In a world where every transaction leaves a digital footprint, preserving your financial privacy while converting crypto to fiat feels like a luxury. As someone who’s navigated the choppy waters of digital asset risk management, I get it: you want a private crypto off ramp that doesn’t demand your life’s story. Enter no-KYC stablecoin debit cards, the bridge for seamless, discreet spending of USDT, USDC, and more at millions of merchants worldwide. But here’s the practical truth in 2025: true anonymity is rarer than it was, thanks to tightening regulations. Still, viable options persist with minimal hurdles, empowering privacy advocates like you.

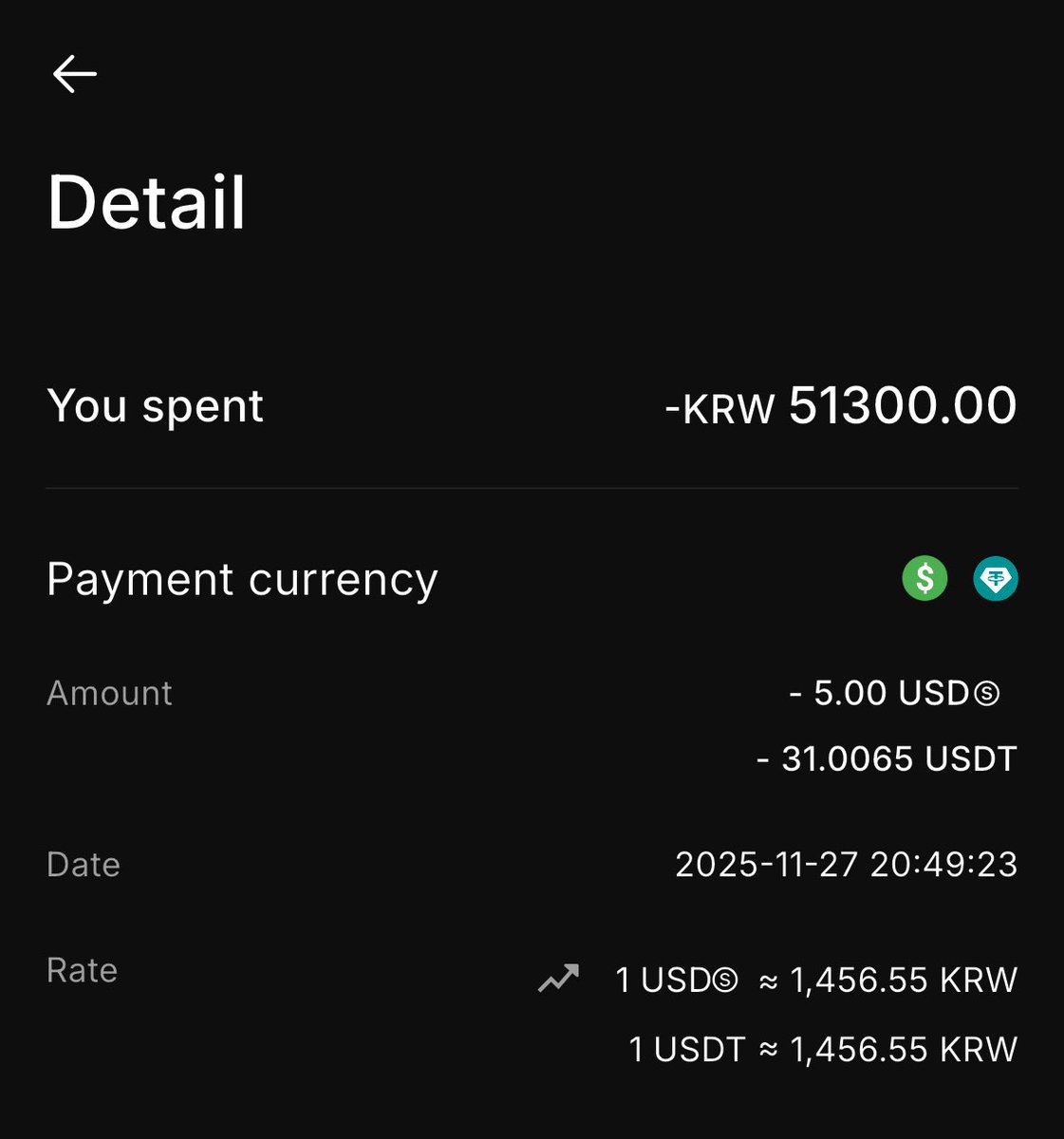

The allure of these cards lies in their ability to top up with stablecoins from self-custodial wallets, then spend like cash without banks prying. No more wrestling with exchange KYC walls or bank freezes on crypto inflows. Yet, as of late 2025, the landscape has shifted. Platforms once in gray zones, like parts of PlasBit, now lean toward compliance. Fully anonymous services? Discontinued or modified. Services like RedotPay step up with minimal KYC for high limits, while Tangem Pay ties Visa cards to hardware wallets, blending self-custody with usability. This evolution demands savvy choices to safeguard your capital.

