In 2025, the landscape for converting USDT to cash anonymously has become a technical arms race between privacy advocates and tightening global regulations. With the implementation of the U. S. GENIUS Act and Europe’s MiCA regime, KYC and AML standards are now baseline for most stablecoin issuers. Yet, demand for anonymous crypto to fiat conversion is stronger than ever, especially among users who value privacy, operational flexibility, or reside in jurisdictions with restrictive banking policies.

Why Stablecoin On/Off-Ramp Cards Are Leading Private Crypto-to-Cash Solutions in 2025

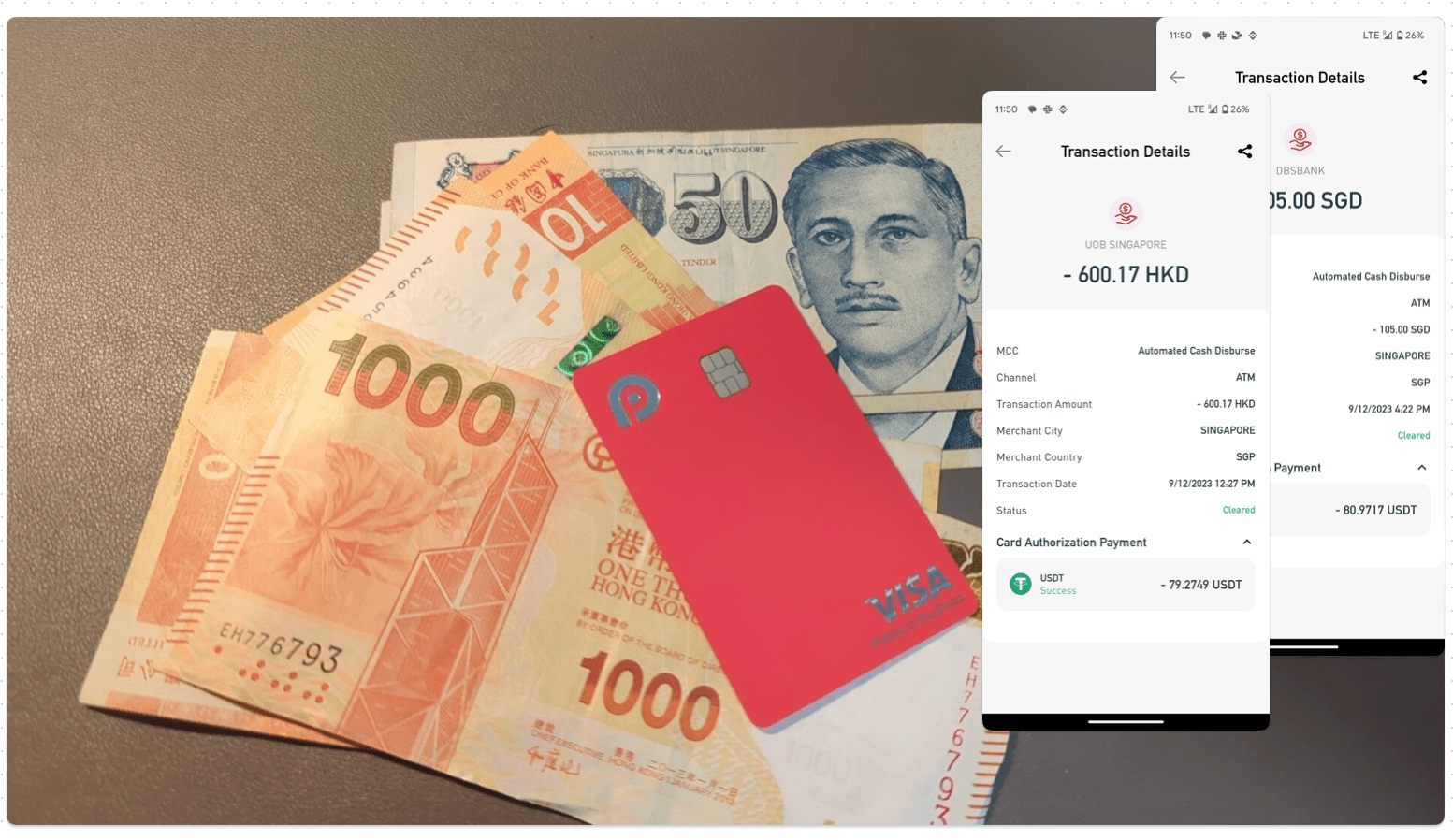

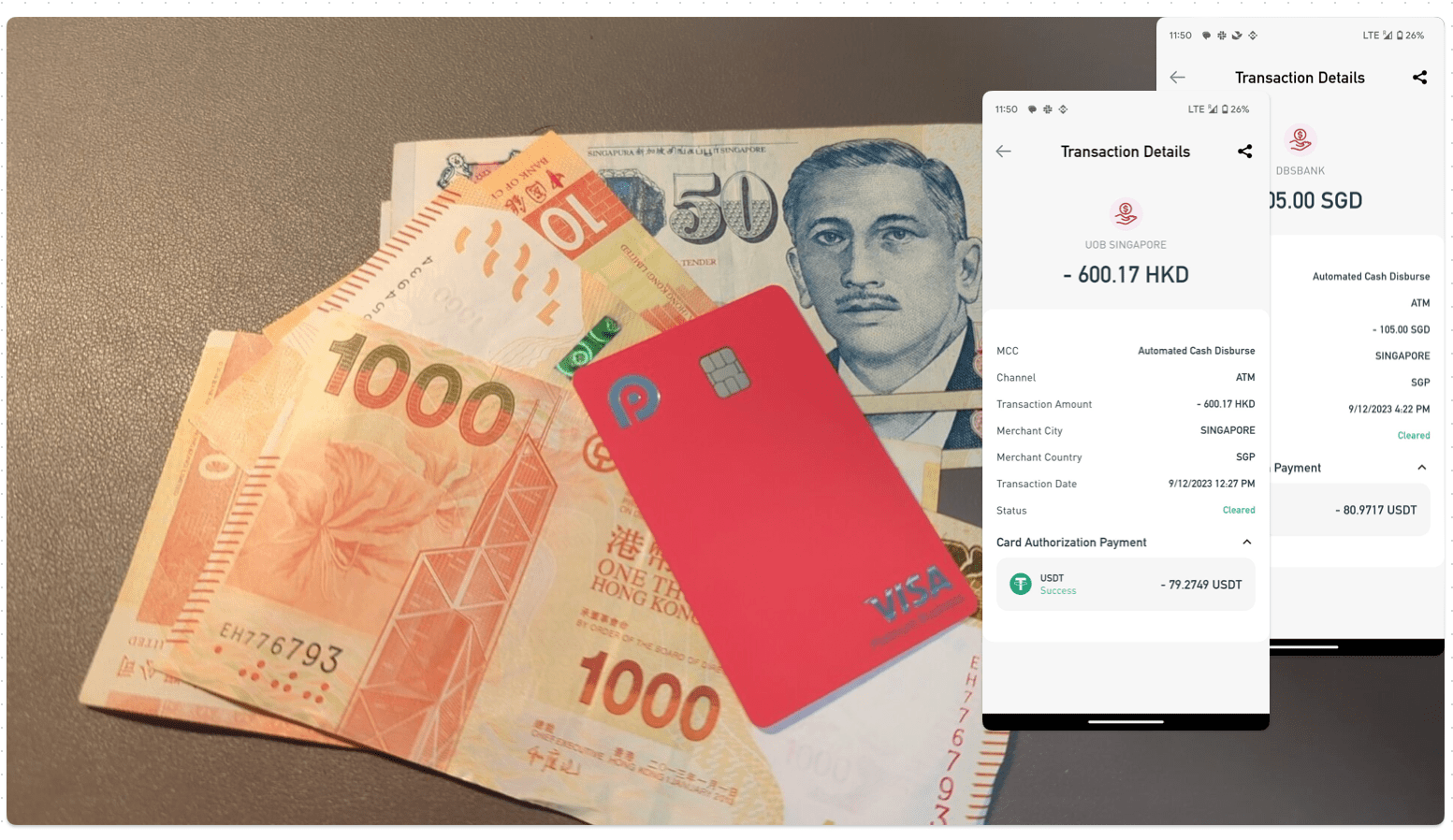

The evolution of stablecoin on/off-ramp cards has been nothing short of transformative. These cards, such as RedotPay and those offered by anonofframp. com, bridge the gap between digital assets and real-world spending. Users can deposit USDT (Tether) onto their card wallet and instantly withdraw local fiat currency at ATMs worldwide or spend directly at merchants. The appeal is clear: minimal friction, fast settlement, and in some cases enhanced privacy compared to centralized exchanges.

