private stablecoin off-ramp solutions employ end-to-end encryption across all communications and transaction data. This means your information is protected in transit and at rest, drastically reducing the risk of interception or unauthorized access. Look for platforms that are transparent about their security stack, whether they use TLS 1.3, hardware security modules, or advanced key management systems. If a service can’t clearly articulate how your data is shielded from both internal and external threats, it’s not worthy of your trust.

Additionally, leading privacy ramps adhere to strict data minimization principles: collecting only what’s absolutely necessary for compliance or technical function, then securely purging it as soon as possible. This practice, combined with encryption, creates a formidable barrier against surveillance or data breaches.

Anonymous Payment Methods: Prepaid Cards and Vouchers

For the truly privacy-conscious, the way you move funds matters just as much as which assets you use. Anonymous payment methods like prepaid cards, crypto vouchers, and even select gift cards are increasingly available through modern ramps. These tools let you load value onto a card or code without linking transactions to your personal identity, perfect for discreet spending or cashing out in sensitive situations.

The best platforms offer these options alongside traditional rails like bank transfers or credit cards, giving users the flexibility to choose their preferred balance of privacy versus convenience. As always, ensure that any anonymous payment method you choose is supported by strong security protocols and reputable partners.

Essential Features of Privacy-Focused Crypto On/Off-Ramps

-

No-KYC or Minimal KYC Requirements: Choose platforms like Mt Pelerin or ZKP2P that allow crypto-fiat transactions with little to no identity verification, preserving your privacy while staying within regulatory limits.

-

Non-Custodial Wallet Integration: Opt for solutions that support direct transfers to and from non-custodial wallets, such as MetaMask or Coinbase Wallet, ensuring you retain full control of your funds at all times.

-

Support for Privacy Coins and Stablecoins: Look for platforms that facilitate transactions with privacy coins like Monero (XMR) and stablecoins such as Tether (USDT) or USD Coin (USDC), offering both anonymity and stability.

-

Anonymous Payment Methods (e.g., Prepaid Cards, Vouchers): Platforms supporting anonymous payment options, like Paxful (gift cards, prepaid cards) or LocalMonero, allow you to buy or sell crypto without directly linking to your bank account.

Navigating the Landscape: What Sets Top Privacy Ramps Apart?

The privacy on/off-ramp sector is evolving rapidly, competition is fierce and innovation happens at breakneck speed. When comparing providers in 2025, prioritize those who:

- Publish independent audits of their security infrastructure

- Offer clear documentation for API integrations (especially critical for businesses)

- Actively support user education around operational security and regulatory changes

- Maintain strong reputations, backed by real user reviews and community engagement

If you’re serious about keeping your financial life private while enjoying seamless fiat-crypto conversion, don’t settle for half measures. Demand transparency from providers, and never underestimate the value of community feedback when evaluating new platforms.

The Takeaway: Privacy Is Power, But It’s Also a Process

The future of secure crypto on-ramps will be shaped by relentless pressure from both regulators and privacy advocates. By focusing on solutions that combine No-KYC/minimal KYC requirements, non-custodial wallet integration, full support for both privacy coins and stablecoins, end-to-end encrypted infrastructure, and truly anonymous payment rails like prepaid cards, you’ll be well positioned to thrive in this new era of digital finance.

If you want to explore more about how non-custodial wallets interact with modern on/off-ramp infrastructure, and why this matters for user control, you can dive deeper via resources like this detailed analysis from Calibraint.