Why Privacy-Focused Off-Ramps Matter More Than Ever

Regulatory pressures from global watchdogs have squeezed pure no-KYC plays, but the need for them hasn’t vanished. Think about it: in an era of surveillance capitalism, linking your identity to crypto spends invites risks from hackers to overzealous governments. A no kyc stablecoin debit card lets you off-ramp privately, preserving psychological edge in volatile markets. My FRM background screams caution: expose less, preserve more. Peer-to-peer off-ramps shine for no-KYC purity, but debit cards add everyday convenience. Sources like CoinGecko highlight multi-chain cards topping charts, underscoring demand amid Coinbase-style limits that cap spends at $2,500 daily.

Privacy isn’t paranoia; it’s prudent capital preservation in crypto’s wild west.

For digital nomads or expats, cards like those from Mexico’s emerging scenes offer expat-friendly anonymity. Yet, balance is key: opt for audited platforms to dodge rug pulls. This sets the stage for our ranked picks, vetted for adoption, limits, and stablecoin support.

Top 10 No-KYC Stablecoin Debit Cards for Private Off-Ramps

Top 10 Privacy Stablecoin Cards 2025

-

#1 KAST Multi-Chain Stablecoin Card: Spend stablecoins & crypto at 100M+ merchants/ATMs. Key features: Multi-chain support, enhanced SOL staking rewards. Limits: Vary by user activity; verify current. Status: Evolving regs—check KYC.

-

#2 RedotPay USDT Virtual Debit Card: Global virtual card for USDT. Key features: Minimal KYC, high limits, wide acceptance. Limits: High spend thresholds. Practical pick for privacy.

-

#3 PlasBit No-KYC Stablecoin Card: Stablecoin-funded debit. Key features: Privacy focus, crypto top-up. Limits: Previously anonymous; now modified. Confirm current KYC requirements.

-

#4 Uquid Anonymous Mastercard: Anonymous crypto Mastercard. Key features: No ID for issuance, stablecoin support. Limits: Tiered by verification level. Reg changes apply—verify.

-

#5 PST.NET Crypto Virtual Card: Virtual cards from crypto. Key features: Instant issue, multiple currencies. Limits: Up to €10K/month unverified. Minimal docs for privacy.

-

#6 Advcash Privacy Debit Card: Privacy-oriented debit for crypto. Key features: Anonymous top-ups possible. Limits: €2.5K/day max. Balance privacy with compliance.

-

#7 Payeer Stablecoin Plastic Card: Physical card for stablecoins. Key features: Plastic debit, global use. Limits: Vary; check account tier. Evolving no-KYC status.

-

#8 Ezzocard USDC Prepaid Card: USDC prepaid virtual card. Key features: Instant, anonymous purchase. Limits: $500-$5K per card. Great for small spends.

-

#9 Capitalist.NET No-KYC Debit: No-KYC virtual debit. Key features: Crypto exchange integration. Limits: Flexible unverified limits. Stay updated on regs.

-

#10 Perfect Money e-Visa Card: e-Voucher to Visa prepaid. Key features: Anonymous e-vouchers for cards. Limits: $1K per voucher. Simple privacy off-ramp.

Leading the pack is the KAST Multi-Chain Stablecoin Card, praised by CoinGecko for SOL staking rewards and access to 100 million merchants. Load it with stablecoins across chains, spend globally, minimal KYC whispers. Next, RedotPay USDT Virtual Debit Card shines with high limits and broad acceptance, ideal for those okay with light verification amid 2025 regs. PlasBit No-KYC Stablecoin Card clings to its roots, though watch for updates; it’s a go-to for plastic over virtual.

Diving deeper, Uquid Anonymous Mastercard delivers true anonymity vibes for everyday buys, topping up via stablecoins without fanfare. PST. NET Crypto Virtual Card excels in virtual realms, perfect for online privacy hawks. These aren’t flawless; fees nibble at edges, and ATM withdrawals vary. But paired with no-KYC wallets like Best Wallet or Zengo, they form a robust stack.

Key Features and Practical Selection Criteria

When eyeing a privacy crypto debit card 2025, prioritize stablecoin compatibility first: USDT, USDC must flow smoothly. Check merchant acceptance; Visa/Mastercard networks rule. Limits matter: RedotPay and KAST push envelopes post-minimal KYC. Fees? Hunt sub-2% loads. Security via self-custody integration, like Tangem’s model, minimizes counterparty risk. For off-ramping, virtual cards dodge physical trails. This guide breaks down the process step-by-step.