While most reputable card issuers require some level of KYC due to regulatory mandates, select providers have innovated with privacy-first issuance models, leveraging jurisdictional arbitrage or low-tier limits that allow for non-intrusive verification. For a detailed breakdown on how these cards facilitate instant USDT-to-cash conversion, see our in-depth guide.

The Top 3 Methods for Instantly Converting USDT to Cash Anonymously in 2025

Top 3 Anonymous USDT to Cash Conversion Methods (2025)

-

Use a Stablecoin On/Off-Ramp Card (e.g., RedotPay, anonofframp.com) to instantly convert USDT to cash at ATMs worldwide. These crypto debit cards link directly to your stablecoin wallet, enabling seamless cash withdrawals and point-of-sale transactions. While some cards may require minimal KYC, platforms like RedotPay and anonofframp.com prioritize privacy and fast settlement, making them ideal for users seeking discretion and global access.

-

Withdraw USDT Anonymously via Bitcoin ATMs Supporting Stablecoins (No KYC Required). Select Bitcoin ATMs now support direct stablecoin (USDT) deposits and cash withdrawals. These machines often allow small, in-person transactions without identity verification, offering a quick and private off-ramp for USDT holders. Always check the ATM’s supported coins and withdrawal limits before proceeding.

-

Leverage Peer-to-Peer (P2P) Crypto-to-Cash Marketplaces with Escrow and Privacy Features (e.g., LocalCryptos, AgoraDesk). Platforms like LocalCryptos and AgoraDesk connect buyers and sellers directly, enabling USDT-to-cash trades with escrow protection and optional privacy tools. These marketplaces often require no KYC for small trades, supporting a range of payment methods and local currencies.

Let’s break down the three most effective platforms and strategies for private stablecoin off-ramping this year:

- Use a Stablecoin On/Off-Ramp Card (e. g. , RedotPay, anonofframp. com) to Instantly Convert USDT to Cash at ATMs Worldwide

These cards allow you to top up with USDT and withdraw local currency from compatible ATMs globally. Some providers offer tiered KYC requirements, meaning you can transact below certain thresholds with minimal identity disclosure. The process is straightforward: deposit USDT into your card wallet, select your withdrawal amount at an ATM, and receive fiat instantly. This method combines speed with relative discretion when compared to traditional bank-linked off-ramps. - Withdraw USDT Anonymously via Bitcoin ATMs Supporting Stablecoins (No KYC Required)

A growing number of Bitcoin ATM networks now support direct stablecoin withdrawals, including Tether (USDT). You simply send your USDT to the provided address or QR code at the ATM interface; after network confirmation, you receive cash on-site. Most machines have transaction limits (often $500–$1,000 per day) before requiring further verification, but within these bounds, no personal data is collected. This makes it one of the purest forms of anonymous crypto-to-cash conversion available today. - Leverage Peer-to-Peer (P2P) Crypto-to-Cash Marketplaces with Escrow and Privacy Features (e. g. , LocalCryptos, AgoraDesk)

P2P marketplaces remain a cornerstone for users seeking both flexibility and privacy. Platforms like LocalCryptos and AgoraDesk offer escrow-protected trades where buyers and sellers negotiate terms directly, often meeting in person or utilizing local bank transfers with anonymized details. Advanced privacy features such as end-to-end encrypted messaging and optional Tor access enhance user anonymity throughout the transaction process.

Navigating Compliance Risks While Prioritizing Privacy

The drive for private stablecoin card services must be balanced against evolving regulatory frameworks. While non-KYC solutions exist, especially for lower-value transactions, they may not be suitable or legal in every jurisdiction. Users should be aware that exceeding platform-imposed limits can trigger mandatory identity checks or even account suspension.

Security is also paramount: non-KYC platforms sometimes attract bad actors due to their very nature; always conduct due diligence on any service before transacting substantial amounts.

Transaction fees and exchange rates are another critical consideration. Bitcoin ATMs that support USDT withdrawals typically charge a premium over spot market rates, with fees ranging from 3% to 8% depending on the provider and location. Stablecoin on/off-ramp cards like RedotPay or anonofframp. com often offer more competitive rates, but users should still review terms for withdrawal limits, card maintenance fees, and cross-border ATM surcharges. Peer-to-peer marketplaces may have variable spreads based on market demand and local liquidity, always confirm the exact amount you’ll receive before committing to a trade.

Best Practices for Anonymous USDT-to-Cash Off-Ramping in 2025

To maximize privacy while minimizing risk, consider the following best practices when converting USDT to cash anonymously:

- Stay Below KYC Thresholds: Most platforms set daily or monthly limits for non-KYC users (e. g. , $500–$1,000 per day at Bitcoin ATMs). Plan your transactions accordingly to avoid triggering identity checks.

- Use Privacy Tools: When possible, access P2P marketplaces or card platforms via Tor or VPN to further obscure your IP address and location data.

- Verify Platform Reputation: Stick with established brands like RedotPay, anonofframp. com, LocalCryptos, or AgoraDesk. Check recent user reviews and community feedback for any red flags.

- Double-Check Transaction Details: Whether using an ATM or P2P escrow service, always verify wallet addresses and amounts before sending USDT. Blockchain transactions are irreversible.

Comparing Privacy Levels Across Methods

The degree of anonymity varies between methods. Stablecoin on/off-ramp cards offer unmatched convenience but typically require some form of verification, even if minimal for lower tiers. Bitcoin ATMs, especially those that support direct stablecoin withdrawals without KYC, provide the highest level of transactional privacy but are subject to geographic availability and lower transaction caps. P2P marketplaces strike a balance: they enable flexible deal sizes and advanced privacy features (such as encrypted chat), but require careful counterparty vetting.

If you’re looking for a detailed walkthrough on using stablecoin cards specifically for anonymous off-ramping, including step-by-step instructions, see our resource: How Stablecoin Cards Enable Instant Crypto-to-Fiat Off-Ramping Without KYC Hassles.

The Bottom Line: Efficient and Private Cash Conversion Is Still Possible, With Caveats

The technical landscape in 2025 is more restrictive than ever for those seeking USDT to cash anonymously. However, by leveraging proven tools, like stablecoin on/off-ramp cards (RedotPay, anonofframp. com), Bitcoin ATMs supporting stablecoins with no KYC requirements, and privacy-focused P2P marketplaces, you can still move between crypto and fiat discreetly within defined limits. Always weigh regulatory risk against your need for privacy; compliance boundaries are shifting rapidly as global authorities tighten their grip on digital asset flows.

Top 3 Anonymous USDT-to-Cash Methods Compared (2025)

-

Use a Stablecoin On/Off-Ramp Card (e.g., RedotPay, anonofframp.com) to Instantly Convert USDT to Cash at ATMs WorldwideOn/off-ramp cards like RedotPay allow users to load USDT and withdraw fiat cash at global ATMs. While KYC is typically required for card issuance, these platforms often provide enhanced privacy compared to traditional banks, and transactions may not be directly linked to your main identity. Card providers such as RedotPay and anonofframp.com support instant conversion and spending, but privacy depends on the provider’s policies and local regulations.

-

Withdraw USDT Anonymously via Bitcoin ATMs Supporting Stablecoins (No KYC Required)Many Bitcoin ATMs now accept USDT and other stablecoins for direct cash withdrawal. Leading networks like CoinATMRadar list machines that permit low-value, no-KYC transactions. This method offers a high degree of anonymity for small amounts, but transaction limits and surveillance camera presence may reduce overall privacy. Always check the ATM’s supported coins and local compliance rules before use.

-

Leverage Peer-to-Peer (P2P) Crypto-to-Cash Marketplaces with Escrow and Privacy Features (e.g., LocalCryptos, AgoraDesk)P2P platforms like LocalCryptos and AgoraDesk connect buyers and sellers for in-person or online cash trades. These platforms offer robust escrow systems and optional privacy tools (e.g., encrypted chat, no mandatory KYC for small trades). While offering the highest potential anonymity, users must exercise caution to avoid scams and comply with local laws.

If you’re serious about maintaining financial autonomy while navigating new regulations, stay updated with trusted sources, and revisit our guides regularly as both technology and compliance landscapes evolve.