Empathetically, I know the frustration of shuttered services. PlasBit users, pivot wisely. Advcash Privacy Debit Card and Payeer Stablecoin Plastic Card offer plastic reliability, while Ezzocard USDC Prepaid Card suits prepaid purists. Capitalist. NET No-KYC Debit and Perfect Money e-Visa Card round out with e-wallet synergies. Test small; scale with confidence. In risk-first trading, these tools preserve your edge.

Let’s break down these options further with a side-by-side view, focusing on what matters for your stablecoin off ramp no kyc needs: stablecoin support, issuance speed, spend limits, and that elusive privacy balance.

Top 10 No-KYC Stablecoin Debit Cards Comparison (2025)

| Card Name | Stablecoins Supported | KYC Level (None/Minimal) | Max Load Limit | Fees | ATM Access |

|---|---|---|---|---|---|

| KAST Multi-Chain Stablecoin Card | USDT, USDC, PYUSD | Minimal | $50,000/month | 1% load, 0.5% FX | Yes 🏧🌍 |

| RedotPay USDT Virtual Debit Card | USDT | Minimal | $100,000/month | 0.5-1% load | Limited 🏧 |

| PlasBit No-KYC Stablecoin Card | USDT, USDC | Minimal | $10,000/month | 2% load | Yes 🏧 |

| Uquid Anonymous Mastercard | USDT, USDC | Minimal | $25,000/month | 1.5% load | Yes 🏧💳 |

| PST.NET Crypto Virtual Card | USDT, USDC | Minimal | $20,000/month | 1-2% load | No ❌ |

| Advcash Privacy Debit Card | USDT | Minimal | $15,000/month | 1% load | Yes 🏧 |

| Payeer Stablecoin Plastic Card | USDT, USDC | Minimal | $30,000/month | 0.5% load | Yes 🏧💳 |

| Ezzocard USDC Prepaid Card | USDC | Minimal | $5,000/month | 2.5% load | No ❌ |

| Capitalist.NET No-KYC Debit | USDT | Minimal | $40,000/month | 1.2% load | Limited 🏧 |

| Perfect Money e-Visa Card | USDT, USDC | Minimal | $10,000/month | 1.8% load | No ❌ |

The table reveals patterns worth noting. KAST and RedotPay lead with multi-chain flexibility and generous limits, making them practical for high-volume users. PlasBit holds appeal for those seeking physical cards, but verify current KYC status on their site, as 2025 updates vary. Uquid’s Mastercard network ensures ubiquity, while PST. NET virtual cards minimize traces for online spends. Advcash and Payeer cater to privacy veterans with plastic options that feel familiar yet crypto-native.

Navigating Risks in the Minimal-KYC Era

I won’t sugarcoat it: the dream of zero-KYC purity has dimmed under regulatory spotlights. Services like Ezzocard for USDC prepaids or Capitalist. NET debits now often require email or light checks, not full passports. Perfect Money’s e-Visa integrates smoothly with e-wallets, but expect geo-restrictions in strict jurisdictions. My advice, drawn from years in risk management? Layer your defenses. Pair these cards with no-KYC exchanges like MEXC or Uniswap for inflows, and self-custodial wallets for holds. This stack dodges single points of failure.

Fees can sting: load costs hover 1-3%, ATM pulls add 2-5%. Test with $100 first, monitor for blocks. Empathizing with your caution, remember blacklisting risks if patterns flag AML bots. Stick to audited providers; CoinGecko’s rankings flag KAST as resilient. For expats eyeing Goblin-like Mexican innovations, watch regional rollouts, but prioritize global reach.

Discipline trumps desire: vet twice, spend smart.

Virtual cards like RedotPay excel for subscriptions, sidestepping physical mail trails. Physical ones from Payeer suit cash needs. In my view, KAST edges ahead for staking perks, blending yield with spend. Yet no card is invincible; P2P off-ramps via Hodl Hodl remain the purest no-KYC path for larger sums, per CoinGape insights.

Alternatives and Future-Proof Strategies

Beyond cards, Tangem Pay’s hardware-linked Visa offers self-custody comfort, though KYC-gated. No-KYC wallets like Best Wallet pair perfectly, enabling swaps pre-load. For 2025, hybrid approaches win: use instant off-ramping guides to chain services. Watch for EU MiCA tweaks; they could reshape borders.

Practically, start with RedotPay or Uquid for quick wins. Top up USDT from a DEX, spend at ATMs, withdraw fiat discreetly. Scale to PlasBit for volume. This preserves your edge without paranoia.

Choosing your anonymous stablecoin card boils down to lifestyle: nomad? Virtual PST. NET. Trader? KAST yields. Privacy purist? Layer with P2P. These tools, though evolved, keep crypto’s promise alive: control your capital, on your terms. Stay vigilant, trade disciplined, and off-ramp wisely.